Accounting for Attorneys: The Definitive Guide for 2026

Legal accounting is more complex than ever in 2026, and the risks of non-compliance for law firms have never been higher. Attorneys today must navigate evolving regulations, manage client trust accounts, and adapt to rapid changes in technology.

This comprehensive guide to accounting for attorneys is designed to help legal professionals master best practices, avoid costly mistakes, and maintain financial health. Whether you are an attorney, firm administrator, or legal professional, you will find actionable steps, expert insights, and compliance tips throughout.

Explore legal accounting fundamentals, compliance essentials, trust accounting, technology solutions, workflow optimization, and the latest industry trends to ensure your practice thrives.

Legal Accounting Fundamentals for Attorneys

Navigating accounting for attorneys requires more than basic bookkeeping. Law firms face specialized requirements, unique reporting, and strict compliance standards. Understanding these fundamentals is essential for every legal professional aiming for financial accuracy and regulatory peace of mind.

Understanding Legal Accounting vs. General Business Accounting

Accounting for attorneys involves different standards and workflows than typical business bookkeeping. Law firms must follow rules designed to protect client funds and uphold professional ethics, such as tracking retainers and client advances separately from operating income.

Double-entry accounting is a must for law practices. This method ensures every transaction is recorded in at least two accounts, maintaining balance and accuracy. Attorneys also have to monitor trust accounts, comply with bar association rules, and document transactions with greater detail.

Unlike other businesses, law firms must always segregate client funds, avoid commingling, and maintain meticulous records. These differences make mastering accounting for attorneys a specialized skill set.

Core Financial Statements Every Attorney Must Know

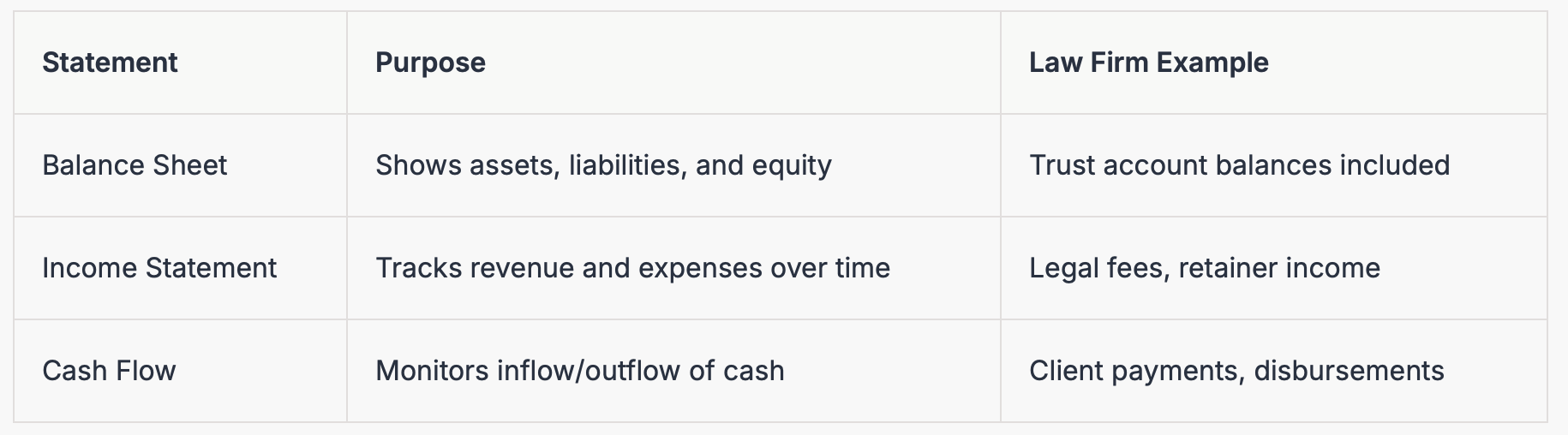

Three core financial statements are crucial in accounting for attorneys: the balance sheet, income statement, and cash flow statement.

Each report helps attorneys manage firm health, spot trends, and ensure compliance. For example, a customized law firm income statement might break down revenue by practice area, helping partners analyze profitability.

