IOLTA Recordkeeping Requirements: What to Keep, How Long, and How to Prepare for Audits

IOLTA recordkeeping requirements mandate that attorneys maintain complete documentation of all trust account activity - including bank statements, client ledgers, deposit records, disbursement authorizations, and monthly reconciliations - for a minimum of five years after the matter closes, though many states require seven years or longer. These records must demonstrate, on demand, that every dollar deposited was properly tracked, safeguarded, and disbursed according to client authorization.

Bar auditors don't schedule appointments. When the state bar requests your trust account records, you have days - not weeks - to produce organized documentation proving compliance. The attorneys who pass audits without incident aren't necessarily better at trust accounting. They're better at recordkeeping.

What IOLTA Recordkeeping Actually Requires

State bar rules require attorneys to maintain records sufficient to identify:

The source and amount of every deposit

The client or matter each deposit belongs to

The recipient, amount, and authorization for every disbursement

The balance owed to each client at any point in time

Monthly proof that bank records match internal ledgers

This isn't optional documentation. It's the paper trail proving you didn't commingle funds, borrow from clients, or lose track of money that wasn't yours. ABA Model Rule 1.15 establishes the baseline; state rules add specific requirements. For a complete overview of compliance obligations, see our guide to IOLTA compliance requirements.

Documents You Must Keep

Every IOLTA account requires the following records:

Bank Records

Monthly bank statements (electronic acceptable)

Deposit slips or electronic deposit confirmations

Check images (front and back)

Wire transfer confirmations

ACH transaction records

Bank fee documentation

Client Ledgers

Individual ledger for each client/matter showing all deposits and disbursements

Running balance for each client

Date, amount, and description of each transaction

Reference to corresponding bank transaction

Reconciliation Reports

Monthly three-way reconciliation reports

Adjusted bank balance calculation

Trust account ledger balance

Sum of all client ledger balances

Documentation of any discrepancies and resolutions

Disbursement Authorization

Written client authorization for each disbursement (email acceptable in most states)

