Guide to Legal Accounting Services: What Law Firms Need in 2026

In 2026, law firms face a landscape where legal accounting services are essential for navigating new regulations, evolving technology, and rising client demands. Outdated financial practices can put your firm at risk, but streamlined, compliant accounting unlocks efficiency and profitability.

This guide gives your firm a clear roadmap to selecting and optimizing legal accounting services. Discover the latest challenges, must-have services, technology trends, compliance strategies, and the key factors for choosing the right provider.

Professional financial management brings peace of mind and opens new growth opportunities. Now is the time to re-evaluate your accounting approach and secure your firm’s future.

The Evolving Landscape of Legal Accounting in 2026

The world of legal accounting services is undergoing rapid transformation in 2026. Law firms are navigating a complex environment shaped by new regulations, client demands, and technological advancements. Staying ahead requires firms to adapt their financial management strategies and embrace innovation.

Key Industry Changes and Trends

Legal accounting services are being reshaped by several key trends in 2026. Regulatory scrutiny is at an all-time high, especially regarding trust and IOLTA account management. Law firms must maintain impeccable records to avoid penalties and protect client interests.

There is a growing expectation for real-time financial insights. Decision-makers want instant access to cash flow data, profitability by matter, and compliance status. This demand is driving the integration of legal practice management platforms with accounting systems.

Remote and hybrid work models are now standard, pushing firms to adopt cloud-based solutions for their legal accounting services. Outsourcing specialized accounting tasks is also on the rise, with over 100 law firms processing invoices monthly through external providers, according to Whiz Consulting.

Security remains paramount. Data breaches and privacy concerns have led to heightened investment in encrypted platforms and strict access controls. For a deeper look at how these trends are shaping the industry, see the Law Firm Finance Trends and Predictions for 2025.

