Outsourcing Ecommerce Bookkeeping: How to Know You’re Ready (2025)

Outsourcing ecommerce bookkeeping is no longer a back-office task - it’s a growth strategy for founders managing high-volume online sales. Shopify, Amazon, and Stripe payouts arrive on different schedules, while multi-state tax compliance adds complexity and risk.

Founders often ask when to outsource ecommerce bookkeeping - the answer depends on transaction volume, reporting needs, and growth goals. Cash flow may look healthy, yet profit erodes through platform fees, chargebacks, and inventory pre-purchases. Outsourced accounting services deliver accurate financial records, real time financial insights, and specialized knowledge of the ecommerce sector. This expertise supports informed business decisions, protects margins, and strengthens financial health as transaction volume and tax rules grow more complex.

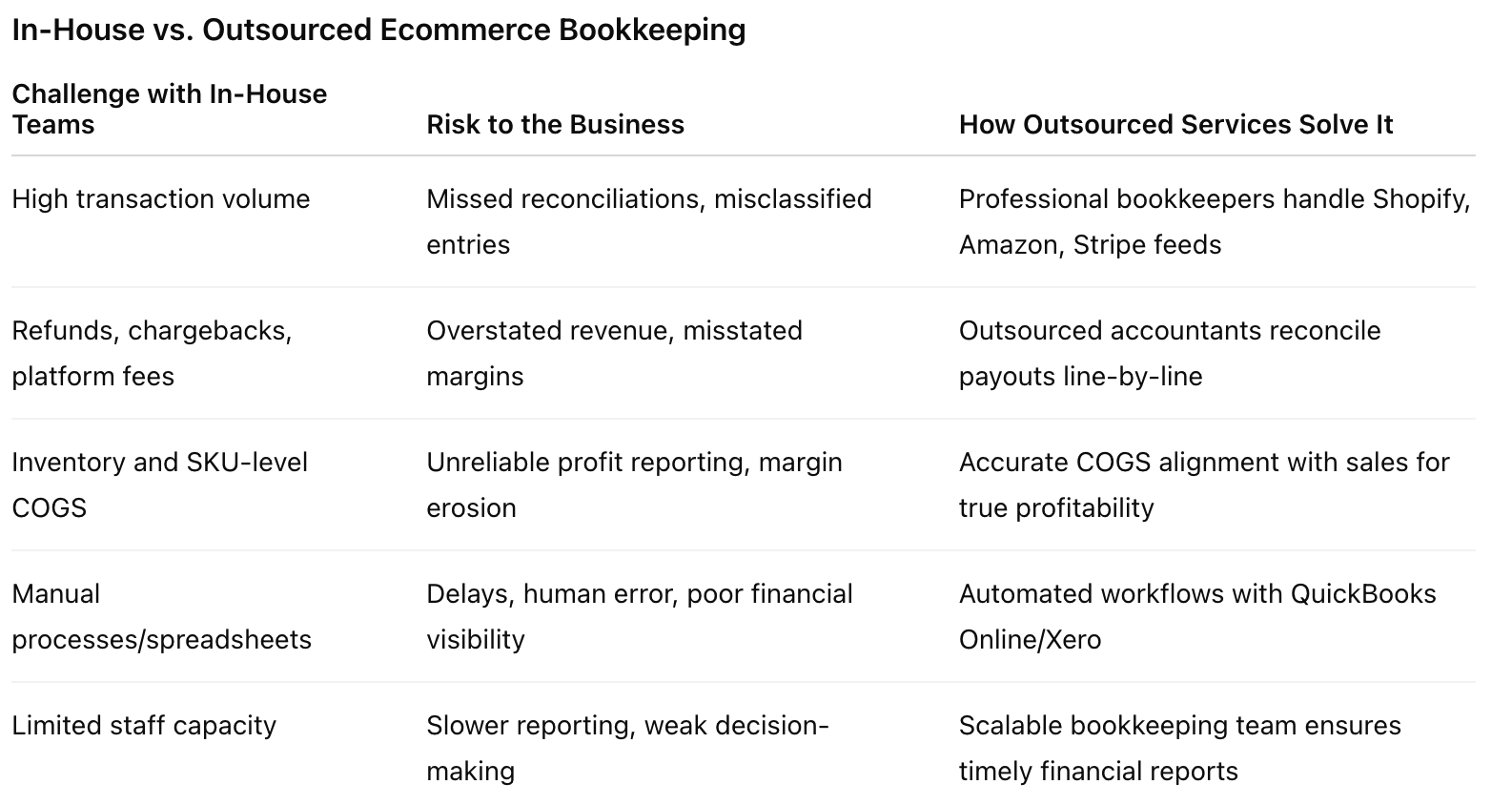

Transaction Volume Has Outgrown In-House Capabilities

As ecommerce order volume grows across Shopify, Amazon, and other platforms, DIY bookkeeping quickly breaks down. Misclassified expenses, missed reconciliations, and other common ecommerce bookkeeping mistakes surface as businesses outgrow spreadsheets and manual processes. A single in house bookkeeper cannot efficiently reconcile hundreds of payouts, refunds, and chargebacks each month. As accounting tasks grow in complexity, missed entries and delayed reconciliations distort financial statements and weaken decision-making.

Outsourced bookkeeping services record every financial transaction accurately in QuickBooks Online or other accounting software. Professional bookkeepers manage high-volume data feeds from Stripe, PayPal, and multiple sales channels while maintaining accurate sales tracking and timely reporting.

Outsourced accountants also align inventory management and SKU-level COGS with sales, preventing overstated margins and unreliable profit reporting. With structured workflows that scale with transaction growth, outsourced accounting services reduce errors, protect financial health, and allow internal teams to focus on core business activities.

For ecommerce founders scaling on Shopify, Amazon, or other multi channel platforms, our specialized ecommerce bookkeeping services deliver accurate financial reporting and efficient financial management built for growth.

