Ecommerce Bookkeeping Services: What CPAs Don’t Cover

Ecommerce bookkeeping services give online businesses more than clean books—they provide the financial infrastructure CPAs often overlook. While CPAs focus on tax preparation and compliance, ecommerce bookkeeping covers daily financial transactions, sales tax compliance, multi-channel payouts from Shopify and Amazon, and SKU-level inventory management.

For ecommerce entrepreneurs, these details determine whether financial statements reflect real profitability or hide costly errors. This guide explains what CPAs don’t cover, why ecommerce bookkeeping services matter for growth, and how specialized systems like QuickBooks Online ensure accuracy, financial health, and informed decision making in 2025.

Ready to streamline your financials? Our specialized ecommerce bookkeeping services go beyond tax filings, managing daily transactions, payouts, and inventory so sellers stay profitable as they scale.

Ecommerce Bookkeeping Services vs. Tax Filings: Why Specialized Support Matters

Ecommerce bookkeeping services extend far beyond annual tax filings. They provide a structured system for tracking revenue, expenses, refunds, and merchant fees across multiple sales channels. Without this clarity, financial records become fragmented and unreliable.

Accurate monthly reports give owners visibility into cash flow, profitability, and liabilities. This level of detail supports better decision making than tax filings alone, which only capture a snapshot once a year.

Key differences between tax filings and ecommerce bookkeeping:

Bookkeeping also ensures sales tax compliance across states, reducing the risk of penalties - a layer of protection tax filings alone cannot provide.

By tying inventory management to cost of goods sold, specialized bookkeeping uncovers true profit margins. Reliable financial statements - income statements, balance sheets, and cash flow reports - give ecommerce sellers the insights needed to scale with confidence.

What CPAs Handle Well - Compliance, Tax Preparation, and Financial Statements

Certified Public Accountants excel in structured financial oversight. They bring rigor to compliance, prepare accurate tax filings, and deliver reliable financial statements that support decision-making and regulatory requirements.

CPAs’ Strengths in Tax Preparation and Financial Statements

CPAs excel in tax preparation and compliance, helping ecommerce businesses meet federal and state requirements. They manage deductions, credits, and liabilities with accuracy, reducing the risk of penalties.

They also prepare standardized balance sheets and income statements that outline assets, liabilities, revenue, and expenses. These reports are critical for audits, investors, or securing financing.

For ecommerce sellers working across Shopify, Amazon, or Stripe, an organized ecommerce chart of accounts ensures CPAs can produce clean statements. Without this structure, tax season becomes more complex and prone to delays.

Key CPA strengths include:

Tax return preparation

Compliance with tax regulations

Financial statements for banks, investors, or audits

Adjusting entries to align books with accounting standards

Where CPAs Fall Short in Ecommerce Bookkeeping Services

Ecommerce sellers face accounting challenges that traditional CPA services often overlook. Complex payout flows, detailed cost tracking, and compliance requirements require specialized bookkeeping to keep financial records accurate and actionable.

Multi-Channel Payout Reconciliation: Shopify, Amazon, and Stripe

Reconciling payouts across platforms is one of the most critical - and most overlooked - tasks in ecommerce bookkeeping. Shopify, Amazon, and Stripe each deduct fees, refunds, and chargebacks before transferring funds, which means deposits in the bank rarely match sales in the ledger.

A structured reconciliation process ensures that every order, fee, and adjustment aligns with financial statements. For example, Stripe reconciliation in QuickBooks Online requires recording sales, merchant fees, and refunds separately to avoid overstating revenue.

Key reconciliation steps:

Match gross sales to platform reports

Record fees and refunds as expenses

Verify deposits equal net payouts

Accurate reconciliation prevents errors that distort profit and mislead monthly reports.

Tracking SKU-Level COGS, Shipping Costs, and Inventory Levels

Many CPAs record inventory as a lump expense, but ecommerce businesses require SKU-level tracking. Each product carries its own cost of goods sold (COGS), shipping expense, and storage fee - all of which directly affect margins.

Linking COGS, shipping, and fulfillment costs to each SKU gives sellers visibility into product profitability and highlights which items need pricing or strategy adjustments.

A simple breakdown illustrates the gap:

Failing to track this level of detail is one of the bookkeeping mistakes that erodes profitability. Accurate SKU-level accounting supports both tax compliance and informed decision making.

Sales Tax Compliance for Ecommerce Sellers Across States and Marketplaces

Sales tax compliance is complex for ecommerce businesses selling across multiple states and platforms. Marketplaces like Amazon may collect and remit in certain jurisdictions, while Shopify sellers often remain responsible for filing. This creates gaps when CPAs assume taxes are universally handled.