Challenges Facing Law Firms

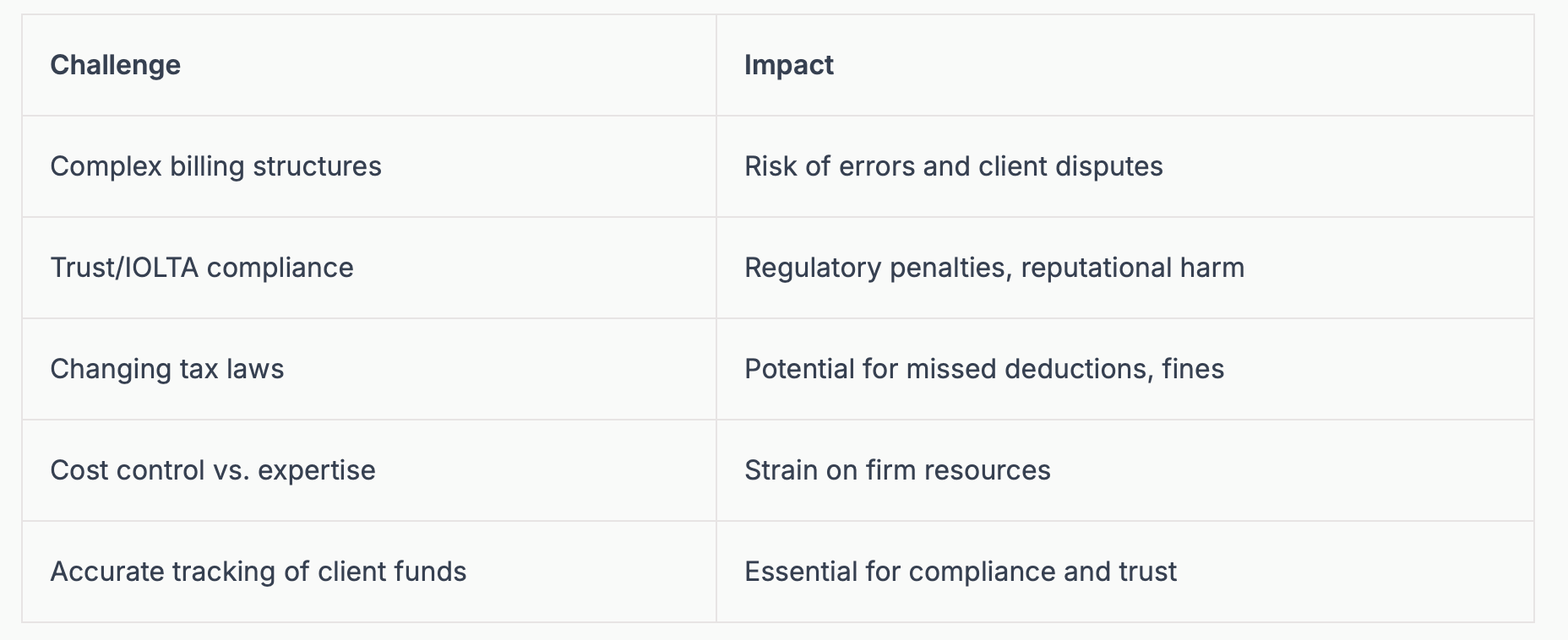

Despite these advancements, law firms encounter significant challenges with their legal accounting services. Managing complex billing arrangements—whether contingency, fixed-fee, or hourly - requires robust systems to track billable hours, retainers, and client funds accurately.

Trust account compliance is a persistent concern. Mishandling client funds can lead to severe penalties and even loss of licensure. Firms must reconcile trust accounts regularly and comply with both state and federal regulations.

Tax laws and reporting standards are evolving quickly. Keeping up with these changes while controlling costs and ensuring financial oversight is difficult for firms of all sizes. Balancing the need for expert financial management with budget constraints is a delicate act.

The following table summarizes these challenges:

Opportunities for Growth and Efficiency

Amid these hurdles, law firms can unlock new opportunities through modern legal accounting services. Automation is a game-changer, reducing manual errors and freeing attorneys from administrative tasks. Advanced analytics empower firms to forecast cash flow, monitor profitability, and make strategic decisions.

Outsourcing bookkeeping and payroll allows attorneys to focus on client service rather than back-office work. Case studies reveal that law firms partnering with dedicated legal accountants see improved cash flow management and reduced compliance risk.

Firms leveraging cloud-based legal accounting services benefit from secure, scalable solutions that support remote teams and keep financial data accessible. By embracing these opportunities, law firms position themselves for sustainable growth, enhanced efficiency, and greater peace of mind.

Core Legal Accounting Services Law Firms Need

Choosing the right legal accounting services is essential for law firms striving to stay competitive and compliant in 2026. Each core service addresses a unique aspect of financial management, supporting both daily operations and long-term strategy. Let us explore the essential areas every law firm should prioritize.

Bookkeeping & Financial Reporting

Accurate bookkeeping tailored to the legal industry forms the backbone of every law firm's financial health. Legal accounting services ensure that transactions are recorded promptly, accounts are reconciled monthly, and three-way trust reconciliations are performed for compliance.

Timely financial reporting enables firms to assess case profitability, monitor cash flow, and compare budget versus actual performance. Monthly financial packages, often with a quality review, empower attorneys to make informed decisions. Up-to-date books are not just a compliance requirement—they are a strategic asset.

For a deeper look at what specialized bookkeeping involves, see this Law Firm Bookkeeping Services Guide.

Trust Accounting & IOLTA Compliance

Legal accounting services play a pivotal role in managing client trust accounts and ensuring strict adherence to IOLTA regulations. Every deposit and disbursement must be tracked, with detailed audit trails maintained for each transaction.

Firms must avoid commingling client and firm funds at all times. Regular trust account reconciliation is mandatory to prevent legal penalties and safeguard the firm's reputation. With increasing regulatory scrutiny, meticulous trust accounting has never been more important.

Accounts Receivable & Client Billing

Streamlining invoicing and collections is a hallmark of effective legal accounting services. Firms must manage retainers, send timely invoices, and process payments for contingency, fixed-fee, and hourly billing arrangements.

Automated reminders reduce late payments and improve cash flow. Leading providers process thousands of invoices monthly, demonstrating the scale and efficiency that specialized support can deliver. Improved billing accuracy leads directly to healthier finances.

Accounts Payable & Vendor Management

Transparent accounts payable processes are critical for law firms. Legal accounting services handle the intake, approval, and payment of vendor bills, ensuring no discrepancies or missed deadlines.

Maintaining clear records and timely payments helps avoid surprise expenses and strengthens vendor relationships. Dedicated accounts payable support minimizes risk and supports smoother operations, freeing attorneys to focus on client matters.

