Legal Accounting Guide 2026: Essential Insights for Law Firms

Did you know that over 30% of law firms faced compliance penalties last year due to errors in legal accounting? As regulations tighten and financial processes grow more complex, law firms must navigate a landscape filled with unique challenges and high stakes.

This comprehensive guide delivers the insights and strategies every law firm needs for compliance, clarity, and growth in 2025. Effective firm's financial management requires specialized practices, including tailored financial analysis and reporting systems designed specifically for law firm operations.

Inside, you will explore legal accounting fundamentals, key compliance rules, trust account management, technology solutions, best practices, and emerging trends.

Ready to master your firm’s finances? Use this guide as your roadmap to confidently manage legal accounting in the year ahead.

Legal Accounting Fundamentals for Law Firms

Legal accounting is a specialized field that goes far beyond ordinary business bookkeeping. Law firms must adhere to strict ethical guidelines and regulatory frameworks, making their accounting needs significantly more complex than those of typical businesses. Failing to meet these standards can lead to license suspension, disbarment, or significant penalties, underscoring the importance of mastering legal accounting fundamentals.

Most law school curricula do not cover accounting or financial management, so legal professionals often need to seek this knowledge independently.

Understanding Legal Accounting vs. General Accounting

Legal accounting serves a distinct purpose compared to general business accounting. It is shaped by ethical obligations such as the ABA Rule 1.15, which mandates the separation of client funds from a law firm’s operating funds. Regulatory bodies closely monitor compliance, and even small errors can have severe consequences.

For example, mishandling client trust funds may result in immediate disciplinary action, including loss of license. According to recent bar association reports, a significant portion of law firm disciplinary cases stem from accounting violations. Regardless of firm size, every practitioner must prioritize legal accounting to maintain compliance and ethical standards. Those who practice law must adhere to strict accounting and trust account management requirements to ensure compliance and maintain professional integrity.

Ethics and accuracy are not optional in legal accounting. For more foundational guidance, visit Bookkeeping for Law Firms Explained.

Core Legal Accounting Terms and Concepts

A law firm’s chart of accounts forms the backbone of its legal accounting system. The firm's financial accounts must be carefully structured to ensure accurate tracking of all financial activities, including trust accounts, operating accounts, and client funds. This structure organizes financial transactions into categories such as client trust liabilities, operating expenses, and income streams. Double-entry bookkeeping is vital, ensuring that every transaction is recorded in at least two accounts for accuracy and transparency.

Three-way reconciliation is a legal accounting practice that compares bank statements, client ledgers, and trust account balances. This process helps prevent errors and uncovers discrepancies before they become compliance issues. Firms must choose between accrual and cash basis accounting, each with its own regulatory considerations. Cash basis tracks income and expenses as they occur, while accrual recognizes them when earned or incurred.

Mistakes in categorizing expenses, such as recording a client disbursement as an office expense, can distort reports and trigger compliance violations. Mastering these core terms and processes is essential for effective legal accounting and risk mitigation.

