Attorney Trust Account Rules: State-by-State Requirements

Attorney trust account rules govern how lawyers hold, manage, and disburse client funds - and every state enforces its own version. While core principles remain consistent nationwide (segregate client funds, maintain records, reconcile regularly), the specific requirements vary: California mandates monthly reconciliation with written reports; Texas requires quarterly; New York demands records be kept for seven years while other states require five. Attorneys practicing in multiple jurisdictions need to track which rules apply to which matters.

This guide covers trust account requirements for the states with the largest attorney populations. Bookmark it for reference, but verify current rules through your state bar - regulations change, and this overview doesn't replace jurisdiction-specific compliance review.

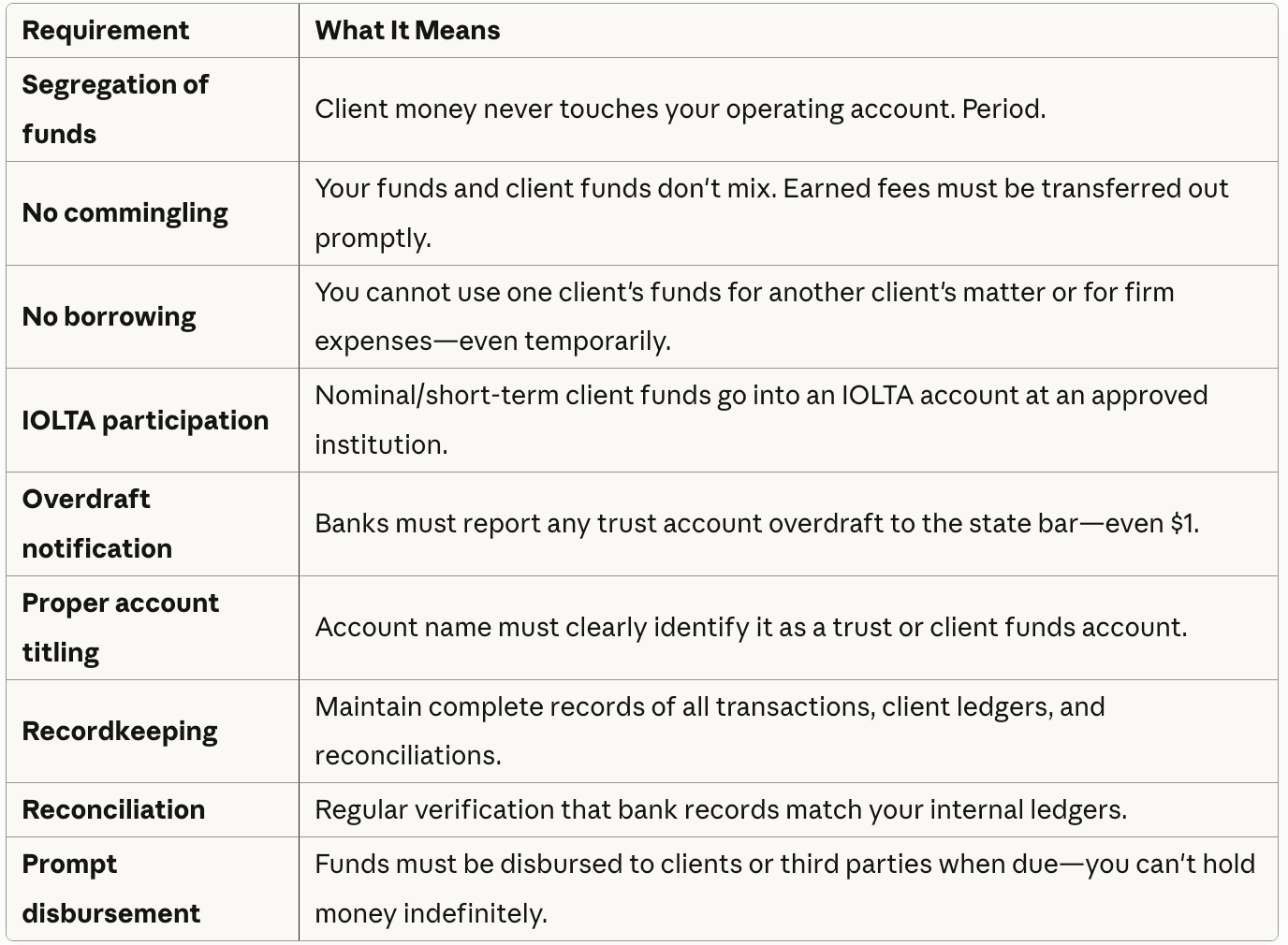

Universal Trust Account Requirements

Before diving into state specifics, these requirements apply everywhere. No state permits exceptions. All nominal or short-term client funds go into an IOLTA account at an approved institution.

