Clio and QuickBooks Integration for Law Firms: Trust Accounting Configuration

Last quarter, we inherited a QuickBooks file from a firm that had been running the Clio integration for eighteen months. The integration had been "working" - invoices synced, payments recorded, reports generated. But when we ran the three-way reconciliation, the trust liability account in QuickBooks showed $47,000 more than the sum of client balances in Clio. Eighteen months of trust payments had been crediting the wrong accounts, and no one caught it because the integration kept running without errors.

The Clio and QuickBooks integration connects your practice management system to your accounting software, syncing invoices, payments, and client data between the two platforms. It eliminates double-entry for operating transactions. But it does not handle trust accounting - and that gap is where configurations go wrong.

As a Clio Certified Partner, I have set up this integration for dozens of firms. The technical connection takes ten minutes. Getting it right for a firm that handles client funds takes actual thought.

Why Clio Needs QuickBooks (and Vice Versa)

Clio tracks your practice. QuickBooks tracks your money. The confusion starts when people treat them as interchangeable.

Clio is where you record time, generate invoices, manage matters, store documents, and track what clients owe you. It also maintains client trust balances - the money sitting in your IOLTA account that belongs to clients, not to you. Clio does these things well.

What Clio cannot do: produce a balance sheet, track accounts payable, calculate your quarterly tax estimates, or give your CPA the financials they need at year-end. Clio knows your revenue and your trust balances. It does not know your rent, your payroll, your equipment loans, or your actual profit.

QuickBooks for law firms fills that gap. It holds your complete financial picture - assets, liabilities, equity, revenue, expenses. It reconciles to your bank. It produces the reports that tell you whether you're actually making money or just busy.

You need both. The integration connects them so you're not entering invoices twice. But the integration only handles the operating side. Every trust transaction still requires manual work in QuickBooks, and that's where most firms get into trouble.

Before You Connect: The Pre-Integration Audit

The integration syncs whatever mess exists. Connect it to a disorganized QuickBooks file and you'll have organized chaos - everything flowing smoothly into the wrong places.

I have seen firms connect the integration to QuickBooks files with seventeen different income accounts, half of them duplicates from years of ad-hoc additions. The sync worked perfectly. The reporting was useless. If your chart of accounts needs cleanup, do it before connecting. Our trust account cleanup process exists because so many firms skip this step.

Your QuickBooks file needs a specific structure before the integration makes sense. You need separate bank accounts for operating and IOLTA - obvious, but I have seen them combined. You need a trust liability account, and if your state requires client-level ledgers (California, New York, Texas, and Florida all do), you need sub-accounts under that liability for each client with funds on deposit. You need income accounts that actually match your Clio billing categories, not a single "Legal Services" catch-all that tells you nothing about your revenue mix.

