Law Firm Cash Flow: Why Profitable Firms Run Short (And How to Fix It)

A family law firm we work with billed $147,000 in March. Their best month ever.

They couldn't make April payroll.

The problem wasn't profitability. Their margins were solid. The problem was timing. $89,000 of that March billing sat in accounts receivable. Another $31,000 sat in trust accounts waiting for client invoice approval. The cash they needed to pay salaries existed on paper but not in their bank account.

That's the law firm cash flow problem in one story: money goes out immediately, but it comes in slowly - and the gap can kill an otherwise healthy practice.

Cash Flow vs. Profitability: Why Profitable Firms Still Run Out of Cash

Profitability measures whether you're building wealth. Cash flow measures whether you can pay this week's bills.

A firm can be profitable and cash-poor. It happens constantly.

The timing mismatch creates the cash flow volatility most firms know too well. Big settlement hits, partners take draws, accounts feel flush. Then three slow collection months in a row and suddenly there's stress about making payroll.

Breaking this pattern requires understanding what actually drives law firm cash flow - and it's not just "bill faster, collect sooner."

The Law Firm Cash Flow Equation

Cash flow in a law firm follows this path:

Work Performed → Invoice Sent → Invoice Paid → Cash Available

Each arrow represents time. That time is called "lockup" - days when your revenue exists but isn't accessible.

Lockup: The Hidden Cash Flow Killer

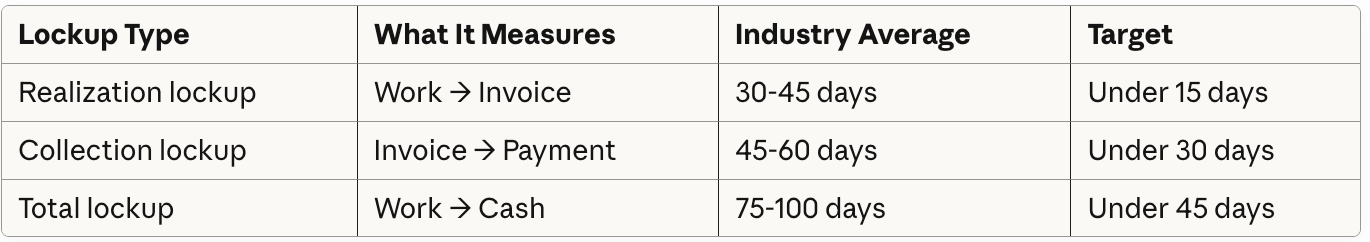

"Lockup" measures how many days your revenue sits unbilled or uncollected. It's the gap between earning money and having it.

Source: Clio Legal Trends Report

The cash flow impact:

At $50,000 monthly revenue with 90-day total lockup, you have $150,000 constantly tied up in work-in-progress and unpaid invoices. That's $150,000 you've earned but can't spend.

Reducing lockup to 45 days frees $75,000. That's not new revenue - it's revenue you already earned, now accessible.

Where lockup hides:

Attorneys holding time entries for "batch billing" at month-end

Invoices waiting for partner review before sending

Clients sitting on invoices with no follow-up

Disputed charges stopping payment on entire invoices

Settlement disbursements waiting for lien confirmations

Most firms don't know their lockup days. They should. It's the single most actionable cash flow metric.

The Trust Account Blind Spot

Here's what most cash flow articles miss entirely: trust accounting directly affects your operating cash - and most firms treat it as a compliance function rather than a cash flow lever.

How Trust Accounts Affect Cash Flow

Money in your IOLTA or client trust account isn't your money. You can't use it for operations. But the timing of moving earned fees from trust to operating directly affects your available cash.

The transfer timing problem:

Client pays $10,000 retainer → Deposited to trust

Attorney performs $3,000 of work → Still in trust

Invoice sent to client for approval → Still in trust

Client approves invoice → Now you can transfer

Transfer processed → Finally in operating

Every step has delay potential. Some firms leave earned fees sitting in trust for weeks because they don't have systems for timely transfer.

Trust Activity as Cash Flow Early Warning

Beyond transfer timing, trust account behavior predicts cash flow problems before they hit your operating account.