Specialized ecommerce bookkeeping services track nexus, confirm marketplace remittance, and file returns where required.

Best practices include:

Maintain a state-by-state tax matrix

Reconcile marketplace tax reports with financial statements

Use automation tools to monitor obligations

Strong sales tax processes protect ecommerce sellers from penalties and interest charges.

Cash Flow Statements and Real-Time Insights for Informed Decision Making

Many CPAs focus on income statements and balance sheets but neglect cash flow statements. For ecommerce sellers, cash flow offers the clearest view of financial health. Inventory purchases, advertising spend, and delayed payouts often create liquidity gaps that income statements don’t reveal.

Real-time insights help owners plan restocks, manage supplier payments, and avoid shortfalls. Monthly reports alone are insufficient; ecommerce requires dashboards that integrate live data from sales channels and banks.

Key benefits of cash flow tracking include:

Anticipating shortfalls before they disrupt operations

Aligning supplier payments with payout schedules

Supporting growth decisions with accurate financial insights

By combining cash flow statements with automated reporting, ecommerce sellers gain visibility that traditional CPA services rarely provide.

Work with QuickBooks Online Certified ProAdvisors for ecommerce who manage the details CPAs can’t - from order-level reconciliation to inventory and sales tax compliance.

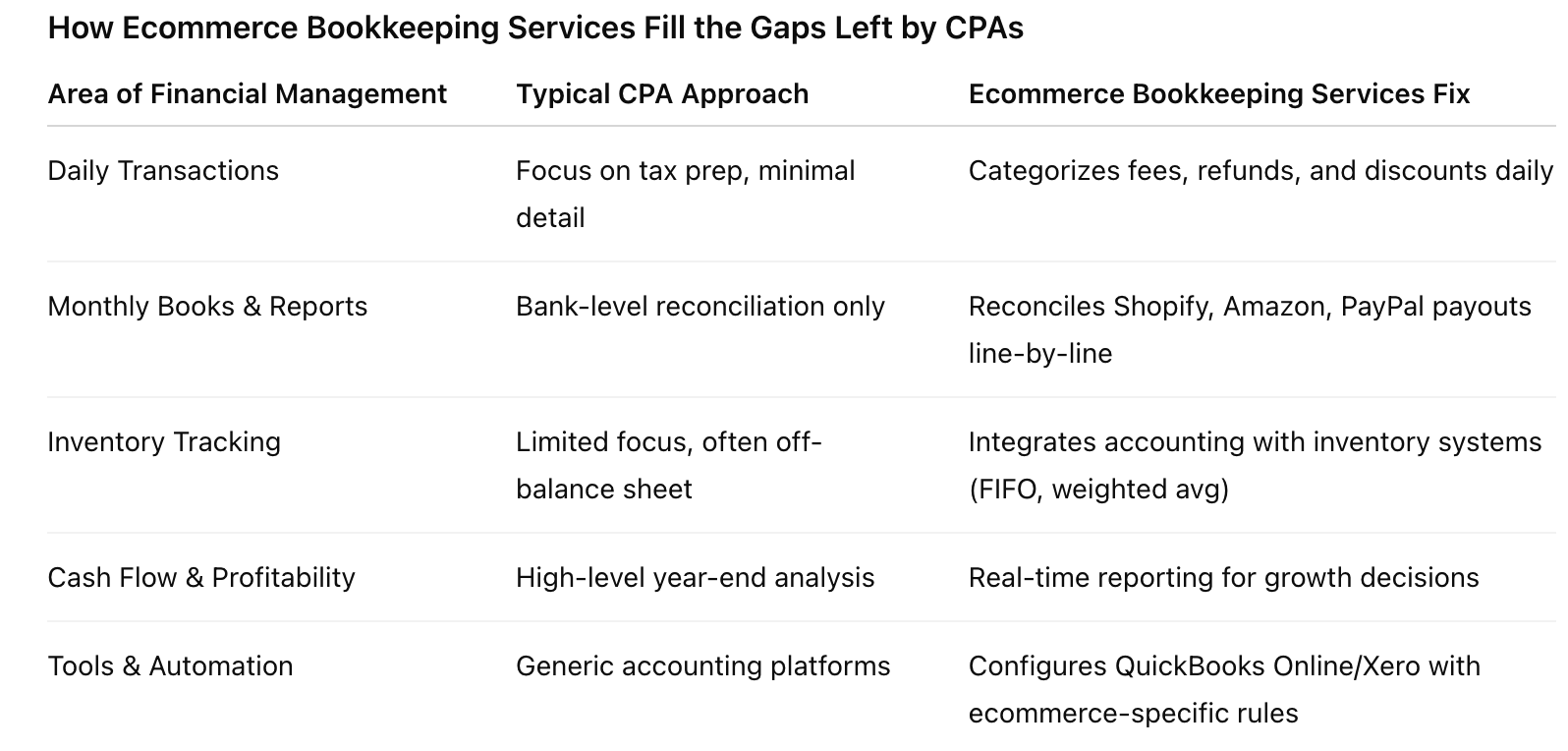

How Ecommerce Bookkeeping Services Close the Gap Left by CPAs

Ecommerce bookkeeping services address gaps that traditional accounting often overlooks. They bring structure to daily financial transactions, align reporting with sales platforms, and add clarity to inventory and tax compliance. With specialized tools and oversight, sellers gain accurate records that support growth and reduce costly errors.

Managing Daily Transactions, Monthly Books, and Financial Reports

Ecommerce sellers process hundreds of transactions across multiple channels. Each order involves processing fees, sales tax, shipping costs, and returns. Without specialized bookkeeping, these details are often misclassified.