Payroll Management

Payroll for law firms is uniquely complex, especially with employees in multiple states and varying benefits packages. Legal accounting services ensure that staff are paid accurately and on time, and that all payroll tax requirements are met.

Weekly payroll reviews help firms prevent costly errors and stay compliant with evolving employment laws. Reliable payroll management supports staff satisfaction and protects the firm from regulatory pitfalls.

Budgeting, Forecasting, and KPI Reporting

Strategic planning depends on robust financial data. Legal accounting services help law firms set realistic budgets, forecast cash flow, and track key performance indicators.

By leveraging comprehensive reports, firms can identify growth opportunities and control costs. Data-driven insights support better decisions, positioning the firm for sustained success in a rapidly changing environment.

Technology and Software Solutions for Legal Accounting

Today’s law firms rely on advanced technology to manage their financial operations with accuracy and efficiency. The right tools are now a necessity for legal accounting services, helping firms keep pace with evolving demands and regulatory requirements.

Essential Features for Law Firms

Modern legal accounting services demand software solutions with robust, law-specific features. Key requirements include:

Seamless integration with practice management systems such as Clio or QuickBooks Online

Automated data entry, reconciliation, and financial reporting for accuracy

Secure client portals to share documents and gain approvals

Real-time dashboards for immediate financial visibility

For example, automated syncing between Clio and QuickBooks eliminates repetitive data entry, freeing staff to focus on higher-level tasks. These essential features support compliance, transparency, and timely decision-making.

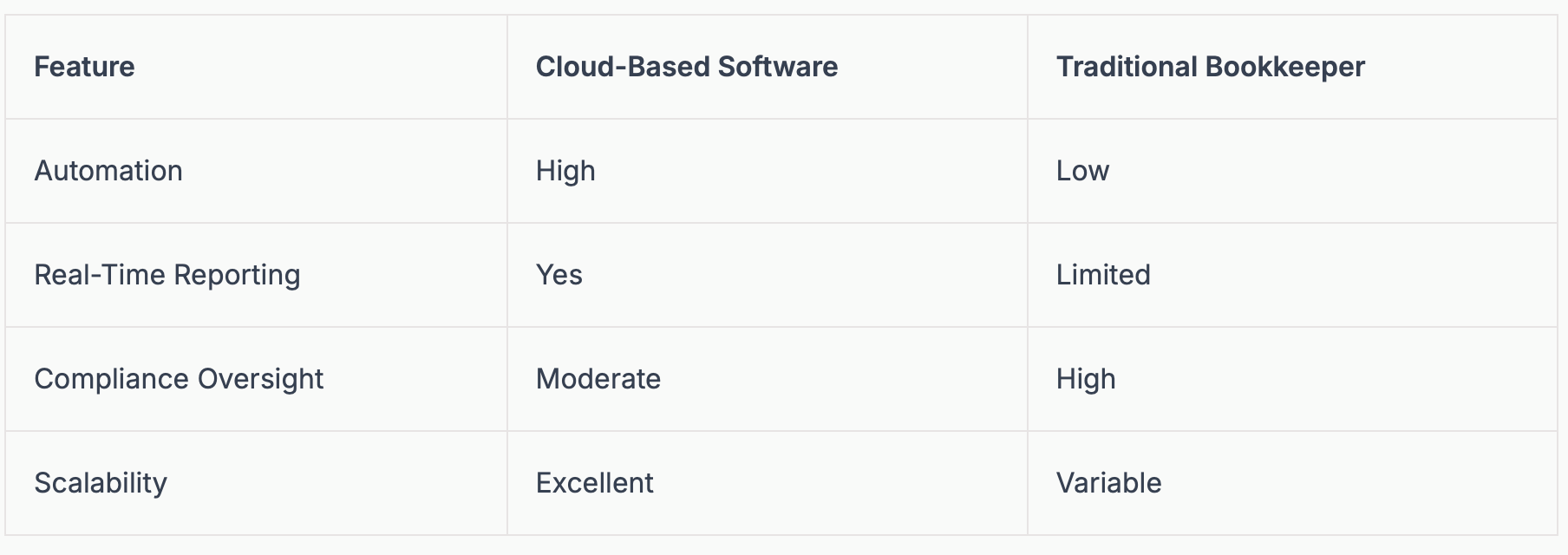

Evaluating and Choosing the Right Platforms

Selecting technology for legal accounting services begins with assessing your firm’s unique needs. Compatibility with your firm’s size, practice area, and current systems is crucial. Security features, including encryption, access controls, and audit logs, cannot be overlooked.