Retainer depletion rates signal future cash needs. If clients are burning through retainers faster than expected, either:

You're underpricing (you'll need more retainers or face AR growth)

Matters are expanding beyond scope (you'll face write-offs or collection issues)

Work is accelerating (you'll need staff capacity and cash to support it)

Any of these affects future cash flow. Trust data shows it first.

Replenishment patterns predict collection risk. Clients who consistently let retainers deplete without replenishing often become collection problems when matters continue beyond trust funds. The pattern is visible in trust records months before it shows up in AR aging.

Trust balance trends reveal practice health. Rising aggregate trust balances indicate strong new matter intake. Falling balances without corresponding operating deposits suggest work completion without proper billing - a realization problem that will compress cash flow.

This is exactly why our Legal Ledger Protocol™ integrates trust accounting into cash flow management. The same data supporting three-way reconciliation also powers cash flow forecasting - but only if you're looking at it that way.

Cash Reserve Targets: How Much Buffer Do You Need?

Cash reserves are your protection against timing mismatches and unexpected expenses. Without adequate reserves, one slow collection month creates a crisis.

The Benchmark

Industry guidance suggests law firms maintain cash reserves of 10-30% of annual revenue.

What the percentages mean:

For a firm billing $600,000 annually:

10% reserve = $60,000

20% reserve = $120,000

30% reserve = $180,000

Days of Operating Expenses

Another way to frame reserves: how many days can you operate without new cash coming in?

Calculate your daily operating expense: Total annual operating expenses ÷ 365 = Daily burn rate

Target: 60-90 days of operating expenses in reserve

A firm with $400,000 annual operating expenses has a daily burn rate of approximately $1,100. A 90-day reserve means $99,000 in accessible cash.

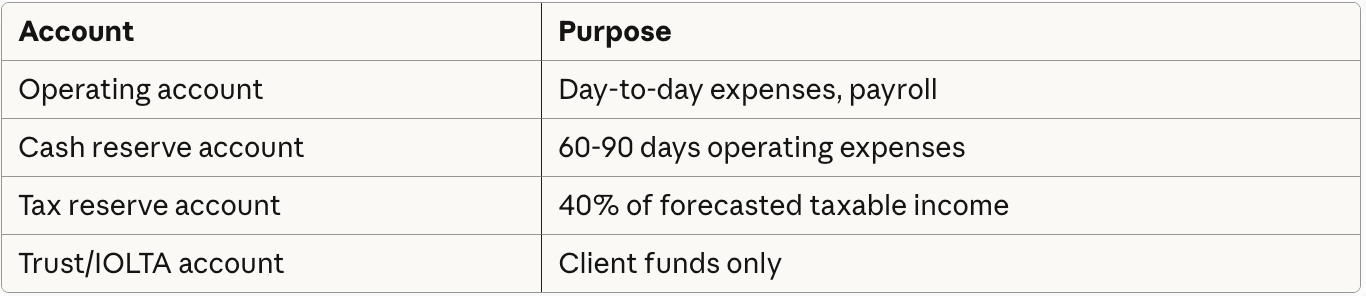

Reserve Account Structure

Don't keep reserves in your operating account. They'll get spent.

Recommended structure:

Separating reserves prevents the "we have plenty of cash" illusion that comes from seeing combined balances. When reserves are in a separate account, you see your true operating position.

The Seven Cash Flow Drains (And How to Fix Them)

Cash flow problems trace to predictable sources. Here's where firms typically lose cash velocity.

1. Slow Time Entry

The problem: Attorneys batch time entries weekly or at month-end. Work performed on the 1st doesn't get recorded until the 30th.

The cash impact: Adds 15-30 days to realization lockup before the billing cycle even starts.

The fix: Daily time entry, enforced. Modern practice management makes this trivial. Every day that passes between work and time entry is a day of unnecessary lockup.

2. Delayed Invoice Approval

The problem: Invoices sit in a partner queue waiting for review and approval before sending to clients.

The cash impact: Common delay of 5-15 days between invoice generation and delivery.

The fix: Set invoice review deadlines. If invoices aren't reviewed within 48 hours, they go out as generated. Perfect is the enemy of paid.

3. No Follow-Up System

The problem: Invoices go out and then... silence. No reminder at 30 days. No call at 45 days. Maybe a statement at 60 days if someone remembers.

