Ecommerce Bookkeeping: Complete Guide for Shopify & Amazon Sellers

In ecommerce accounting, small errors quickly snowball into major profit drains. Misapplied fees, untracked COGS, or unreconciled Shopify and Amazon payouts can quietly erode margins and distort your growth strategy. As an ecommerce entrepreneur, you face financial challenges that traditional bookkeeping simply doesn’t address - multi-channel integrations, platform fees, sales tax nexus, and SKU-level inventory accounting.

Without structured, accurate records, you can’t see where margin is leaking, forecast cash flow, or determine whether growth initiatives are truly affordable. That’s why specialized ecommerce bookkeeping is no longer optional - it’s the foundation of long-term stability and scalable profit.

Accounting Atelier specializes in ecommerce bookkeeping services for Shopify and Amazon sellers, ensuring your financial systems are as scalable as your storefront.

What Is Ecommerce Bookkeeping (And Why It Matters for Shopify & Amazon Sellers)

Ecommerce bookkeeping is the backbone of every successful online business. At its core, it’s the process of recording, organizing, and analyzing all financial transactions that flow through your ecommerce business. This means tracking every sale, expense, refund, and fee - across every platform and payment method you use. Unlike traditional businesses, ecommerce businesses operate in a fast-paced, digital environment where cash flow can shift daily and financial health depends on real-time data.

Proper ecommerce bookkeeping is more than just a compliance checkbox. It’s the foundation of ecommerce accounting, giving you the clarity to make smarter business decisions, manage cash flow, and stay ahead of tax laws. Without accurate records, you can’t spot margin leaks, plan for growth, or ensure your online business is truly profitable. In short, ecommerce bookkeeping is what keeps your business stable, scalable, and ready for whatever the market throws your way.

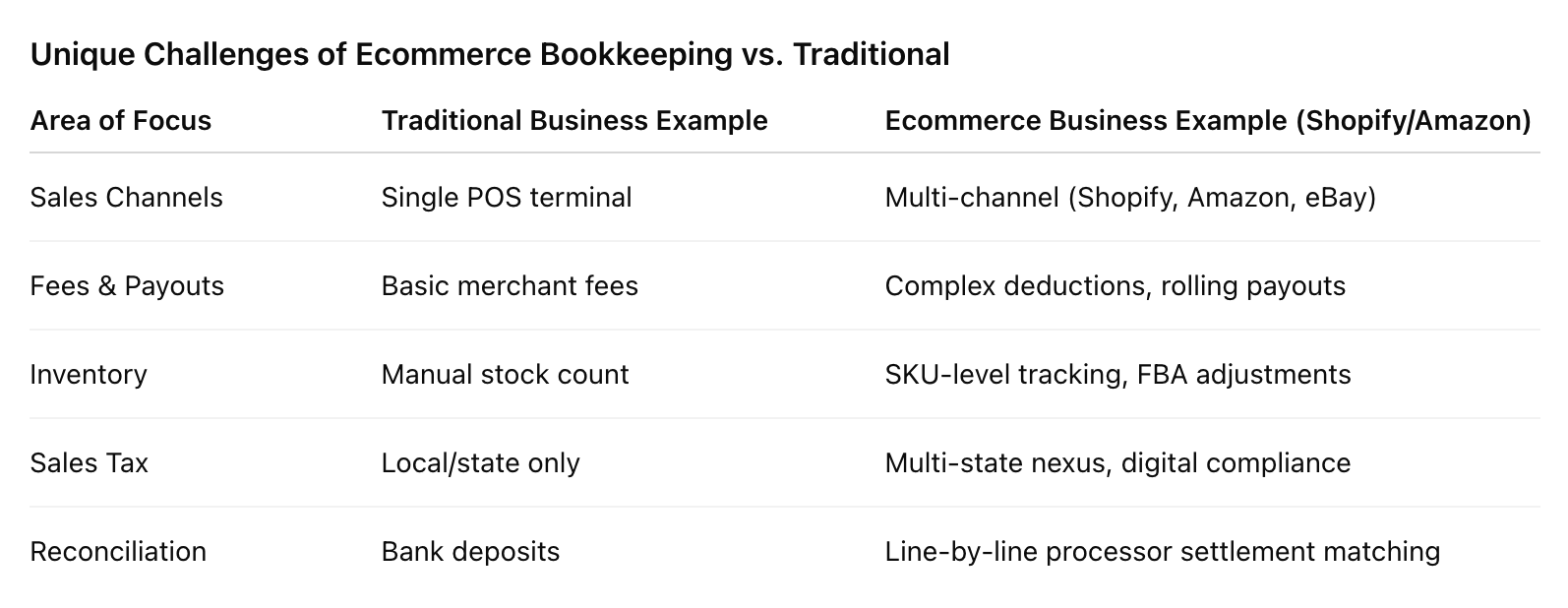

Why Ecommerce Bookkeeping Isn’t Just “Regular” Bookkeeping With a Shopify Login

If you think ecommerce bookkeeping is just traditional bookkeeping with a Shopify login, think again. Ecommerce businesses face a unique set of challenges that go far beyond what most brick-and-mortar stores encounter. You’re juggling multiple sales channels - Shopify, Amazon, eBay, and more - each with their own payment processors, fee structures, and reporting quirks. Add in complex inventory management, frequent returns, and ever-changing sales tax rules, and you’ve got a recipe for chaos if you’re not prepared.