These aren't suggestions. Violating any of them creates exposure to bar discipline regardless of your state. For implementation guidance, see our guide to trust accounting.

State-by-State Trust Account Rules

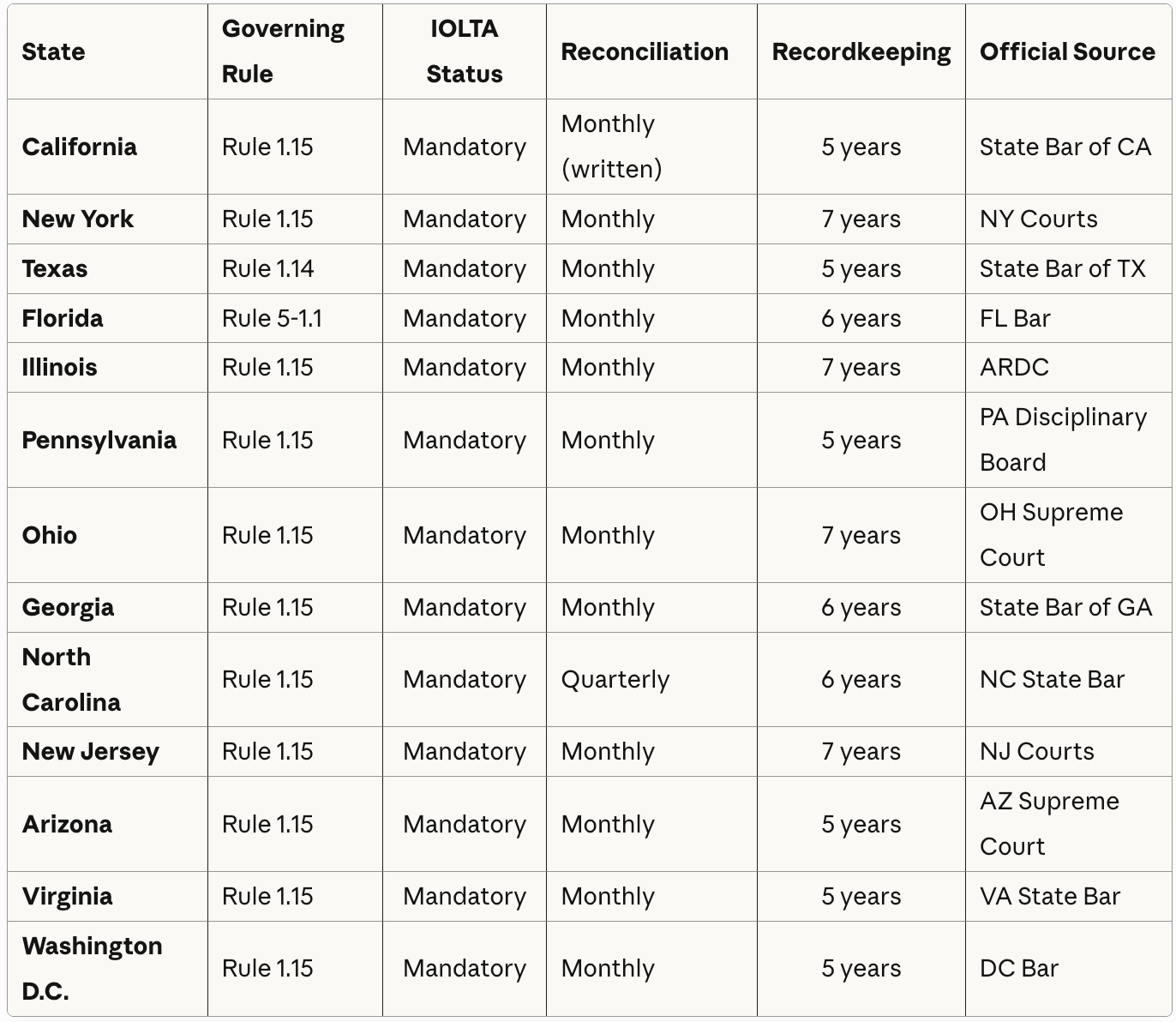

The following table covers the 12 states with the largest attorney populations plus Washington D.C. Each state's rules are governed by its version of Rule 1.15 (or equivalent), which derives from the ABA Model Rules but includes state-specific modifications.

Important: Rules change. See "How to Find Your State's Specific Rules" below for links to official sources.

Key Differences Between States

While the table provides an overview, certain variations create real compliance implications for attorneys.

