Bookkeeping for Law Firms: The Complete Guide to Legal Accounting

Updated November 2025

Law firm bookkeeping - whether you call it bookkeeping for attorneys, bookkeeping for lawyers, or legal bookkeeping - isn't regular bookkeeping with a legal client list. It's a specialized discipline with unique requirements, compliance obligations, and risks that don't exist in other industries.

Get it wrong, and you're not just dealing with tax penalties or messy financials. You're facing bar complaints, IOLTA violations, and potential license suspension.

Accounting for law firms is more than reconciling numbers - it’s about compliance, strategy, and risk prevention

This guide covers what law firm bookkeeping actually includes, how it differs from standard accounting, when to handle it yourself versus outsourcing, and how to choose the right system or partner for your practice.

What Law Firm Bookkeeping Actually Includes

Law firm bookkeeping goes far beyond recording income and expenses. It requires managing multiple account types, maintaining bar compliance, and producing reports that support both financial and ethical obligations.

Core Bookkeeping Functions

General ledger maintenance Recording all financial transactions - revenue, expenses, payroll, owner distributions - in your chart of accounts. This creates the foundation for all financial reporting.

Bank reconciliation Matching your bank statements to your books monthly. Ensures every transaction is recorded and catches errors, fraud, or discrepancies quickly.

Accounts receivable tracking Monitoring unbilled time, outstanding invoices, and collection status. Critical for cash flow management and identifying slow-paying clients.

Accounts payable management Tracking vendor bills, scheduling payments, and maintaining good relationships with service providers while managing cash flow.

Financial statement preparation Generating monthly profit & loss statements, balance sheets, and cash flow statements. These aren't just for tax time - they're decision-making tools.

For more on what your financial reports should show, see our law firm financial reports guide.

Trust Accounting (The Non-Negotiable Difference)

What is law firm accounting?

This is what separates law firm bookkeeping from every other industry:

IOLTA account management Maintaining pooled client trust accounts for retainers, settlement funds, and costs. Every dollar must be tracked to a specific client and matter.

Three-way reconciliation Monthly reconciliation that matches three numbers: your trust bank balance, your trust ledger balance, and the sum of all individual client ledger balances. All three must match to the penny.

For a detailed walkthrough, see our IOLTA trust accounting guide.

For a foundational overview, start with our complete IOLTA account guide.

Client ledger tracking Individual ledgers for every client showing deposits, disbursements, and running balances. Required for bar compliance and audit readiness.

Proper timing of fund transfers Moving money from trust to operating only when fees are earned - not when billed or when convenient. Timing violations are one of the most common IOLTA mistakes.

Audit-ready documentation Maintaining records that satisfy bar requirements: transaction logs, reconciliation reports, client ledger summaries, and supporting documentation.

Practice-Specific Reporting

Profitability by practice area Revenue and expenses broken down by matter type. Tells you which work is actually profitable versus just busy.

Attorney performance metrics Billable hours, realization rates, and revenue per attorney. Essential for evaluating performance and making hiring decisions.

For the key metrics to track, see our law firm financial metrics guide.

Cash flow analysis Understanding when money comes in versus when it goes out. Critical for managing payroll, quarterly taxes, and growth investments.

Owner compensation tracking Properly categorizing draws, distributions, and salary. Keeps personal and business finances separate and simplifies tax preparation.

For a complete breakdown of monthly deliverables, see law firm bookkeeping reports every managing partner needs.

How Law Firm Bookkeeping Differs From Standard Bookkeeping

Standard Bookkeeping:

One bank account

Revenue when earned

Expenses when incurred

Monthly reconciliation

Financial statements for taxes and management

Law Firm Bookkeeping:

Multiple accounts (operating, trust, possibly separate client trusts)

Revenue recognition tied to ethical rules (earned vs. unearned)

Trust funds that are liabilities, not assets

Monthly three-way reconciliation (not just bank matching)

Financial statements plus compliance reports

Bar audit readiness at all times

The stakes are different. A bookkeeping error at a retail store might cost money or trigger an IRS notice. A bookkeeping error with trust funds can cost you your license.

