Ecommerce Chart of Accounts: 2025 Guide to Setup

Running an ecommerce business without a structured chart of accounts is like navigating without a map - every transaction gets recorded, but the big picture disappears. In 2025, with sales spread across Shopify, Amazon, and Stripe, rising shipping costs, and complex sales tax rules, a well-structured ecommerce chart of accounts is the difference between messy books and sustainable growth.

This guide shows you how to set up a chart of accounts tailored for ecommerce - including categories most sellers overlook. Whether you’re managing product sales, fulfillment expenses, or digital marketing spend, the right structure delivers accurate financial reporting, informed decision-making, and tax-ready compliance.

For a complete overview of how ecommerce bookkeeping works beyond the chart of accounts, see our ecommerce bookkeeping guide.

What Is An Ecommerce Chart Of Accounts

An ecommerce chart of accounts (CoA) provides a structured way to record, classify, and review every financial transaction. It organizes income, expenses, assets, liabilities, and equity so owners can see exactly how money moves through the business and prepare accurate financial statements.

Definition And Purpose In Ecommerce Accounting

A chart of accounts is a standardized list of all accounts used to record business transactions. In ecommerce, it goes beyond a simple ledger because it must capture sales channels, merchant fees, fulfillment costs, and digital advertising spend.

The CoA serves as the backbone of bookkeeping. Each account becomes a “bucket” where transactions are posted, such as cash, accounts receivable, inventory, or shipping expense. This structure allows accountants to build clean financial reports without missing key details.

For ecommerce sellers, the CoA ensures that payouts, sales tax, and cost of goods sold (COGS) are tracked in the right accounts. Without this structure, numbers can become unreliable, making tax filings or financial reviews more difficult. A well-designed chart of accounts supports compliance, clarity, and long-term growth.