Reconciliation Frequency

Most states require monthly reconciliation. North Carolina is notable for permitting quarterly reconciliation—but monthly remains the professional standard even there. Monthly three-way reconciliation catches errors before they compound. Waiting 90 days between reconciliations allows small discrepancies to become large problems.

Regardless of your state's minimum, reconcile monthly.

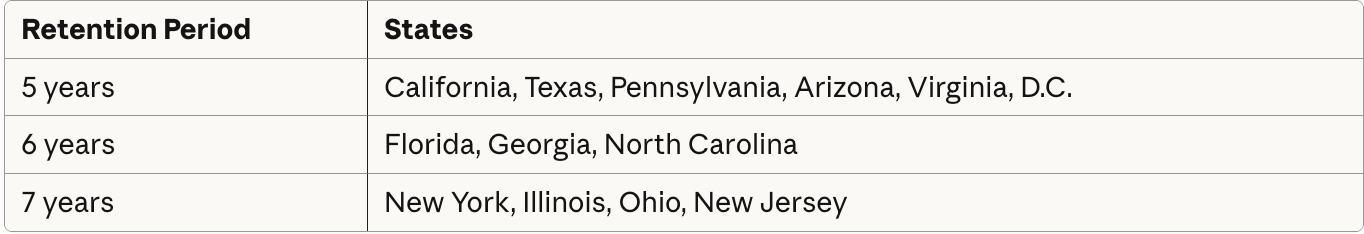

Recordkeeping Periods

The clock starts when the matter closes or representation terminates - not when the record was created. A deposit slip from 2024 for a matter that closes in 2027 must be retained until at least 2032 (in a 5-year state) or 2034 (in a 7-year state).

For detailed retention requirements, see our guide to IOLTA recordkeeping requirements.

Interest Rate Requirements

States take different approaches to IOLTA interest rates:

Comparability states (CA, TX, IL, PA, NJ, GA, VA): Banks must pay rates comparable to similar non-IOLTA accounts

Benchmark states (FL): Banks must pay at least 75% of the federal funds target rate

Program-set states (NY, OH): The state IOLTA program negotiates or sets rates with participating banks

This affects legal aid funding, not your compliance obligations. Your firm has no liability related to interest rates - the bank handles remittance automatically.

Audit and Reporting Requirements

Random audit frequency varies significantly:

California: Random audits of approximately 2% of attorneys annually through the Client Trust Account Protection Program

New Jersey: Random audits plus mandatory annual registration of trust accounts

New York: Biennial registration required; random audits conducted

Florida: Random audits through the Florida Bar's audit program

Some states (like New Jersey) require affirmative annual reporting. Others audit randomly without regular registration. Know your state's approach - being selected for audit isn't unusual, and preparation determines whether it's routine or problematic.

Approved Financial Institutions

Every state maintains a list of banks approved for IOLTA accounts. Using a non-approved bank creates compliance issues regardless of how well you manage the account.

Before opening a trust account:

Check your state bar's current approved institution list

Verify the specific branch participates (some regional branches don't)

Confirm the bank will title the account properly and report overdrafts

Banks occasionally withdraw from IOLTA programs. If your bank stops participating, you'll need to move your trust account to an approved institution.

Multi-Jurisdictional Practice

Attorneys licensed in multiple states face layered compliance obligations. The general rule: apply the trust account rules of the jurisdiction governing each matter.

Example: A California-licensed attorney also licensed in Arizona handles a matter for an Arizona client involving Arizona law. Arizona trust account rules apply to funds related to that matter - even if the attorney deposits them in their California IOLTA account.

Practical approaches:

Separate accounts: Maintain jurisdiction-specific IOLTA accounts. Cleanest for compliance but creates administrative overhead.

Single account with careful tracking: Maintain one IOLTA account in your primary state, apply the strictest applicable standard across all matters, and document which state's rules govern each client ledger.

Matter-specific evaluation: For significant matters in secondary jurisdictions, open jurisdiction-specific accounts.

The safest approach: default to the strictest requirement across all jurisdictions where you practice. If New York requires 7-year retention and California requires 5, keep records for 7 years. If California requires monthly written reconciliation and your other state requires quarterly, reconcile monthly with written reports.

How to Find Your State's Specific Rules

State bar websites are the authoritative source. Here's where to look:

Rules of Professional Conduct: Every state publishes its version of Rule 1.15 (safekeeping property). This is the foundation.

Trust Account Handbooks: Many state bars publish supplementary guides explaining trust account requirements in detail. California, Florida, and Texas have particularly comprehensive handbooks.

IOLTA Program Pages: State IOLTA programs publish requirements for account setup, approved institutions, and interest rate compliance.

Ethics Hotlines: Most state bars operate ethics hotlines where you can ask specific questions about trust account compliance. Use them -that's what they're for.

