Stripe Reconciliation for Ecommerce Sellers: What Everyone Gets Wrong

Most ecommerce owners assume that the Stripe deposit showing up in their business bank account equals their actual sales. It doesn’t. Stripe batches dozens - sometimes hundreds - of customer payments, deducts processing fees, applies refunds, and holds chargebacks before sending a single payout. By the time funds hit your checking account, the numbers no longer line up with the original sales.

That’s where Stripe reconciliation comes in. Without a deliberate reconciliation process in QuickBooks Online, ecommerce sellers risk overstated revenue, missing expenses, and financial statements that don’t reflect reality. Stripe payouts may look clean, but hidden inside are the mismatches that distort profit margins and decision-making. This guide avoids the errors we explore in our ecommerce bookkeeping mistakes breakdown.

Boutique bookkeeping firms don’t just “record deposits” - they trace every Stripe transaction, reconcile payouts against bank statements, and ensure refunds, fees, and adjustments are accounted for. Done correctly, Stripe reconciliation turns transaction chaos into accurate records sellers can trust - records that investors, tax authorities, and business owners rely on to make confident moves.

Without accurate reconciliation, ecommerce sellers risk overstated revenue, missed expenses, and unreliable reports — issues our ecommerce bookkeeping services are built to prevent.

Why Stripe Payouts Rarely Match Business Bank Deposits

Stripe payouts often differ from the deposits that appear in a business bank account. The differences stem from how Stripe groups transactions, applies fees, and records adjustments before sending funds. These timing and accounting variations make direct one-to-one matches rare.

Stripe Transactions vs. Customer Payments – Where Mismatches Start

A customer payment does not move directly from Stripe to the bank. Instead, Stripe collects multiple payments over a period and then issues a single payout. This batching process means one bank deposit often represents dozens or even hundreds of customer transactions.

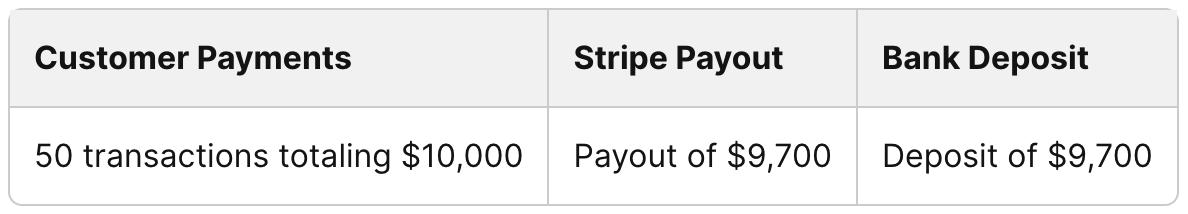

For example:

The payout amount excludes certain adjustments, so it will not equal the sum of customer sales. This separation makes reconciliation more complex than simply matching one payment to one deposit.

Without structured bookkeeping, businesses risk overlooking missing or duplicated transactions. Professional oversight ensures that each transaction is properly tied back to the bank record.

Automatic Deductions for Payment Processing Fees and Refunds

Stripe deducts payment processing fees, refunds, chargebacks, and dispute amounts before releasing funds. The payout is always net of these adjustments - not gross sales.

For example, $5,000 in sales with $150 in fees and a $200 refund results in a Stripe payout of $4,650. Businesses comparing only sales totals to deposits see unexplained gaps.

Accurate reconciliation in QuickBooks Online requires recording sales, fees, and refunds separately. Boutique bookkeeping ensures these entries are precise, so financial statements reflect true revenue and costs. Misclassifying these items is one of the most common ecommerce bookkeeping mistakes we see.

Data Discrepancies Between Stripe Account Activity and Bank Statements

Stripe’s internal records show every transaction, fee, and payout. Bank statements, however, only show the final deposit. This creates a data gap. To reconcile, businesses must align detailed Stripe reports with the summarized bank entries.