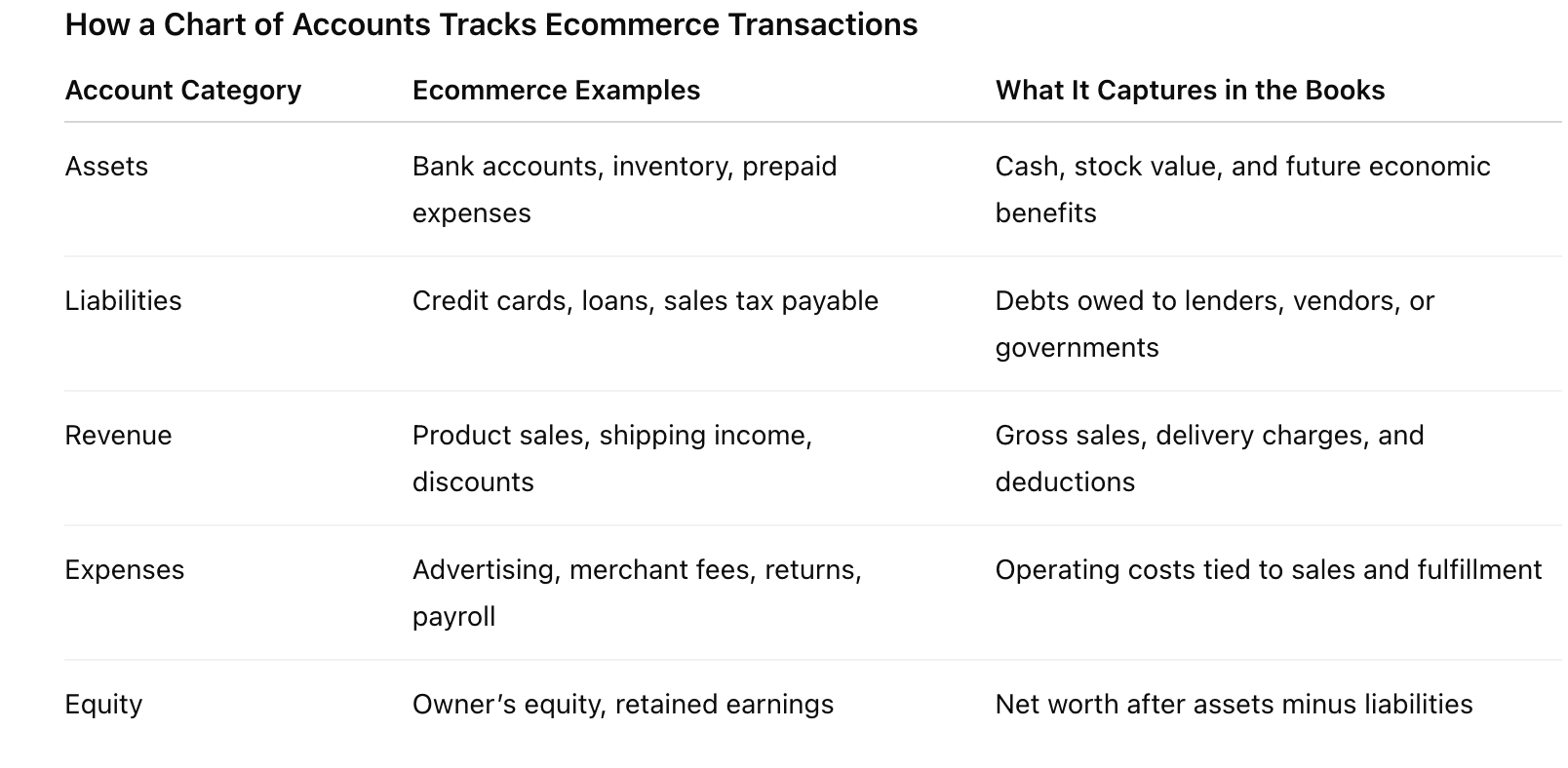

How A Chart Of Accounts Tracks All Your Business Transactions

Every ecommerce transaction flows into the chart of accounts. When a customer makes a purchase, the system records revenue, reduces inventory, and logs payment processing fees. When the business pays for shipping or marketing, those expenses are categorized into their respective accounts.

The five main categories—assets, liabilities, equity, revenue, expenses—form the framework. Within these, sub accounts capture detail:

Assets: bank accounts, inventory, prepaid expenses

Liabilities: credit cards, loans, sales tax payable

Revenue: product sales, shipping income, discounts

Expenses: advertising, merchant fees, returns, payroll

This structure ensures that financial statements reflect real performance. By reviewing the CoA regularly, owners can spot trends like rising fulfillment costs or shrinking margins. Proper tracking also simplifies ecommerce bookkeeping in platforms like QuickBooks Online, where automation depends on accurate account mapping.

Why Accurate Categorization Drives Informed Financial Decisions

Accurate categorization in your ecommerce chart of accounts isn’t bookkeeping detail—it’s the foundation of every financial decision. Misclassify an expense—say, recording advertising spend as office costs—and suddenly your true customer acquisition cost disappears.

Clear categorization unlocks margin analysis. When cost of goods sold (COGS) is separated from shipping expenses, owners can evaluate profitability at the SKU level. Tracking merchant fees apart from marketing expenses exposes how much revenue is absorbed by processors versus outreach.

A disciplined chart of accounts also streamlines tax readiness. Sales tax liabilities, deductible expenses, and inventory valuations must be exact to avoid penalties or overpayments. Well-structured accounts produce accurate financial statements, empowering leaders to make informed calls on pricing, hiring, and expansion.

Clean, dependable financial support that sets up your chart of accounts correctly from day one.

The 5 Main Categories In An Ecommerce Chart Of Accounts

An ecommerce chart of accounts groups every business transaction into five main categories: assets, liabilities, equity, income, and expenses. Together, these categories form the backbone of accurate financial reporting.

Assets track what the business owns (cash, inventory, receivables).

Liabilities record what it owes (loans, credit cards, vendor bills).

Equity reflects owner investment and retained earnings.

Income captures sales across ecommerce channels.

