IOLTA Account Interest: Where It Goes and Why You Never See It

IOLTA account interest goes directly to your state's IOLTA program, which distributes the funds to legal aid organizations, pro bono programs, and access-to-justice initiatives. You never see this interest on your statements, your clients don't receive it, and your firm can't access it. The bank calculates interest on your pooled trust account balance and remits it automatically to the state program - that's the entire point of the "I" in IOLTA account.

This arrangement confuses attorneys who expect interest-bearing accounts to generate income for someone they know. In this case, the beneficiary is the legal system itself.

Why Attorneys Never See the Interest

Before IOLTA programs existed, client funds held in pooled trust accounts earned nothing. Federal banking regulations prohibited interest on demand deposit accounts until 1980, and even after that changed, attorneys couldn't ethically keep interest earned on client money. The funds sat idle.

IOLTA solved this by directing interest that would otherwise benefit no one toward funding civil legal services. The structure works because:

Individual client deposits are too small to earn meaningful interest. A $3,000 retainer held for 60 days generates pennies. The administrative cost of tracking and distributing that interest exceeds its value.

Pooled balances generate meaningful interest. Your $50,000 average trust account balance, combined with thousands of other attorneys' balances, creates millions in collective interest statewide.

Attorneys can't profit from client funds. Ethical rules prohibit you from benefiting financially from money that belongs to clients. IOLTA channels that interest toward public benefit instead.

Your bank statement shows deposits, disbursements, and fees - but no interest credits. The interest calculation happens behind the scenes, and the bank sends those earnings directly to your state IOLTA program monthly or quarterly.

How IOLTA Interest Is Calculated

Banks calculate IOLTA interest the same way they calculate interest on any account: average daily balance multiplied by the annual percentage yield, divided by 365, multiplied by days in the period.

Example: Your IOLTA account maintains a $75,000 average daily balance for March (31 days). The bank pays 0.60% APY on IOLTA accounts.

$75,000 × 0.0060 × (31 ÷ 365) = $38.22

That $38.22 goes to your state IOLTA program. You don't see it, report it, or account for it.

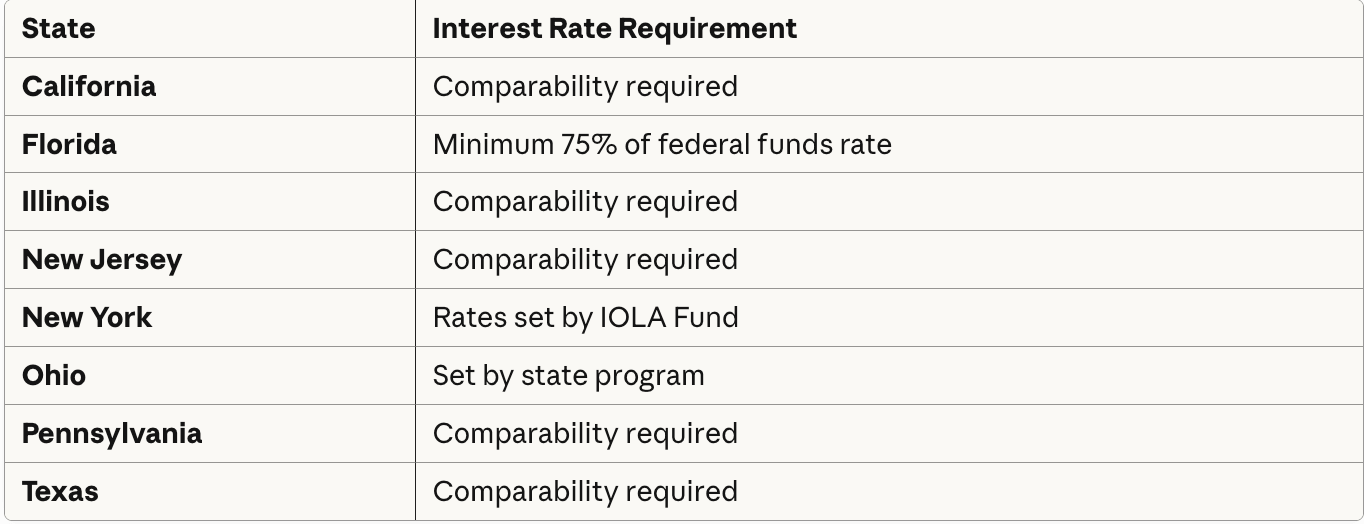

Interest rate requirements vary by state. Some states mandate "comparability" - banks must pay IOLTA accounts rates comparable to similar non-IOLTA accounts. Others set specific benchmarks.