Common Legal Accounting Mistakes and How to Avoid Them

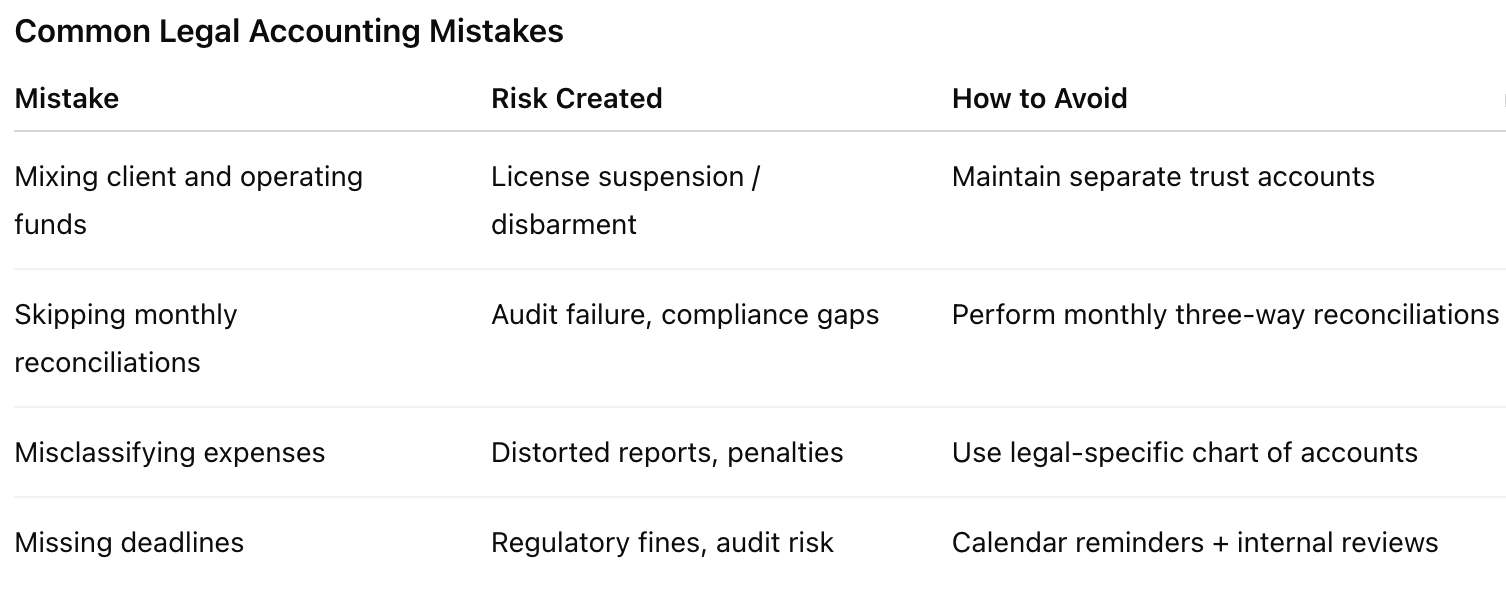

Data entry errors and fund misclassification are among the most frequent pitfalls in legal accounting. Failing to separate client trust funds from operating accounts or neglecting regular trust account reconciliations can quickly result in compliance breaches. Overlooked reporting deadlines add to the risk.

Consider the case of a small firm penalized for missing a quarterly trust account review. The oversight led to an audit and temporary suspension. Violating legal accounting rules can result in severe penalties, including audits, fines, or even disbarment. To prevent such issues, law firms should implement regular internal reviews, maintain detailed ledgers, and use checklists for monthly reconciliations.

Practical steps include:

Setting calendar reminders for compliance deadlines

Conducting peer reviews of account entries

Using specialized legal accounting software for accuracy

By embedding these controls, law firms can reduce risk and build a strong foundation for compliance and financial clarity.

Trust Accounting and Compliance Essentials

Trust accounting is at the core of legal accounting for every law firm, regardless of size or specialty. Mishandling client funds can result in severe consequences, including disciplinary action or even loss of licensure. That is why understanding trust accounting essentials and compliance standards is crucial for building a resilient, ethical legal practice. Adhering to legal accounting rules is essential to avoid compliance breaches and protect client assets.

The Importance of Trust Accounting in Law Firms

Trust accounts serve a unique purpose in legal accounting: they hold client funds separately from the firm’s operating accounts. These funds often include retainers, settlement proceeds, or court fees. Regulatory bodies, such as state bars, require strict compliance with rules like IOLTA (Interest on Lawyers’ Trust Accounts) to protect client assets.

A common scenario involves a law firm accepting a retainer, depositing it in a designated trust account, and then drawing only earned fees as work is completed. Once fees are earned, they are transferred from the trust account to the firm's operating account, which is used for managing business expenses and processing fees. The process is tightly regulated, and any commingling of funds can lead to investigations or sanctions.

Notably, the American Bar Association’s Model Rule 1.15 outlines the ethical obligations for handling client property, making trust accounting a foundational pillar of legal accounting. For a deeper dive into these principles and compliance requirements, see Trust Accounting for Law Firms.