Expenses detail costs like shipping, marketing, and software subscriptions.

When structured correctly, these categories provide clean financial statements and equip owners to make strategic decisions with confidence.

The chart of accounts is the backbone, but it’s only one piece of the system described in our guide to ecommerce bookkeeping.

Asset Accounts – Current Assets, Inventory, Raw Materials

Asset accounts track what the business owns and expects to convert into cash. For ecommerce, this includes current assets such as checking accounts, savings accounts, and accounts receivable—key indicators of liquidity and short-term stability.

Inventory is the most critical sub-account. Finished goods, raw materials, and packaging supplies all belong here. Accurate tracking keeps cost of goods sold (COGS) precise and prevents inflated margins.

A well-structured asset section typically includes:

Cash and Bank Accounts

Accounts Receivable

Inventory and Raw Materials

Prepaid Expenses

When asset accounts aren’t reconciled, businesses risk misstating profits and cash flow. Poor inventory tracking is one of the most common ecommerce bookkeeping mistakes - and it directly erodes profitability. Clean reporting ensures owners know exactly what resources are available at any time.

Liability Accounts in an Ecommerce Chart of Accounts

Liability accounts represent what the business owes - future cash outflows that must be managed with discipline. Common examples include accounts payable, credit card balances, and outstanding loans.

For ecommerce sellers, sales tax payable is especially critical. Online transactions often create tax obligations across multiple states or jurisdictions. Mismanaging this account risks audits, penalties, and unnecessary cash flow strain.

Key liability sub-accounts include:

Accounts Payable

Credit Cards and Loans

Sales Tax Payable

Accrued Expenses

Accurate liability tracking ensures tax filings are correct, vendors are paid on time, and business owners know how much of their cash belongs to governments or suppliers - not to the business itself.

Equity Accounts in an Ecommerce Chart of Accounts

Equity accounts capture the owner’s stake in the business—the balance between what the company owns and what it owes. Owner’s equity reflects initial investments plus any additional contributions, adjusted for withdrawals or distributions.

Retained earnings track cumulative profits that are reinvested rather than distributed. This figure rises when revenues exceed expenses and declines when losses occur.

Common equity sub-accounts include:

Owner’s Equity

Retained Earnings

Additional Paid-In Capital

Equity accounts provide a long-term view of financial health. They show whether an ecommerce business is building sustainable value or eroding it through losses. For companies seeking financing, lenders and investors often review equity balances to assess stability and growth potential.

Revenue Accounts in an Ecommerce Chart of Accounts

Revenue accounts record every income stream in an ecommerce business. This includes product sales, subscription services, wholesale orders, and marketplace transactions. Separating revenue by channel shows which streams generate the most profit and where marketing spend delivers the highest return.

Common revenue sub-accounts include:

Direct Website Sales

Amazon or Marketplace Sales

Wholesale Income

Other Online Sales

Channel-level tracking clarifies gross revenue trends and supports strategic decisions on marketing budgets, channel expansion, and product mix. It also ensures financial statements reflect true top-line performance.

Revenue accounts should always reconcile back to payment processors and bank deposits. Regular reconciliations catch chargebacks, refunds, or fees that reduce actual income—so owners see accurate results, not inflated sales figures.

Expenses – Shipping Costs, Marketing Expenses, Software Subscriptions, Customer Acquisition

Expense accounts track the costs of running the business. For ecommerce, shipping costs are often one of the largest categories. This includes postage, freight, and fulfillment center fees.

Marketing expenses cover ad spend, influencer campaigns, and email platforms. These costs should be segmented to measure customer acquisition costs against sales.

Common expense sub-accounts include:

Shipping and Fulfillment

Marketing and Advertising

Software Subscriptions

Merchant Fees

Customer Acquisition Costs

Separating expenses into detailed sub-accounts provides insight into profitability. For example, tracking software subscriptions ensures recurring costs are not overlooked. Monitoring customer acquisition costs against lifetime value helps owners decide whether campaigns are sustainable.