Banks participating in IOLTA programs agree to these terms. The National Association of IOLTA Programs tracks state-specific requirements.

What IOLTA Programs Fund

IOLTA interest funds civil legal services for people who can't afford attorneys. Specific allocations vary by state, but common recipients include:

Legal Aid Organizations

Tenant defense in eviction proceedings

Domestic violence protective orders

Public benefits appeals

Consumer protection cases

Pro Bono Programs

Coordination of volunteer attorney services

Training for attorneys taking pro bono cases

Malpractice insurance for pro bono work

Access to Justice Initiatives

Self-help court programs

Legal information hotlines

Law school clinical programs

Judicial education

Administration of Justice

Court interpreter services

Lawyer referral programs

Bar foundation grants

The American Bar Association reports that IOLTA programs nationwide distribute over $175 million annually to these causes. Your compliant trust account contributes to that total.

How Much Interest IOLTA Programs Generate

IOLTA revenue fluctuates with interest rates. When rates drop, legal aid funding drops with it.

Historical context:

2007 (pre-recession): IOLTA programs generated approximately $371 million nationally

2013 (near-zero rates): Revenue dropped to approximately $94 million

2023 (rising rates): Revenue recovered to approximately $300+ million

Individual state programs publish annual reports showing collections and distributions. California's program distributed $148 million in fiscal year 2023. Texas distributed approximately $35 million. Smaller states generate less but fund proportionally significant local legal aid.

The practical implication: higher interest rate environments mean more funding for legal aid. Your trust account balance contributes whether rates are high or low - but the impact scales with the rate environment.

Does the Interest Rate Matter to Your Firm?

From a compliance perspective, no. You have no obligation to select a bank based on IOLTA interest rates, and the interest doesn't affect your IOLTA compliance obligations. Your three-way reconciliation requirements, IOLTA recordkeeping obligations, and exposure to IOLTA mistakes remain identical regardless of what rate your bank pays.

From a practical perspective, choose your IOLTA bank based on:

Fee structures

Online banking capabilities

Customer service for trust accounts

Branch accessibility

Interest rates are a tiebreaker, not a primary factor. That said, if you're choosing between two otherwise equal banks and one pays higher IOLTA rates, the higher-rate bank directs more funding toward legal aid at no cost to you.

Some attorneys feel a professional obligation to maximize IOLTA contributions. That's a reasonable position - legal aid programs depend on this funding, and selecting a higher-rate bank is a low-effort way to support access to justice.

Trust Accounting Without the Complexity

Interest is the one part of IOLTA that requires nothing from you - the bank handles everything automatically. The compliance obligations are elsewhere: recordkeeping, reconciliation, proper disbursement.

If your trust accounting needs attention, Accounting Atelier provides bookkeeping for law firms with IOLTA requirements. We handle the parts that actually matter for compliance so you can focus on practicing law.

Schedule a trust account review →

Frequently Asked Questions

-

No. IOLTA interest is not taxable income to you or your clients. The IRS ruled that because the interest goes to a tax-exempt charitable purpose (legal aid), it creates no tax liability for the attorney or client. You won't receive a 1099 for IOLTA interest.

-

No. Interest from your IOLTA account goes to your state's designated IOLTA program. You cannot direct it to specific legal aid organizations or causes. The state program makes distribution decisions.

-

Because the interest never credits to your account. The bank calculates interest internally and remits it directly to the state IOLTA program. From your perspective, the account behaves like a non-interest-bearing account - you see no interest line items.

-

Funds substantial enough to earn net interest for the client after administrative costs should go into an individual client trust account - not your IOLTA. That interest belongs to the client. The threshold varies, but generally amounts over $10,000 held for 60+ days warrant evaluation for individual trust treatment.

-

Not typically. IOLTA contributions are anonymous by design - your state program doesn't publicize which firms generate the most interest. Some state bars acknowledge IOLTA participation generally, but individual firm contributions aren't tracked or reported publicly.

-

It still goes to the IOLTA program, but the amounts are minimal. During near-zero rate environments (2009-2021), many legal aid organizations faced significant funding cuts. IOLTA revenue is inherently volatile because it tracks interest rate cycles.