The 5 Bookkeeping Mistakes That Get Law Firms in Trouble

1. Commingling Trust and Operating Funds

The mistake: Depositing client retainers into your operating account, leaving earned fees in trust "until you need them," or using trust funds to cover short-term firm expenses.

Why it matters: Commingling is an ethics violation in every state. It triggers bar complaints and audits even when no money is missing.

The fix: Client funds go in trust. Firm funds go in operating. Never mix them, not even temporarily.

2. Skipping Monthly Trust Reconciliation

The mistake: Reconciling trust accounts quarterly, annually, or "when you get around to it" instead of monthly.

Why it matters: Most states require monthly reconciliation. Problems compound quickly - what's a $100 discrepancy in month one becomes a $5,000 unexplained gap by month six.

The fix: Complete three-way reconciliation by the 10th of each month. Document everything. Don't skip months.

3. Missing or Negative Client Ledger Balances

The mistake: Transferring fees to operating without checking the specific client ledger balance. Result: negative balance, meaning you used another client's funds.

Why it matters: Using Client A's funds to pay yourself for Client B's work is misappropriation - even if unintentional.

The fix: Always verify the client ledger balance before transferring funds. If the ledger shows $500, you can't transfer $600.

4. Using Generic Accounting Software Without Legal Configuration

The mistake: Setting up QuickBooks like a regular business - no trust liability tracking, no client ledgers, no proper chart of accounts.

Why it matters: Generic setup can't track trust funds properly. You end up with books that look fine but violate bar rules.

The fix: Use legal-specific software (Clio, MyCase, LeanLaw) or configure QuickBooks specifically for law firm accounting with proper trust account structure.

5. No Separation Between Personal and Business Finances

The mistake: Paying firm expenses from personal accounts, depositing client payments into personal checking, or using the same credit card for both.

Why it matters: Pierces the corporate veil, creates tax nightmares, makes bookkeeping impossible, and can trigger bar inquiries.

The fix: Separate business checking, savings, trust account, and credit card from day one. Never mix personal and business transactions.

DIY Bookkeeping vs. Outsourced: When Each Makes Sense

When DIY Bookkeeping Works

You're a good fit for DIY if:

Solo or very small practice (under $200K revenue)

Limited trust account activity

You're detail-oriented and disciplined

You have time for 3-5 hours/week of bookkeeping

You understand trust accounting rules

Your state bar provides good IOLTA training

What you'll need:

Legal practice management software with trust accounting (Clio, MyCase)

QuickBooks Online configured for law firms

Monthly reconciliation discipline

Bar-approved training on IOLTA compliance

Estimated time investment: 3-5 hours/week for transaction entry, reconciliation, and monthly close.

For a deeper look at what can go wrong, see our guide to DIY bookkeeping for law firms.

When to Outsource Law Firm Bookkeeping

You should outsource if:

Your revenue exceeds $250K/year

You handle significant trust account volume

You're spending 5+ hours/week on bookkeeping

You've made IOLTA errors or received bar notices

You dread reconciliation or avoid it

You're not confident in your trust accounting knowledge

Your time is worth more than bookkeeping costs

What you get with professional bookkeeping:

Expert handling of trust accounting and IOLTA compliance

Monthly three-way reconciliation completed on time

Financial statements delivered by the 10th

Clean books ready for tax preparation

Reduced audit risk

Time back to practice law

Cost: $500-$1,500/month depending on firm size and transaction volume.

For detailed pricing breakdown, see our law firm bookkeeping cost guide.