Understanding these statements is at the heart of effective accounting for attorneys.

Chart of Accounts for Law Firms

A well-structured chart of accounts forms the backbone of accounting for attorneys. This system categorizes assets, liabilities, revenue, expenses, and trust funds, providing clear visibility into financial operations.

Typical law firm accounts include:

Operating bank account

Client trust account (IOLTA)

Retainers and fee advances

Legal fees earned

Disbursements for client expenses

Segregating trust funds from operating accounts is non-negotiable. Customizing your chart of accounts to match your firm's size and practice areas is best practice. For a detailed walkthrough, see this Bookkeeping for Law Firms Guide.

Common Legal Accounting Mistakes to Avoid

Mistakes in accounting for attorneys can lead to serious consequences. Common pitfalls include mixing client funds with firm money, failing to reconcile trust accounts monthly, and not recording retainers correctly.

Real-world examples show that incomplete records or sloppy trust reconciliations often trigger disciplinary action or even disbarment. Attorneys must ensure all transactions are documented, reconciliations are timely, and funds are always segregated.

Avoiding these mistakes keeps law firms compliant and protects client relationships.

Regulatory and Ethical Considerations

Accounting for attorneys is highly regulated. The ABA Model Rules and state bar associations set strict guidelines for managing client funds, trust accounts, and reporting.

Penalties for non-compliance can include fines, suspension, or loss of license. In fact, a significant percentage of disciplinary actions stem from accounting violations. Staying updated on regulatory changes and conducting regular internal reviews is vital.

Ethical accounting practices not only safeguard your firm but also build client trust and professional reputation.

Mastering Trust Accounting and IOLTA Compliance

Navigating trust accounting and IOLTA compliance is a cornerstone of accounting for attorneys in 2026. Law firms face strict regulatory oversight, and any misstep in handling client funds can result in serious consequences. With evolving state rules and technology, mastering these essentials is non-negotiable for every legal practice.

This section unpacks the fundamentals of trust accounting, walks through compliant workflows, highlights common pitfalls, reviews top software, and equips you for audit readiness. By building these skills, you'll protect your firm, uphold ethical standards, and ensure your accounting for attorneys strategy meets the highest bar.

What Is Trust Accounting and Why Is It Critical?

Trust accounting for attorneys is the specialized process of managing funds held on behalf of clients or third parties. These funds, often retainers or settlements, must remain separate from the firm's operating accounts at all times. The cornerstone of trust accounting for attorneys is to ensure that client money is never used for firm expenses and is available on demand.

IOLTA, or Interest on Lawyers Trust Accounts, is a system required in most states. It directs interest earned on pooled client funds to public service programs, while attorneys remain responsible for strict recordkeeping and timely disbursement. Regulations vary, but all jurisdictions demand accurate tracking, segregation, and reporting.

Mismanagement can lead to disbarment, fines, or even criminal charges. For accounting for attorneys, establishing robust trust accounting practices is not just an ethical duty, but a legal imperative.

Step-by-Step Trust Accounting Workflow

Implementing a compliant trust accounting workflow is vital for law firms. Every step must be deliberate and documented to ensure accounting for attorneys adheres to both ethical and regulatory standards.

Receive client funds and immediately deposit them into a designated IOLTA or trust account.

Record each deposit with detailed client and matter information.

Document every transaction, including disbursements for case expenses or attorney fees.

Ensure supporting documentation, such as invoices or settlement statements, is attached to each transaction.

Perform monthly three-way reconciliations, matching bank statements, client ledgers, and trust account journals.

This systematic approach to accounting for attorneys minimizes risk, streamlines audits, and provides peace of mind for clients and regulators alike.

Common Trust Accounting Pitfalls and How to Prevent Them

Despite best intentions, errors in trust accounting for attorneys are common and can be costly. The most frequent mistakes include:

Commingling client funds with firm operating accounts

Over-drafting client ledgers or the trust account itself

Incomplete or inaccurate trust reconciliations

Failing to promptly return unearned funds

Many disciplinary actions stem from these errors. For a deeper look at what can go wrong, review Trust Account Reconciliation Mistakes to understand how overlooked details can jeopardize compliance.