Financial Records Are Delayed or Consuming Valuable Time

When business owners spend hours chasing receipts, updating spreadsheets, or closing monthly reports, valuable time is lost to bookkeeping tasks instead of marketing, sourcing, or customer growth.

Delays in financial records create blind spots. Without timely monthly bookkeeping, leaders can’t see if ad spend drives profit or if inventory is draining cash flow. Late reconciliations also increase the risk of errors or fraud. Accurate financial reporting is essential for oversight, informed decision-making, and efficient operations.

Outsourced bookkeeping services provide on-time financial reports, structured statements, and consistent reconciliation of accounts payable, receivable, and sales channels. Dedicated professionals record financial transactions accurately, maintain reliable financial data, and give leadership real time financial insights without the scramble of catch-up.

Cash Flow No Longer Aligns With Actual Profit

Many ecommerce businesses discover that cash flow and profit figures tell different stories. Delayed payouts from Amazon or Shopify, combined with upfront inventory purchases, can distort financial health. Monitoring profit margins is crucial to accurately assess business performance and ensure true profitability. It’s possible to show profit on paper while struggling to cover daily expenses.

This misalignment often signals the need for professional oversight. Outsourced bookkeepers track both cash flow and profit, ensuring leadership sees a full financial picture. They reconcile timing differences between payouts, refunds, and expenses.

Understanding the difference between cash flow vs profit is critical for growth. Without clarity, businesses risk overextending or underinvesting. Outsourced teams provide structured reporting that keeps these metrics aligned.

Hiring In-House Is Costlier Than Outsourcing

Building an internal bookkeeping team requires salaries, benefits, training, and software - costs that often outweigh the value delivered. A single bookkeeper rarely has the specialized knowledge to manage multi channel sales, payment reconciliation, and tax compliance, while outsourced accounting services provide access to dedicated professionals with broader expertise.