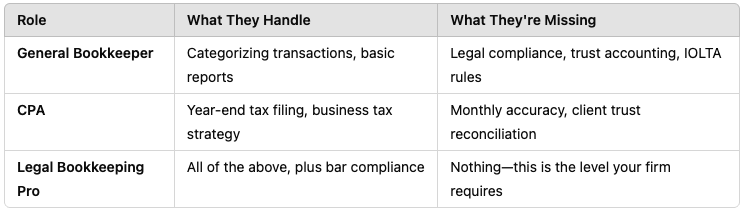

Comparison: Bookkeeper vs. CPA vs. Legal Bookkeeping Pro

What to Look for in a Law Firm Bookkeeper

If you decide to outsource, don't hire a general bookkeeper and hope they figure it out. See our breakdown of what law firm bookkeeping services should include.

Must-Have Expertise

Legal-specific experience They should work primarily or exclusively with law firms. Trust accounting rules, IOLTA compliance, and bar requirements aren't things a general bookkeeper can learn on the job with your firm.

Three-way reconciliation knowledge They should complete this monthly without needing instruction. If they've never heard of three-way reconciliation, they're not qualified for law firm work.

Software proficiency Experience with your practice management system (Clio, MyCase, LeanLaw) and QuickBooks Online. Integration between systems is where errors happen - they need to know both.

Bar compliance understanding They should know your state's IOLTA requirements, reconciliation deadlines, and reporting obligations. Compliance isn't optional.

Green Flags

They ask about your trust account immediately First question should be about your trust account setup, not just general financials.

They explain three-way reconciliation without prompting Shows they understand the core requirement of law firm bookkeeping.

They reference specific IOLTA rules If they mention timing of transfers, client ledger tracking, or audit requirements, they know what they're doing.

They discuss practice-specific reporting Asking how you want to see profitability (by practice area, attorney, matter type) shows they understand law firm needs.

They have a clear process Monthly timeline, deliverables list, communication cadence. Professional bookkeepers have systems, not ad-hoc approaches.

Red Flags

"I've done bookkeeping for all kinds of businesses" Law firms aren't "all kinds of businesses." They have unique requirements.

They don't mention trust accounts in the first conversation If they're not immediately focused on IOLTA compliance, they don't understand law firm work.

They suggest you can "probably handle trust accounting yourself" Professional law firm bookkeepers know trust accounting is high-risk and recommend proper oversight.

No clear timeline or deliverables "I'll get you reports when they're ready" isn't professional service.

Price seems too good to be true Quality law firm bookkeeping costs $500-1,500/month. If someone offers $200/month, they don't know what's involved.

Not sure if you're ready? Use our decision framework for outsourcing law firm bookkeeping.

The Software Stack for Law Firm Bookkeeping

Whether you're doing it yourself or outsourcing, you need the right tools:

Essential Software

Practice management system Clio, MyCase, or LeanLaw. Handles client intake, time tracking, billing, and trust accounting features.

Accounting software QuickBooks Online configured for law firms. Tracks general ledger, produces financial statements, manages payables and receivables.

Integration between the two Your practice management system should feed data to QuickBooks. Manual data entry between systems creates errors.

Bank feeds Automatic transaction downloads from your bank accounts. Reduces manual entry and catches transactions faster.

Nice-to-Have Tools

Payment processing LawPay or similar for accepting credit cards while maintaining IOLTA compliance.

Receipt capture Dext or similar for photographing receipts and automatically coding expenses.

Time tracking If your practice management system doesn't handle this well, standalone time tracking tools help.

Reporting dashboards Tools like Spotlight Reporting or TrulySmall Accounting for visual dashboards beyond standard QuickBooks reports.

What Law Firm Bookkeeping Costs

DIY Approach

Software: $200-400/month

Practice management: $40-150/month

QuickBooks Online: $30-70/month

Payment processing: $30-100/month

Add-ons: $20-50/month

Time: 3-5 hours/week = 12-20 hours/month

Your hourly rate: If you bill at $250/hour, that's $3,000-5,000 in opportunity cost monthly.