Ecommerce accounting demands a specialized approach. You need to track sales tax collection across states, reconcile payouts from various payment processors, and generate financial reporting that actually reflects your business reality - not just what your ecommerce platforms spit out. Managing multiple sales channels means your bookkeeping system must be robust enough to handle high transaction volumes, real-time inventory updates, and the nuances of digital sales tax. In short, ecommerce bookkeeping isn’t just about recording numbers - it’s about building a system that can keep up with the speed and complexity of online sales.

The Hidden Complexity Behind Every Ecommerce Sale

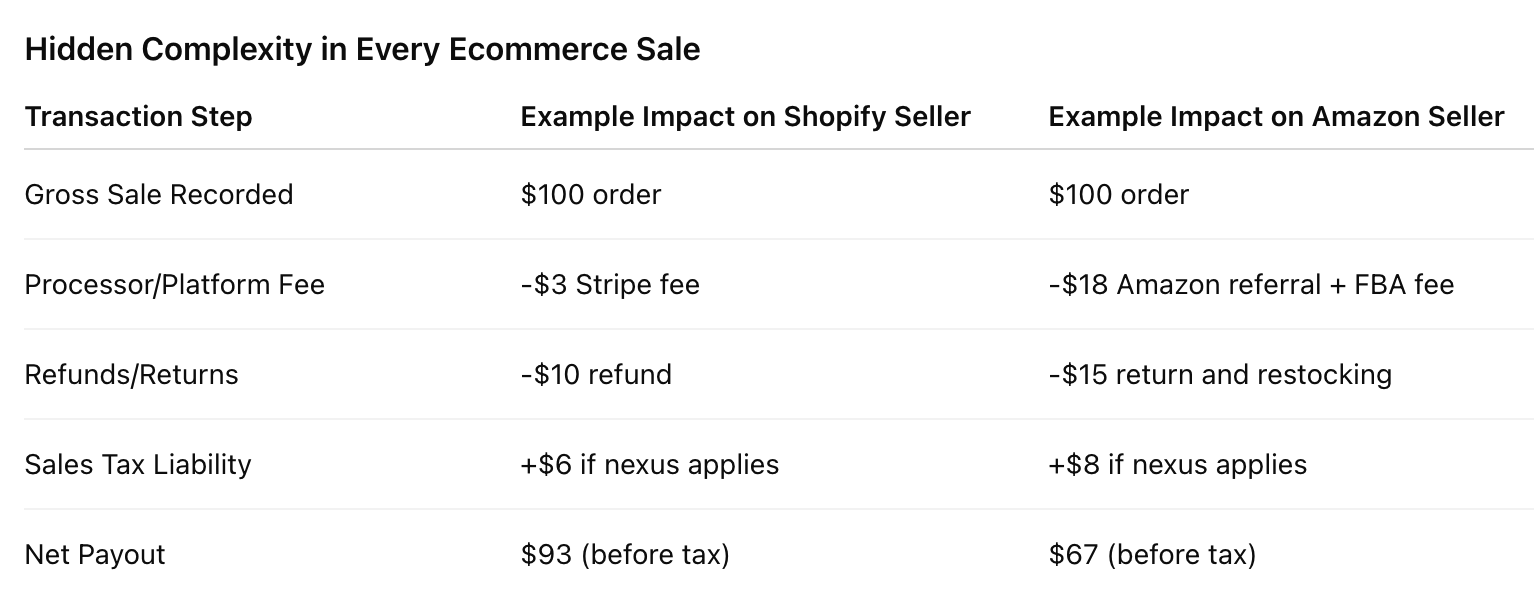

Every time your ecommerce platform registers a sale, there’s a lot more happening behind the scenes than just money changing hands. Each transaction triggers a web of financial activity: payment processing fees are deducted, sales tax may need to be collected (depending on your nexus and the buyer’s location), and your inventory management system must update in real time. If you’re not tracking these moving parts, your financial records will quickly become inaccurate - and that’s a fast track to compliance headaches and profit leaks.

Ecommerce businesses must pay close attention to payment processing fees, which can quietly eat into your margins if left unchecked. Sales tax collection is another minefield; if you have economic nexus in a state, you’re responsible for collecting and remitting the correct amount, or risk running afoul of tax regulations. Accurate financial records aren’t just about knowing your top-line sales - they’re about understanding the true net revenue after every fee, tax, and inventory adjustment. That’s why ecommerce bookkeeping is so much more than just logging sales; it’s about capturing the full financial picture of every transaction.

