Ecommerce Cash Flow vs Profit (2025 Guide): The Costly Difference

An ecommerce brand can report $250,000 in profit and still run out of cash. Here’s why: Shopify holds payouts for days, Amazon deducts refunds and chargebacks before you ever see a deposit, suppliers want payment up front, and ad spend clears instantly. On paper, the income statement looks healthy. In your bank account, cash is gone.

This mismatch between profit and cash flow is the silent killer of fast-growing ecommerce businesses. In this guide, we’ll break down why ecommerce cash flow vs profit is the #1 financial distinction every online seller must understand - and how aligning the two protects your company’s financial health, fuels growth, and ensures you can reinvest with confidence.

For a broader perspective on how ecommerce bookkeeping impacts growth, see our ecommerce bookkeeping guide, which explains the systems every scaling brand should have in place.

Cash Flow vs Profit in Ecommerce: Why the Distinction Shapes Growth Decisions

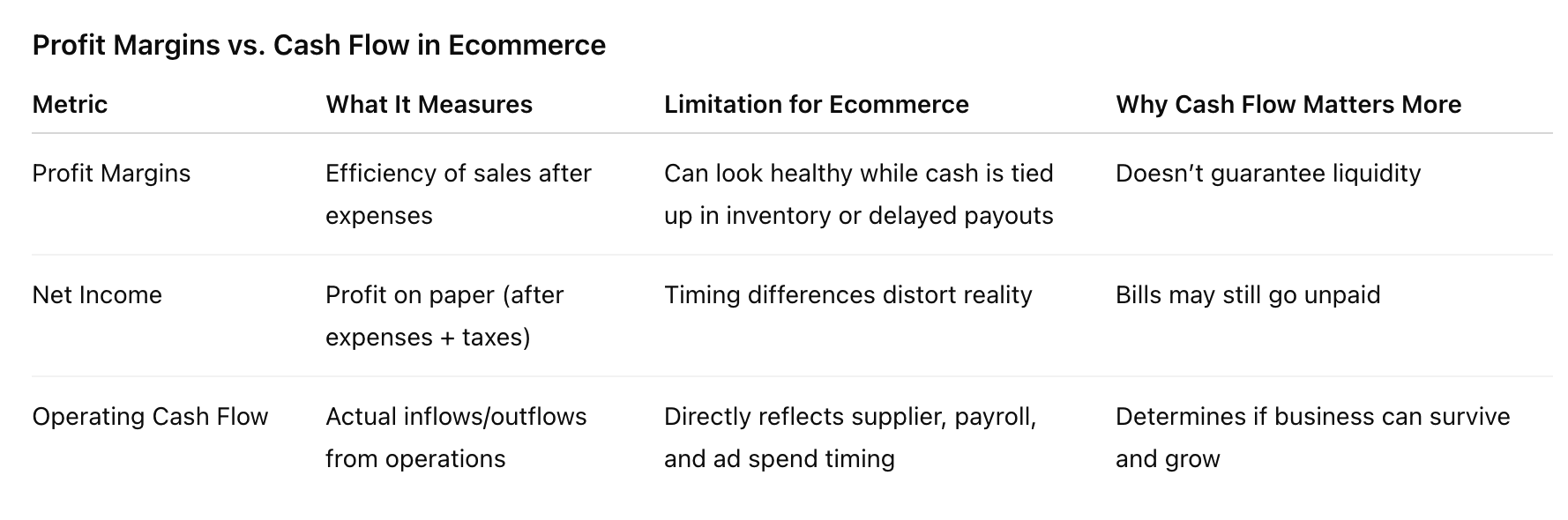

Profit measures earnings after expenses, while cash flow tracks the actual movement of money in and out of the business. Both influence a company’s financial health, but they highlight different realities - especially in ecommerce, where sales revenue rarely equals bank deposits.

