IOLTA Account: The Complete Guide for Law Firms

An IOLTA account (Interest on Lawyer Trust Account) is a pooled interest-bearing bank account where attorneys hold client funds that are too small in amount or held too briefly to earn interest for the individual client. The interest earned flows to state IOLTA programs that fund legal aid services. The principal remains the property of the client. Every state requires attorneys who handle client funds to maintain IOLTA accounts, making them one of the most regulated - and frequently mismanaged - aspects of law firm finance.

I've reconciled hundreds of IOLTA accounts over the past decade. Most compliance failures don't stem from intentional misconduct. They stem from attorneys who were never taught trust accounting in law school, handed a checkbook, and expected to figure it out. This guide covers what bar associations assume you already know.

What Does IOLTA Stand For?

IOLTA stands for Interest on Lawyer Trust Accounts (sometimes called Interest on Lawyers' Trust Accounts). The acronym varies by jurisdiction - New York uses IOLA (Interest on Lawyer Accounts) - but the underlying concept is consistent nationwide.

The "interest" component distinguishes IOLTA accounts from traditional client trust accounts. Before IOLTA programs emerged in the 1980s, small client deposits sat in non-interest-bearing accounts because the administrative cost of setting up individual interest-bearing accounts exceeded any potential earnings. State bars recognized an opportunity: pool these small amounts, generate meaningful interest collectively, and direct those earnings toward expanding access to justice.

Today, IOLTA programs in all 50 states fund legal aid organizations, pro bono programs, and civil legal services for low-income individuals. According to the American Bar Association, IOLTA has generated over $4 billion in revenue since 1981, with annual grants exceeding $175 million nationwide.

How IOLTA Accounts Work

The mechanics operate on a straightforward principle with complex execution.

The Interest Flow

When you deposit client funds into your IOLTA account, the bank treats the pooled balance as a single interest-bearing account. Each month, the bank calculates interest on the total balance - not individual client portions - and remits that interest directly to your state's IOLTA program. You never touch the interest. Your clients never receive it. The bank handles the transfer automatically.

Example: Your IOLTA account maintains an average monthly balance of $50,000. The bank pays 0.5% APY. Approximately $20.83 in interest flows to your state IOLTA program that month. Scale that across thousands of attorneys statewide, and these nominal amounts fund millions of dollars in legal aid annually.

The Principal Protection

While interest leaves the account, every dollar of principal belongs to your clients—and you're personally responsible for safeguarding it. This fiduciary obligation means you must:

Know exactly how much belongs to each client at all times

Never commingle client funds with operating funds

Never use one client's funds to cover another client's matter

Disburse funds only when earned or when the client directs

The bank sees one account balance. Your records must track dozens or hundreds of individual client balances within that single account. This dual-ledger requirement creates the reconciliation complexity that trips up firms.

Eligible vs. Ineligible Funds

Not all client funds belong in IOLTA. The determining factors are amount and duration:

IOLTA-eligible: Funds too small or held too briefly to generate net interest for the client after accounting for bank fees and administrative costs

Non-IOLTA trust: Larger amounts held longer, where the client benefits from individual interest earnings

Most states set no specific dollar threshold, leaving the determination to attorney judgment. Here's how it works in practice:

A $3,000 retainer for a family law matter expected to last 60 days → IOLTA

A $5,000 flat fee for estate planning work billed over 90 days → IOLTA

A $75,000 personal injury settlement held pending medical lien resolution over 4-6 months → Individual client trust account

A $150,000 real estate escrow deposit held for 30 days → Individual account given the amount

The threshold I use with clients: amounts under $10,000 held for under 90 days go to IOLTA. Above those thresholds, evaluate whether the client would net more than the administrative costs of a separate account.