Scalability is key for growing firms or those with remote teams. Many law firms report improved workflow efficiency after adopting cloud-based solutions. For a deeper comparison, explore this resource on Legal Accounting Software vs. Bookkeeper, which examines how software stacks up against dedicated professionals.

A table can help compare platforms:

Leveraging Automation and AI

Automation and AI are transforming legal accounting services. Automating routine bookkeeping, trust account reconciliations, and invoice processing reduces manual errors and administrative workload.

AI-powered tools can detect anomalies and potential fraud, offering another layer of protection for client funds. Automated invoice tracking ensures timely payments and minimizes human oversight. With these advances, law firms achieve more accurate records and improved cash flow management.

Data Security and Privacy Considerations

Data security is a cornerstone of legal accounting services. Firms must choose providers and platforms that comply with industry data protection standards, including encrypted data storage and secure workflows.

Regular software updates and ongoing staff training are essential to defend against cyber threats. Legal accounting services providers often highlight secure, encrypted systems as a core value, ensuring both client and firm data remain confidential and protected.

By prioritizing these considerations, law firms can confidently adapt to the technological landscape while maintaining compliance and trust.

Compliance, Risk Management, and Best Practices

Staying compliant and minimizing risk are top priorities for law firms relying on legal accounting services. With regulations evolving and financial oversight under increased scrutiny, firms must adopt best practices that ensure accuracy, transparency, and security. A proactive approach to risk management not only protects the firm's reputation but also builds trust with clients and regulators.

Navigating Regulatory Requirements

Legal accounting services must address a complex web of state and federal rules, especially regarding trust and IOLTA account management. Firms are required to perform regular reconciliations, maintain detailed records, and submit timely reports to regulatory bodies. Even minor errors in handling client funds can lead to disciplinary action or loss of licensure.

To avoid critical mistakes, attorneys should familiarize themselves with common pitfalls. For a deeper understanding, read about IOLTA Compliance Errors Explained, which outlines frequent issues that can compromise compliance. Regular internal audits and clear documentation are essential for safeguarding client assets and ensuring that legal accounting services meet all regulatory requirements.