Net Income Vs Actual Cash Movement

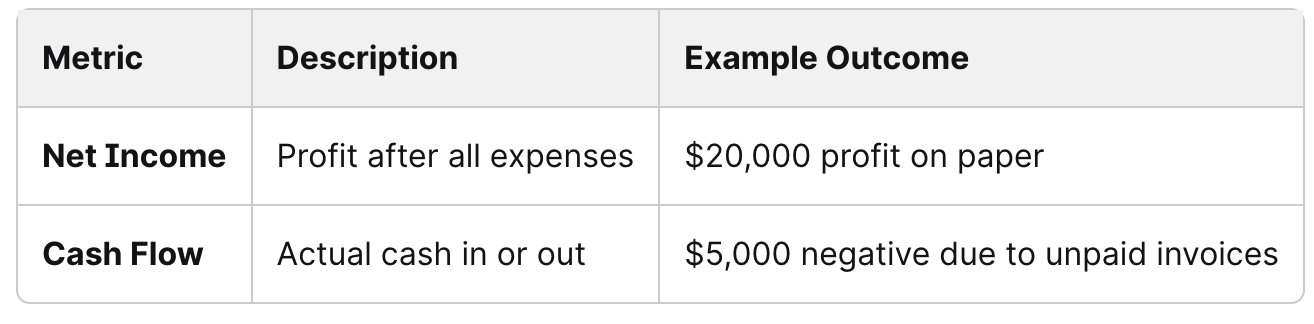

Net income (or net profit) shows what remains after deducting operating expenses, taxes, and interest. It appears on the income statement and signals profitability, but it does not capture the timing of cash inflows and outflows.

Cash flow records when money actually moves. For ecommerce businesses, this means customer payments that clear days later, supplier payments due upfront, refunds and chargebacks deducted instantly, and inventory costs that drain cash long before products are sold. The result? Many ecommerce businesses operate with “healthy” profit margins on paper while facing negative cash flow in practice - a gap that quietly erodes financial stability.

A simple example illustrates the difference:

Understanding both net income and cash movement ensures leaders see beyond accounting results and into operational liquidity.

Positive Vs Negative Cash Flow Scenarios In Online Sellers

Positive cash flow occurs when cash inflows exceed outflows in a given period. In ecommerce, this happens when customer payments clear faster than supplier invoices or ad spend. A seller with healthy operating cash flow can restock inventory, launch marketing campaigns, and invest in new tools without draining cash reserves or relying on short-term debt. Positive cash flow signals financial stability — the flexibility to grow without constant stress.

Negative cash flow arises when expenses outpace receipts. This often happens when Shopify or Amazon hold payouts, Stripe deducts transaction fees and refunds instantly, or inventory costs tie up thousands before products ship. On the income statement, the brand may look profitable; in the bank account, cash is gone. For many ecommerce businesses, this mismatch is the root cause of ongoing cash flow issues — a silent drag on growth that erodes even strong profit margins.

Consider two scenarios:

Positive Cash Flow: $50,000 in sales collected this month, $30,000 in expenses paid → $20,000 available cash.

Negative Cash Flow: $40,000 in sales recorded, but only $15,000 collected; $25,000 in expenses due → $10,000 cash shortfall.

Tracking both profit margins and cash flow trends helps ecommerce owners avoid liquidity gaps and maintain financial control. For more detail, see how cash flow vs profit differ in practice.

Common Cash Flow Issues That Undermine Ecommerce Financial Stability

Ecommerce businesses often face cash flow pressure from delayed payouts, high operating expenses, and unpredictable costs. Negative cash flow can emerge even when sales look strong, creating financial strain that limits growth and stability.

Marketplace Payout Delays And Transaction Fees

Ecommerce sellers rarely see sales revenue hit their bank accounts right away. Amazon may hold payouts for 7–14 days, while Shopify batches deposits on a 2–5 day schedule. During that time, operating expenses don’t wait: suppliers want payment, shipping carriers bill instantly, and ad spend clears daily. The result is a cash flow gap — money recorded as sales but unavailable for use.

Transaction fees deepen the issue. Marketplaces and processors like Stripe deduct 2%–5% per transaction, plus additional charges for cross-border sales, refunds, or chargebacks. Sellers often record healthy gross profit on the income statement, yet their actual cash inflows shrink before reaching the bank.