Outsourced bookkeeping services also offer flexible, cost effective pricing that scales with transaction volume. Ecommerce businesses pay only for what they need - monthly bookkeeping, reconciliations, financial reports, or advisory support - without carrying payroll overhead.

The cost advantage extends to accuracy. Professional bookkeepers deliver accurate financial reporting and reduce errors that create tax penalties or misstated statements. By outsourcing ecommerce bookkeeping, brands achieve cost efficiency, maintain accurate financial records, and strengthen financial health without managing an in house department.

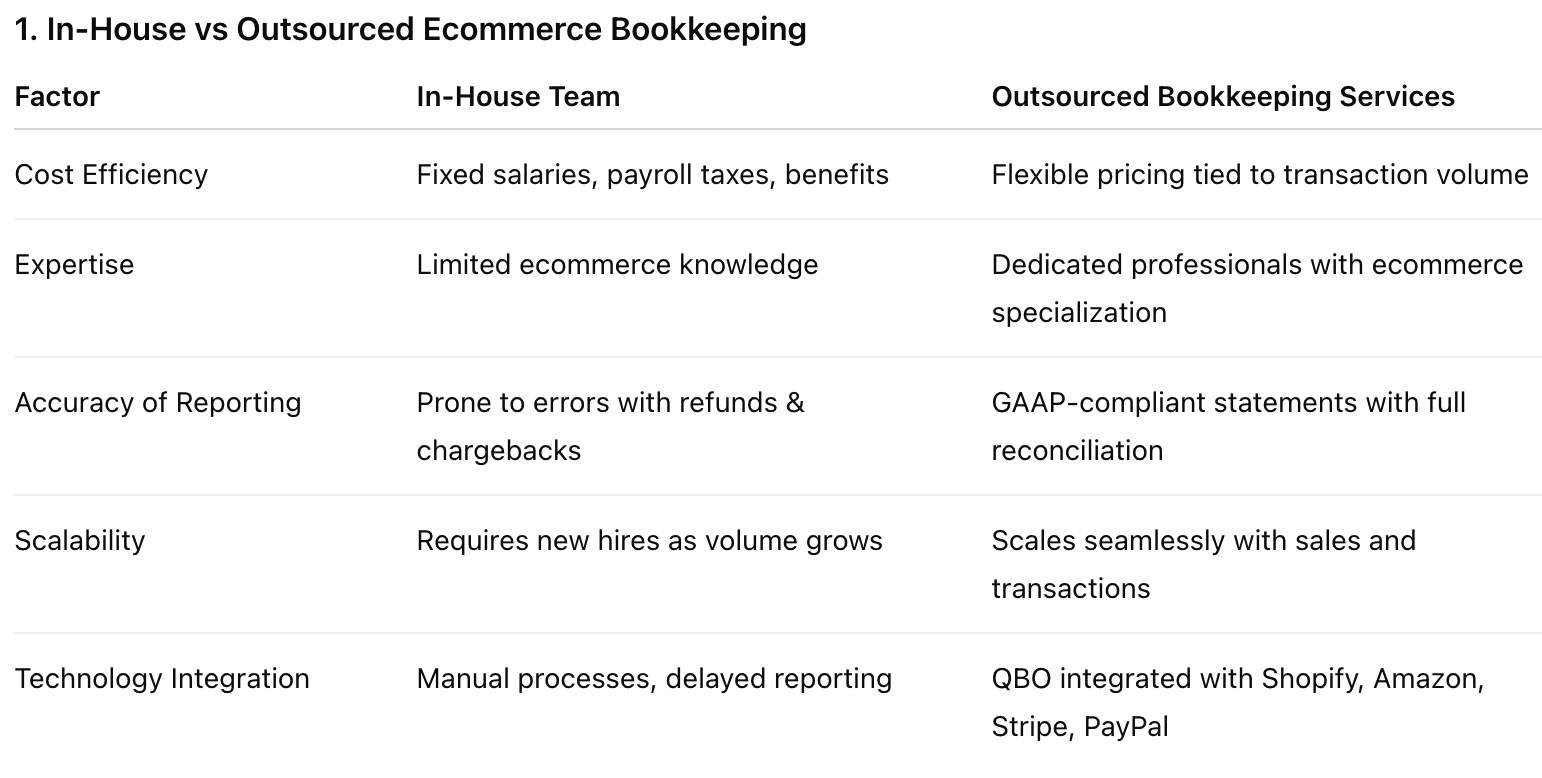

In-House vs. Outsourced Ecommerce Bookkeeping

Ecommerce businesses must decide whether to rely on in-house bookkeeping or engage outsourced bookkeeping services. The choice shapes cost efficiency, financial accuracy, and the ability to manage multi channel sales data. Across the accounting industry, outsourcing has become the cost-effective solution for businesses that need accurate financial reporting while focusing internal teams on growth.

Instead of carrying payroll, training, and office overhead, ecommerce businesses gain cost efficiency and accurate financial records by partnering with our ecommerce bookkeeping services.

Dedicated Professionals vs. Overextended In-House Teams

In-house bookkeepers often split attention between financial tasks and unrelated administrative work. This creates gaps in inventory management, sales tax compliance, and reconciliations across platforms.

Outsourced accounting services give ecommerce businesses access to dedicated professionals focused exclusively on financial management. With QuickBooks Online integrated into Shopify, Amazon, and Stripe, outsourced accountants maintain accurate financial records, deliver timely reporting, and support full tax compliance.

The result is efficient financial management, fewer errors, and reliable financial statements for informed decision-making. Because Stripe payouts rarely match gross sales, outsourced bookkeepers reconcile every fee, refund, and chargeback - see our full Stripe reconciliation guide for ecommerce.

Accurate Monthly Bookkeeping and Financial Reporting

Accurate monthly bookkeeping is the foundation of financial health for every ecommerce business. While in-house staff may prepare financial statements, accuracy often falters without expertise in ecommerce-specific details such as returns, chargebacks, and fulfillment fees.

Outsourced bookkeeping services implement structured processes for reconciling accounts and producing financial statements that reflect true revenue, cost of goods sold, and sales tax liabilities. With a properly designed ecommerce chart of accounts, outsourced accountants categorize transactions consistently, keeping financial data clear and audit-ready.

By outsourcing ecommerce bookkeeping, companies receive timely reporting, accurate financial records, and GAAP-compliant financial statements that meet investor expectations. This consistency strengthens informed business decisions and supports scalable growth.