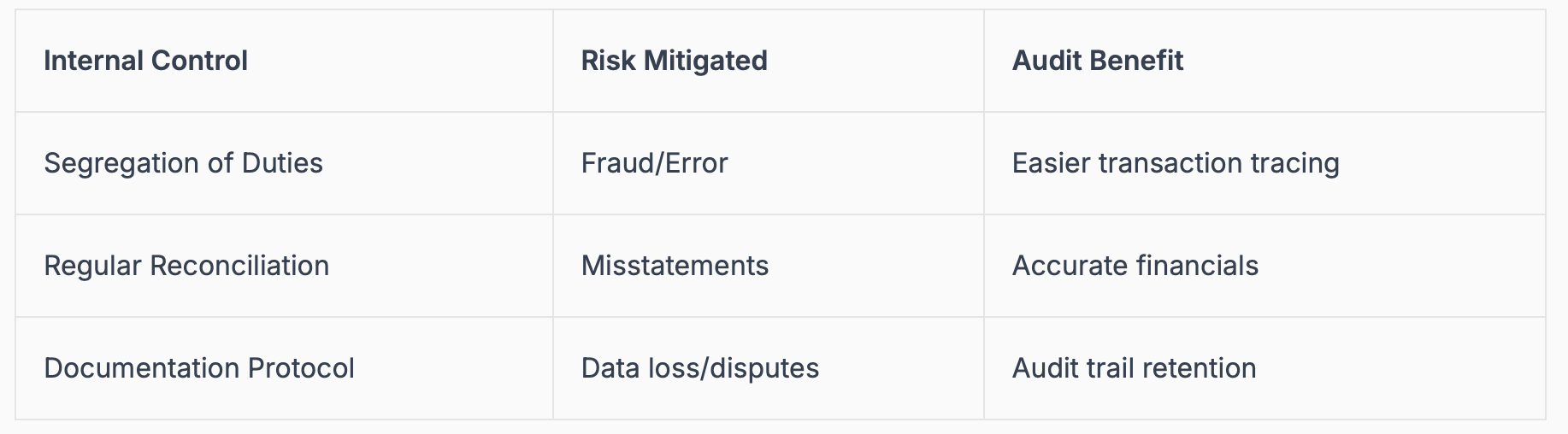

Internal Controls and Audit Readiness

Implementing strong internal controls is a cornerstone of effective legal accounting services. These controls help prevent fraud, detect errors early, and ensure every transaction is properly authorized and recorded. Maintaining organized documentation for all financial activities is vital for both day-to-day operations and audit readiness.

Preparing for annual audits means having reconciled bank statements, detailed trust account ledgers, and supporting documentation readily available. Law firms should schedule periodic quality reviews of financial reports. This proactive approach ensures that legal accounting services remain transparent and withstand regulatory scrutiny at any time.

Minimizing Risk Through Professional Oversight

Professional oversight is crucial for reducing risk in legal accounting services. Outsourcing complex tasks to accountants with legal industry expertise ensures compliance with the latest tax and regulatory changes. These specialists stay informed about evolving laws, minimizing the chance of costly errors or missed deadlines.

By leveraging dedicated legal accountants, law firms can focus on client service instead of navigating intricate financial regulations. Consistent monitoring and review by professionals also help firms adapt quickly to regulatory updates, further reducing compliance risk and administrative burden.

Data Security and Confidentiality

Protecting sensitive client and firm information is a core responsibility for any provider of legal accounting services. Firms must ensure that all financial data is stored in encrypted systems and accessed only by authorized personnel. Implementing secure workflows and regular software updates helps guard against cyber threats.

Ongoing staff training on privacy best practices and breach response protocols is equally important. A commitment to confidentiality not only protects the firm but also reinforces client trust in the legal accounting services provided.

Adopting Best Practices for 2026 and Beyond

To remain competitive and compliant, law firms should continually update their approach to legal accounting services. This involves monitoring changes in accounting standards, legal requirements, and technology trends. Investing in professional development for both in-house and outsourced teams ensures everyone is prepared for new challenges.

Best practices for 2026 include:

Regular training on new regulations and software

Scheduled reviews of internal controls and workflows

Adoption of cloud-based, secure accounting platforms

Collaboration with industry-focused accounting partners

By prioritizing these actions, firms position themselves for ongoing compliance, reduced risk, and long-term financial stability.

How to Choose the Right Legal Accounting Partner in 2026

Selecting the best legal accounting services for your law firm is a pivotal decision in 2026. As the industry evolves, your choice of partner will shape how your firm navigates compliance, efficiency, and growth. This section provides a step-by-step approach to ensure your firm’s financial management thrives in a competitive landscape.

Identifying Your Firm’s Needs and Priorities

Begin by assessing your firm’s current structure, growth plans, and unique requirements. Are you a solo practitioner needing hands-on, personalized legal accounting services, or a larger firm requiring scalable solutions for complex operations?

Consider these factors:

Practice size and number of attorneys

Types of cases and billing arrangements

Volume of transactions and trust accounts

In-house expertise versus need for external support

A clear understanding of your firm’s needs ensures you select legal accounting services that align with your workflow and ambitions.

Evaluating Provider Expertise and Credentials

Not all providers are created equal. Prioritize legal accounting services with deep industry specialization, proven credentials, and a track record of compliance.

Key evaluation points include:

Experience with trust/IOLTA account management

Certifications (e.g., CPA, QuickBooks ProAdvisor, legal industry credentials)

Client testimonials and references

Familiarity with your state’s regulatory environment

Providers serving over 100 law firms demonstrate reliability and robust expertise. This targeted knowledge helps your firm stay ahead of compliance challenges and financial risks.