For businesses with thin profit margins, these delays and fees can push them into negative cash flow. Without careful cash flow management and forecasting, ecommerce brands may rely on credit lines just to cover operational expenses — a cycle that erodes financial stability over time.

Refunds, Chargebacks, And Unexpected Expenses

Refunds and returns are a constant in ecommerce - but they create immediate cash outflows. When Amazon or Shopify processes a refund, the payment is reversed before the merchant ever sees the deposit, while the cost of goods sold and shipping remain unrecovered. What looks like sales revenue on the income statement vanishes from cash balances, eroding operating cash flow.

Chargebacks compound the problem. Processors like Stripe pull disputed amounts directly from the merchant’s bank account and tack on penalty fees. A few disputes can drain hundreds or thousands in cash reserves, often with little warning.

Then come the true unexpected expenses: replacing equipment, covering new compliance fees, or absorbing rising software costs. Even if profit margins appear solid, these sudden costs can push sellers into negative cash flow and destabilize financial health. Successful ecommerce businesses anticipate these shocks by forecasting refund rates, building cash reserves, and treating reserve funds as a core cash flow strategy - not an afterthought.

Inventory Costs And Supplier Payments

Inventory is often the single largest cash outflow for ecommerce businesses. Suppliers frequently require upfront deposits or full payment before goods ship, tying up thousands in cash weeks — or even months — before sales revenue arrives. This mismatch between expenses and sales creates persistent cash flow gaps.

If demand forecasts are inaccurate, the risk multiplies. Overstocking locks capital into unsold products, drives up Amazon FBA or 3PL storage fees, and reduces cash available for operating expenses like marketing campaigns. Understocking has its own cost: missed sales and lost market share.

Supplier terms add another layer. Many require payment within 30 days, while customer payments may lag in clearing. When accounts receivable don’t align with supplier deadlines, merchants can face liquidity challenges even if profit margins appear healthy.

Strong financial management — from SKU-level reporting to cash flow forecasting — ensures sellers can balance supplier obligations with cash availability. Negotiating favorable payment terms, combined with proactive bookkeeping, allows ecommerce businesses to protect financial stability while scaling.

Marketing Campaigns And Rising Ad Spend

Digital advertising is essential for ecommerce growth, but it creates one of the sharpest cash flow challenges. Platforms like Google Ads and Meta bill daily or weekly, while the sales they generate may take weeks to clear through Shopify, Amazon, or Stripe. This timing mismatch means cash outflows often arrive long before the inflows.

Rising ad costs intensify the issue. Competition for visibility has driven up cost-per-click rates year after year, forcing sellers to spend more to maintain the same traffic. When campaigns underperform, the expense still hits the bank account immediately — leaving negative cash flow even if profit margins look healthy on paper.

Seasonal spikes compound the pressure. During holidays, ad budgets often double or triple, creating sudden surges in operating expenses. Without careful cash flow planning, businesses can overspend, drain cash reserves, and compromise financial stability at the very moment demand peaks. A disciplined approach — aligning campaign budgets with cash availability and forecasting spend against expected inflows — is essential to protect liquidity.