Stripe provides a bank reconciliation report and a payout reconciliation report to bridge this gap, but interpreting them requires careful review. Timing differences, such as weekend or holiday delays, can also shift when deposits appear.

Manual matching is prone to errors, especially when transaction volumes increase. Professional bookkeeping ensures that Stripe activity and bank deposits remain synchronized, protecting financial accuracy and reducing the risk of missed discrepancies.

Breaking Down The Reconciliation Process In QuickBooks Online

Accurate reconciliation in QuickBooks Online requires recording sales at the gross level, aligning deposits with bank activity, and categorizing Stripe fees correctly. Each step ensures that financial statements reflect the true performance of the business and that payouts can be traced without gaps or inconsistencies.

Recording Gross Stripe Sales vs. Net Payouts For Accurate Records

Stripe deposits only the net payout into the bank account. This means processing fees are already deducted before funds arrive. If only the net amount is recorded, sales will appear understated, and expenses will be missing.

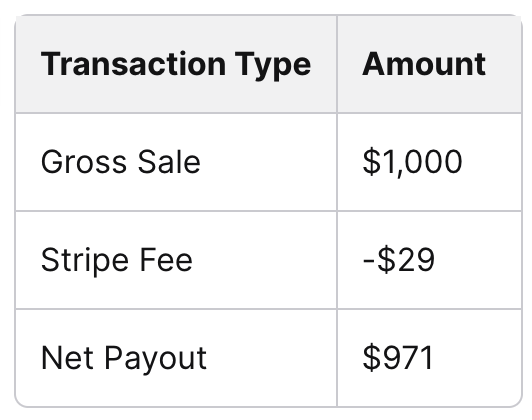

To prevent this, businesses should record gross sales as income and then separately track Stripe fees as expenses. For example:

This structure ensures income statements show the full revenue picture while still accounting for costs. Without this step, margin analysis and tax reporting can become misleading.

Professional bookkeeping reduces the risk of misreporting when handling large volumes of Stripe transactions. Even small errors in recording gross versus net can compound into significant discrepancies over time.

Matching Transactions Against Bank Account Deposits

Each Stripe payout groups multiple customer payments into a single deposit. QuickBooks Online users need to match these grouped transactions against actual bank deposits to confirm accuracy.

Using the payout ID from Stripe helps identify which sales are included in each deposit. This makes it easier to reconcile the clearing account in QuickBooks with the bank feed. Tools that integrate Stripe with QuickBooks, such as automated syncing solutions, can reduce manual matching work.

If transactions are not matched correctly, duplicate income entries or missing deposits can occur. This leads to overstated revenue or unexplained variances during reconciliation.

A professional bookkeeping process ensures these matches are consistent, preventing errors that can distort financial statements or delay month-end closes.

Categorizing Stripe Fees And Expenses For Clean Financial Statements

Stripe deducts fees before sending payouts, but these charges must still be recorded as operating expenses. QuickBooks Online allows fees to be categorized under merchant processing, which keeps expense reporting clear.

Recording fees separately also helps track effective processing rates. For example, if fees increase due to higher international card usage, the business can see the trend and adjust pricing or payment policies. Guidance on handling this can be found in step-by-step reconciliation guides.

Without categorization, fees may be hidden within deposits, reducing visibility into true operating costs. This can mislead decision-making when reviewing profitability.

Boutique bookkeeping practices ensure these expenses are consistently tracked and categorized, safeguarding the clarity of financial statements and reducing the chance of hidden costs eroding margins.

The Stripe Clearing Account Method

A Stripe clearing account acts as a temporary holding account that mirrors the flow of funds from Stripe before they reach the business bank account. This method provides visibility into fees, timing differences, and unmatched transactions that can otherwise create confusion in financial records.

Setting Up A Dedicated Stripe Clearing Account In QuickBooks Online

In QuickBooks Online, the Stripe clearing account is created as a separate bank-type account. This setup ensures Stripe transactions are tracked independently from the actual bank account. Each payment processed through Stripe increases the balance of the clearing account, while transfers to the bank reduce it.