Clean, dependable financial support that sets up your chart of accounts correctly from day one.

Ecommerce-Specific Accounts To Include

An ecommerce chart of accounts must capture the unique flow of online sales, returns, and fulfillment. Clear categorization of revenue and expenses produces accurate financial statements, supports tax compliance, and reveals the margins driving sustainable growth.

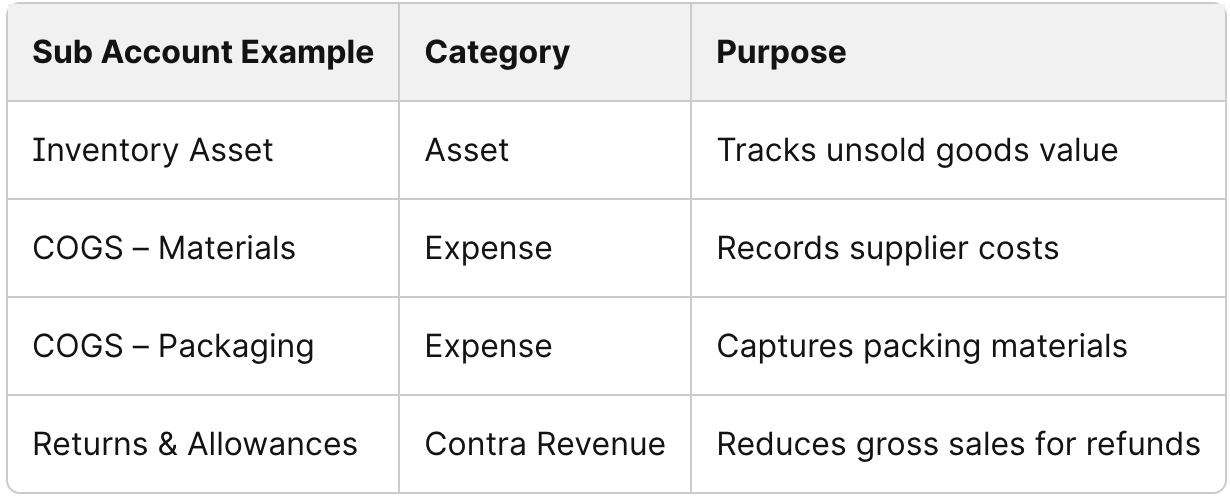

Cost of Goods Sold (COGS) and Inventory Management

Cost of Goods Sold (COGS) includes wholesale purchase price, manufacturing costs, packaging, and inbound shipping. Correct tracking keeps gross profit margins accurate.

Inventory management requires sub-accounts for raw materials, finished goods, and returns/allowances. Separating these balances shows how much capital is tied up in stock versus what has already been sold.

A strong chart of accounts links inventory assets on the balance sheet with COGS on the income statement - creating clear visibility into product profitability and preventing overstated margins.

Inventory and COGS are two of the most misunderstood areas in ecommerce - both covered in depth in our ecommerce bookkeeping guide.