How To Manage Ecommerce Cash Flow For Financial Stability

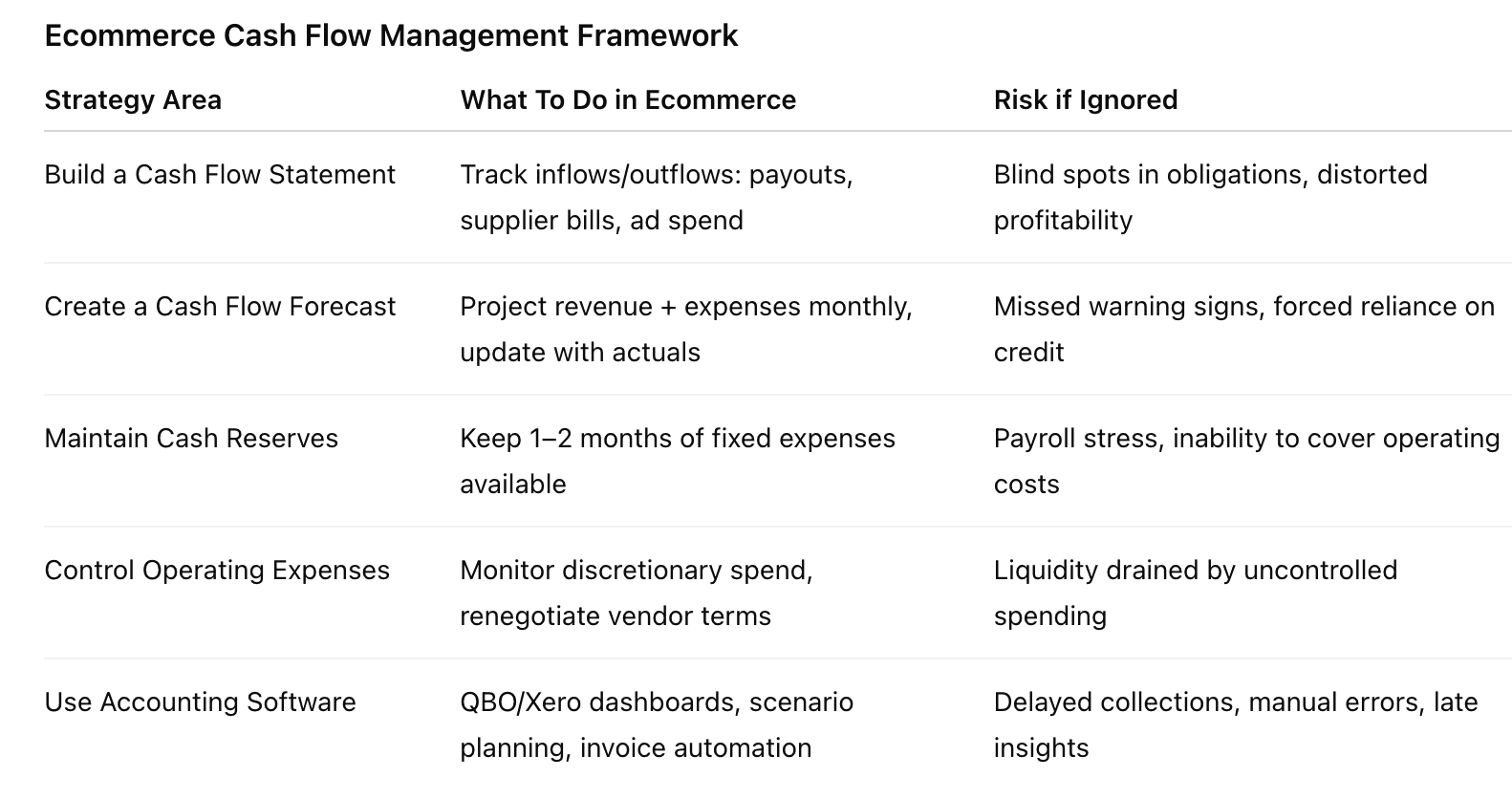

Strong cash flow management allows an ecommerce business to meet obligations on time, maintain liquidity, and avoid unnecessary borrowing. It requires structured forecasting, disciplined reserves, and the right accounting systems to keep operations steady through both growth and seasonal fluctuations. In ecommerce - where payout schedules, refunds, and inventory cycles constantly shift - managing cash is not optional; it’s the foundation of financial stability.

Building A Cash Flow Statement And Forecast

Profit alone cannot measure a company’s financial health. A cash flow statement provides visibility into how money actually moves in and out of the business, complementing the income statement and balance sheet. It highlights whether operations generate enough cash inflows to cover short-term outflows like supplier invoices, payroll, and marketing campaigns.

A cash flow forecast extends this visibility. By projecting sales revenue alongside major expenses, owners can anticipate cash flow gaps before they occur. This means mapping payout timelines from Shopify or Amazon, Stripe deductions for transaction fees and refunds, supplier payment schedules, and ad spend commitments.