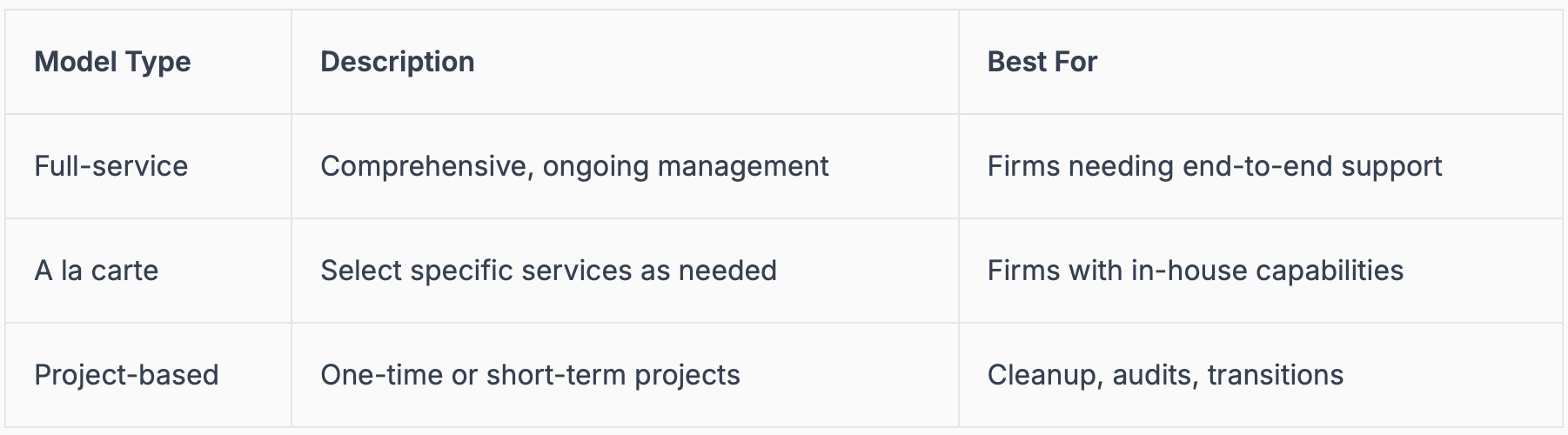

Comparing Service Models and Pricing

Legal accounting services offer various models to fit diverse needs. Understanding these structures helps you make a cost-effective choice without sacrificing quality.

Common service models:

Compare pricing structures, such as flat monthly fees versus per-transaction billing. Outsourcing can lower overhead while improving accuracy and compliance. For more on how evolving industry practices impact pricing, see 18 Accounting Trends to Pay Attention to in 2025.

Technology Integration and Support

Effective legal accounting services should seamlessly integrate with your practice management tools and support modern workflows. Prioritize providers who offer robust technology solutions and ongoing support.

Look for:

Compatibility with platforms like Clio or QuickBooks Online

Secure, cloud-based access for remote teams

Automated data syncing and real-time reporting

Dedicated onboarding and technical support

For a deeper look at how technology trends are shaping legal accounting, review Top Trends that will Shape the Accounting Industry in 2025.

Questions to Ask Potential Partners

Before finalizing your choice, ask targeted questions to ensure your legal accounting services partner meets your expectations.

Consider these questions:

What is your experience with legal trust accounting and compliance?

How do you safeguard client and firm data?

What types of reports will I receive, and how often?

Can your services scale as my firm grows?

Top providers offer tailored financial insights and proactive compliance support, giving your firm confidence in all financial matters.

The ROI of Professional Legal Accounting Services

Law firms that invest in professional legal accounting services gain more than just accurate books. The return on investment goes far beyond compliance, impacting profitability, efficiency, decision-making, and long-term growth. Let us break down how these services drive measurable value for your legal practice.