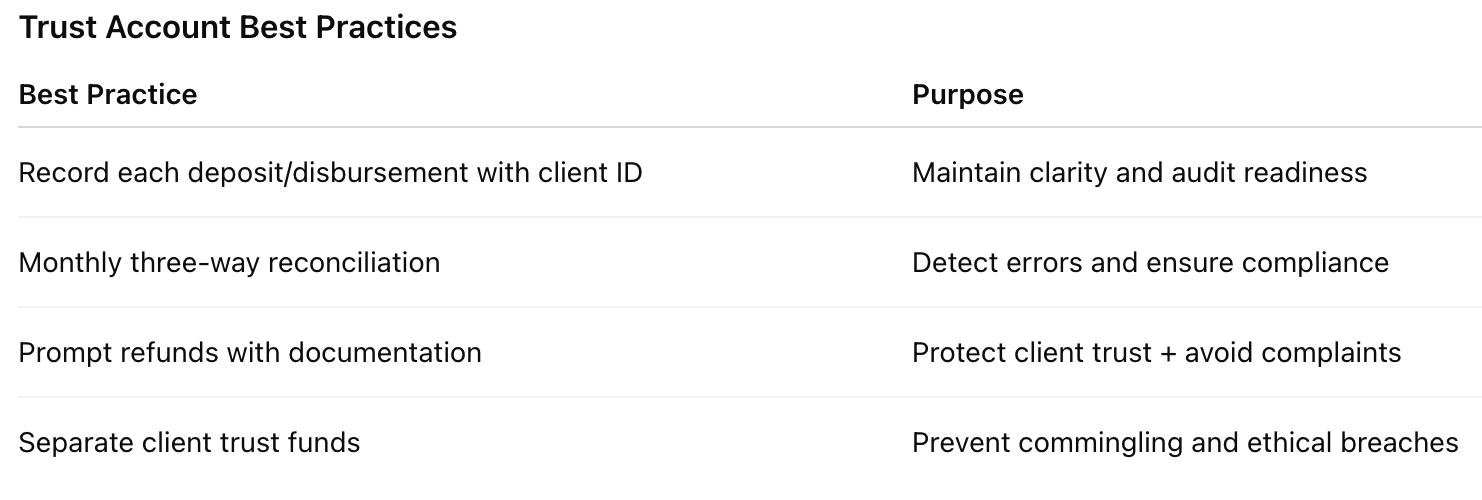

Trust Account Management Best Practices

Effective trust account management starts with setting up accounts that comply with state and federal regulations. Strict adherence to compliance regulations is essential to avoid penalties and maintain client trust. Each client’s funds must be individually tracked, and every transaction documented. This process ensures no confusion between client money and the firm’s own funds.

Best practices in legal accounting include:

Recording each deposit and disbursement with clear client identifiers.

Completing monthly three-way reconciliations, comparing the trust ledger, bank statement, and client sub-ledgers.

Issuing prompt refunds when necessary, with detailed documentation.

For example, a monthly reconciliation process typically involves reviewing all transactions, matching account balances, and investigating any discrepancies right away. This discipline not only supports compliance but also builds client trust.

A structured routine for trust account reviews reduces the risk of errors and helps firms avoid costly compliance issues associated with legal accounting mistakes.

Compliance, Audits, and Recordkeeping

Legal accounting demands rigorous recordkeeping to prepare for audits and maintain compliance. Maintaining accurate accounting records is critical for demonstrating compliance and passing audits. Law firms must meet key deadlines for trust account reporting, as required by their state bar or regulatory authority.

Audit triggers often involve late reconciliations, missing client ledgers, or discrepancies in balances. According to bar association reports, most compliance failures result from incomplete records or delayed reporting.

To stay audit-ready, implement regular internal reviews, maintain organized digital and physical files, and ensure all trust account transactions in your legal accounting system are up to date. This proactive approach minimizes risk and demonstrates your firm’s commitment to client protection and regulatory standards.

Financial Management Strategies for Law Firms

Effective financial management is essential for law firms navigating the increasingly intricate world of legal accounting. Robust financial management practices are key to safeguarding the firm's financial health and ensuring long-term stability. Whether you are running a solo practice or managing a large team, robust financial strategies can drive compliance, profitability, and growth.