Settlement statements showing distribution of funds

Invoices or bills supporting cost disbursements

Fee agreements authorizing transfer of earned fees

Account Administration

Bank signature cards

Account opening documentation

IOLTA registration with state bar

Any account changes or updates

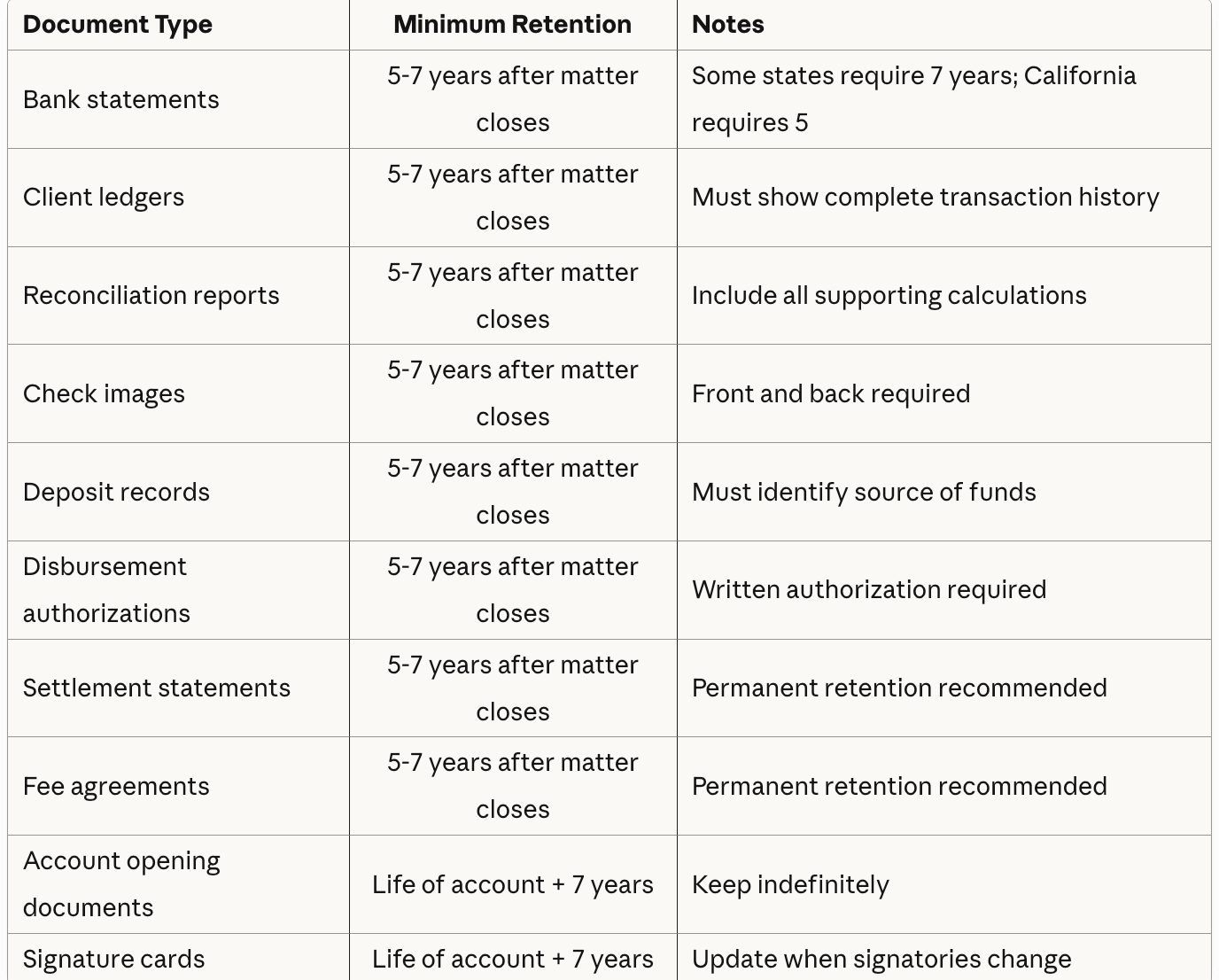

Retention Periods by Document Type

Retention requirements vary by state. This table reflects common standards - verify your jurisdiction's specific rules.

State-Specific Variations

California: 5 years from date of final distribution or termination of representation

New York: 7 years after the events they record

Texas: 5 years after termination of representation

Florida: 6 years from the later of completion or termination

Illinois: 7 years after termination of representation

The retention clock typically starts when the matter closes or representation ends - not when the document was created. A deposit slip from January 2024 for a matter that closes in December 2026 must be retained until at least December 2031 (assuming a 5-year requirement).

Practical recommendation: Default to 7 years for all trust account records. Digital storage costs are negligible, and records surface in malpractice claims and fee disputes years after formal retention periods expire.

How to Organize IOLTA Records

Disorganized records are functionally the same as missing records. A bar auditor requesting your March 2023 reconciliation won't wait while you search through email attachments and filing cabinets.

Folder Structure

Organize trust account records by year, then by month:

IOLTA Records/

├── 2024/

│ ├── 01-January/

│ │ ├── Bank Statement - January 2024.pdf

│ │ ├── Reconciliation Report - January 2024.pdf

│ │ ├── Client Ledgers - January 2024.pdf

│ │ └── Deposit-Disbursement Detail/

│ ├── 02-February/

│ └── ...

├── 2025/

├── Client Matter Files/

│ ├── [Client Name - Matter]/

│ │ ├── Fee Agreement.pdf

│ │ ├── Disbursement Authorizations/

│ │ └── Settlement Statement.pdf

└── Account Administration/

├── Account Opening Documents.pdf

├── Signature Cards.pdf

└── IOLTA Registration.pdf

Naming Conventions

Use consistent, searchable file names:

Bank Statement - 2024-03.pdfReconciliation - 2024-03.pdfClient Ledger - Smith Jones Matter - 2024-03.pdfDisbursement Auth - Smith - 2024-03-15.pdf

Digital vs. Paper

Most states accept electronic records if they're:

Complete and unaltered

Readily accessible

Capable of being printed on demand

Scan paper documents promptly. A check image from your bank's online portal satisfies the requirement - you don't need the physical check.