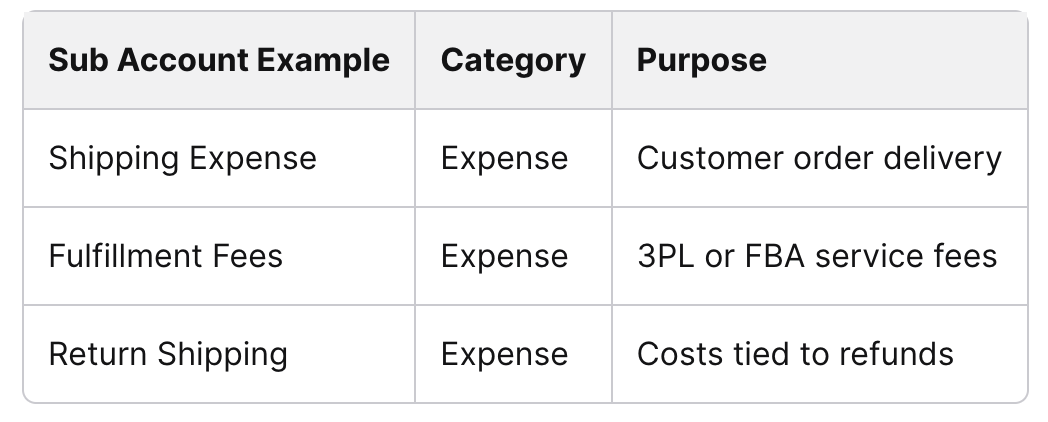

Shipping Costs and Fulfillment Expenses

Shipping and fulfillment are major expense categories for an ecommerce business. They include carrier fees, third-party logistics (3PL) charges, warehouse rent, and packaging materials. Recording these separately from COGS prevents inflated gross margins.

Returns create additional costs. A sub-account for return shipping makes it clear how much customer returns reduce profitability.

Fulfillment providers like Amazon FBA or Shopify Fulfillment also charge storage and handling fees. These belong in expense accounts—not inventory—so financial statements reflect true operating costs. Proper categorization guides accurate pricing decisions and reveals whether free shipping offers are sustainable.

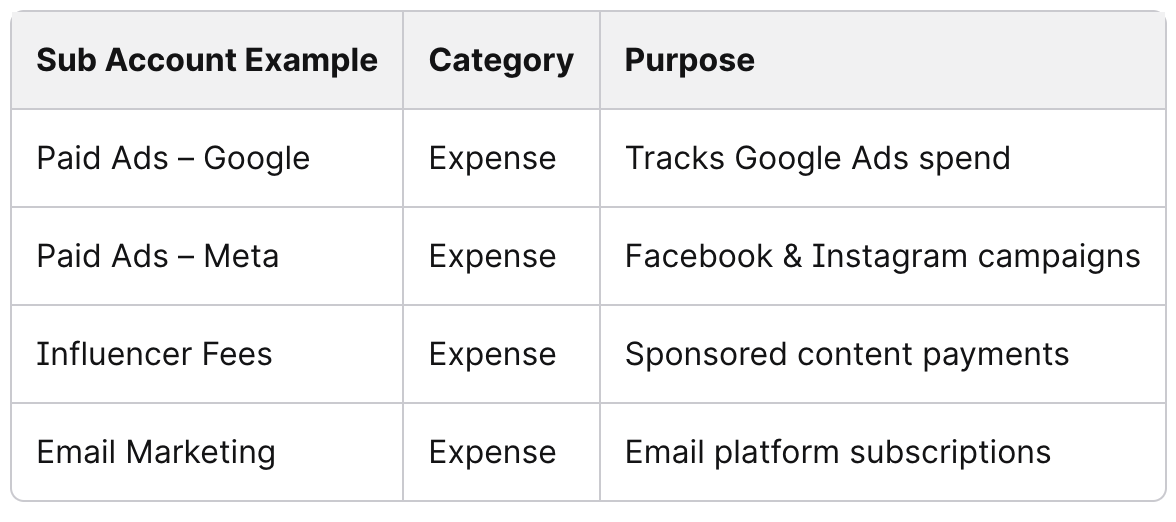

Marketing Expenses and Customer Acquisition Costs

Marketing is one of the most variable expense categories in an ecommerce business. It includes paid ads, influencer partnerships, email platforms, and affiliate programs. Tracking these in sub-accounts shows which channels deliver the best return on ad spend (ROAS).

Customer acquisition cost (CAC) must be monitored against gross margin. A high CAC signals unsustainable growth. Categorizing spend across Google Ads, Meta Ads, and SEO tools connects financial reporting directly to performance data.

Separating brand marketing from direct-response campaigns adds clarity. Brand-building may not drive immediate sales but still requires consistent budget allocation.