Forecasts should be updated monthly to reflect actual performance. Breaking activity into operating, investing, and financing categories ensures reporting remains consistent and actionable. For ecommerce businesses, where sales cycles are volatile and returns unpredictable, a forecast acts as an early warning system. It allows leaders to negotiate supplier terms proactively, adjust marketing spend, or draw on a cash reserve instead of scrambling for reactive financing.

Maintaining A Healthy Cash Position

Liquidity underpins financial stability in ecommerce. A brand may show profit but still struggle if cash is tied up in inventory or delayed customer payments. Strong cash reserves protect payroll, shipping, and marketing spend when sales dip or payouts lag.

Setting clear reserve thresholds - often one to two months of fixed operating expenses - safeguards working capital and reduces stress during seasonal fluctuations or supply chain issues.

Controlling expenses is equally critical. Monitoring discretionary spend, renegotiating vendor contracts, and managing inventory to avoid both overstocking and stockouts preserve liquidity and protect profit margins.

Treating cash management as a daily discipline, not a quarterly review, ensures healthy cash flow, strengthens a company’s financial health, and minimizes reliance on borrowing.

Using Accounting Software To Bridge Cash Flow Gaps

Modern accounting platforms such as Xero and QuickBooks simplify cash flow management by integrating sales, expenses, and banking data in real time. They generate automated cash flow statements and forecasts, reducing manual errors and saving time.

These tools also provide dashboards that highlight upcoming obligations and overdue receivables. With alerts and customizable reports, owners gain a clear view of liquidity without waiting for end-of-month reconciliations.

Some platforms offer scenario planning. This allows businesses to model the effect of delayed payments, increased ad spend, or faster sales growth. By testing outcomes, leaders can prepare strategies before cash flow gaps appear.

Accounting software also bridges timing mismatches by supporting invoice automation and payment reminders. Faster collections improve working capital and reduce reliance on short-term credit.

When used consistently, these systems become more than record-keeping tools. They act as active cash flow management partners, ensuring ecommerce businesses maintain stability while scaling.

Choosing the right platform is part of staying ahead—see our QuickBooks vs Xero ecommerce bookkeeping comparison for a breakdown of which system better supports accurate cash flow management.

Strategic Cash Flow Decisions Ecommerce Owners Must Get Right

Sustainable ecommerce growth depends on careful financial choices that balance liquidity with long-term profitability. Decisions about debt, reinvestment, and day-to-day cash flow management directly influence stability, investor confidence, and the ability to fund future opportunities.

Debt Management And Long-Term Obligations

Debt can accelerate business growth, but it also creates fixed obligations that reduce flexibility. Ecommerce owners must weigh the benefits of loans against the risk of limiting future cash reserves. High-interest financing may erode profit margins and weaken the bottom line if not matched with predictable revenue streams.

Maintaining a clear repayment schedule is essential. A structured approach to financing cash flow ensures that obligations such as principal and interest do not disrupt operations. Businesses that fail to align debt service with incoming cash often face liquidity shortages, even when profitability looks strong on a profit and loss statement.

Investors also evaluate debt levels when reviewing financial metrics. A company with manageable obligations signals discipline, while excessive leverage raises concerns about long-term stability. Strong debt management supports both top-line growth and predictable dividend payments.

Reinvesting Profits Vs Keeping Enough Cash

Reinvestment fuels ecommerce growth, but keeping sufficient cash balances protects against downturns. The tension lies between funding inventory, marketing, or technology upgrades and holding liquidity for payroll and supplier payments.

A disciplined review of the profit and loss statement ensures reinvestment decisions don’t weaken financial stability. Reinvesting every dollar of EBIT without considering working capital creates shortfalls that stall operations, even when profit margins look strong.

Owners must separate investment cash flow that drives growth from the reserves needed to maintain financial health. A comparison table can clarify how much to save money for stability versus how much to reinvest for expansion.

Balancing both ensures growth without compromising operational health.

Why Cash Flow, Not Profit Margins, Determines Ecommerce Financial Stability

Profit margins reflect efficiency, but cash flow determines survival. A business can post strong profitability yet fail if customers pay late or inventory ties up too much capital. Timing of cash inflows and outflows often matters more than reported earnings.