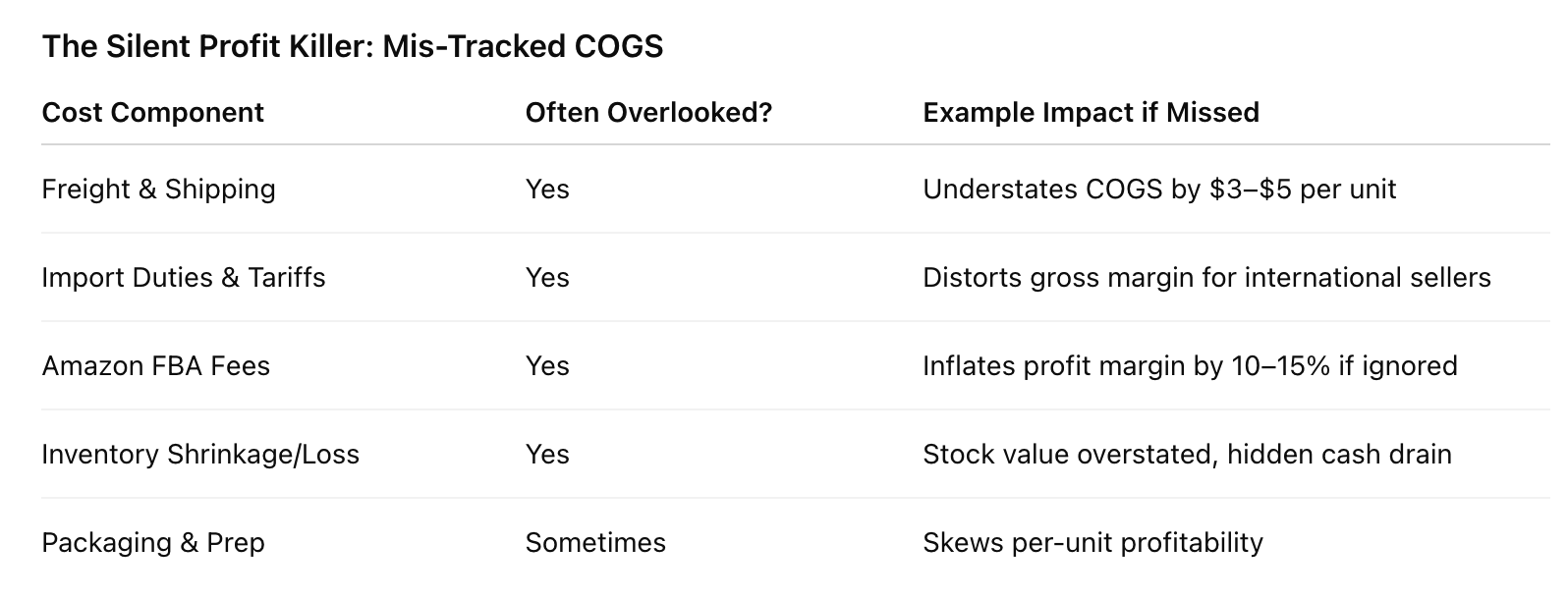

The Silent Profit Killer: Mis-Tracked Ecommerce COGS

Most ecommerce operators underestimate the complexity of tracking Cost of Goods Sold (COGS). Failing to include freight costs, platform fees (from Shopify or Amazon), import duties, and even inventory shrinkage delivers a distorted gross margin. If you’re simply taking last month’s purchases and dividing by items sold, you’re missing variable costs like Amazon fulfillment fees or restocking losses.

Inaccurate COGS reporting leads to two key risks:

Overstated margins – making you think every sale is more profitable than reality

Missed cash drain signals – slow-moving or high-CAC inventory goes unnoticed

To identify profit leaks, reconcile monthly COGS with actual invoices. Use your backend reports (Shopify, Amazon) to capture per-SKU cost variance and eliminate “averaging” errors. This approach gives your business accounting real clarity and ensures your pricing strategy reflects true costs. Maintaining profitability depends on accurate COGS tracking, as it allows you to monitor margins closely and control costs effectively.

Why Your CPA Isn’t Reconciling Shopify, Stripe, or PayPal (And Why That’s a Problem)

A common blind spot is payment gateway reconciliation. Many CPAs or in-house bookkeepers rely on bank deposits alone, ignoring the granular settlement data from Stripe, Shopify Payments, or PayPal. Ecommerce businesses often use various payment gateways, such as PayPal, Stripe, and Square, each presenting unique reconciliation challenges, especially when it comes to accurately capturing and recording transaction fees from each gateway. Each platform deducts fees, holds funds, and – in the case of refunds or chargebacks – can distort what ultimately arrives in your account.

Without line-by-line reconciliation:

Refunds and transaction fees get miscategorized

Gross revenue is overstated

Payout lags create false positives in available cash flow

Insist on monthly downloads of payment processor reports. Ensure your accountant matches every payout to its transactional origin, including currency conversion. It is also essential to reconcile these transactions with your bank accounts to ensure all amounts are accurately recorded. Precise platform reconciliation is critical for matching gross receipts to net sales and understanding true LTV and CAC by channel.

Without expert support, it’s easy to misstate gross margin - our monthly ecommerce bookkeeping retainers are designed to capture SKU-level COGS, platform fees, and true profitability.

Cash Basis Is Keeping You Blind - Not Scalable

Many ecommerce stores default to cash basis accounting because it’s simple - you record sales when cash is received and expenses when paid out. This approach cannot scale for high-growth or multi-channel operators. Cash basis hides future liabilities, distorts true profitability, and makes seasonality or marketing ROI impossible to analyze in real-time. Additionally, cash basis accounting can obscure accounts payable, making it difficult to track short-term obligations and understand your company's liabilities as reflected on financial statements like the balance sheet.