Official trust account resources by state:

California: Client Trust Accounting & IOLTA

Florida: Rules Regulating Trust Accounts

Georgia: Rules of Professional Conduct

Illinois: Lawyers Trust Fund of Illinois

New Jersey: Rules of Professional Conduct

New York: Attorney Registration

North Carolina: Rules of Professional Conduct

Pennsylvania: Disciplinary Board Rules

Texas: IOLTA Program

Virginia: Rules of Professional Conduct

Washington D.C.: Rules of Professional Conduct

If your state isn't listed, search "[State] bar association trust account" or "[State] IOLTA program."

Common Violations Across All States

Trust account violations account for a substantial percentage of attorney discipline cases nationwide. The same mistakes appear regardless of jurisdiction.

Commingling: Mixing personal or firm funds with client funds. This includes leaving earned fees in trust too long or depositing personal funds to cover bank fees (prohibited or restricted in most states).

Conversion/Misappropriation: Using client funds for any purpose other than the client's matter. "Borrowing" from trust - even with intent to repay - is conversion.

Failure to Maintain Records: Inadequate documentation makes it impossible to prove compliance. If you can't demonstrate proper handling, regulators assume improper handling.

Failure to Reconcile: Not performing regular reconciliation, or performing it without the three-way verification (bank balance, trust ledger, sum of client ledgers).

Improper Disbursement: Disbursing funds without authorization, disbursing before deposits clear, or disbursing to the wrong party.

Negative Client Balances: Allowing any individual client ledger to show a negative balance - meaning you've paid out more than that client deposited. This indicates you used another client's funds.

For a detailed breakdown of compliance failures and how to prevent them, see our guide on IOLTA compliance mistakes.

When Rules Change

Trust account rules evolve. States periodically update requirements - reconciliation standards, recordkeeping periods, approved institutions, and reporting obligations all change over time.

Stay current through:

State bar publications: Most bars notify members of rule changes through journals, newsletters, or emails

CLE programs: Trust accounting CLEs cover current requirements

IOLTA program updates: Programs announce changes affecting account management

Professional networks: Other attorneys in your jurisdiction often flag changes

If you haven't reviewed your state's trust account rules in more than two years, verify current requirements. What was compliant in 2022 may not satisfy 2026 standards.

Trust Accounting Without the State-by-State Confusion

Tracking jurisdiction-specific requirements adds complexity to an already demanding compliance area. The attorneys who stay out of trouble either master these details or delegate them to specialists who have.

If your trust accounting needs attention - whether you're establishing systems, cleaning up historical issues, or adding jurisdictions -Accounting Atelier provides bookkeeping for law firms with complex IOLTA compliance requirements. We implement the Legal Ledger Protocol™ to keep you compliant across jurisdictions.

Schedule a trust account review →

Frequently Asked Questions

-

It depends on when the fee is earned. If a flat fee is earned upon receipt (and your engagement letter specifies this), it goes directly to your operating account - not trust. If the flat fee is earned incrementally or upon completion, unearned portions must be held in trust until earned. Check your state's rules on flat fee treatment; some require specific disclosure language.

-

Most states prohibit or strictly limit this practice. Some permit a nominal amount (typically $50-150) solely to cover bank fees. Others prohibit any firm funds in trust. Check your state's rule before depositing any personal funds - even to prevent overdrafts.

-

Incomplete records create a presumption of improper handling. You cannot prove compliance you cannot document. Consequences range from remedial requirements to formal discipline depending on severity. Maintain records from day one - reconstruction after an audit notice is rarely successful.

-

Not required, but sometimes advisable. A single IOLTA account with proper client ledgers satisfies compliance requirements. However, firms with high-volume distinct practice areas (personal injury settlements vs. real estate closings) sometimes find separate accounts simplify management and reduce errors.

-

Most states require "prompt" disbursement without specifying exact timelines. The standard interpretation: disburse funds as soon as practically possible once the conditions for disbursement are met -typically within days, not weeks. Holding funds without legitimate reason creates compliance exposure.

-

Verify the resulting institution is IOLTA-approved in your state. Bank mergers sometimes affect IOLTA participation status. If the acquiring bank isn't approved, you'll need to move your trust account. Your state bar or IOLTA program can confirm current approved status.

-

In most states, real estate transaction funds follow the same trust account rules as other client funds. Some states have additional requirements for real estate escrow (specific disclosures, insurance requirements). If you handle real estate closings, verify whether your state imposes additional obligations beyond standard trust account rules.

-

Generally yes. Rule 1.15 typically covers "property of clients or third persons." If you're holding funds that belong to someone other than your firm - whether client, opposing party, or third-party lienholder - trust account rules apply.