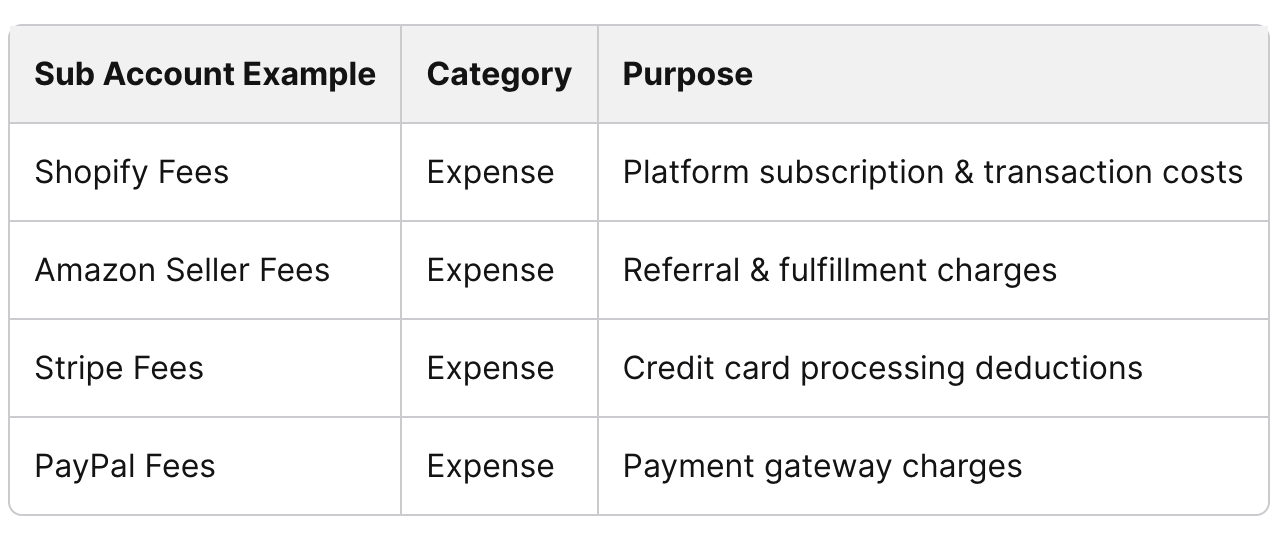

Platform and Payment Processing Fees

Ecommerce businesses rely on platforms like Shopify, Amazon, and WooCommerce—each charging transaction fees, subscriptions, and sometimes referral or storage costs. Tracking these separately reveals true net revenue by channel.

Payment processors such as Stripe, PayPal, and Shopify Payments deduct fees before deposits hit the bank. Without a dedicated sub-account, revenue appears understated and reconciliations become inaccurate.

Returns and allowances also affect platform fees. For example, Amazon may keep a portion of the fee even after issuing a refund. Recording these adjustments ensures financial statements reflect actual income.

Software Subscriptions and Ecommerce Operations Tools

Modern ecommerce businesses run on software subscriptions. These include QuickBooks Online, inventory management systems, CRM platforms, and analytics tools. Categorizing them under operating expenses reveals the business’s fixed cost base.

Sub-accounts should separate accounting software, project management tools, and customer support systems. This makes it clear which tools are essential versus optional when reviewing expenses.

Some subscriptions support sales and marketing (email automation, SMS platforms), while others—like warehouse management software—improve fulfillment efficiency. Proper classification ensures accurate reporting across financial statements.

How to Structure Your Ecommerce Chart of Accounts

A well-structured chart of accounts organizes every business account into clear categories, keeping records accurate and financial statements aligned with real activity. For an ecommerce business, this framework makes it easy to track inventory, shipping costs, and marketing spend.