Budgeting and Financial Planning

Budgeting provides a financial roadmap for law firms, ensuring that resources are allocated efficiently and future obligations are anticipated. Annual budgets set the foundation, while case-based budgets allow for granular tracking of expenses and revenues on each matter.

Strategic financial planning in legal accounting goes beyond simple cost tracking. Financial forecasting is a crucial component, enabling firms to anticipate future revenue and expenses. Providing financial forecasting helps law firms make informed decisions and plan for growth. It involves forecasting revenue cycles, identifying potential cash flow gaps, and making informed decisions based on accurate financial data. For example, a firm that regularly reviews its budgets can quickly respond to shifts in client demand or changes in case volume, supporting both stability and growth.

To maximize the benefits, incorporate regular budget reviews and adjust as needed. This proactive approach ensures that your legal accounting practices remain agile and support the long-term goals of your firm.

Bank Accounts and Cash Flow Management

Effective management of bank accounts and cash flow is fundamental to a law firm’s financial health and long-term success. Law firms must establish a robust system for organizing financial transactions, which starts with maintaining separate bank accounts for operating funds, client trust accounts, and other firm-specific financial activities. This segregation is not just a best practice—it is a requirement for trust accounting compliance and a safeguard against violating ethics rules.

Leveraging legal accounting software that integrates directly with your firm’s bank accounts can transform your financial management. These platforms automate the reconciliation process, track every transaction in real time, and provide instant visibility into your firm’s cash flow. With accurate, up-to-date financial data, law firms can quickly identify trends, spot potential issues, and make informed decisions to optimize their financial performance.

Maintaining a healthy cash flow requires ongoing attention to your firm’s financial statements, accounts receivable, and accounts payable. Implementing efficient billing and invoicing processes—such as offering online payment options and automating reminders—can accelerate collections and reduce outstanding balances. Regularly reviewing expenses and eliminating unnecessary costs further strengthens your firm’s financial position.

Trust accounting compliance remains a top priority. Law firms must keep meticulous records of all client trust accounts, perform regular reconciliations, and ensure that client funds are never commingled with operating funds. Failure to adhere to these standards can result in significant financial penalties and reputational harm.

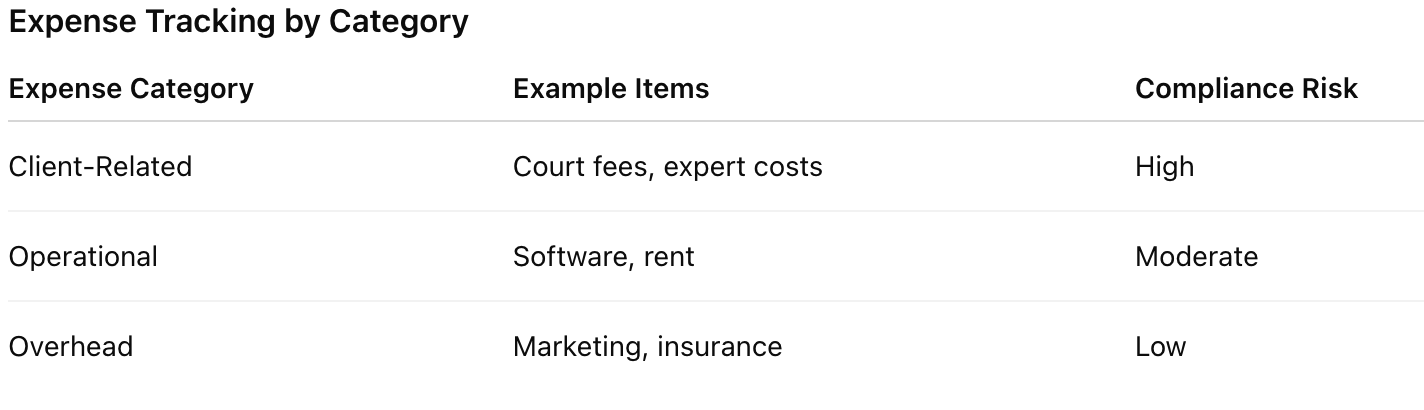

Expense Tracking and Profitability Analysis

Accurate expense tracking is critical in legal accounting, as misclassified costs can lead to compliance issues and distorted profitability metrics. Firms should categorize expenses into client-related, operational, and overhead to clarify where money is being spent.