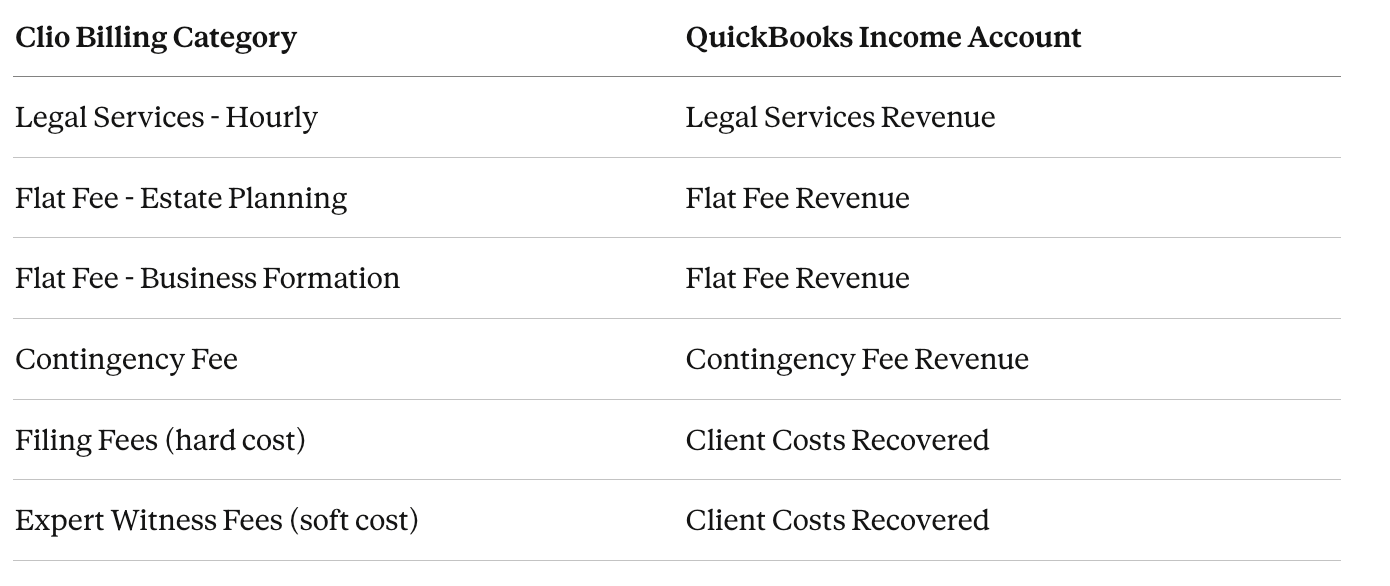

On the Clio side, review your billing categories and payment allocation settings before enabling sync. Create a mapping document: Clio billing category in one column, corresponding QuickBooks income account in the other. Every category needs a destination.

Here's what a clean mapping looks like:

Avoid the "Legal Services" catch-all that tells you nothing about your revenue mix. Granular mapping takes ten extra minutes during setup and saves hours of reporting frustration later.

If you find Clio categories without clear QuickBooks matches, fix them first. The integration will ask for this mapping - fumbling through it during setup creates errors.

One decision matters more than people realize: bank feeds. Use QuickBooks bank feeds or Clio bank feeds, not both. Running dual bank feeds creates duplicate transactions that take hours to untangle. Most firms do better with bank feeds in QuickBooks only, letting the integration create invoice and payment records that match against those feeds.

Trust Accounting Configuration: Where Integrations Fail

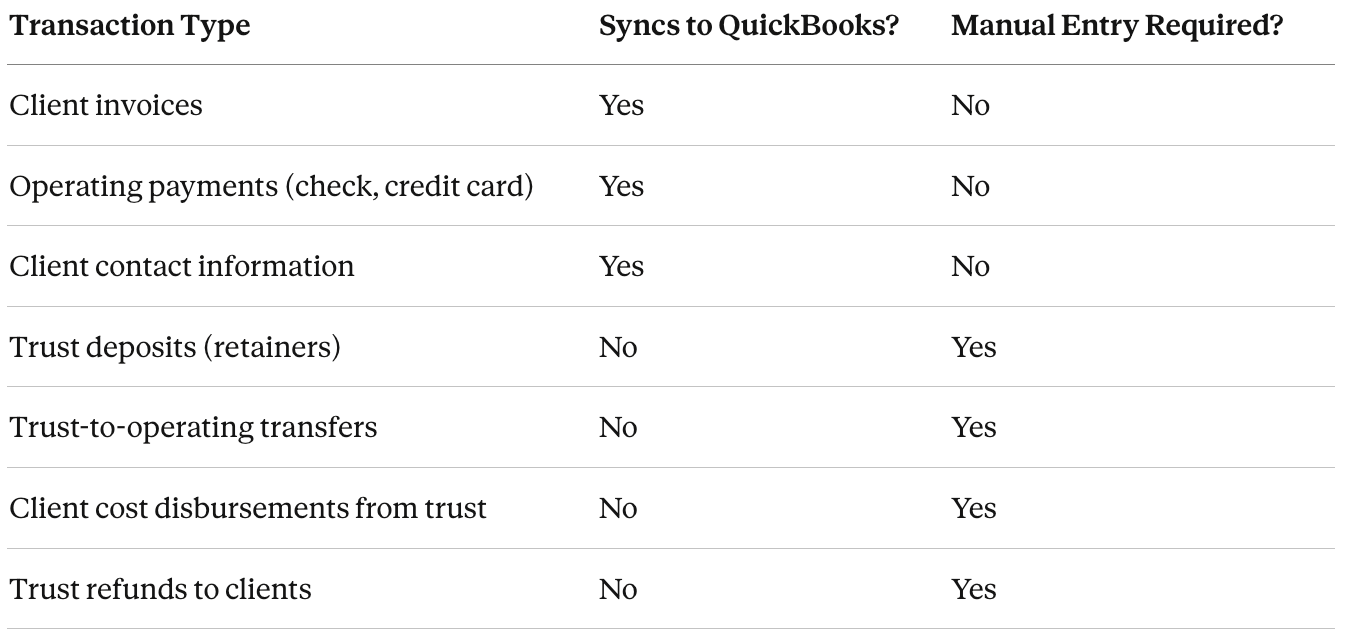

The Clio QuickBooks integration does not sync trust transactions. This is correct - trust accounting requires controls that prevent errors from propagating automatically. But the boundary between what syncs and what doesn't creates problems that show up months later during reconciliation.

Here's what the integration handles and what it ignores:

Every "No" in that middle column is a potential failure point.

Trust deposits allocated to the wrong client

When a retainer arrives, you record it in Clio as a trust deposit to that client's balance. In QuickBooks, the deposit hits your bank feed, and someone categorizes it to the trust liability account. If you use sub-accounts per client - and your bar almost certainly requires this - you have to select the correct client sub-account manually.