Preventing these pitfalls starts with regular reconciliations, clear recordkeeping, and ongoing staff training. Prioritizing these habits in accounting for attorneys can safeguard your firm’s reputation and license.

Tools and Software for Trust Accounting

Selecting the right technology is essential for modern accounting for attorneys. Trust accounting software streamlines compliance by automating reconciliations, segregating funds, and maintaining detailed audit trails.

Leading solutions such as Clio, LeanLaw, and CosmoLex offer features tailored for law firms. Look for:

Automated three-way reconciliation

Client-specific ledgers and reports

Secure document storage and access controls

Seamless integration with billing and case management systems

These tools not only reduce manual effort but also help attorneys comply with jurisdictional requirements, making accounting for attorneys more efficient and less error-prone.

Trust Accounting Audit Preparation

Audit readiness is a non-negotiable aspect of accounting for attorneys. Regulators may audit trust accounts at any time, and unprepared firms face penalties or worse.

To prepare:

Maintain up-to-date client ledgers and supporting documentation

Complete and retain monthly three-way reconciliations

Ensure all disbursements are authorized and properly recorded

Respond promptly to any audit requests with organized records

According to industry data, a significant percentage of law firms undergo trust account audits annually, with common findings including incomplete reconciliations and missing documentation. Building a culture of compliance in accounting for attorneys ensures that your firm is always ready for scrutiny and maintains the trust of clients and regulators.

Essential Bookkeeping and Financial Management Practices

Accurate and compliant bookkeeping is the backbone of financial health for law practices. As regulations evolve, accounting for attorneys requires careful attention to detail, specialized workflows, and a proactive mindset. Mastering these practices helps safeguard your reputation, supports growth, and ensures you meet all professional obligations.

Setting Up a Robust Bookkeeping System for Your Firm

Every law firm should start by establishing a bookkeeping system tailored to legal industry needs. Unlike typical businesses, accounting for attorneys involves managing client funds, retainers, and strict trust accounting. Choose between handling bookkeeping yourself, hiring an in-house bookkeeper, or outsourcing to a certified professional.

When selecting a solution, prioritize platforms designed for law firms. Look for features like trust account tracking, compliance workflows, and integration with practice management tools. Hiring a certified legal bookkeeper adds an extra layer of confidence, as they understand the nuances of legal accounting and can keep your firm audit-ready.