Monitoring profitability by practice area or attorney allows firms to identify strengths and address inefficiencies. Key performance indicators such as realization rates and collection rates provide actionable insights. For instance, regularly analyzing these KPIs can help uncover non-billable expense leakage, enabling corrective action.

By maintaining precise records and reviewing expense categories, law firms can ensure that their legal accounting supports both compliance and profitability.

Billing, Invoicing, and Revenue Collection

Timely and accurate billing is a cornerstone of effective legal accounting. Best practices include meticulous time tracking, clear client billing statements, and proactive management of accounts receivable.

Automation can transform billing processes, minimizing errors and reducing administrative burden. Many firms are evaluating legal accounting software vs bookkeeper to streamline invoicing, automate payment reminders, and maintain accurate ledgers. This technology ensures bills are sent promptly and payments are tracked in real time.

Efficient billing directly impacts cash flow and client satisfaction. Clients appreciate transparent, timely invoices, while firms benefit from reduced write-offs and improved revenue collection. Embedding these legal accounting practices helps build trust and financial stability. Generating regular financial reports enables firms to monitor billing efficiency and revenue collection performance.

Internal Controls and Fraud Prevention

Robust internal controls are vital for safeguarding a law firm’s financial assets and protecting its reputation. Segregating duties within the legal accounting process reduces the risk of errors and fraud. For example, different individuals should handle funds receipt, disbursement approval, and account reconciliation.

Integration with Practice Management Tools

Seamless integration between legal accounting systems and practice management tools is a game changer. Legal practice management software combines case management, time tracking, billing, and accounting functions to streamline law firm operations. When accounting software syncs with case management and billing systems, law firms eliminate duplicate data entry and minimize the risk of discrepancies.

This integration enables:

Real-time syncing of client billing and expense data

Automated workflow for invoicing and payments

Consistent tracking of billable hours linked to financial records

For legal accounting, this means more accurate financial statements and faster month-end closes. Automated workflows also reduce administrative overhead, freeing up staff to focus on client service. As a result, law firms can maintain better control over their finances and improve overall productivity.

Data Security and Confidentiality

Safeguarding sensitive financial and client data is a top priority in legal accounting. Law firms must comply with data privacy regulations, such as GDPR or HIPAA when handling protected information. Modern legal accounting platforms offer advanced encryption, role-based access controls, and regular security updates to protect against cyber threats.

Best Practices for Sustainable Growth and Compliance

A strong legal accounting foundation is essential for law firms aiming for sustainable growth and regulatory compliance. Robust accounting systems and compliance practices are key drivers of a firm's success, ensuring financial health and long-term stability. By focusing on robust systems, effective training, and proactive adaptation, your firm can navigate the complex accounting landscape with confidence.

Building a Robust Bookkeeping System

Developing a reliable bookkeeping system is the backbone of legal accounting. Implementing specialized firm's accounting software simplifies financial workflows and ensures compliance with legal and ethical standards. Start by establishing clear daily, weekly, and monthly routines for data entry, reconciliation, and reporting. Customize your chart of accounts to meet the unique requirements of legal accounting, ensuring that client funds, trust accounts, and operating expenses are always accurately segregated.

Regular reconciliations are critical. Schedule monthly three-way reconciliations to compare client ledgers, trust bank statements, and internal records. This process helps catch discrepancies before they become compliance issues. Implementing automation tools, such as those highlighted in Artificial Intelligence in Accounting, can streamline repetitive tasks and reduce human error in legal accounting.

Bookkeeping Checklist:

Daily: Record all transactions promptly.

Weekly: Review for data entry errors.

Monthly: Perform three-way reconciliation and review reports.