Practice Management Software

Clio, MyCase, and similar platforms generate trust accounting reports that satisfy recordkeeping requirements - client ledgers, transaction histories, and reconciliation reports export directly to PDF. QuickBooks Online with proper class/location tracking works for the accounting side. The key: run the exports monthly and save them to your records folder. Software databases aren't permanent archives; firms lose access when they switch platforms or cancel subscriptions.

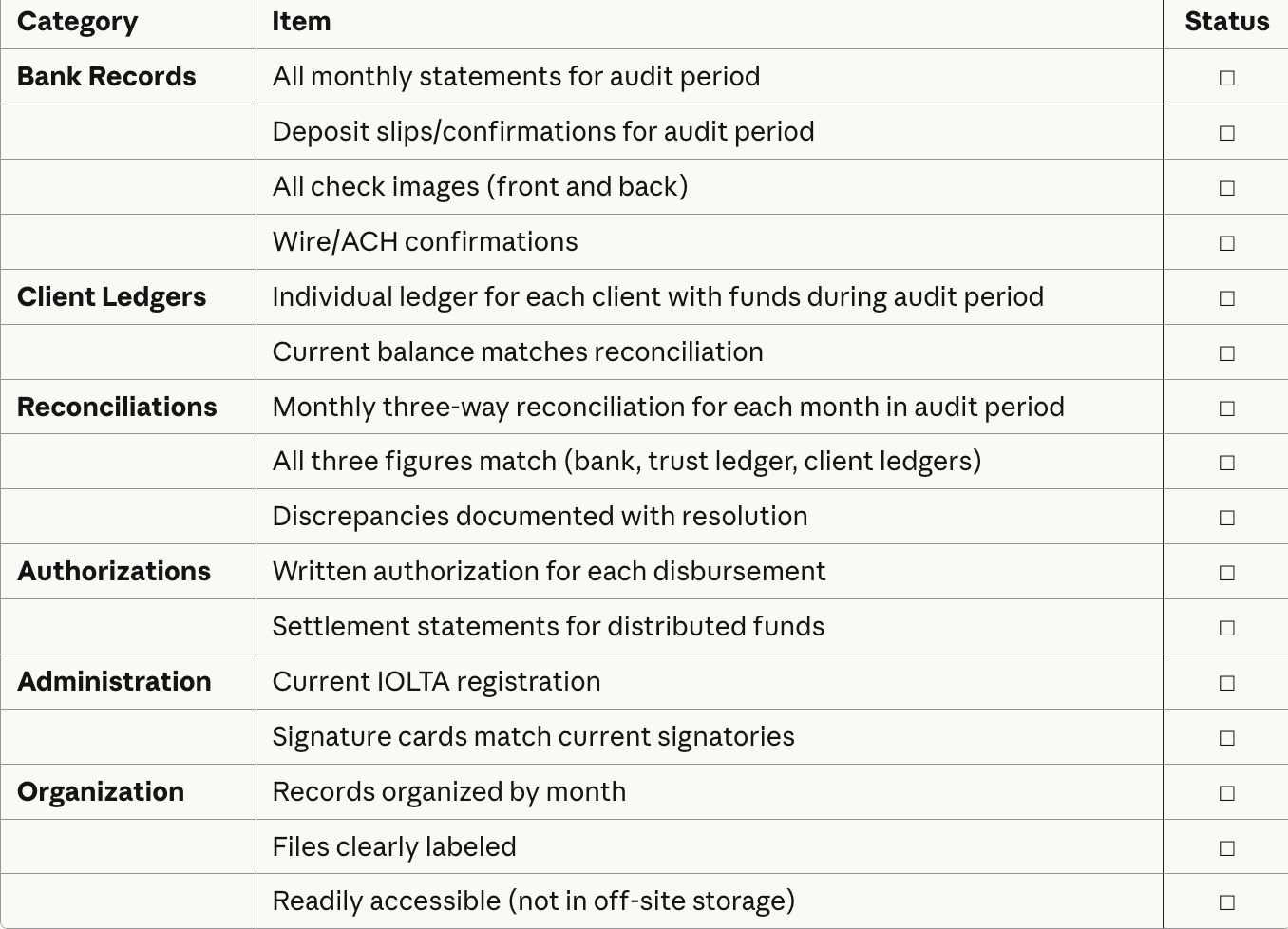

Audit Preparation Checklist

When a bar audit notice arrives, you should be able to produce compliant records within 48-72 hours. Use this checklist to verify audit readiness.