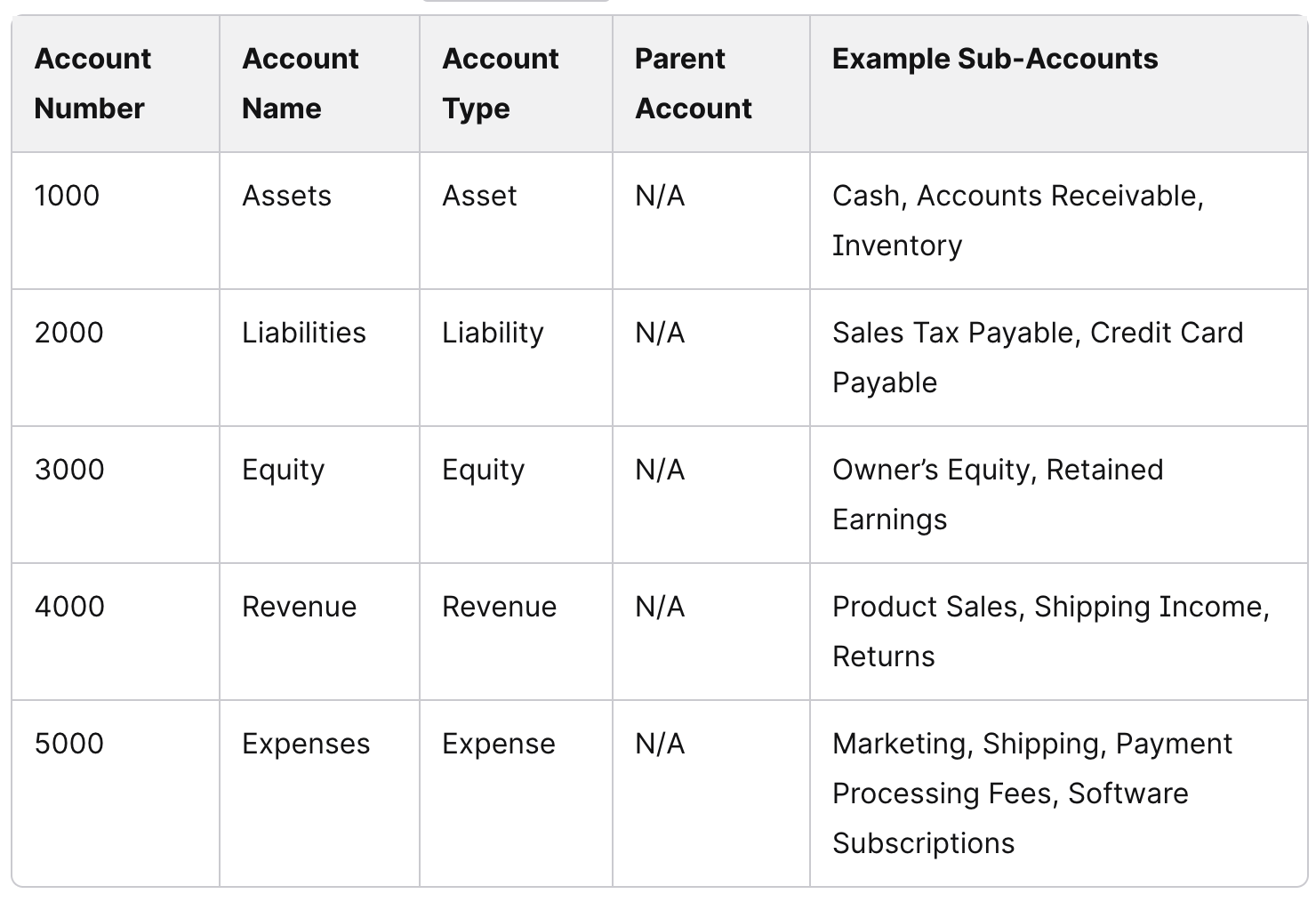

Using Account Numbers and Sub-Accounts

Assigning account numbers creates order and prevents confusion. Most ecommerce businesses follow a standard sequence:

Assets (1000s)

Liabilities (2000s)

Equity (3000s)

Revenue (4000s)

Expenses (5000s)

Sub-accounts add clarity. For example, “Expenses” may include sub-accounts for advertising, payment processing fees, and shipping. These child accounts roll up to the parent account, providing both detail and a high-level view.