To configure properly, businesses should:

Create a new account named Stripe Clearing in the Chart of Accounts.

Assign it as a bank account type for accurate reporting.

Use this account exclusively for Stripe deposits, refunds, and fees.

By keeping Stripe activity isolated, the clearing account reflects the exact balance Stripe owes the business at any point in time. This structure makes it easier to identify discrepancies and confirm that Stripe payouts align with recorded sales. Professional bookkeeping ensures this setup is consistent, reducing the risk of misclassified entries.

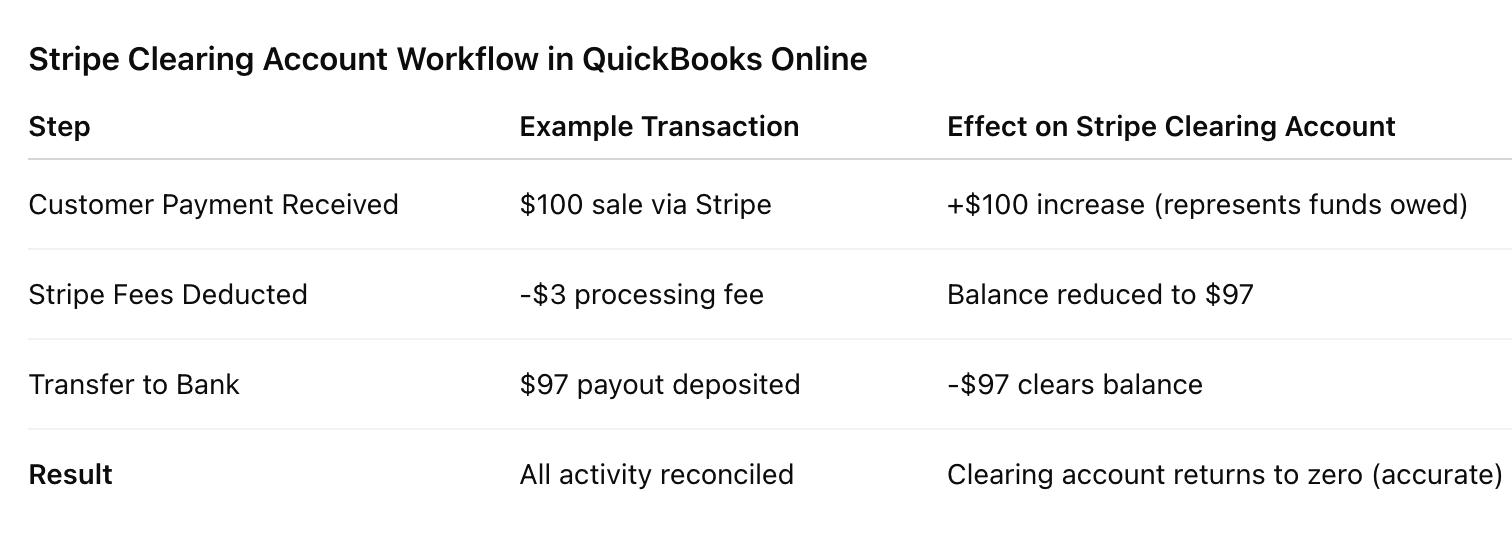

Using The Clearing Account To Reconcile Stripe Payments With Bank Activity

The clearing account serves as the bridge between Stripe and the company’s bank account. Each customer payment recorded in Stripe is mirrored in the clearing account. When Stripe transfers funds to the bank, that transfer is recorded as a reduction in the clearing account and a deposit into the bank account.

For example:

Customer pays $100 via Stripe. Clearing account increases by $100.

Stripe deducts $3 in fees. Clearing account shows $97.

Stripe transfers $97 to the bank. Clearing account decreases by $97.