When inventory is purchased but not immediately sold, or when a sale is made on Amazon but payout is delayed, cash basis disconnects operational activity from your financial dashboard. Accrual accounting, though more complex, is essential for proper inventory tracking, accurate LTV, and actionable insights on marketing spend versus gross margin.

Switching to accrual enables you to forecast inventory needs, review true CAC payback periods, and manage seasonality with confidence. Don’t let legacy processes keep your ecommerce business accounting in the dark.

How to Set Up Ecommerce Bookkeeping the Right Way

Getting your ecommerce books set up right from day one is non-negotiable if you want to avoid costly errors down the road. Start by choosing accounting software that can handle the complexity and volume of your financial transactions - think QuickBooks Online, Xero, or another platform built for ecommerce businesses. Next, create a detailed chart of accounts that reflects the unique needs of your online business, including categories for each sales channel, payment processor, and inventory asset.

Establish clear processes for recording every financial transaction, from sales and refunds to shipping costs and platform fees. The right setup will make it easier to generate accurate financial statements, monitor cash flow, and stay compliant with tax laws. Investing time in this foundation now will save you countless hours (and headaches) as your ecommerce business grows.

Ecommerce Chart of Accounts: The Foundation You Can’t Ignore

Your chart of accounts is the blueprint for your entire ecommerce bookkeeping system. It’s where you organize and categorize every financial transaction, making it possible to track performance across sales channels, payment processors, and inventory management systems. For ecommerce businesses, a well-structured chart of accounts is essential for producing accurate financial statements like the balance sheet and income statement, and for ensuring your financial reporting is both detailed and actionable.

A tailored chart of accounts lets you break out revenue and expenses by channel - so you can see exactly how Shopify, Amazon, or any other platform is performing. It also helps you track inventory assets, cost of goods sold, shipping expenses, and platform fees with precision. By mapping out your accounts to reflect the realities of multiple sales channels and payment processors, you’ll simplify tax preparation, improve financial reporting, and empower yourself to make smarter business decisions. Don’t treat your chart of accounts as an afterthought - it’s the foundation that supports every other aspect of your ecommerce accounting.

COGS, Inventory, and Gross Margin: Metrics Every Seller Must Track Weekly

Weekly scrutiny of SKU-level COGS, inventory, and gross margin keeps your financials accurate, directly influencing pricing, reordering, and growth decisions. These processes also help you track revenue in real time, ensuring you have the data needed for effective financial reporting and decision-making. Attention to detail here reveals hidden leaks in cash flow and protects long-term store profitability.

How to Calculate SKU-Level COGS Without Losing Your Margins

Track each SKU’s Cost of Goods Sold using clean, repeatable steps. Start by determining the direct product cost: include your wholesale purchase or manufacturing cost, inbound shipping, packaging, and any tariffs. For most ecommerce stores, you’ll find these inputs on your supplier invoice and shipping statements.

On platforms like Shopify and Amazon, COGS calculation is prone to error if you treat purchases as instantly expensed. Only record COGS once the item is actually sold, not when you receive it in a purchase order. Pair this with unit-level tracking in your inventory management software to avoid duplicated or missed costs.

Mistakes in SKU COGS can quietly erode gross margins and distort CAC and LTV data.

What Counts as Ecommerce COGS: Shipping, Fulfillment, Packaging, and Shrinkage

COGS includes every expense directly attached to getting a product ready to ship to your buyer, not just the buy price. Count products, inbound freight, packaging, FBA or 3PL inbound fees, platform fees, and any labeling or prep charges. If it’s required to bring the product to its sellable state, add it.

Inventory shrinkage, lost stock, and damaged returns must be tracked weekly. This impacts both inventory value and operating expenses, lowering your gross margin if missed. Shrinkage is common for high-volume Amazon sellers due to lost-in-transit or unreturned FBA stock. Track and reconcile these losses to avoid COGS understatements.

Don’t mix non-product costs into COGS. Exclude advertising, merchant processing, and general admin expenses - misclassifying these distorts your profit picture.

The Essential Ecommerce Bookkeeping Tools: A2X, QuickBooks Online, and Inventory Integrations

To streamline bulk COGS, inventory, and margin management, use platforms that automate granular data flows. A2X syncs your Amazon and Shopify order data directly to QuickBooks Online or Xero, mapping each SKU-level transaction to the correct accounts and automating platform fee categorization. This ensures your records accurately reflect true unit economics week to week.

Inventory management software such as DEAR, TradeGecko, and Skubana let you track stock counts, incoming purchase orders, and shrinkage across channels. Integration with your accounting platform locks down consistency, delivering real-time cash flow clarity. These integrations also provide real-time insights, enabling better decision-making for inventory management and financial reporting.

When scaling, choose tools based on direct integration with your ecommerce stack and how they handle complex inventory scenarios. A robust, connected ecosystem minimizes manual entry, costly errors, and ensures you don’t miss out on optimized inventory and COGS accounting for maximum gross margin visibility.