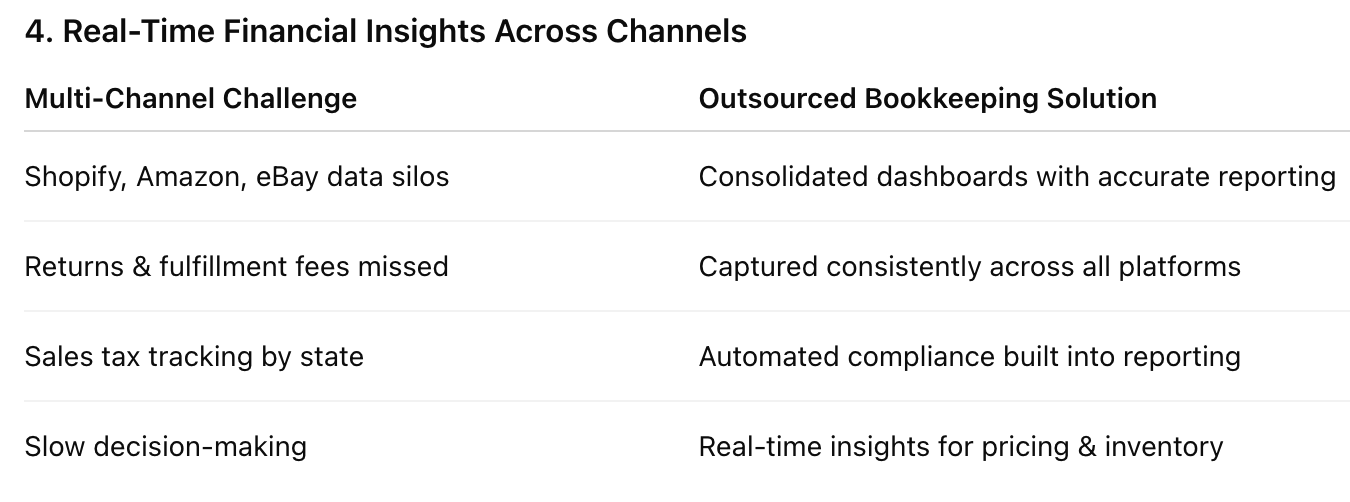

Real-Time Financial Insights Across Multiple Sales Channels

Ecommerce sellers on Shopify, Amazon, eBay, and direct sites generate complex data that in-house bookkeeping struggles to consolidate. Outsourced bookkeeping services integrate multi channel sales data through virtual bookkeeping tools, creating one dashboard for revenue, refunds, shipping costs, and fulfillment fees.

With accurate financial reporting in real time, business owners gain clear visibility across platforms, adjust pricing or inventory faster, and maintain sales tax compliance. Every financial transaction is captured by state and marketplace, delivering timely reporting and protecting the business from compliance risks.

Cost Efficiency vs. In-House Overhead

In house bookkeeping adds fixed expenses - salary, payroll taxes, benefits, training, and office space - that remain constant even when sales decline. For many ecommerce businesses, these costs strain financial health and limit flexibility.

Outsourced bookkeeping services convert those fixed expenses into a variable service fee tied to transaction volume and reporting needs. Business owners gain accurate financial reporting, monthly bookkeeping, and tax compliance support without the overhead of payroll or ongoing training.

In-House: Salary + payroll taxes + benefits + training + office space

Outsourced: Service fee based on transaction volume and financial reporting requirements

By partnering with outsourced accountants, ecommerce entrepreneurs achieve cost efficiency while maintaining accurate financial records. Experienced professionals using cutting edge accounting software deliver efficient financial management, compliance with tax laws, and reporting that scales as the business grows.

Scalability, Accuracy, and Financial Health

In house bookkeeping provides oversight but rarely scales. A single bookkeeper handling payroll, expenses, and monthly reports struggles when transaction volume spikes, while adding staff increases payroll taxes, benefits, and office costs—straining financial health. Generic CPAs often focus on tax preparation alone, leaving gaps in reporting and compliance. We highlight these gaps in What Your CPA Doesn’t Tell You About Ecommerce Bookkeeping.

Outsourced ecommerce bookkeeping services scale with transaction flow, adapting to seasonal peaks and multi channel sales without increasing fixed costs.

Accuracy also improves with outsourced accounting services. Instead of spreadsheets, outsourced accountants use QuickBooks Online and cutting edge accounting software to deliver accurate financial records, reliable inventory management, and timely reporting. The result: fewer reconciliation errors and stronger long-term financial performance.

Payment Reconciliation, Accounts Payable, and Accounts Receivable

In house bookkeeping can handle vendor bills and customer invoices, but capacity limits often create gaps in accounts payable and accounts receivable. Delayed payment reconciliation distorts financial statements and disrupts cash flow.

Outsourced bookkeeping services use structured workflows to manage AP and AR, reconciling payouts from multiple sales channels, tracking invoices, and processing vendor payments accurately. Financial records stay current, reliable, and audit-ready.

When transaction volume scales, DIY bookkeeping almost always fails - a key sign it’s time to outsource ecommerce bookkeeping. With outsourced accounting services, expense tracking is automated - flagging duplicate charges, late fees, and missed credits. Timely reconciliation strengthens cash flow management, supports accurate monthly bookkeeping, and delivers financial reports that improve decision-making and long-term financial health.