The cash impact: Collection lockup extends indefinitely for clients who simply need a reminder.

The fix: Systematic follow-up at 30, 45, 60 days. Automated reminders for the first two touchpoints. Personal contact for anything past 60. Track AR aging weekly, not monthly.

4. Payment Friction

The problem: Firm only accepts checks. Or only accepts credit cards for certain amounts. Or makes clients log into a portal they can't remember.

The cash impact: Every friction point delays payment. Research shows firms accepting online payments get paid 39% faster.

The fix: Accept every reasonable payment method. Credit cards, ACH, online payment links. Yes, there are processing fees. They're cheaper than carrying receivables.

5. Trust Transfer Delays

The problem: Earned fees sit in trust accounts because no one has processed the transfer to operating.

The cash impact: Money you've earned isn't available for operations. In some firms, thousands sit in trust for weeks after being earned.

The fix: Process trust-to-operating transfers weekly. Match transfers to specific invoiced work. Make it a calendar item, not an "I'll get to it" task.

6. Evergreen Retainer Neglect

The problem: Client retainers deplete. No one notices until the retainer is exhausted. Work continues anyway. Now you're carrying AR instead of prepaid retainer.

The cash impact: Shifts from cash-positive (prepaid retainer) to cash-negative (AR collection required).

The fix: Monitor retainer balances weekly. Set replenishment triggers at 50% depletion. Pause non-urgent work if retainers aren't replenished. The conversation is easier at 50% than at 0%.

7. Partner Distributions Exceeding Cash Reality

The problem: Partners take distributions based on profitability without regard to actual cash position. "We made $200K profit" becomes "We can each take $100K" even when only $80K is in the bank.

The cash impact: Operating account gets drained. Reserves get invaded. Next month starts in a hole.

The fix: Base distributions on actual cash available after reserves, not on paper profit. Build distribution timing around collection cycles, not calendar quarters.

Cash Flow Forecasting: Seeing Problems Before They Hit

The difference between cash flow management and cash flow crisis is forecast visibility. If you see the problem three months out, you have options. If you see it next week, you're scrambling.

The 13-Week Cash Flow Forecast

A rolling 13-week forecast gives you quarterly visibility with weekly granularity. It shows exactly when cash crunches will hit.

Weekly inputs:

What to watch for:

Any week where ending balance drops below reserve target

Trend direction - are balances growing, shrinking, or stable?

Concentration risk - is one big collection making or breaking the quarter?

Seasonal Patterns

Most practice areas have predictable slow periods:

Your firm has patterns too. Look at the last three years of monthly collections. Where are the consistent dips? Build those into your forecast and your reserve targets.

Building Cash Flow Into Matter Pricing

Pricing decisions affect cash flow. A matter priced at hourly with 60-day payment terms has fundamentally different cash characteristics than a flat-fee matter with 50% upfront.

Cash-positive pricing elements:

Retainers sufficient to cover first phase of work

Retainer replenishment requirements before work continues

Flat fees with significant upfront component

Evergreen retainer structures

Cash-negative pricing elements:

Pure contingency (100% cash invested until resolution)

Hourly billing with no retainer requirement

Extended payment terms (net 60, net 90)

Discounted rates in exchange for volume (reduces cash per hour worked)

Neither approach is wrong. But if your practice mix is heavily cash-negative, your reserve requirements are higher and your cash flow forecasting becomes more critical.

Cash Flow Emergency Playbook

Despite best planning, cash crunches happen. Here's the priority sequence when they do.

Immediate Actions (1-7 Days)

Accelerate collections — Call every receivable over 30 days personally. Offer payment plans. Accept partial payments. Cash today beats full payment maybe.

Process all pending trust transfers — Audit trust accounts for earned fees not yet transferred. This is often where "hidden" cash lives.

Delay discretionary spending — Pause any non-essential purchases. Renegotiate payment timing with vendors where possible.

Communicate with partners — If distributions need to be delayed, say so immediately. Surprises destroy trust.

Short-Term Actions (1-4 Weeks)

Establish or draw on credit line — A line of credit you don't need is cheap insurance. A line of credit you need urgently is expensive or unavailable.

Review upcoming expenses — What can be delayed without damaging operations? What contracts can be renegotiated?