I have seen firms categorize every trust deposit to the parent liability account without client allocation. The total trust liability looked correct, so nobody questioned it. But the client-level detail was fiction, and when the firm faced a random bar audit, they had 47 client ledger discrepancies totaling $31,000 in misallocations. Every deposit for eight months had hit the parent account instead of the client sub-account. Reconstructing the correct allocation took weeks.

The fix is boring but necessary: a trust deposit workflow that requires client sub-account selection, every time, with the client name verified against the deposit slip before categorization.

Trust-to-operating transfers recorded as phantom revenue

When you apply trust funds to pay a client invoice in Clio, the integration sees a "paid" invoice and records a payment in QuickBooks. The default behavior credits your operating bank account and debits accounts receivable.

That's wrong. The money did not materialize from nothing. It transferred from your IOLTA account to your operating account. The correct QuickBooks entry has two parts: a bank transfer (debit operating, credit IOLTA) and a liability reduction (debit trust liability, credit accounts receivable). If your payment method mapping sends trust applications through the standard payment flow, your operating account shows cash that isn't there.

We onboarded a firm last year with $23,000 in phantom cash. Their QuickBooks operating balance was $23,000 higher than the actual bank balance because eighteen months of trust-to-operating transfers had been double-counting the cash. The integration was "working." The books were wrong.

The fix: create a separate payment method in Clio for trust applications, and map it to a transfer workflow in QuickBooks rather than a standard payment receipt.

Voided invoices leaving orphaned payments

Void an invoice in Clio after it has synced to QuickBooks and you've created a reconciliation puzzle. Sometimes the void syncs and reverses the QuickBooks invoice. Sometimes it doesn't, and you have an orphaned invoice in QuickBooks that Clio no longer knows about.

Both scenarios create problems if payments were involved. A voided invoice with a recorded payment leaves an unexplained credit balance in A/R. An orphaned invoice that someone manually deletes from QuickBooks—without voiding the associated payment - creates a reconciliation gap that surfaces during month-end close.

The fix: void in Clio first, verify the sync completed, then clean up payment artifacts in QuickBooks. Never delete invoices in QuickBooks that came from Clio. Void them so the audit trail survives.

Duplicate entries from parallel data entry

This happens constantly. A firm enables the integration on a QuickBooks file that already has manually-entered invoices. The integration creates new invoices for the same clients, doubling everything. Or staff enter a transaction in QuickBooks without realizing the sync will create it automatically.

One firm had three months of duplicate invoices before anyone noticed. Their P&L showed $180,000 in quarterly revenue. Actual revenue was $90,000.

The fix: before enabling integration, clear all open invoices in QuickBooks for clients managed in Clio. Going forward, one rule: invoices originate in Clio, period. Anyone working in QuickBooks needs to know this.

Bank feed conflicts with synced payments

With QuickBooks bank feeds active and the Clio integration running, the same deposit can appear twice - once from the bank feed, once from the synced payment. If someone categorizes the bank feed transaction without matching it to the synced record, you've double-booked the revenue.

The accounts might still reconcile to the bank. But your A/R aging shows mysterious credits, and your revenue-by-client reports are overstated. These errors hide until someone digs into the detail.

The fix: train anyone working in QuickBooks to use the "match" function for bank feed transactions that correspond to Clio payments. Match, don't categorize independently.

Integration Settings That Actually Matter

Clio's documentation covers the click-by-click setup. What matters more: the configuration decisions that determine whether this integration helps you or creates cleanup work.

Invoice sync timing: Real-time sync sounds efficient. In practice, it causes problems. Save a draft invoice in Clio - maybe you're adding time entries throughout the day - and real-time sync pushes an incomplete invoice to QuickBooks. Now you have to edit it in both places or wait for the edit to sync and hope it overwrites cleanly.

Weekly batch sync, timed to your invoicing cycle, produces cleaner results. Finalize everything in Clio first, then let the batch run. Only finished invoices hit QuickBooks.

Payment method mapping: This is where trust accounting lives or dies. Create distinct payment methods in Clio for operating payments (checks, credit cards, ACH) and trust applications. Map them to different workflows in QuickBooks. Operating payments go through standard accounts receivable. Trust applications trigger transfer entries. Do not let them flow through the same path.

Contact sync direction: Clio-to-QuickBooks, one way. Clio is your system of record for client information. Bidirectional sync creates duplicates when someone edits a contact in both systems. One-way sync, Clio as source, eliminates the conflict.

Expense sync: Skip it. The integration can push Clio expenses to QuickBooks, but they arrive without the categorization detail QuickBooks needs. You end up re-categorizing everything anyway. Enter expenses directly in QuickBooks or let them flow through bank feeds. Use Clio for matter-level cost tracking, QuickBooks for firm-level expense management.