How to Reconcile Payouts Across Shopify, Amazon, PayPal, and Stripe

Accurately reconciling payouts from Shopify, Amazon, PayPal, and Stripe protects you from overstated sales and silent profit loss. Every platform introduces discrepancies caused by fees, returns, and delayed payments, so your books must follow the cash as it actually flows. Reconciling your internal records with bank statements is essential to detect discrepancies, errors, and duplicate transactions, ensuring your financial records are accurate.

Why Ecommerce Sellers Overstate Revenue Without Payout Reconciliation

If you record e-commerce sales as they appear in your Shopify or Amazon dashboard, you risk ignoring the impact of transaction fees, refunds, and timing variances. This can inflate gross margin and understate true inventory shrinkage.

Consider this scenario: You book a $10,000 sales day on Shopify, but after platform fees, Stripe processing, and refunds, your actual payout might only be $9,250. Without reconciling, your reported revenue - and even LTV calculations - are off by 7.5%.

To maintain audit-ready records and ensure compliance with 1099-K reporting thresholds, you need to trace deposits back to their journeys through each payment processor. Accurate reconciliation empowers you to analyze channel-specific CAC and track where leaks in actual collection occur. For practical reconciliation techniques covering both Shopify and Amazon payouts, clearing accounts are highly effective.

Example Walkthrough: Reconciling Shopify to Stripe to QuickBooks Online

Begin by downloading your Shopify Payments payout report and Stripe’s settlement statement for the same period. Compare the gross sales reported by Shopify to the net Stripe deposit in your bank statement.

Set up a clearing account in your bookkeeping system (such as “Shopify Clearing”) to record gross daily sales. Next, subtract Stripe transaction fees, any refunds, and chargebacks. The ending balance of this account should match Stripe’s bank deposit exactly. If the numbers diverge, review for unposted returns or unresolved disputes.

Monthly, match the clearing account’s zero balance to confirmed bank deposits. This gives you transparency into what actually hit the account and ensures your QuickBooks balances align with real cash flow. More detail on this approach is explained in this step-by-step Shopify reconciliation guide.

Platform Fees and Processing Charges: The Hidden Drain on Real Profit

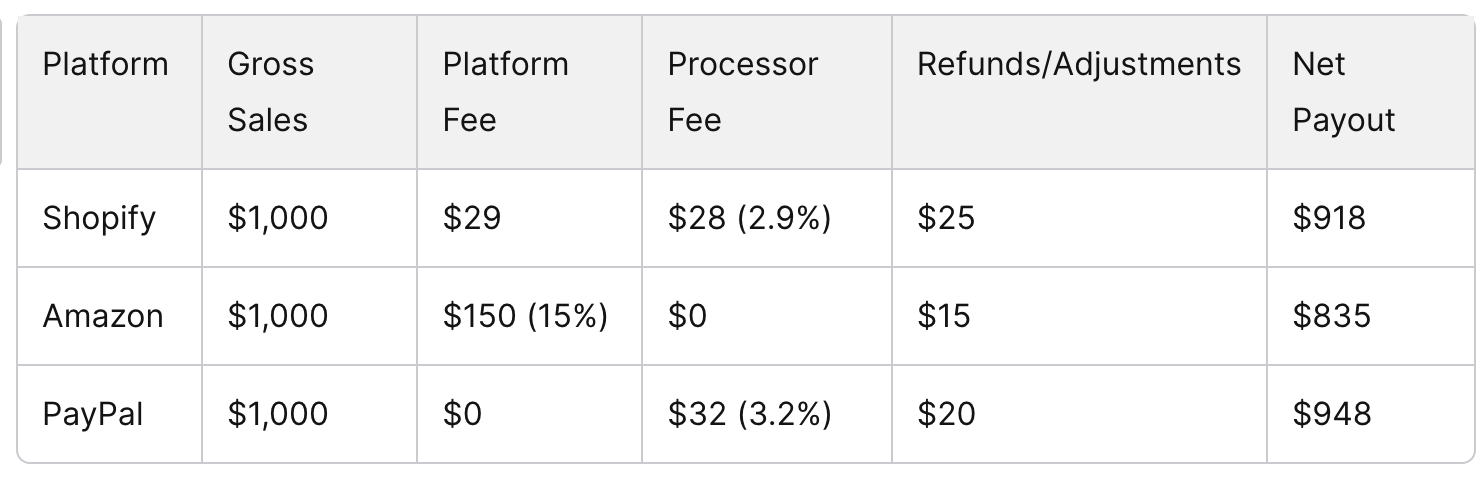

Fees are silent erosion on every payout. Shopify, Amazon, Stripe, and PayPal each layer on different transaction charges—often 2.5–3.5%—plus flat per-transaction fees and potential cross-border surcharges.

Here’s a look at typical deductions per $1,000 in sales:

Unchecked, these fees compress gross margin and distort CAC/LTV models. Only through granular, channel-level reconciliation can you see where costs spike or returns drag down profit. Fees might also mask inventory shrinkage if product returns aren’t matched to corresponding chargebacks. Rigorous reconciliation is the only way to reveal your true margin and keep decision-making anchored to real, collected dollars.

Explore the benefits and tricks of precise fee management for Shopify Payments for streamlined margin control.