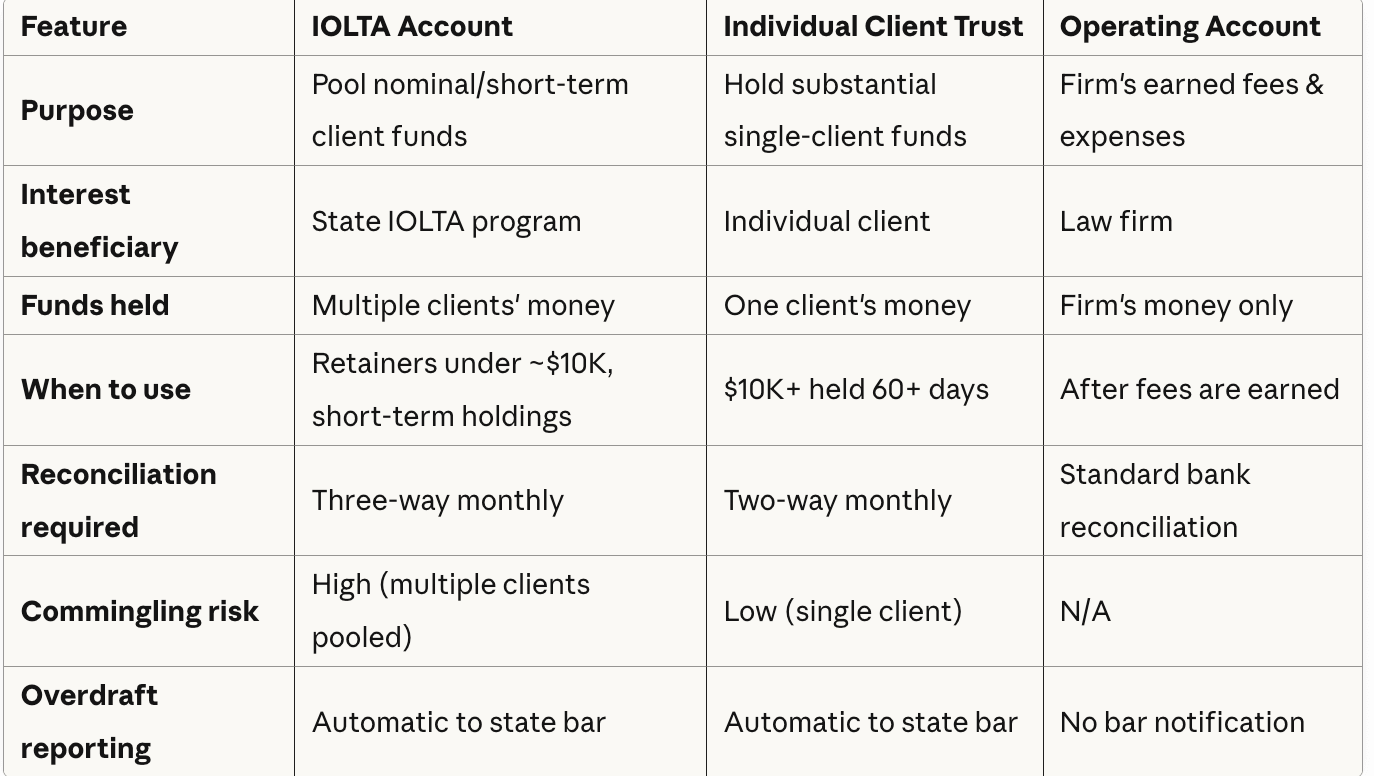

IOLTA vs. Other Trust Accounts

Attorneys frequently confuse IOLTA accounts with other trust account structures.

The key distinction: IOLTA is for pooled client funds where individual interest would be negligible. When a single client's funds would generate meaningful interest, you have an ethical obligation to establish an individual trust account for that client.

Who Needs an IOLTA Account

If you're a licensed attorney who holds client funds - even occasionally - you need an IOLTA account. This includes:

Solo practitioners handling retainers, settlements, or real estate closings

Law firms of any size with client-facing billing

Of counsel attorneys who receive funds independently

Contract attorneys who handle client funds directly

The only attorneys exempt from IOLTA requirements are those who never hold client money. If your practice involves flat fees paid entirely upfront as earned, or if you work exclusively as in-house counsel, you don't need an IOLTA account. Everyone else does.