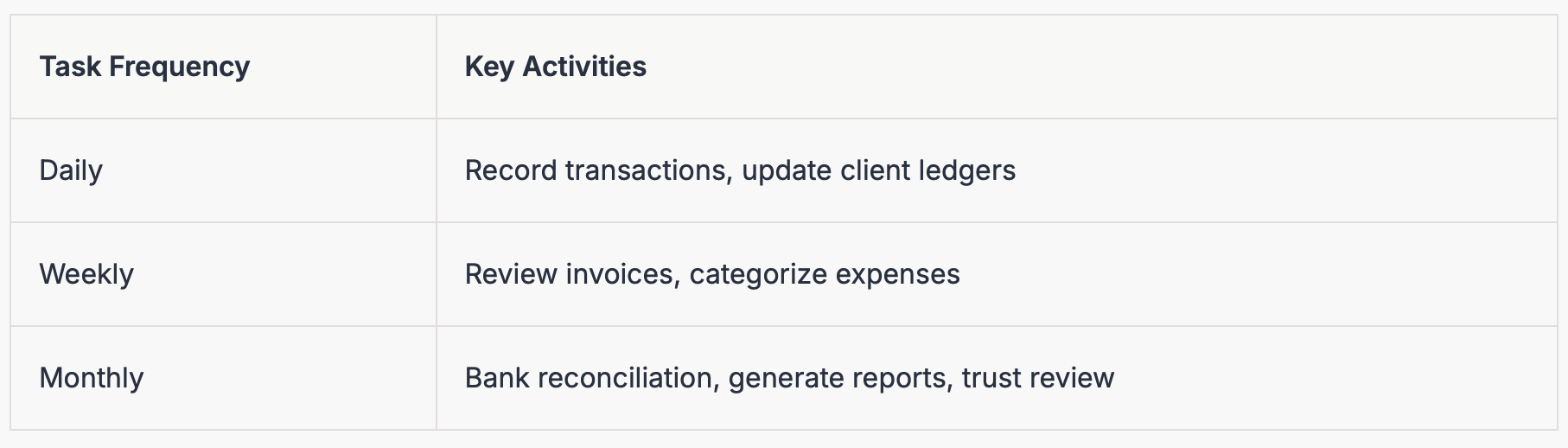

Daily, Weekly, and Monthly Accounting Tasks

Consistency is key to maintaining accurate records and staying compliant. For accounting for attorneys, develop a routine that includes recording all transactions, categorizing expenses, and reconciling accounts. Daily tasks may involve logging client payments and checking for discrepancies.

Weekly, review outstanding invoices and update billing records. Each month, perform a full bank reconciliation, generate financial reports, and review trust account balances. Use a checklist or table to ensure no steps are missed. Routine diligence helps catch errors early and keeps your firm financially organized.

Tax Planning and Compliance for Attorneys

Proactive tax planning is essential for law firms to avoid penalties and maximize deductions. Accounting for attorneys means knowing which expenses are deductible, such as bar dues, legal research, and client development costs. Track these items meticulously throughout the year.

Attorneys must also manage estimated tax payments and quarterly filings. Missing deadlines or misclassifying income can trigger IRS audits. Stay informed about audit triggers specific to law firms and consult with a tax professional familiar with legal practices. Careful compliance keeps your firm in good standing and minimizes financial surprises.

Cash Flow Management Strategies

Strong cash flow is vital for sustaining operations and funding growth. Accounting for attorneys involves monitoring client receivables, retainer balances, and ongoing expenses. Use forecasting tools to anticipate cash shortages or surpluses.

Optimize billing by sending invoices promptly and following up on overdue payments. Implementing online payment systems and e-billing portals can accelerate collections. For more hands-on strategies, review these Law Firm Financial Management Tips to ensure your processes align with industry best practices. Strategic cash flow management supports long-term stability.