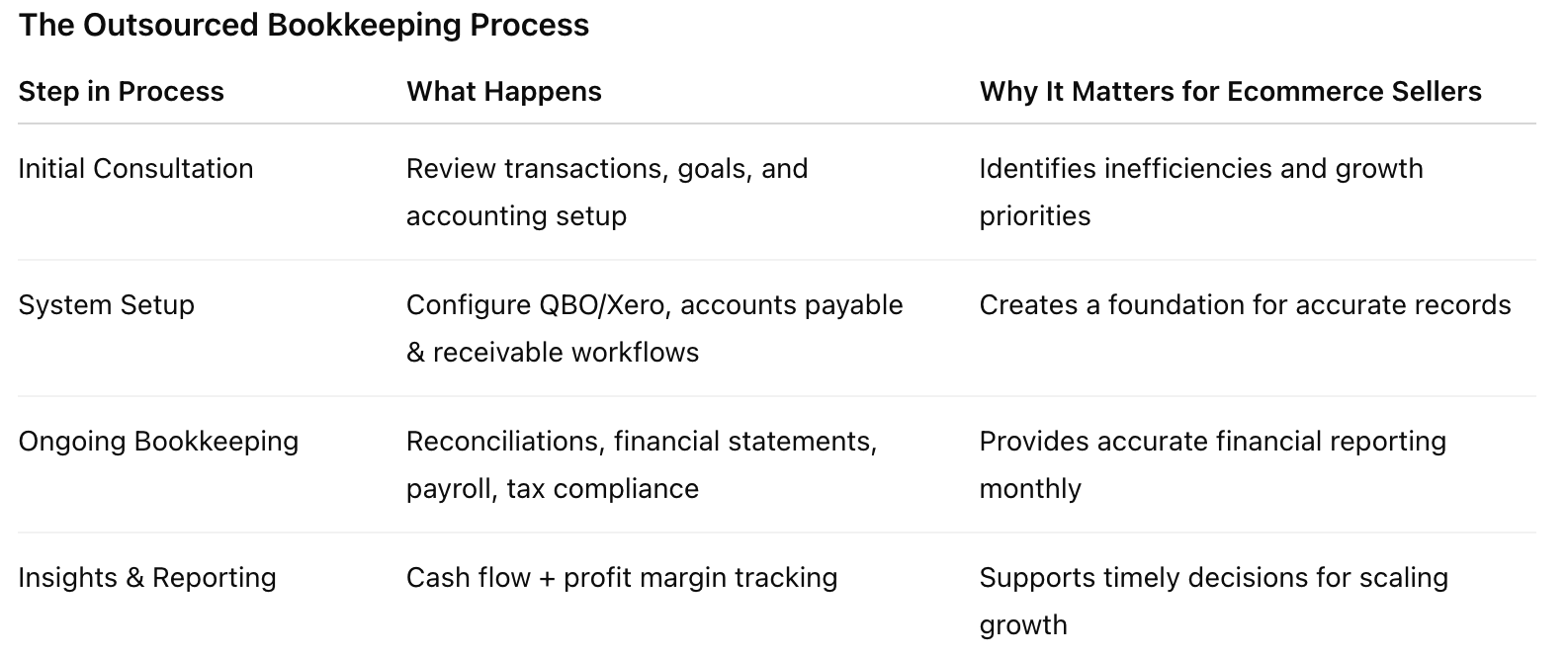

The Outsourced Bookkeeping Process

Outsourcing ecommerce bookkeeping begins with a consultation to review financial transactions, goals, and existing accounting processes. From there, outsourced bookkeeping services configure QuickBooks Online or other accounting software, set up accounts payable and receivable workflows, and build a system to maintain accurate financial records.

Your bookkeeping team then manages monthly bookkeeping - reconciliations, financial statements, payroll taxes, and tax compliance. With accurate financial reporting and timely insights into cash flow and profit margins, business owners gain efficient financial management without the cost of in house bookkeeping.