Establish your IOLTA account before you need it. Opening an account takes weeks. A client handing you a settlement check requires immediate deposit.

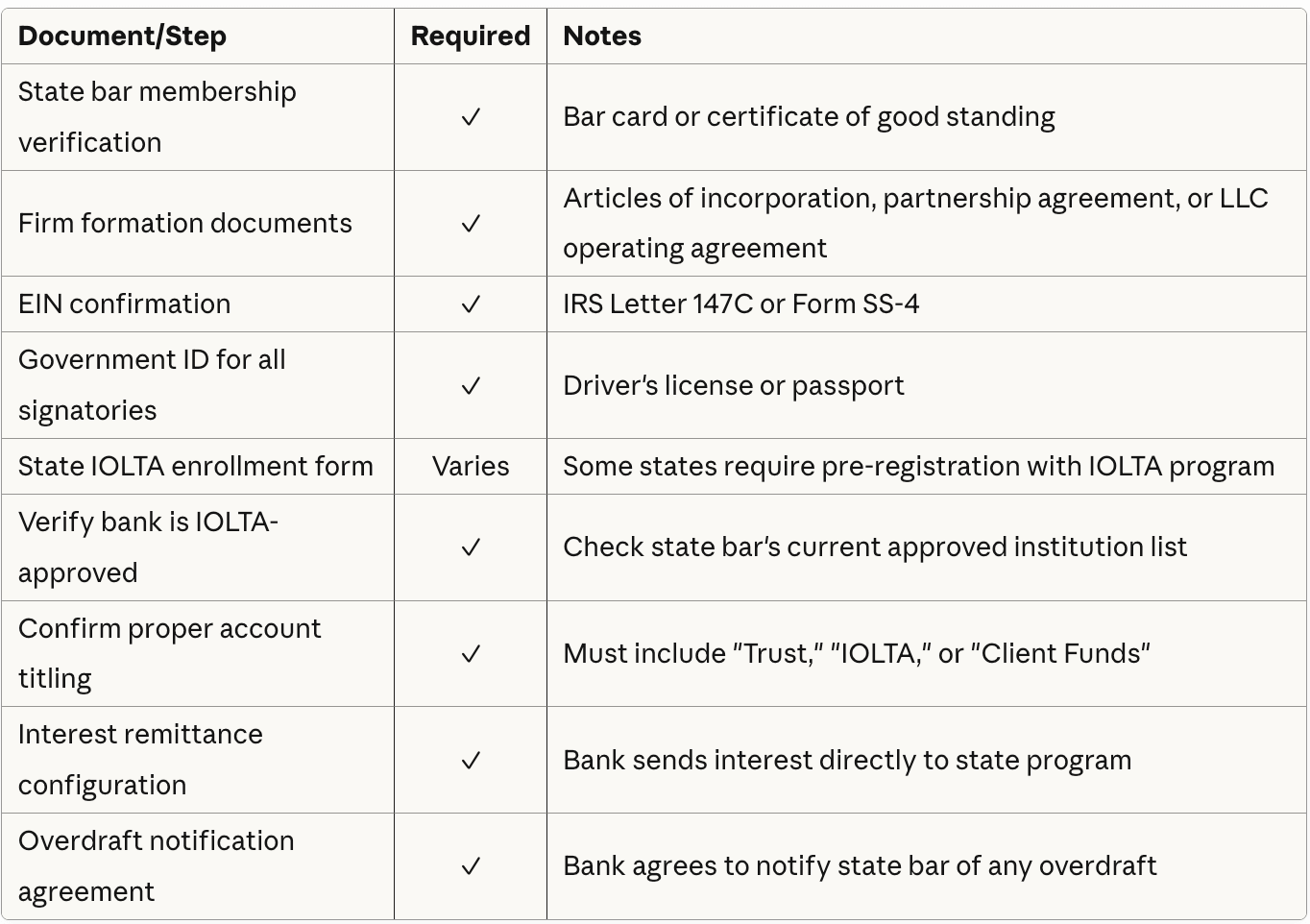

How to Open an IOLTA Account

Opening an IOLTA account requires more documentation than a standard business account.