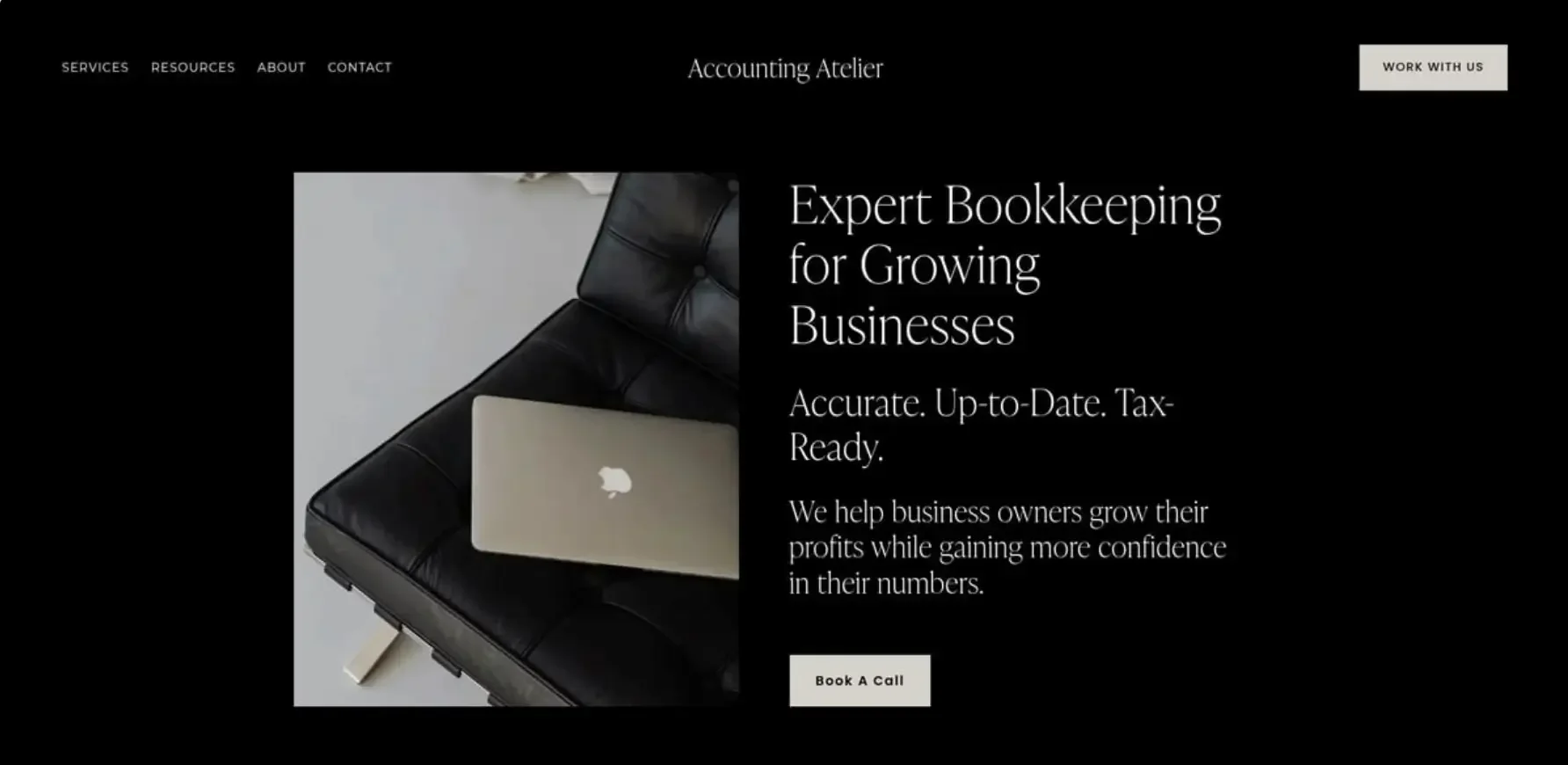

Accounting Atelier: Expert Bookkeeping for Law Firms

Outsourcing your bookkeeping to specialists like Accounting Atelier can transform your firm’s financial management. Their team of certified experts understands accounting for attorneys, offering tailored services from trust account compliance to audit-ready reporting.

By relying on professionals with legal industry experience, your firm reduces the risk of errors and non-compliance. Outsourced bookkeeping supports profitability, allows you to focus on legal work, and creates a stress-free environment. Consider partnering with experts to enhance your firm’s compliance, accuracy, and financial peace of mind.

Leveraging Technology: Accounting Software, Automation, and Integrations

Modern technology is transforming accounting for attorneys. As law practices face growing compliance and client demands, leveraging the right technology is no longer optional. From specialized software to secure integrations, embracing innovation safeguards your firm’s finances and reputation.

Choosing the Right Legal Accounting Software

Selecting the best software is a foundational step in accounting for attorneys. Legal-specific solutions like Clio Manage, LeanLaw, and CosmoLex are designed for law firm workflows, offering robust trust accounting, billing, and compliance features.

Consider the following key features when evaluating options:

User experience, customer support, and compliance capabilities are paramount. Choose accounting for attorneys software that aligns with your firm’s size, practice areas, and jurisdictional requirements.

Automating Routine Accounting Tasks

Automation is revolutionizing accounting for attorneys by reducing manual effort and minimizing risk. Automated billing, expense tracking, and reconciliation ensure accuracy and save time.

Examples of automation workflows for law firms:

Scheduling recurring invoices for retainers

Auto-categorizing client expenses

Syncing bank feeds for real-time reconciliation

By automating these tasks, your team can focus on client service and strategic growth. Automation in accounting for attorneys also strengthens compliance by standardizing processes and creating consistent records.

Integrating Practice Management and Accounting Platforms

Seamless integration between practice management and accounting for attorneys platforms is essential for operational efficiency. Integrations like Clio with QuickBooks or MyCase with Xero eliminate double entry and ensure real-time data flow.