By combining account numbers with sub-accounts, an ecommerce chart of accounts stays scalable and precise. This structure highlights cost drivers like fulfillment expenses while supporting tax compliance and inventory management in QuickBooks Online or similar systems.

Double-Check Accuracy with Regular Reconciliations

Even a well-structured chart of accounts loses value if it isn’t reconciled regularly. Reconciliation means comparing recorded balances with bank statements, payment processors, and inventory records.

For an ecommerce business, this includes:

Matching Stripe, PayPal, and Amazon deposits to revenue accounts

Verifying sales tax collected aligns with liability accounts

Confirming shipping costs are properly categorized

Regular reconciliations catch duplicate entries, misclassified expenses, and overstated revenue—keeping financial records audit-ready and reliable for growth decisions.

Example Table: Sample Ecommerce Chart Of Accounts (With Categories + Sub Accounts)

Below is a simplified example of how ecommerce businesses might structure their chart of accounts with parent accounts and sub-accounts.

Chart Of Accounts Setup In QuickBooks Online

A clear chart of accounts in QuickBooks Online helps an ecommerce business separate income streams, track direct costs, and manage sales tax obligations. Proper setup produces accurate financial statements and supports pricing, cash flow, and growth decisions.

Why QuickBooks Online Works Best for Ecommerce

QuickBooks Online organizes the five main categories—assets, liabilities, equity, revenue, and expenses—and routes each transaction to the right account. This automation improves reporting accuracy and keeps records audit-ready.

Unlike spreadsheets or manual tracking, QuickBooks handles reconciliations automatically, which is critical for ecommerce sellers processing high volumes across multiple channels.

When comparing QuickBooks vs. Xero, QuickBooks typically scales better for ecommerce. Its integrations make it easier to manage payouts, inventory, and sales tax, while Xero suits smaller businesses with simpler needs.

For ecommerce owners, the right tool isn’t just about recording sales—it’s about maintaining a reliable system that reduces errors, ensures compliance, and delivers clarity in financial reporting.

Step-by-Step Setup for Financial Accounts and Sub-Accounts

Setting up an ecommerce chart of accounts begins with the five main categories:

Assets: bank accounts, receivables, inventory

Liabilities: credit cards, loans, sales tax payable

Equity: owner’s contributions, retained earnings

Revenue: product sales, shipping income, discounts

Expenses: marketing, merchant fees, software subscriptions

Sub-accounts refine reporting. For example, revenue may split into Shopify, Amazon, and wholesale sales. Expenses can separate ad spend by platform (Google Ads, Meta Ads).

This layered structure shows profitability by channel, aligns shipping costs with revenue, and keeps cash flow visible—insights often lost without sub-accounts.

How to Integrate QuickBooks Online with Ecommerce Platforms

Integrating QuickBooks Online with platforms like Shopify, Amazon, and Stripe ensures sales, refunds, and fees post correctly—reducing manual entry and reconciliation errors.

Shopify: Route payouts through a clearing account before they hit the bank.

Amazon: Split deposits between product revenue and shipping income.

Stripe: Record sales, refunds, and processing fees separately to avoid overstated revenue.

Mapping each integration to the correct account keeps reporting accurate and real time. Done right, this prevents mismatched deposits and untracked fees—giving ecommerce businesses reliable financial statements from day one.

From Transactions To Insights – Turning Data Into Decisions

A well-structured chart of accounts turns raw business transactions into accurate financial statements that guide decision-making. By categorizing revenue, expenses, assets, liabilities, and equity, ecommerce owners gain clarity on financial performance and create reports that support growth strategies.

A well-structured chart of accounts transforms raw transactions into reliable financial reporting. For an ecommerce business, that means knowing exactly where revenue comes from, how expenses impact margins, and whether cash flow supports growth.

Our ecommerce bookkeeping services ensure your chart of accounts is set up correctly from day one- so every decision is backed by clean, dependable data.