Accurate reconciliation across Shopify, Amazon, PayPal, and Stripe is non-negotiable; our ecommerce bookkeeping firm structures integrations so every payout matches the bank.

The Ideal Ecommerce Financial Stack for Serious Sellers

A robust financial stack enables swift reconciliation, transparent oversight of all transactions, and reliable margin calculations. Integrating accounting platforms with marketplace channels and automated workflows is critical to scaling profitably and maintaining clear audit trails. Leveraging specialized ecommerce bookkeeping services or outsourced bookkeeping services ensures efficient management of inventory, sales, and taxes across multiple platforms, while providing expert support and software integration for tax ready financials.

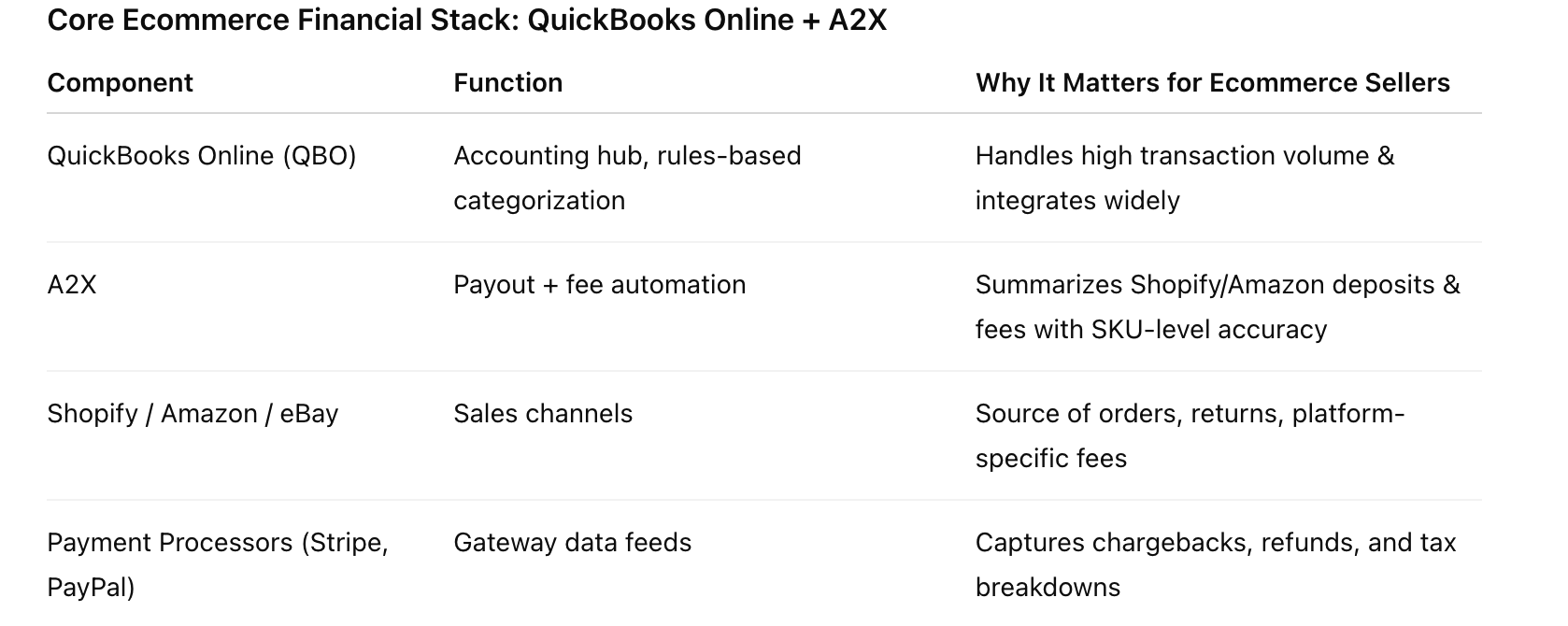

Why QuickBooks Online + A2X Is Non-Negotiable for Ecommerce Sellers

For ecommerce operators, precision and scalability start with accounting software tailored to multichannel sales. QuickBooks Online remains the most widely used platform due to its ability to manage high transaction volumes, automate rule-based categorization, and integrate seamlessly with other tools. However, raw transaction data from Shopify or Amazon often arrives in bulk, unstructured, and heavy with platform fees, chargebacks, and sales tax.

A2X is the automation layer that transforms this noise into clarity. By summarizing deposits, fees, and tax with item-level precision, A2X ensures that every payout matches your actual sales activity. This prevents costly reconciliation gaps and makes it easier to track gross margin, CAC, and LTV per channel. Timely and accurate reconciliation through QuickBooks Online and A2X helps you spot issues like inventory shrinkage or abnormal platform deductions before they affect cash flow. A2X connects directly to major channels including Shopify, Amazon, and eBay for fully automated bookkeeping.