This process ensures the clearing account reaches a zero balance once all payouts and fees are accounted for. If the balance does not clear, it signals missing or misapplied entries. Accurate reconciliation prevents overstated revenue and ensures bank activity matches accounting records. Bookkeeping oversight here safeguards against errors that manual tracking often introduces.

Why This Matching Process Eliminates Manual Errors And Improves Record Keeping

The clearing account method eliminates the guesswork of reconciling Stripe payouts. Instead of forcing lump-sum bank deposits to match dozens of individual payments, each Stripe transaction is first recorded in a clearing account. This makes the reconciliation process structured, traceable, and far less prone to manual errors.

It also improves reporting accuracy. Sales, refunds, and Stripe fees are separated, giving financial statements a true picture of net revenue and creating a reliable audit trail. Professional bookkeeping ensures these reconciliations are performed consistently, safeguarding financial accuracy and dependable record keeping.

While these steps outline the mechanics, most businesses save time and avoid costly errors by relying on professional ecommerce bookkeeping to manage Stripe reconciliation in QuickBooks Online.

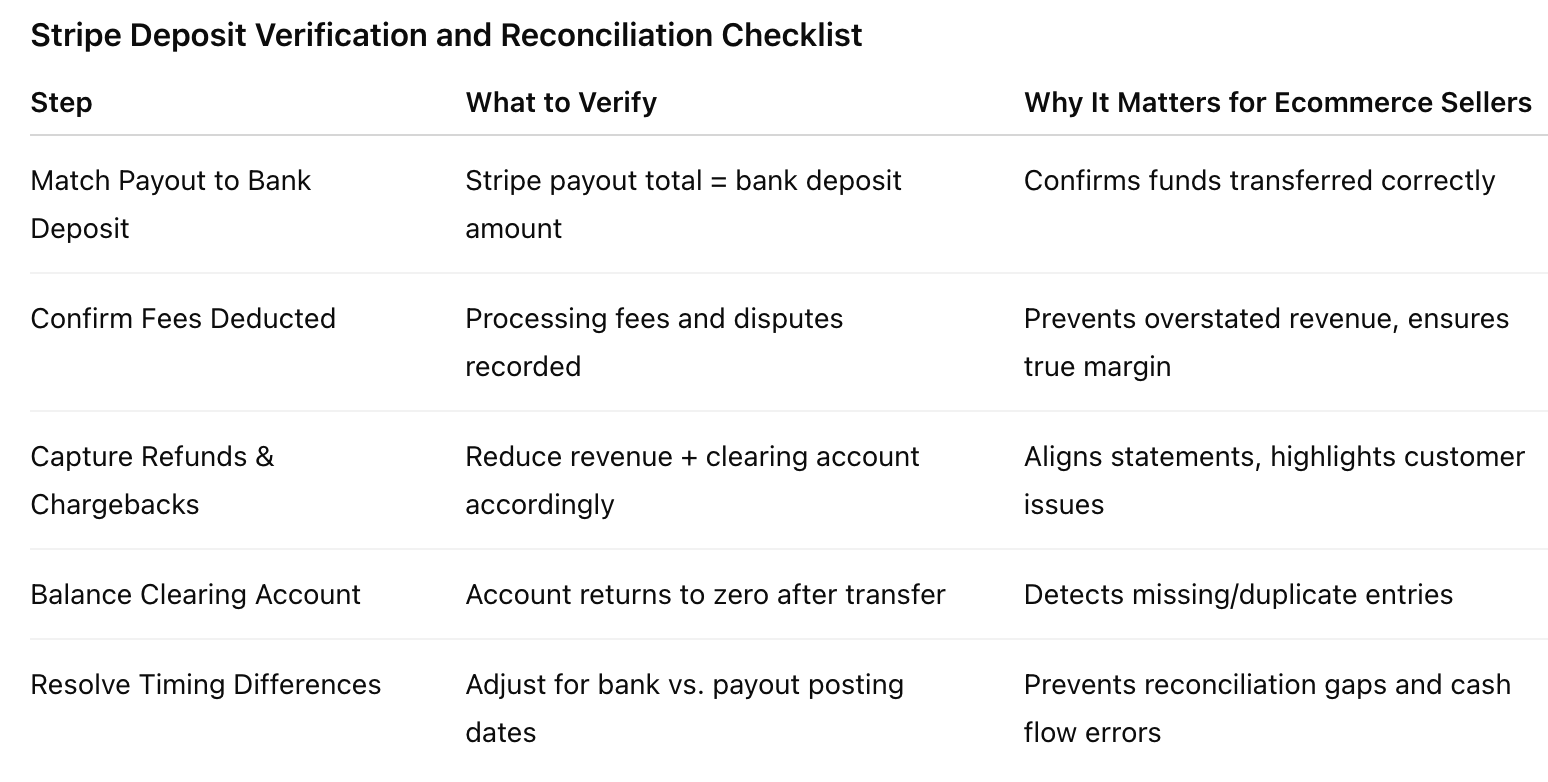

Step-By-Step – How To Reconcile Stripe Payments Manually

Accurate reconciliation ensures that Stripe transactions match bank deposits, refunds, and chargebacks. Each step requires attention to detail so that financial records reflect the true flow of money through the business.

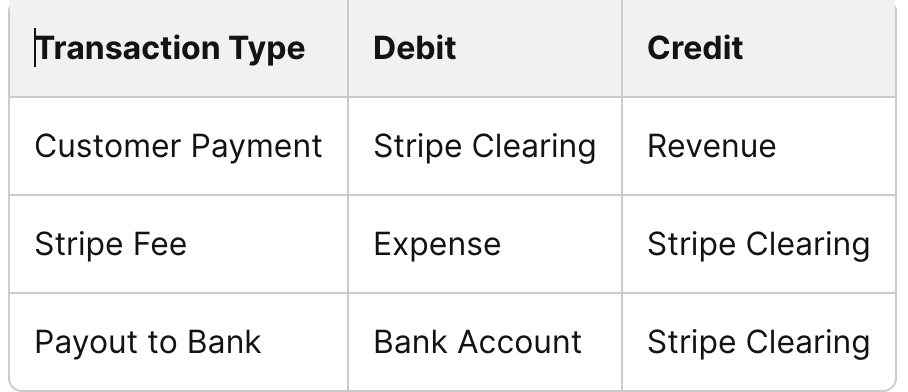

Posting Journal Entries To Reflect Stripe Transactions And Payouts