When the integration breaks: It will. Authorization tokens expire, API updates cause temporary failures, syncs fail silently. Build verification into your workflow: weekly invoice count comparison between systems, monthly sync log review in Clio settings, immediate investigation of any error notifications. When the connection drops, re-authorize it and manually verify every transaction that crossed the outage. Do not assume the sync catches up automatically.

LeanLaw vs. Native Integration

Some firms use LeanLaw as middleware between Clio and QuickBooks instead of the native integration. LeanLaw costs money (the native integration is free), so the question is whether the additional features justify the expense.

My take: for most firms with straightforward billing and a single IOLTA account, the native integration works fine if you configure it correctly and maintain the manual trust workflows. The failure modes above aren't integration failures - they're configuration and process failures. The native integration can work.

LeanLaw makes sense in specific situations: firms with multiple trust accounts that need consolidated reporting, firms with LEDES billing requirements, firms where the trust volume is high enough that manual QuickBooks entries become a real time burden. LeanLaw's trust accounting features are genuinely better than the native integration's approach of "just don't sync trust at all."

If you're debating between them: start with the native integration, implement proper trust workflows, and evaluate after six months. If the manual trust entries are eating significant time or creating errors despite good processes, LeanLaw may be worth the cost. If things are running smoothly, you don't need it.

What the Integration Cannot Do

The Clio QuickBooks integration moves data between systems. That's it. It does not:

Categorize your expenses

Reconcile your bank accounts

Verify trust account reconciliation (three-way reconciliation requires a human reviewing three different reports)

Catch silent sync failures

Produce accurate financials from inaccurate inputs

Know anything about your bar's trust accounting rules

The integration is infrastructure. Someone still needs to verify the sync completed, reconcile accounts monthly, record trust transactions correctly, and catch discrepancies before they compound into the $47,000 problems we opened with.

For firms handling client funds, that someone needs to understand both the software and the rules. California requires client ledger cards with running balances and California-based bank accounts. New York requires attorney attestations on trust transactions and separate escrow accounts for real estate matters. Texas allows interest-bearing trust accounts with specific allocation requirements. Florida mandates six-year record retention with prescribed reconciliation formats. The integration does not track any of this. Your bar's random audit program does not care that your sync ran successfully.

How We Handle This

At Accounting Atelier, we configure Clio QuickBooks integrations as part of our Legal Ledger Protocol™ - a trust accounting compliance system built for firms that handle client funds. The integration handles operating transaction sync. We handle everything it can't:

Daily trust account monitoring

Weekly three-way reconciliation between bank, QuickBooks, and Clio

Monthly compliance review against your bar's specific requirements

Quarterly audit-readiness checks

The integration is one piece. If you want the whole system - someone who has fixed the problems above and knows how to prevent them - law firm bookkeeping is what we do.

Accounting Atelier provides law firm bookkeeping and trust accounting compliance for law firms. Clio Certified Partner. QuickBooks Online ProAdvisor. We configure integrations that actually work.

Frequently Asked Questions

-

No. The native integration supports QuickBooks Online only. If you're on Desktop, your options are migrating to Online, using a third-party connector like Zapier (adds complexity and cost), or maintaining both systems manually. Most firms find the migration worthwhile.

-

All of them, including Simple Start. But Simple Start lacks class and project tracking, which most law firms need for matter-level reporting. QuickBooks Online Plus or Advanced gives you the features that make law firm accounting actually useful.

-

MyCase offers similar QuickBooks Online integration - invoice and payment sync for operating transactions, trust handled separately. The configuration considerations are nearly identical. Same pre-integration audit, same trust workflow requirements, same reconciliation needs.

-

The connection is instant. If you have historical invoices in Clio, the first sync of that data can take several hours depending on volume. Plan to enable integration when you can monitor the initial sync and verify data transferred correctly.

-

Check the connection status in Clio settings - authorization tokens expire, especially with two-factor authentication enabled. Re-authorize, then manually sync any invoices created during the gap. Build a weekly check into your workflow: compare invoice counts between systems.

-

LeanLaw provides better trust accounting features than the native integration - client ledger tracking, trust transaction categorization, LEDES support. It costs more. Worth it for firms with complex trust needs or high trust transaction volume. Overkill for straightforward practices with a single IOLTA account.

-

If your trust accounting is simple -handful of clients, minimal trust activity, one IOLTA account - careful DIY setup can work. Read this guide, create your mapping document, plan your trust workflows before connecting.

If you have significant trust volume, multiple accounts, or a QuickBooks file that needs cleanup first, professional configuration prevents the compounding errors that take weeks to untangle later. The $47,000 discrepancy we opened with took longer to fix than proper setup would have taken.

-

Not cleanly. When a payment splits between trust application and operating deposit, the trust portion requires manual entry. The integration handles the operating side.