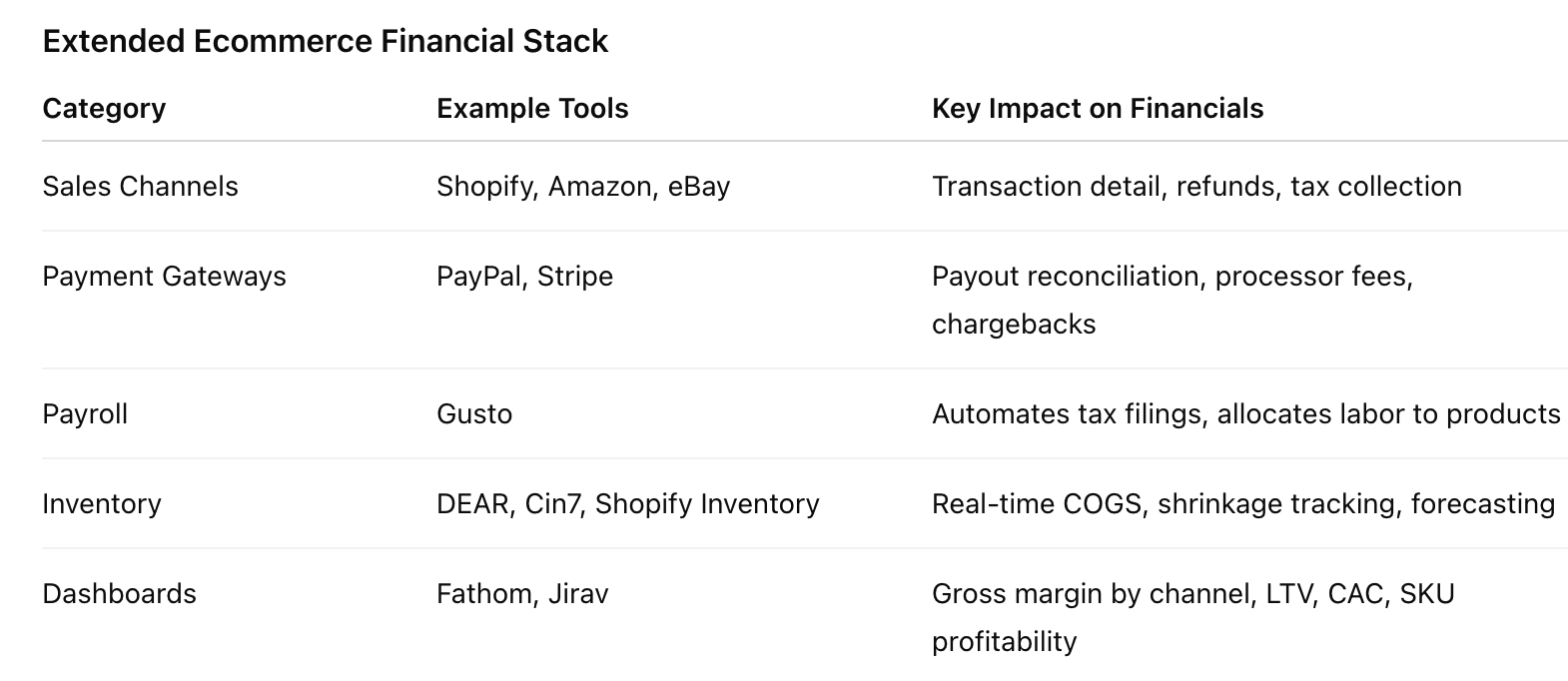

Building a Synced Ecommerce System: Shopify, Amazon, PayPal, and Gusto

Your financial stack must capture data from every sales channel and payment processor. Shopify and Amazon both produce granular fee breakdowns, chargebacks, and tax records. Integrate each with your accounting software for direct import of orders, returns, and payment fees. Leverage A2X to aggregate these transactions for accurate COGS and platform fee attribution by SKU.

For payouts and cash flow, link PayPal or other gateways with QuickBooks Online via direct feeds or supported integrations. Payroll complexity can drain time, especially with remote teams. Software like Gusto handles local, contractor, and international payroll compliance, automates tax filings, and records labor costs by location or team. Maintain clear records of payroll allocations to support margin analysis and segment profitability. Use your integrated stack to generate reports and regularly review key financial reports—such as profit and loss statements, balance sheets, and cash flow statements - to support informed decision-making.

Checklist:

Connect all channels (Shopify, Amazon, PayPal) directly

Reconcile payouts weekly

Link payroll and labor costs to products and channels

Optional: Inventory Tools And Dashboards

Inventory management becomes a differentiator at mid to high volume. Tools like DEAR, Cin7, or Shopify’s built-in inventory module offer live inventory tracking, demand forecasting, and B2B/B2C order management. Integrate your inventory tool with QuickBooks Online for real-time COGS calculations, flagging excess stock, and automating write-downs for inventory shrinkage.

Analytics dashboards (e.g., Fathom, Jirav) translate raw data into actionable metrics — gross margin by channel, LTV, CAC, and stock turnover. Leverage dashboards to monitor SKU-level profitability, platform fee impact, and seasonal trends. When combined, these tools close the loop between your accounting software, inventory, and financial strategy for your online store. Review inventory data monthly for discrepancies against your financials and audit high-value SKUs.