Monthly books depend on consistent daily tracking. Services tailored to ecommerce reconcile payouts from Shopify, Amazon, and PayPal so chargebacks, discounts, and refunds appear correctly in the ledger.

Timely financial reports give owners a clear view of cash flow, profitability, and liabilities. With organized financial records, sellers can prepare for tax deadlines, secure funding, and make informed growth decisions.

QuickBooks Online and Accounting Software for Ecommerce Sellers

QuickBooks Online and Xero are the most common platforms for ecommerce bookkeeping. Both integrate with sales channels, payment gateways, and bank feeds to reduce manual entry and provide real-time visibility into financial health.

QuickBooks Online supports custom charts of accounts, helping sellers separate revenue streams, fulfillment costs, and advertising spend. Xero offers strong multi-currency support for international sellers.

Ecommerce bookkeeping services configure these tools by setting up rules, automating reconciliations, and managing sales tax compliance. Leveraging accounting software reduces administrative work and lets sellers focus on scaling operations.

Inventory Management Systems for Goods Sold and Transaction Volume

Inventory is one of the most complex areas of ecommerce bookkeeping. Each sale impacts cost of goods sold (COGS), gross margin, and tax obligations. If not tracked properly, financial statements lose accuracy.

Specialized bookkeeping services connect accounting software with inventory systems so stock levels, reorder points, and valuation methods (FIFO, weighted average) align with financial records. For high-volume sellers, this integration prevents discrepancies between warehouse counts and reported assets.

Large transaction volumes can overwhelm manual systems. Syncing sales platforms with bookkeeping tools streamlines bulk data entry, reduces reconciliation errors, and delivers accurate gross profit reporting.

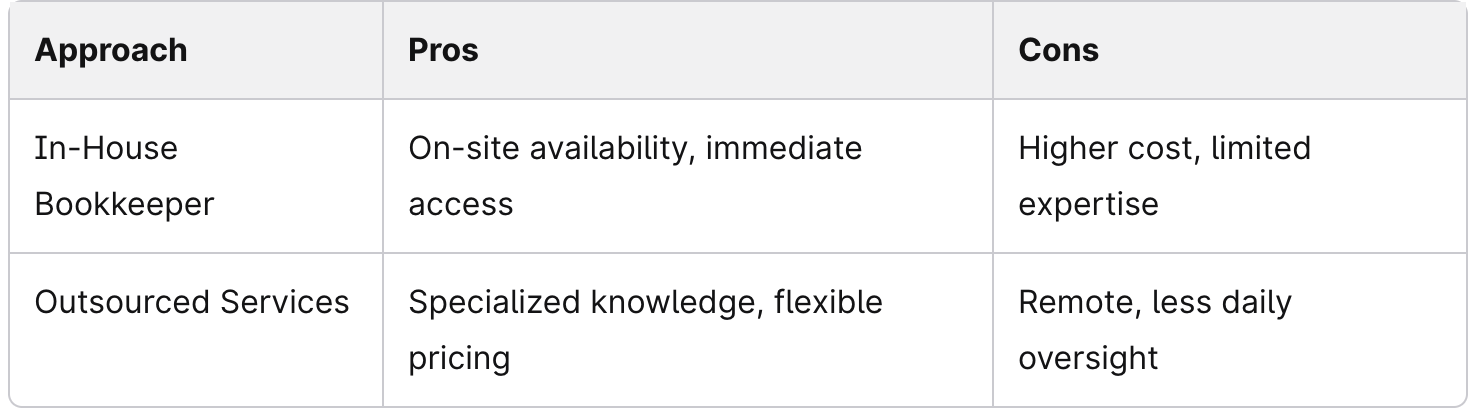

Outsourcing Ecommerce Bookkeeping Services vs. In-House Bookkeepers

Ecommerce sellers often weigh hiring in-house staff against outsourcing. In-house bookkeepers provide daily oversight but add fixed costs for salary, benefits, and training - and many lack ecommerce-specific expertise.