The reconciliation process begins with recording Stripe activity in the accounting system. Each sale, fee, and payout must be captured as a journal entry. This creates a clear trail between gross revenue, Stripe fees, and the net payout transferred to the bank.

A common approach is to use a clearing account. For example:

This method ensures that the clearing account zeroes out once payouts are posted.

Without precise journal entries, discrepancies appear between Stripe activity and financial reports. Professional bookkeeping reduces the risk of missed fees or misapplied revenue, keeping records consistent and audit-ready.

Verifying Deposits Against Bank Statements And Payout Reconciliation Reports

After posting entries, deposits must be compared against actual bank statements. Stripe groups multiple transactions into a single payout, which means the deposit amount rarely matches individual sales. The Stripe payout reconciliation report provides a detailed breakdown of what each deposit includes.

The key task is confirming that:

The payout amount equals the bank deposit

Fees and refunds are included correctly

The clearing account balances to zero after posting

If a mismatch occurs, it is often due to timing differences between the payout date and when the bank clears the funds. Careful tracking prevents duplicate entries or missing deposits.

Even small variances can distort cash flow reporting. Consistent review by a bookkeeping professional ensures that each deposit is validated and tied back to Stripe’s official reports.

Capturing Refunds, Disputes, and Amounts Received Accurately

Refunds and chargebacks reduce payouts directly in Stripe, so they must be recorded as adjustments to revenue in QuickBooks Online. If they’re ignored, income is overstated and profit margins appear healthier than reality.