Step 1: Verify Your State Bar Requirements

Before visiting any bank, check your state bar's IOLTA program website for:

Approved financial institutions (not all banks participate)

Required account titling format

Reporting obligations

Minimum interest rate requirements (some states mandate rates)

Your state bar maintains a list of IOLTA-approved banks. Using a non-approved institution creates compliance issues regardless of how well you manage the account. The National Association of IOLTA Programs (NAIP) maintains links to every state program.

Step 2: Gather Required Documentation

Step 3: Select a Participating Bank

Choose a bank that participates in your state's IOLTA program. Evaluate:

Interest rates paid to the IOLTA program (higher rates mean greater legal aid funding)

Fee structures (some banks waive fees on IOLTA accounts)

Online banking capabilities for reconciliation

Check imaging and transaction detail access

Branch accessibility if you handle cash or physical checks

Step 4: Open the Account with Proper Titling

Your IOLTA account title must clearly identify it as a trust account. Standard formats:

[Firm Name] IOLTA Trust Account [Firm Name] Attorney Trust Account - IOLTA [Attorney Name], Esq., IOLTA Account

The bank will configure the account to remit interest directly to your state IOLTA program and provide the program with periodic balance reports. You'll receive monthly statements showing all transactions but no interest credits (interest transfers automatically to the state program).

Step 5: Establish Your Recordkeeping System

Before depositing a single dollar, establish your client ledger system. Track:

Individual client balances within the pooled account

Source and purpose of each deposit

Recipient and authorization for each disbursement

Running reconciliation between bank balance and total client ledgers

Whether you use legal practice management software, accounting software with sub-ledger capabilities, or manual ledger cards, your system must maintain the integrity of these records indefinitely. Most state bars require trust account records be retained for five to seven years after matter closure.

Step 6: Register with Your State IOLTA Program

Most states require attorneys to register their IOLTA accounts directly with the state program:

Account number and bank name

Attorney bar number

Firm contact information

Some states handle registration through annual bar dues or licensing renewals. Verify your state's process.

IOLTA Compliance Overview

IOLTA compliance extends beyond opening the right type of account. Ongoing obligations vary by state but generally include:

Record Retention Requirements

Maintain complete trust account records:

Bank statements and reconciliations

Client ledger cards or software records

Deposit slips and supporting documentation

Disbursement records with client authorizations

Three-way reconciliation reports

Overdraft Notification

Most states require banks to notify the state bar of any trust account overdraft - even a $1 shortage lasting one day. This automatic reporting means innocent errors trigger bar inquiry. Proper reconciliation prevents these situations.

Audit Readiness

State bars conduct random and for-cause trust account audits. Your records must demonstrate compliance on demand - systematic documentation, not reconstruction from memory.

For a comprehensive breakdown of compliance requirements and implementation, see our guide to IOLTA compliance requirements.

Monthly IOLTA Management Routine

Attorneys who avoid compliance issues follow structured routines that catch discrepancies before they become problems.

Daily Monitoring

Review your trust account balance and recent transactions daily. Five minutes. You're looking for:

Unexpected debits or fees

Returned deposits or failed transactions

Balance anomalies indicating errors

Weekly Reconciliation

Reconcile your bank balance against your total client ledgers weekly. The figures must match. Any discrepancy requires immediate investigation - not next month, not when you have time.

Monthly Three-Way Reconciliation

The cornerstone of trust accounting is the three-way reconciliation: your adjusted bank balance, your trust account ledger, and the sum of all individual client ledgers must equal the same figure. This triangulated verification catches errors that simple bank reconciliation misses.