Cash flow analysis provides a clearer picture than profit alone. For example, ecommerce owners who track operating cash flow alongside profitability metrics can anticipate shortages before they disrupt operations. This approach supports stronger business decisions than focusing only on margins.

According to Webgility, 82% of businesses fail due to cash flow problems, not a lack of profitability. Prioritizing liquidity ensures obligations are met, investors remain confident, and growth strategies can proceed without interruption. Cash flow discipline is the foundation for both stability and long-term business growth.

If you want to go deeper into building the right financial foundation, our full ecommerce bookkeeping guide covers reporting, reconciliations, and cash flow planning in more detail.

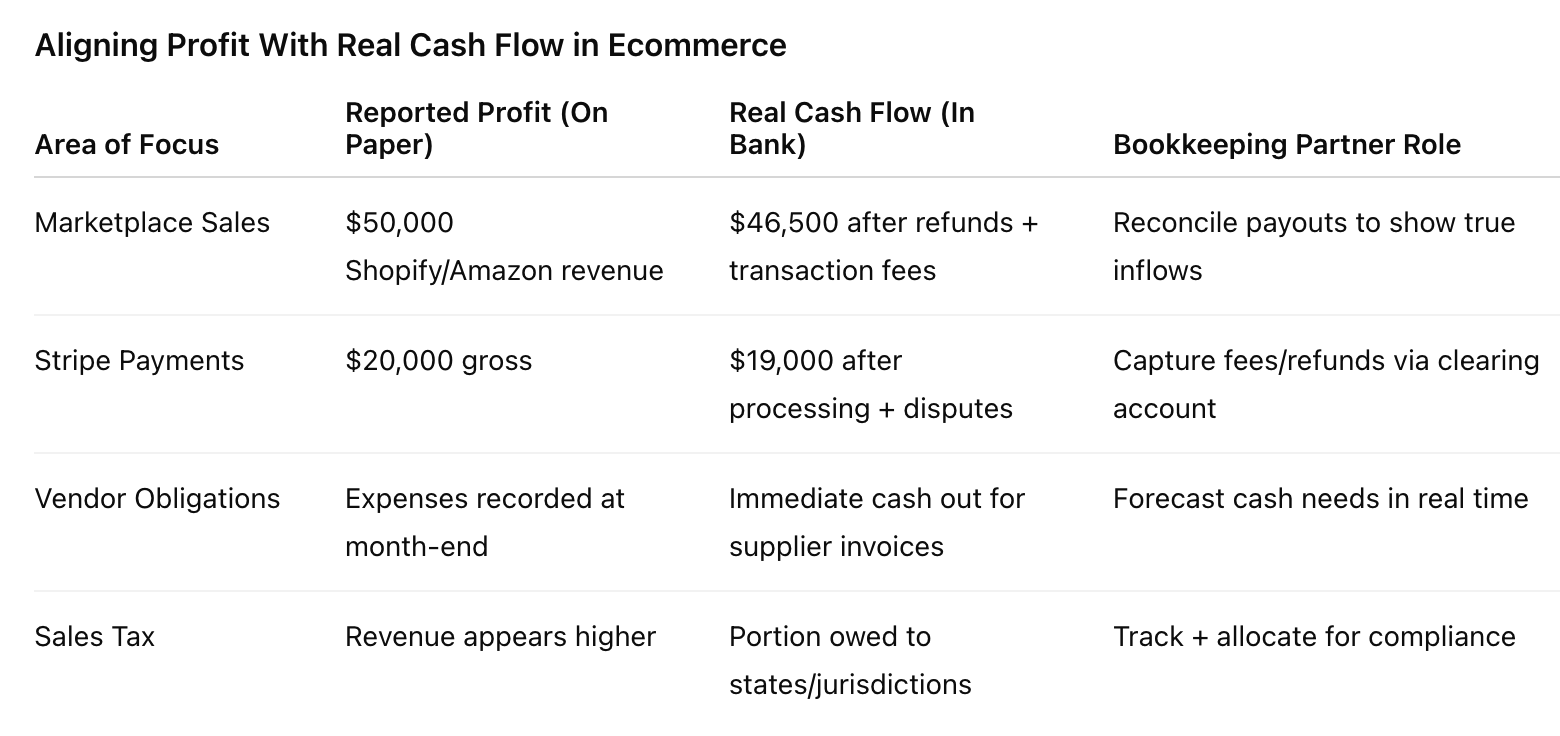

The Role of a Boutique Bookkeeping Partner in Aligning Profit With Real Cash Flow

Accurate bookkeeping ensures that cash flow aligns with actual profitability. It provides clarity on whether funds are available to reinvest, cover expenses, or handle growth without relying on assumptions. Precision in this area protects margins and prevents financial blind spots.