Disputes often include extra Stripe fees. Tracking these separately gives management visibility into the true cost of chargebacks and helps identify patterns that need operational fixes.

For refunds, the accounting entry should mirror the original sale—reducing both revenue and the Stripe clearing account—to keep the reconciliation process balanced. Professional bookkeeping ensures these adjustments are posted consistently, maintaining financial accuracy and protecting the integrity of reports.

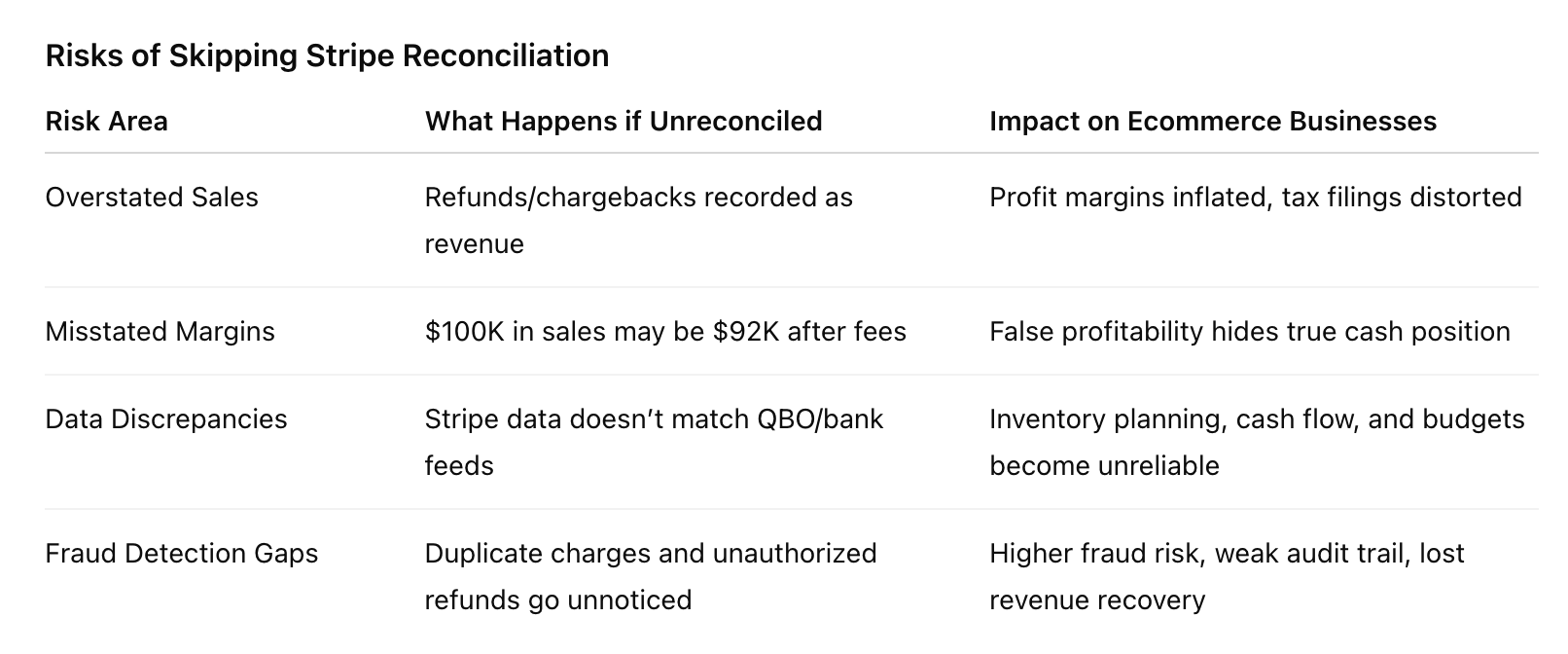

Risks Of Skipping Stripe Reconciliation

When Stripe transactions aren’t reconciled, financial records drift from reality. This leads to inaccurate financial statements, poor decision-making, and blind spots in detecting fraud or payment errors.