A firm handling 30 active client matters:

Bank statement balance: $47,250.00

Less outstanding checks: ($2,100.00)

Adjusted bank balance: $45,150.00

Trust ledger balance: $45,150.00

Sum of 30 client ledgers: $45,150.00

All three figures match. If they don't, you have an error requiring identification and correction before closing the month.

Quarterly Review

Review dormant balances quarterly. Funds sitting untouched for 90+ days indicate:

Matters that closed without final disbursement

Client overpayments requiring refund

Unclaimed funds requiring escheatment evaluation

Address these balances proactively.

Common IOLTA Mistakes

Trust account violations account for a significant percentage of attorney discipline cases. Most stem from avoidable administrative errors rather than intentional misconduct.

The mistakes I encounter most frequently when onboarding new law firm bookkeeping clients:

Commingling earned fees with client funds — leaving earned fees in trust too long. You bill $1,200 against a client's $5,000 retainer on March 15. By April 30, that $1,200 should have moved to your operating account. Leaving it in trust beyond a reasonable billing cycle creates commingling.

Disbursing before deposits clear — treating deposited checks as immediately available. A client's $8,500 settlement check deposited Monday isn't available until it clears (2-5 business days). Disbursing against it Tuesday risks overdraft if the check bounces.

Inadequate client ledger maintenance — relying on memory or bank statements alone without tracking individual client balances within the pooled account.

Failing to reconcile monthly — discovering errors months after they occurred, making correction exponentially harder.

Improper check signing practices — pre-signed checks, single-signatory on large disbursements, or allowing non-attorney staff to sign without proper controls.

For a detailed examination of trust accounting errors and prevention, see our guide on common IOLTA mistakes.

State-Specific IOLTA Considerations

Core IOLTA principles apply nationally. Implementation varies significantly by state.

Requirements change. Verify current rules with your state bar's IOLTA program.

Interest Rate Requirements

Some states mandate that participating banks pay interest rates meeting specific benchmarks. California requires rates comparable to non-IOLTA accounts. Florida requires at least 75% of the federal funds target rate.

Participation Requirements

Most states mandate IOLTA participation for all attorneys holding client funds. A few permit voluntary participation or allow opt-outs under specific circumstances.

Reporting Obligations

Reporting frequency varies. Some states require quarterly bank reports; others require annual attorney certification.

Audit Frequency

Random audit rates differ dramatically. Some states audit a percentage of attorneys annually; others conduct audits only for cause. Maintain audit-ready records regardless.

Eligible Financial Institutions

States maintain approved bank lists based on agreements regarding interest rates, fee waivers, and reporting compliance. Verify your bank's current approved status - banks occasionally withdraw from IOLTA programs.

For attorneys licensed in multiple jurisdictions: each state's requirements apply to funds related to matters in that state. A California attorney handling a Texas matter must comply with Texas trust account rules for those funds.

Integrating IOLTA Management with Practice Management

Modern trust accounting benefits from practice management software integration. Platforms like Clio, MyCase, and others offer trust accounting modules that:

Maintain client ledgers automatically

Generate three-way reconciliation reports

Track trust transactions alongside matter activity

Flag compliance issues proactively

Software doesn't guarantee compliance. The system is only as reliable as the data entered and the oversight maintained. Whether you use sophisticated software or manual ledgers, the discipline of daily monitoring, weekly reconciliation, and monthly verification determines your compliance posture.

At Accounting Atelier, we developed the Legal Ledger Protocol™ specifically for law firm trust accounting - a systematic approach to IOLTA management that integrates with your practice management software while maintaining the documentation rigor bar auditors expect.

Take Control of Your Trust Accounting

IOLTA compliance doesn't have to consume your practice. Proper systems, consistent routines, and clear documentation turn trust accounting into a manageable operational function.