Outsourced bookkeeping services offer scalable support. Specialized firms understand platform payouts, marketplace fees, and cross-border tax rules, delivering CPA-level oversight without the expense of a full-time hire.

For many sellers, outsourcing strikes the right balance. It provides access to ecommerce-specific expertise while keeping overhead low and financial reporting consistent.

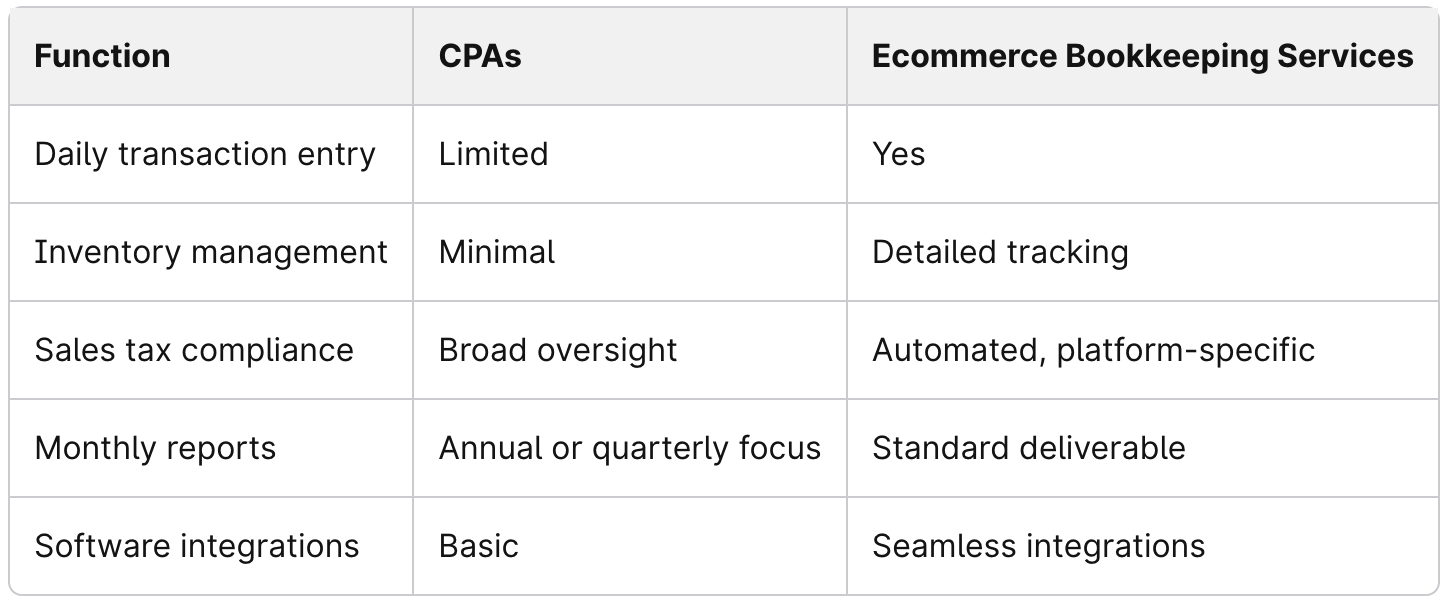

CPA vs. Ecommerce Bookkeeping Services: Key Differences

CPAs and ecommerce bookkeeping services both support financial management, but their focus is different. CPAs provide high-level tax and compliance expertise, while specialized bookkeeping services manage the daily flow of transactions, inventory, and platform integrations.

Features, Depth, and Scalability of Ecommerce Bookkeeping Services

Ecommerce bookkeeping services specialize in recording sales, expenses, and payouts across multiple channels. They reconcile payment processors, track order-level data, and prepare monthly reports that reflect real-time performance. This level of detail goes beyond traditional CPA work, which often centers on tax filings and compliance.

Scalability also sets bookkeeping apart. As sellers expand into new markets, bookkeepers configure tools like QuickBooks vs Xero to handle multi-channel sales and international tax rules. CPAs may advise on structure, but bookkeepers ensure daily operations run smoothly at scale.