From Reports to Strategy: Proactive Cash Flow Management for Scaling Brands

A boutique bookkeeping partner does more than generate financial statements. They track the movement of money daily, ensuring inflows and outflows are visible in real time. This prevents surprises when vendor payments, platform fees, or tax obligations come due.

Instead of waiting for end-of-month reports, proactive management highlights shortfalls before they occur. For ecommerce brands, this means adjusting promotions, inventory purchases, or marketing spend with confidence.

Common errors like poor reconciliations or missed sales tax filings quietly erode margins. Avoiding these bookkeeping mistakes helps protect cash flow and ensures profit is not overstated. A partner focused on prevention creates stability and keeps the business positioned for growth.

Aligning Reported Profit With Real-Time Cash Across Ecommerce Platforms

Profit on paper rarely equals the actual cash movement in an ecommerce business. Marketplaces deduct refunds and transaction fees instantly, while payouts from Shopify, Amazon, and Stripe lag behind recorded sales. Without reconciliation, financial reports can show profit that doesn’t exist in the bank.

Specialized ecommerce bookkeeping aligns reported earnings with real cash inflows and outflows. Reconciling across multiple sales channels ensures the cash flow statement reflects reality, not projections.

For example, reconciling Stripe in QuickBooks Online matches sales, fees, and refunds precisely. This level of detail prevents overstated profit, keeps financial records reliable, and gives owners the confidence to make growth decisions based on cash they actually control.

Boutique Bookkeeping That Aligns Profit With Cash for Scaling Ecommerce Brands

Scaling ecommerce brands don’t fail because they lack sales — they fail when profit and cash stop matching. Marketplace holds, refunds, and inventory costs can drain liquidity overnight, even while financial reports show growth. Without disciplined oversight, expansion becomes a gamble.

At Accounting Atelier, we provide boutique-level bookkeeping designed for scaling ecommerce businesses. Our role goes beyond categorization — we reconcile payouts, align profit with real-time cash flow, and deliver product-level visibility so founders know exactly what can be reinvested safely.

This is the difference between running numbers and running a business with confidence. If you’re ready to scale without second-guessing your cash, partner with us for high-touch ecommerce bookkeeping that keeps growth controlled, not chaotic.

Ecommerce Cash Flow vs Profit: Frequently Asked Questions

-

Cash flow shows actual money moving in and out of the business, while profit measures earnings after expenses. In ecommerce, delayed Shopify or Amazon payouts, refunds, and inventory costs mean reported profit often doesn’t match available cash.

-

Cash flow management focuses on timing — making sure cash inflows cover operating expenses like supplier payments, marketing, and payroll. Profit optimization targets margins by reducing costs or raising prices. Both are essential, but cash flow keeps the business liquid.

-

Because expenses hit before revenue clears. Examples: Amazon holding payouts, Stripe deducting refunds instantly, or suppliers demanding prepayment. This timing mismatch creates negative cash flow even when income statements show profit.

-

Yes. Quick customer payments and efficient inventory turnover can create healthy cash flow even if net income is low due to thin margins or high expenses. This signals operational efficiency but highlights the need to improve profitability.

-

Cash flow issues: late supplier payments, overdrafts, reliance on credit.

Profitability concerns: shrinking margins, rising expenses, declining net income.

Both impact financial stability, but each requires different corrective action. -

If outflows like supplier invoices or ad spend occur before inflows from Shopify/Amazon payouts, even profitable sellers face liquidity gaps. This is why monitoring cash position and forecasting matters more than profit alone.