Integrated systems help maintain accurate client trust balances, streamline billing, and support compliance. For example, integrating your accounting system with a trust accounting workflow simplifies IOLTA compliance. For an in-depth look at evolving IOLTA requirements, consult IOLTA Trust Accounting in 2025.

When integrating, avoid data silos by choosing platforms with proven compatibility and secure APIs. Consistent integration empowers accounting for attorneys to adapt quickly to regulatory changes and client expectations.

Data Security and Confidentiality in Legal Accounting

Data security is at the heart of accounting for attorneys. Protecting client and financial data requires robust encryption, secure cloud storage, and strict access controls.

Best practices for safeguarding sensitive information include:

Using two-factor authentication for all platforms

Conducting regular security audits

Training staff on cybersecurity protocols

Compliance with privacy laws such as GDPR and CCPA is non-negotiable. Secure remote access and encrypted backups are vital for maintaining client trust and regulatory compliance in accounting for attorneys.

Future Trends: AI and Analytics in Legal Accounting

Artificial intelligence and advanced analytics are shaping the future of accounting for attorneys. AI-driven bookkeeping automates routine entries, detects anomalies, and accelerates reconciliations.

Predictive analytics offer real-time dashboards and financial forecasts, empowering law firms to make proactive decisions. As adoption rates climb, firms leveraging AI gain a competitive edge in efficiency and compliance.

Staying ahead of these trends ensures your accounting for attorneys processes remain agile and resilient. Embrace innovation to future-proof your financial management and deliver exceptional value to clients.

Compliance, Ethics, and Risk Management in Attorney Accounting

Maintaining compliance, upholding ethics, and managing risk are nonnegotiable aspects of accounting for attorneys. As regulations tighten in 2026, law firms must stay vigilant or risk severe penalties, loss of licensure, or reputational damage. Mastering these areas is essential for running a successful and trustworthy legal practice.

Understanding Key Compliance Requirements

Compliance is the foundation of accounting for attorneys. Law firms must adhere to federal, state, and bar association rules, which can vary widely across jurisdictions. Staying current with regulatory changes, such as updates to trust account management or tax rules, is critical.

One of the most important resources for navigating these complexities is the IOLTA Compliance Overview, which details the steps for trust account setup and reconciliation. Common compliance gaps include improper segregation of client funds, incomplete trust reconciliations, and outdated policies.

A proactive approach, with regular policy reviews and staff training, helps prevent costly mistakes in accounting for attorneys.

Ethics in Law Firm Financial Management

Ethical management is integral to accounting for attorneys. Attorneys have a duty to handle client funds with utmost integrity, avoid conflicts of interest, and maintain transparent billing practices. Violations can result in disciplinary action or even disbarment.

Recent ABA IOLTA Conference Materials highlight evolving ethical standards and real-world case studies. For example, misapplying client trust funds or overbilling can lead to severe penalties. Attorneys must always prioritize the client’s best interest and document all financial transactions accurately.

Ongoing education in ethics keeps law firms aligned with best practices in accounting for attorneys.