Transitioning to Outsourced Bookkeeping

Moving from in house bookkeeping to outsourced accounting services reduces costs and improves accuracy. The process starts by identifying inefficiencies and setting up outsourcing solutions aligned with business goals. A specialized accounting firm configures chart of accounts, integrates ecommerce platforms, and provides training for a smooth transition.

Outsourced accountants bring specialized knowledge of multi channel sales, inventory management, and payment reconciliation. Their accurate financial reports and advanced reporting tools support informed business decisions, while structured workflows scale with transaction growth.

Security and Compliance in Outsourced Accounting

When selecting outsourced bookkeeping services, security and compliance are critical. Experienced professionals protect financial data with encryption, access controls, and monitoring, while keeping financial reports accurate and compliant with tax laws.

Bookkeepers also manage sales tax compliance across multiple jurisdictions and provide timely reporting for tax preparation. Leading outsourced accounting firms add disaster recovery systems, giving ecommerce businesses confidence that financial management is secure, compliant, and built to support growth.

Why Specialized Ecommerce Bookkeeping Firms Outperform Generic Providers

Specialized ecommerce bookkeeping services offer the industry expertise that generic outsourced bookkeeping cannot. Partnering with an accounting firm experienced in ecommerce means tailored workflows, accurate financial reporting, and reliable tax compliance. These providers understand multi channel platforms, payment processors, and inventory management, delivering financial records that strengthen both compliance and strategy.

Beyond accuracy, specialized firms provide structured financial reports that highlight sales by channel, inventory valuation, and contribution margins. With online bookkeeping services built for ecommerce, businesses gain streamlined processes, automated reporting, and fewer errors - delivering financial management that scales with growth.

Partner with Specialized Ecommerce Bookkeepers to Drive Profitable Growth

Outsourcing ecommerce bookkeeping is more than a way to stay compliant - it’s a strategy for building a stronger, more profitable business. Specialized firms translate financial data into insights that matter: customer acquisition costs, advertising ROI, inventory turnover, and channel profitability. Instead of reacting to problems after they appear, founders gain monthly financial reports that spotlight cash flow, gross margins, and emerging trends - giving them the clarity to act early and scale confidently.

At Accounting Atelier, we deliver this level of partnership. Our QuickBooks Online Certified ProAdvisors manage the complexity of multi channel payouts, inventory management, and tax compliance, while providing accurate financial reporting that supports pricing, marketing, and expansion decisions.

If you’re ready to replace compliance-driven bookkeeping with a growth-focused financial partner, book a call with our ecommerce bookkeeping team.

FAQ: Common Questions About Outsourcing Ecommerce Bookkeeping

-

Outsourced ecommerce bookkeeping delivers accurate financial records, monthly reporting, and tax compliance without the overhead of in-house staff. Specialized firms handle Shopify, Amazon, and Stripe transactions at scale, giving founders reliable data to manage cash flow and profitability.

-

Specialized firms understand ecommerce platforms, payment processors, and accounting software integration. They reconcile payouts across multiple channels, track SKU-level COGS, and deliver financial statements tailored to online sellers—something general bookkeepers often overlook.

-

Professional bookkeepers apply consistent accounting standards and use QuickBooks Online to reconcile bank feeds, merchant accounts, and multi-channel payouts. The result is clean financial statements that reflect true revenue, expenses, and cash flow.

-

Yes. Ecommerce bookkeeping firms track nexus obligations and apply the correct rates across states. Integrated software automates filings, helping online businesses remain compliant as they scale.

-

Specialized bookkeepers sync accounting software with ecommerce platforms to track COGS, reconcile stock levels, and adjust for returns or write-offs. This keeps profitability reporting accurate and prevents cash flow from being distorted by unsold inventory.

-

Bookkeepers maintain day-to-day financial records, monthly reports, and tax-ready schedules, while CPAs focus on audits and strategy. Outsourced bookkeeping closes operational gaps, so CPAs and founders can make decisions with confidence.