Accelerate billing cycles — If you bill monthly, bill weekly until cash stabilizes. Get invoices out faster.

Structural Actions (1-3 Months)

Analyze how you got here — Was it a collection problem? A matter mix problem? A pricing problem? An expense problem? The answer determines the structural fix.

Adjust reserve targets — If reserves were inadequate, increase the target and build a plan to reach it.

Implement forecasting — If you didn't see this coming, your visibility was insufficient. Build the forecast system.

Building Cash Flow Infrastructure

Most cash flow problems persist because firms lack systems to see them coming. Proper bookkeeping infrastructure makes the difference.

What Your Systems Should Track

Practice management system:

Time entries by date worked (not date entered)

Invoice status and aging

Trust account balances by client

Matter profitability and realization rates

Accounting system:

AR aging by client and invoice

Operating cash position

Reserve account balances

Expense categorization for forecasting

Integration between them:

Trust-to-operating transfers matched to invoices

Collection data feeding back to matter records

Cash position visible alongside profitability

Without this infrastructure, you're extracting data manually - which means you're probably not doing it consistently. The investment in systems pays for itself in visibility alone.

The Weekly Cash Flow Review

Make cash flow review a weekly discipline, not a monthly surprise.

Weekly review checklist:

Current operating account balance

Reserve account balance vs. target

AR aging review (anything new over 30 days?)

Trust account review (earned fees pending transfer?)

13-week forecast update

Collections projected vs. actual

Upcoming large expenses

Takes 30 minutes. Prevents most cash crunches.

The Trust-Operating Integration Advantage

Here's the insight that separates firms with cash flow problems from firms with cash flow clarity: trust accounting and cash flow management should be unified, not separate functions.

When you treat trust compliance as a standalone task - quarterly reconciliation, audit prep, bar requirement - you miss the cash flow intelligence sitting in that data.

When you integrate trust accounting into your financial management:

Retainer depletion becomes a forecasting input

Trust-to-operating timing becomes a cash flow lever

Client payment patterns become visible months earlier

Three-way reconciliation serves both compliance AND operations

This integration is exactly what the Legal Ledger Protocol™ provides. Same data, dual purpose. Compliance and cash flow visibility from one system.

Frequently Asked Questions

-

Target 10-30% of annual revenue depending on your practice. Firms with shorter cash cycles (hourly billing, strong collections) can target 10-15%. Contingency-heavy practices with longer case cycles should target 20-30%. Alternatively, maintain 60-90 days of operating expenses as a reserve buffer.

-

Lockup measures days between performing work and receiving payment. Calculate realization lockup (work to invoice) and collection lockup (invoice to payment) separately. Add them for total lockup. Industry average is 75-100 days total. Well-managed firms achieve under 45 days.

-

Profitability and cash flow operate on different timelines. You can be profitable on paper while cash is locked in unbilled work-in-progress and unpaid invoices. High lockup days, inadequate reserves, or distributions exceeding actual cash availability all create the profitable-but-cash-poor situation.

-

Weekly. Monthly reviews catch problems too late. Weekly reviews of operating balance, reserve status, AR aging, and 13-week forecast projections prevent most cash crunches. The review takes 30 minutes and provides essential visibility.

-

Trust accounts hold client funds you haven't yet earned. Delays in transferring earned fees from trust to operating directly reduce available cash. Retainer depletion patterns predict future collection challenges. Integrating trust accounting with cash flow management provides earlier visibility into cash position.

-

Reduce lockup. Daily time entry, 48-hour invoice approval, systematic follow-up at 30/45/60 days, and accepting online payments can collectively reduce total lockup by 30-50 days. On $50,000 monthly revenue, reducing lockup from 90 to 45 days frees $75,000 in previously locked capital.

-

Base distribution timing on cash flow patterns, not calendar convention. Quarterly distributions aligned with collection cycles are often more sustainable than monthly draws. Always distribute based on actual cash available after reserves - not paper profitability.

-

Common causes include slow time entry (adding days to billing cycles), delayed invoice approval, lack of collection follow-up, payment friction, trust transfer delays, depleting retainers without replenishment, and partner distributions exceeding actual cash. Most are process problems with process solutions.