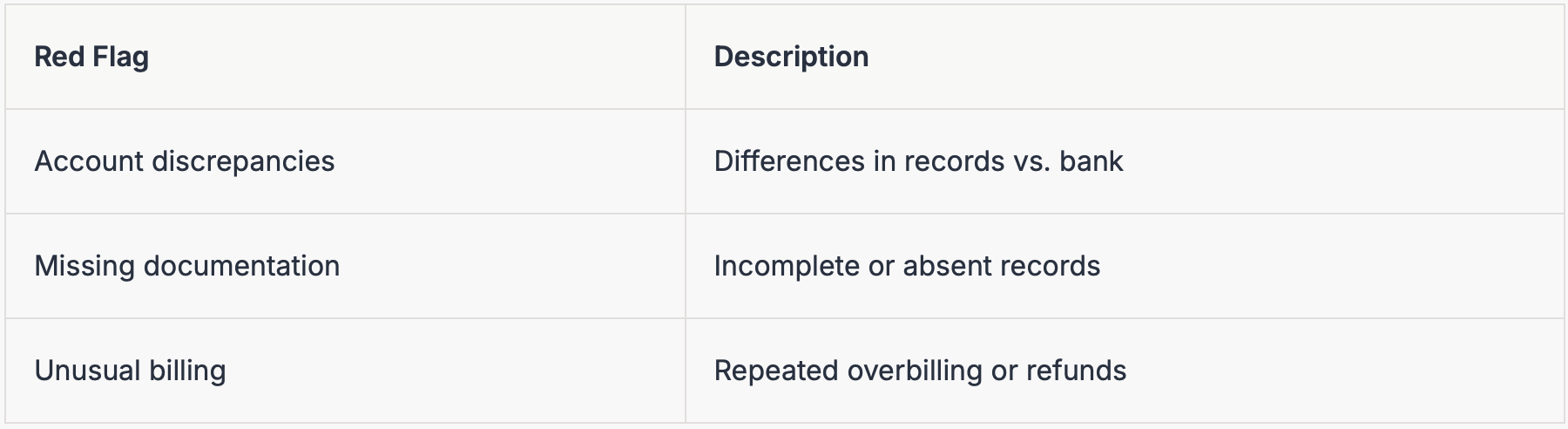

Internal Controls and Fraud Prevention

Robust internal controls are vital for safeguarding law firm assets and ensuring ethical accounting for attorneys. Segregation of duties, approval workflows, and audit trails help prevent errors and deter fraud. Small law firms are especially vulnerable, with studies showing that a significant percentage experience financial fraud annually.

Key red flags include:

Unexplained account discrepancies

Missing documentation

Unusual billing patterns

Regular audits and prompt investigation of anomalies protect the integrity of accounting for attorneys.

Preparing for Regulatory Audits and Reviews

Audit readiness is a core responsibility in accounting for attorneys. Regulatory audits can occur unexpectedly, so maintaining organized, up-to-date records is essential. Documentation should include reconciled trust accounts, detailed invoices, and written accounting procedures.

A simple audit preparation checklist:

Review all trust account reconciliations monthly

Maintain client ledger balances

Update written policies regularly

Ensure all staff understand audit protocols

Utilize industry resources such as the IOLTA Compliance Overview for comprehensive audit preparation guidance. These steps reduce the risk of negative audit findings and support long-term compliance in accounting for attorneys.

Building a Culture of Compliance

Creating a culture of compliance empowers everyone involved in accounting for attorneys. Regular staff training, clear policies, and open communication foster accountability. Professional development and staying current with industry trends help law firms adapt to regulatory changes.

A compliance-first mindset enhances firm reputation, reduces risk, and builds client trust. By prioritizing education and continuous improvement, attorneys ensure their financial management practices remain effective and ethical year after year.

Optimizing Law Firm Accounting Workflows for Growth

Optimizing accounting for attorneys is essential for sustainable law firm growth. As your practice expands, streamlined workflows ensure accuracy, compliance, and profitability. Adopting best practices across billing, metrics, planning, and technology will position your firm for long-term success.

Streamlining Billing and Collections

Efficient billing and collections are crucial for accounting for attorneys aiming for growth. Implement e-billing portals to accelerate invoicing and offer clients multiple payment options. This reduces delays and improves cash flow.

Use automated invoice reminders

Accept online payments securely

Track outstanding balances regularly

Digitizing payment systems not only saves time but also minimizes errors. By maintaining transparent billing, you build trust with clients and reduce disputes. Prioritize clear policies and consistent follow-up to enhance overall financial health.