Next Steps: Partner With an Ecommerce Bookkeeping Expert

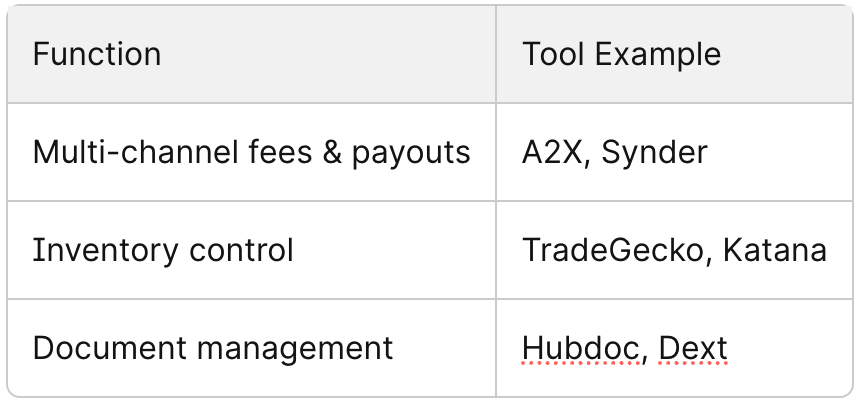

To operate a multi-channel store with confidence, examine your bookkeeping platform and integrations today. Evaluate whether your current process distinguishes between platform fees from Shopify, cost of goods sold, shipping, and returns on Amazon. Small errors in categorizing these transactions can distort your gross margin and trigger unnecessary tax liabilities.

For sellers serious about scaling, partnering with a specialist in ecommerce bookkeeping turns financial chaos into reliable reporting you can grow on.

Next steps to prioritize:

Audit a recent month for inventory shrinkage and unaccounted fees. List discrepancies and match them against payout schedules.

Reconcile your sales tax collected with actual state liabilities to avoid overpayments.

Experienced high CAC and tight margins? Review your reports by sales channel. Comparing LTV by channel in your income statement will help reallocate acquisition budgets effectively.

Quick reference for tools:

You’ve invested in building a six- or seven-figure store - your bookkeeping deserves the same level of strategy as your operations. Generic accounting won’t cut it. True ecommerce bookkeeping means tracking SKU-level COGS, reconciling payouts from Shopify, Amazon, Stripe, and PayPal, and integrating tools like QuickBooks Online and A2X so every number reflects real profit.

If your books are behind, margins are slipping, or you’re unsure whether your CPA is reconciling correctly, now is the time to bring in an ecommerce bookkeeping specialist who understands the complexity of online platforms. Move proactively to protect your margins, streamline cash flow, and position your business for the next stage of growth.

👉 Book a consultation today to see how our boutique bookkeeping firm supports high-volume Shopify and Amazon sellers with reliable, structured, and scalable financial systems.

Ecommerce Bookkeeping FAQs

Mastering ecommerce bookkeeping requires more than spreadsheets. It takes platform-specific expertise, advanced software integrations, and professional oversight to protect your margins as your store scales. At Accounting Atelier, we specialize in building the financial systems that Shopify, Amazon, and multi-channel sellers rely on to grow profitably.

-

Accurate ecommerce bookkeeping requires more than recording sales. You need to reconcile every payout from Shopify, Amazon, PayPal, and Stripe against your actual bank deposits, while capturing platform fees, refunds, and ad spend deductions.

Inventory tracking is equally critical—monitoring shrinkage, landed costs, and SKU-level margins ensures you’re not overstating profit. You also need visibility into COGS, gross margin, CAC, LTV, and sales tax nexus obligations.

At Accounting Atelier, we design bookkeeping systems that automate these workflows, reduce tax risk, and provide investor-ready reporting.

-

You could try learning every Shopify report, Amazon fee structure, and tax rule yourself—but most sellers quickly discover it’s a full-time job. True proficiency requires:

Daily or weekly reconciliations to catch payout errors and fee overcharges.

Deep knowledge of inventory costing methods and multi-state sales tax compliance.

Integration mastery with tools like QuickBooks Online and A2X.

That’s why high-volume sellers turn to Accounting Atelier: we manage these complexities for you, so you can focus on scaling sales instead of fixing spreadsheets.

-

The gold standard is to connect your store directly to QuickBooks Online via a proven connector like A2X. This eliminates manual entry, ensures platform fees and refunds are captured, and maps every SKU to the right chart of accounts.

But integrations aren’t “set and forget.” They require testing, monitoring, and corrections for tax codes or inventory sync issues.

At Accounting Atelier, we implement and maintain these integrations so your financials stay accurate month after month.

-

For most sellers, QuickBooks Online + A2X is the non-negotiable combination. It provides automation, multi-currency handling, and flexible reporting. For larger, inventory-heavy operations, NetSuite may be appropriate.

The real differentiator isn’t just choosing the right software—it’s configuring it properly and keeping it optimized.

Accounting Atelier ensures your software stack is not only best-in-class but tailored to your exact sales channels and reporting needs.

-

Global sellers face unique complexity: reconciling Amazon Global, Shopify Payments, and PayPal deposits across multiple currencies while accounting for FX gains and losses.

QuickBooks Online automates conversions, but you must also maintain separate clearing accounts and audit realized vs. unrealized FX impact. Done wrong, your books misstate profit and create tax compliance issues.

Our team at Accounting Atelier has extensive multi-currency experience—we ensure every conversion, fee, and tax implication is accounted for with precision.