Total cost (including opportunity cost): $3,200-5,400/month

Outsourced Bookkeeping

Professional service: $500-1,500/month

Includes all transaction entry

Monthly reconciliation (operating and trust)

Financial statement preparation

IOLTA compliance management

Tax-ready books

Your time saved: 12-20 hours/month

Total cost: $500-1,500/month (plus software costs)

ROI calculation: If you bill those 12-20 hours to clients at $250/hour, you generate $3,000-5,000 in revenue while paying $500-1,500 for bookkeeping. Net gain: $1,500-3,500/month.

For more details, see our full law firm bookkeeping cost breakdown.

When Your Bookkeeping System Needs an Upgrade

Signs your current approach isn't working:

You're behind on reconciliation by 2+ months You can't answer "how much is in trust for Client X" without digging You dread looking at your books Tax time is always chaotic You've received a bar inquiry or audit notice Your financial reports don't help you make decisions You're not sure if you're making money

Any of these mean it's time to either:

Invest in proper training and systems (if DIY)

Hire professional help (if you're overwhelmed)

Fire your current bookkeeper and find someone qualified (if they're not delivering)

Get Your Law Firm Bookkeeping Right From Day One

Law firm bookkeeping isn't optional, and it's not something to figure out as you go. The complexity of trust accounting, the severity of compliance violations, and the time required make this a critical business function that deserves professional attention.

Whether you choose to handle it yourself with proper training and systems, or outsource to specialists who understand legal accounting, the key is having a system that maintains compliance, produces accurate reports, and supports your growth.

If your current bookkeeping setup isn't giving you confidence in your numbers and peace of mind about compliance, it's time for a change.

We specialize in bookkeeping for law firms - monthly trust reconciliation, IOLTA compliance, and financial reporting designed for legal practices. Learn more about our law firm bookkeeping services.

Book a 15-Minute Consultation. No pressure. Just clarity.

Frequently Asked Questions

-

Trust accounting. Law firms hold client funds in IOLTA accounts that require monthly three-way reconciliation, individual client ledger tracking, and bar compliance documentation. Regular businesses don't have these requirements. Additionally, revenue recognition follows ethical rules (earned vs. unearned) rather than just standard accounting principles.

-

Yes. Generic bookkeepers don't understand IOLTA compliance, trust accounting requirements, or bar audit expectations. They can create serious problems - even with good intentions. The risk of ethics violations makes legal-specific expertise essential.

-

Professional bookkeeping for law firms typically costs $500-1,500/month depending on firm size, transaction volume, and trust account complexity. Solo practices with minimal trust activity might pay $500-750/month. Small firms with multiple attorneys and high trust volume might pay $1,000-1,500/month.

-

Three-way reconciliation matches three numbers: your trust bank balance, your trust ledger balance, and the sum of all individual client ledger balances. All three must equal. This ensures every dollar in your trust account is properly allocated to a specific client and catches errors or misappropriations immediately. Most state bars require this monthly.

-

Yes, but it must be configured specifically for law firms. You need proper trust liability tracking, client ledger structure, and integration with your practice management system. Generic QuickBooks setup won't handle trust accounting correctly. Most firms use QuickBooks Online integrated with Clio, MyCase, or LeanLaw.

-

Outsource when: (1) your revenue exceeds $250K/year, (2) you're spending 5+ hours/week on bookkeeping, (3) you handle significant trust funds, (4) you've made IOLTA compliance mistakes, or (5) your time is worth more than bookkeeping costs. DIY works for very small practices with limited trust activity and disciplined owners.

-

Trust accounting errors can trigger bar complaints, audits, and disciplinary action - even when no money is missing. Consequences range from required remedial training to suspension or disbarment depending on severity and pattern. IOLTA violations are taken seriously because they involve client funds and professional ethics.

-

Monthly, at minimum. Most state bars require monthly reconciliation. Some firms reconcile weekly to catch problems faster. Never skip months or wait until quarter-end. Problems compound quickly, and late reconciliation signals poor management to auditors.