Ensuring Accuracy, Financial Health, and Seamless Integration

Accuracy comes from consistent reconciliation. Every payout, return, and fee is tied to financial records, preventing errors that distort cash flow or inventory reporting. CPAs verify compliance, but they often rely on bookkeepers’ data to prepare financial statements.

Monthly reports highlight revenue trends, margins, and expenses, giving sellers visibility into financial health. These insights help owners adjust pricing, manage cash, and plan for growth in real time - not just at tax season.

Seamless Integrations for Online Sellers

Bookkeeping services integrate directly with Shopify, Amazon, and payment gateways, reducing manual entry and improving accuracy. CPAs may review totals, but they rarely configure or maintain these integrations. For ecommerce sellers, this distinction determines whether financial systems stay efficient as the business scales.

Benefits of Choosing Specialized Ecommerce Bookkeeping Services

Specialized ecommerce bookkeeping services give sellers visibility into cash flow, profitability, and tax obligations while reducing errors. They also provide tools to track performance, manage inventory, and scale with confidence.

Proactive Financial Management and Key Metrics Tracking

Ecommerce businesses face unique challenges like delayed payouts, complex fees, and multi-channel sales. A specialized bookkeeper tracks these details in real time so cash flow aligns with profit. Without this oversight, sellers may confuse revenue with actual liquidity.

By monitoring key metrics such as gross margin, average order value, and customer acquisition costs, bookkeeping services help identify trends early. Owners can adjust pricing, control expenses, and improve profitability with timely insights.

Clarity on Cash Flow vs. Profit

Shopify and Amazon payouts often distort timing. Bookkeeping services highlight the difference between cash flow and profit, helping businesses avoid shortfalls while maintaining healthy margins.

Tax Compliance for Online Businesses

Specialized bookkeeping supports sales tax compliance across states. Tracking obligations accurately protects ecommerce sellers from penalties and keeps records audit-ready.

Making Informed Decisions with Accurate Financial Records

Accurate financial records are the foundation of decision-making. Ecommerce bookkeeping services reconcile data from sales channels, payment gateways, and merchant accounts to give sellers a consolidated view of performance.

Using QuickBooks Online, professionals generate monthly reports that highlight revenue, expenses, and net income. These reports help owners evaluate whether marketing campaigns or product launches deliver returns.

Detailed financial statements also support funding requests. Investors and lenders expect clear reports that demonstrate financial health, not spreadsheets with errors. With accurate bookkeeping, sellers can access capital faster and on better terms.

By linking cost of goods sold (COGS) to sales, owners can identify which products drive profit and which drain resources - insight that’s difficult to achieve without specialized systems.

How Ecommerce Entrepreneurs and Online Sellers Scale with the Right Bookkeeping Systems

Ecommerce bookkeeping services close the gaps CPAs leave behind - from daily reconciliations and sales tax compliance to SKU-level inventory tracking. With specialized systems and real-time reporting, sellers gain the insight to scale confidently without losing control of their numbers.

Partner with Accounting Atelier for clean, dependable financial support tailored to ecommerce businesses. Book a consultation today and work directly with QuickBooks Online Certified ProAdvisors who understand the complexities of Shopify, Amazon, and multi-channel growth. Partner with Accounting Atelier for clean, dependable financial support tailored to ecommerce businesses. Book a consultation today and scale with confidence.

Frequently Asked Questions About Ecommerce Bookkeeping Services

-

Ecommerce bookkeeping covers recording multi-channel sales, tracking expenses, reconciling bank accounts, and preparing monthly reports. A specialized service also monitors cash flow and prepares financial statements so sellers see true profitability across Shopify, Amazon, and Stripe.

-

Inventory tracking ties directly into COGS, margins, and cash flow. Bookkeeping services connect accounting software with platforms and warehouses so stock, orders, and sales update automatically — eliminating manual entry and misstatements.

-

Look for accurate reconciliations, inventory integration, sales tax support, and monthly reports with insights. Top providers configure QuickBooks Online to connect with Amazon, Shopify, and Stripe so financials stay current while you scale.

-

Sellers face different rules across states and marketplaces. Bookkeepers track transactions, apply correct rates, and generate filing reports. Many use automation to keep compliance accurate and on time, protecting businesses from penalties.

-

Strong processes matter: close books monthly, reconcile accounts, and prepare income, balance sheet, and cash flow statements. With automation, sellers get reliable reports faster — ready for investors, lenders, or tax deadlines.

-

QuickBooks Online integrates with major platforms, automates bank feeds, and supports expense categorization and monthly reporting. Paired with inventory apps, it keeps stock levels accurate and gives sellers real-time visibility into financial health.