Pre-Audit Review

Before submitting records, verify:

Bank statement balances match reconciliation reports

Client ledger totals match reconciliation reports

No unexplained variances or outstanding items older than 30 days

All disbursements over $1,000 have written authorization on file

No negative client balances appear on any ledger

No round-number disbursements without supporting documentation ($5,000 exactly raises questions; $4,847.50 with an invoice doesn't)

Timing of fee transfers aligns with billing dates (fees transferred before invoices were sent signals problems)

Dormant balances have documented explanations

Auditors look for patterns, not perfection. A single missing deposit slip is a minor issue. Systematic gaps in reconciliation reports or missing client ledgers signal larger problems.

Common Recordkeeping Mistakes

These documentation failures create audit problems regardless of whether funds were properly handled:

Relying on bank statements alone. Bank statements prove what happened in the account. They don't prove what should have happened. Without client ledgers, you can't demonstrate that the $5,000 disbursed to John Smith was authorized by John Smith - not borrowed from another client.

Inconsistent reconciliation. Skipping months, then reconstructing records before an audit. Auditors recognize reconstructed documentation. Monthly reconciliation completed in real-time is the standard.

Undocumented authorizations. Verbal client approval for disbursements doesn't satisfy recordkeeping requirements. An email saying "yes, please send the check" is sufficient. Nothing in writing is not.

Orphaned deposits. Funds sitting in the trust account without clear client attribution. Every dollar must belong to an identified client or matter.

Destroyed records before retention period. Shredding files when a matter closes rather than when the retention period expires. These are different dates.

For a complete discussion of trust account compliance failures, see our guide on common IOLTA mistakes.

Make Your Records Audit-Ready

Recordkeeping isn't the interesting part of running a law practice. But it's the part that determines whether a bar audit becomes a routine verification or a months-long investigation.

If your trust account records need organization, cleanup, or systematic management, Accounting Atelier provides bookkeeping for law firms with complex IOLTA requirements. We implement documentation systems that keep you audit-ready without adding hours to your week.

Schedule a trust account review →

Frequently Asked Questions

-

Five to seven years after the matter closes or representation terminates, depending on your state. California requires 5 years; New York and Illinois require 7 years. When in doubt, retain for 7 years. Digital storage is cheap; reconstructing missing records is not.

-

Yes. Most states accept electronic records if they're complete, unaltered, and readily accessible. Scanned documents, PDF bank statements, and accounting software exports all qualify. Ensure you can print records on demand if requested.

-

Missing records create a presumption of impropriety. Auditors can't verify compliance they can't see. Depending on severity and pattern, consequences range from written warnings to trust account restrictions to formal discipline.

-

No. Check images (front and back) satisfy recordkeeping requirements. Most banks provide check images through online banking. Download and save them - banks typically only retain images for 7 years, and older images may become inaccessible.

-

Written authorization is required. Email approval is sufficient in most jurisdictions. Save the email with your disbursement records. For settlements, the signed settlement statement typically serves as authorization for the distribution.

-

The invoice or billing statement showing work performed, plus the fee agreement authorizing the transfer. Some firms also document the transfer with a memo noting the invoice number and amount moved to operating.

-

Monthly, at minimum. Complete your three-way reconciliation within 30 days of each statement period. Quarterly reconciliation doesn't satisfy most state bar requirements and creates dangerous gaps in oversight.

-

Yes. Maintain an individual ledger for each client or matter with funds in trust. The ledger must show every deposit and disbursement, with dates and running balances. Pooling client records into a single ledger defeats the purpose of trust accounting.