By following structured routines, your firm can maintain audit-ready books and ensure legal accounting compliance at all times.

Partnering with Expert Legal Bookkeepers

Trust accounting isn’t just a detail - it’s the foundation of your firm’s integrity. Inaccurate ledgers, missed reconciliations, and unclear invoicing don’t just cost time - they risk client trust and bar compliance.

If your law firm bookkeeping isn’t delivering monthly trust reconciliations, accurate financials, and audit-ready reports, the system is working against you.

We bring clarity, structure, and compliance to your books - so you can focus on practicing law, not managing spreadsheets.

Get expert support. Contact us today.

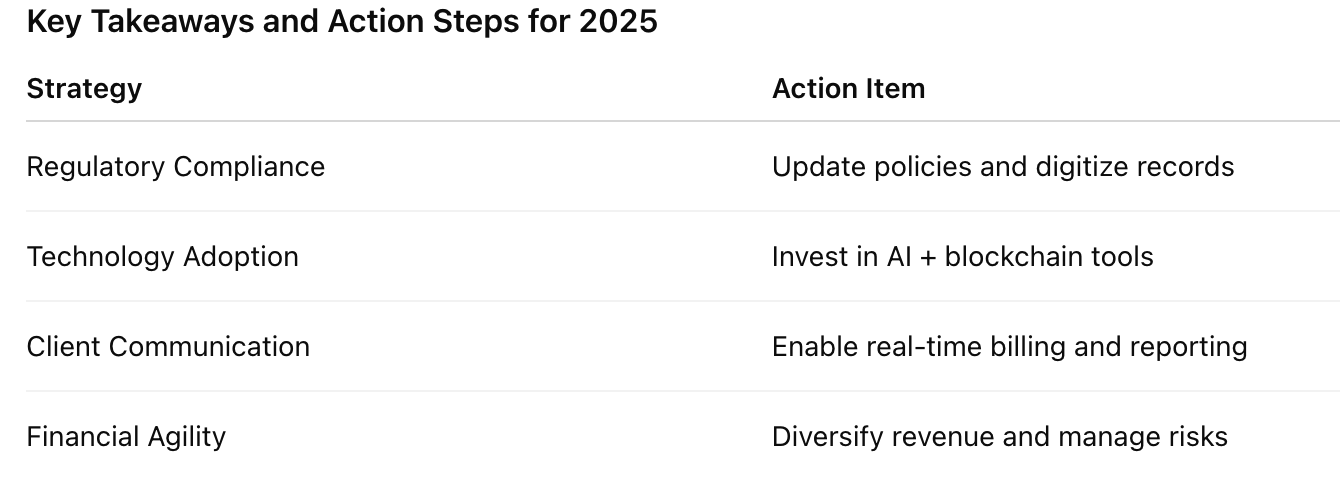

The Future of Legal Accounting: Trends and Predictions for 2026

Staying ahead in legal accounting means understanding the shifts shaping the profession. Many law firms are adopting advanced technologies and integrated solutions to remain competitive and compliant. In 2026, change is accelerating, from regulatory updates to advanced technologies and evolving client demands. Here is what every law firm needs to know to remain competitive and compliant.

Evolving Regulatory Landscape

Regulatory changes are set to redefine legal accounting in 2026. New mandates will require digital financial records and more transparent reporting. Many state bars are introducing stricter oversight, including digital audit trails for trust accounts. For law firms, adapting policies to meet these standards is not optional. Failing to comply can result in penalties, audits, or loss of licensure. Regulatory changes may also affect tax implications for law firms, making it important to stay informed and adapt accordingly.

Technology Innovations Shaping Legal Accounting

Technology will continue to transform legal accounting through automation, artificial intelligence, and predictive analytics. These innovations are reshaping law firm accounting by improving efficiency, accuracy, and compliance. Law firms adopting AI-powered tools will streamline expense categorization and fraud detection. The integration of blockchain is also gaining traction, offering new levels of transparency and security. For more insights on how blockchain is reshaping accounting, see Blockchain Integration in Finance. Embracing these advances will be crucial for staying efficient and competitive.