Overstated Sales and Misstated Margins

Unreconciled Stripe payouts often record refunds, chargebacks, or failed payments as revenue. A business that reports $100,000 in sales may only have $92,000 after deductions—an $8,000 gap that distorts profit margins and misguides tax filings. Clean reconciliation in QuickBooks Online ensures refunds, Stripe fees, and disputes are captured correctly, protecting compliance and financial accuracy.

Data Discrepancies Undermine Decisions

When transaction data in Stripe doesn’t match bank statements or accounting records, leaders can’t rely on reports. Inventory planning, cash flow management, and budgets all suffer. Unreconciled refunds may mask customer dissatisfaction, while mismatched payouts delay audits and weaken investor confidence. Professional bookkeeping applies a structured reconciliation process to maintain accurate records for sound decision making.

Fraud Detection Gaps

Skipping reconciliation creates blind spots for fraud. Duplicate charges, unauthorized refunds, or small irregular transactions blend into daily sales unless each payout is verified. Without proper documentation, businesses also struggle to dispute chargebacks and recover lost revenue. Routine reconciliation by a professional bookkeeper ensures every Stripe payment is matched, reducing fraud risk and building a reliable audit trail.

Why Professional Ecommerce Bookkeeping Eliminates Stripe Errors

Stripe reconciliation ecommerce looks simple until mismatched transaction data creates financial discrepancies. Stripe payouts include fees, refunds, and chargebacks, so the business bank account never mirrors gross sales. Without accurate reconciliation in QuickBooks Online, financial statements lose integrity and leadership makes decisions on bad data.

Ecommerce Expertise Matters

Every customer payment must be reconciled against Stripe activity. Accountants without ecommerce experience often miss timing gaps between orders, payouts, and bank deposits. Professional bookkeepers use a Stripe clearing account to capture gross sales, deduct Stripe fees, and match deposits correctly—ensuring accurate records and audit-ready documentation.

Efficiency and Accuracy

Manual reconciliation across numerous transactions is slow and error-prone. Boutique bookkeeping firms combine structured workflows with reconciliation tools, so Stripe payments are matched quickly, refunds and fees are recorded, and the matching process is consistent. This safeguards financial accuracy, improves operational efficiency, and provides reliable data for audits, investors, and future reference.

If you’re ready to eliminate errors and scale with confidence, our boutique bookkeeping for ecommerce sellers ensures every Stripe payout, fee, and refund is reconciled accurately.

Common Questions on Reconciling Stripe Transactions in QuickBooks Online

-

Each Stripe payment, refund, and fee must be recorded in QuickBooks Online and matched against the bank feed. A Stripe clearing account ensures gross sales, Stripe fees, and refunds are captured before deposits hit the bank. This structured reconciliation process prevents missed items and maintains accurate financial statements.

-

Stripe deducts processing fees and refunds before sending payouts. Record gross sales, fees, and net deposits separately, and apply refunds against the original transaction for a clear audit trail. Professional bookkeeping ensures accurate revenue and expense reporting, protecting financial accuracy.

-

Record the chargeback amount and related Stripe fee as separate expenses. If the dispute is resolved, reclassify the funds back to income. Structured handling of chargebacks keeps revenue reporting accurate and transparent.

-

Stripe batches transactions into single payouts. Reconcile by matching the payout reconciliation report to the business bank account deposit, then verify underlying transactions. This ensures all amounts received are correctly reflected in financial records.

-

Recurring payments should be tagged with unique identifiers that tie to customer records. Automating categorization reduces manual errors and speeds the matching process. A bookkeeping professional ensures subscription revenue is consistently reconciled.

-

Most data discrepancies stem from timing differences, missing entries, or misclassified fees. Begin by identifying the mismatched transactions, then adjust QuickBooks records to align with verified Stripe data. Document each change to preserve compliance and financial integrity.