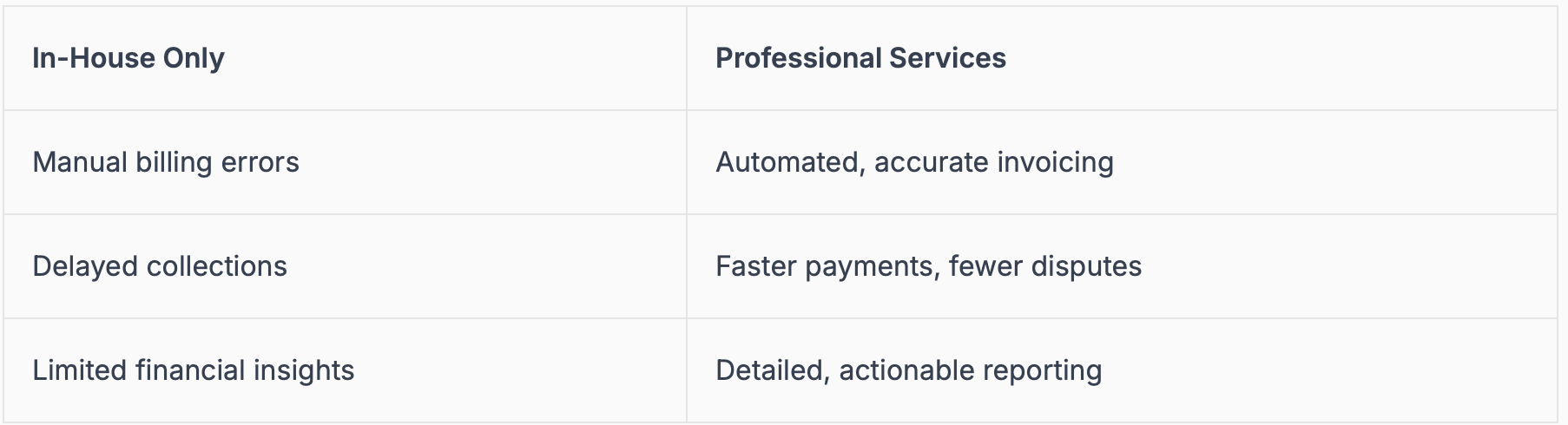

Financial Benefits for Law Firms

Professional legal accounting services directly impact your bottom line. Accurate billing and streamlined collections reduce revenue leakage, resulting in improved cash flow. With up-to-date financial records, law firms can identify cost-saving opportunities and avoid unnecessary expenditures.

Consider this comparison:

Firms leveraging legal accounting services often report fewer late payments and increased revenue.

Time Savings and Operational Efficiency

Attorneys and staff can reclaim hours each week by outsourcing bookkeeping, payroll, and reconciliations. Legal accounting services automate repetitive tasks, allowing your team to focus on client work and case strategy.

Automated invoice processing

Streamlined trust account management

Reduced administrative workload

By shifting financial administration to experts, law firms gain efficiency and minimize costly errors. This operational edge keeps your practice agile and responsive.

Enhanced Decision-Making with Real-Time Insights

Legal accounting services provide up-to-date dashboards and reports, empowering firm leaders to make informed strategic choices. Real-time access to profitability metrics, cash flow forecasts, and budget variances enables proactive planning.

Identify underperforming practice areas

Monitor spending in real time

Adjust budgets based on data

Firms with robust legal accounting services are better equipped to spot growth opportunities and control costs, supporting smarter business decisions.

Risk Reduction and Peace of Mind

Compliance is critical in the legal industry. Mishandling client trust accounts or failing to meet regulatory requirements can result in severe penalties. Professional legal accounting services offer oversight, ensuring financial records are audit-ready and secure.

For more on safeguarding your trust accounts, see these Trust Account Reconciliation Tips.

Regular reconciliations to prevent errors

Ongoing monitoring of compliance standards

Reduced risk of costly violations

Attorneys gain peace of mind knowing their financial systems are in expert hands.

Positioning for Growth and Adaptability

The legal landscape is evolving rapidly. Firms need financial systems that scale with growth and adapt to new regulations. Legal accounting services offer flexible solutions, supporting expansion, mergers, or shifts in practice focus.

Industry trends, such as those outlined in Accounting Trends 2025, highlight the importance of adaptable, tech-driven accounting models.

Scalable service options

Seamless technology integration

Future-proof financial management

With the right legal accounting services, your firm is ready to seize new opportunities and thrive in 2026 and beyond.

Contact us today for expert support.

Trust accounting isn’t optional - it’s the backbone of your firm’s reputation. Missed reconciliations, unclear records, or inaccurate ledgers don’t just create inefficiencies - they put client trust and bar compliance at risk.

If your bookkeeping isn’t delivering monthly trust reconciliations, accurate reports, and audit-ready records, your systems are holding you back.

At Accounting Atelier, we bring structure, clarity, and compliance to your books - so you can focus on growing your practice, not managing the backend.

👉 Let’s protect your firm’s integrity. Contact us today for expert support.