Financial KPIs and Metrics for Law Firms

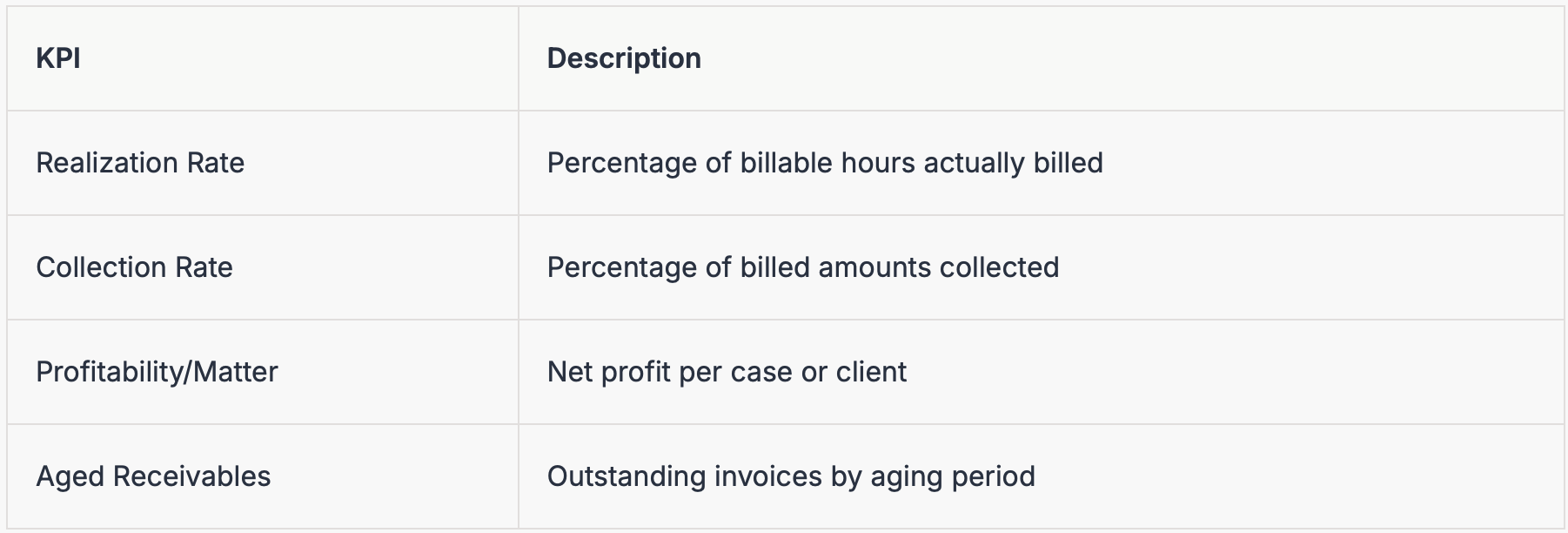

Tracking performance metrics is a core aspect of accounting for attorneys. Focus on a few key indicators to gauge your firm’s financial health:

Regularly review these metrics to identify trends and areas for improvement. Benchmarking against industry standards helps your firm remain competitive and highlights opportunities to optimize service delivery.

Budgeting and Financial Planning for Attorneys

Budgeting is vital in accounting for attorneys who want steady growth. Begin by outlining projected revenues and fixed expenses, then allocate funds for marketing, staffing, and technology.

Steps for effective law firm budgeting:

List all revenue sources

Estimate monthly and annual expenses

Set aside reserves for taxes and emergencies

Use forecasting tools to plan for different scenarios, such as onboarding new clients or expanding practice areas. A well-structured budget supports informed decision-making and helps avoid cash shortfalls.

Scaling Your Accounting Processes as You Grow

As your firm expands, scaling accounting for attorneys becomes more complex. Transition from manual spreadsheets to robust legal accounting software to handle increased transaction volume and reporting needs.

Consider these steps:

Automate routine bookkeeping tasks

Integrate billing, trust accounting, and payroll systems

Outsource to certified legal bookkeepers as needed

When managing multi-state or multi-practice offices, standardized workflows help maintain compliance and efficiency. Evaluate staffing needs regularly to support continued growth without sacrificing accuracy.

Continuous Improvement and Staying Ahead of Trends

Continuous improvement is a cornerstone of effective accounting for attorneys. Stay updated on regulatory changes, tax laws, and legal technology advancements by consulting industry reports and joining professional networks.

Encourage ongoing education for your team and regularly review internal processes for bottlenecks. Embrace innovation and data-driven decision-making to keep your firm agile. By fostering a culture of financial agility, your practice will be well-positioned for future challenges and opportunities.