If your IOLTA account needs cleanup, reconciliation, or systematic management, Accounting Atelier specializes exclusively in law firm bookkeeping - including trust accounting for firms with complex IOLTA requirements. We implement the Legal Ledger Protocol™ to bring your trust accounts into compliance and keep them there.

Schedule a trust account review →

Frequently Asked Questions

-

IOLTA accounts are checking accounts. The checking structure provides the liquidity attorneys need for frequent deposits and disbursements - savings account transaction limits don't work for client fund management. Banks classify IOLTA accounts as Negotiable Order of Withdrawal (NOW) accounts or Business Interest Checking, allowing interest to accrue while maintaining on-demand access.

-

Your bank notifies your state bar automatically. Even if the overdraft resulted from a bank error or timing issue, expect a letter from the bar requesting explanation. Document everything: the cause, your correction, steps taken to prevent recurrence. Most bars treat inadvertent, promptly-corrected overdrafts differently than patterns of mismanagement - but the inquiry process creates administrative burden regardless. I've seen attorneys receive bar inquiries over $12 overdrafts caused by unanticipated bank fees.

-

No. Interest flows to the state IOLTA program for legal aid funding - not to you or your clients. To earn interest on funds, hold them in a different account type: your operating account for earned fees, or an individual client trust account for substantial client funds.

-

Zero of your own money. IOLTA accounts contain only client funds. Some attorneys deposit a small amount ($50-100) to cover bank fees, but most states prohibit or strictly limit this practice. Check your state rules - many require banks to waive fees on IOLTA accounts or require fees be paid from your operating account.

-

Yes. Some firms benefit from separate accounts for different practice areas. A firm handling personal injury settlements and real estate closings might maintain separate IOLTA accounts for cleaner recordkeeping. Each account requires independent reconciliation and compliance monitoring. I work with one firm that maintains three IOLTA accounts: litigation, transactional, and real estate - each with its own three-way reconciliation.

-

Both hold funds belonging to others pending specific conditions. The distinction is regulatory: IOLTA accounts are specifically for attorney-held client funds under state bar rules, with interest directed to legal aid programs. "Escrow account" applies to real estate escrow, third-party escrow services, or other holding arrangements outside the attorney trust account framework. A title company's escrow account is not an IOLTA; an attorney holding earnest money for a real estate transaction uses their IOLTA.

-

Most states require retention for five to seven years after the matter closes or the attorney-client relationship ends. Some states require permanent retention. Given minimal storage costs for digital records, retain trust account records indefinitely - they surface in malpractice defense or client disputes long after formal retention periods expire.

-

Funds remaining after reasonable efforts to locate the client must be escheated to the state as unclaimed property. Timelines vary by state - typically one to five years holding plus documented good-faith contact efforts. Never keep unclaimed funds or transfer them to your operating account. Review balances over 12 months old quarterly to prevent accumulation.

-

State rules vary, but most permit authorized staff signatories with appropriate controls. Best practices: dual-signature requirements above $5,000, prohibition of pre-signed checks, regular review of all disbursements by an attorney. Delegation of signing authority doesn't delegate fiduciary responsibility - the attorney remains accountable for all trust account transactions.

-

You need trust accounts complying with rules governing each matter's jurisdiction. Some states permit out-of-state IOLTA accounts for attorneys primarily practicing elsewhere; others require in-state accounts for any matters involving their jurisdiction. Multi-jurisdictional practice requires careful analysis of each state's requirements. Common solution: maintain your primary IOLTA in your home state, open jurisdiction-specific accounts only when required by rule.

-

Credit card retainers present trust accounting challenges. The deposit posts to your merchant account (operating), but funds aren't earned yet (trust). Transfer retainer amounts from operating to trust immediately upon receipt, document the transfer, and maintain the client ledger in trust until fees are earned. The processing fee (2.5-3.5%) comes from operating funds, not the client's retainer. Client pays $5,000 retainer by credit card, fees are $150: you transfer $5,000 to trust and absorb the processing fee.