Law Firm Growth: 6 Metrics That Show If You're Actually Growing (Or Just Getting Busier)

Updated November 2025

Your revenue is up. Your calendar is full. Your team is busy.

But is your law firm actually growing - or just getting busier?

Most attorneys searching for law firm growth strategies find generic advice: "get more clients" or "hire associates." That's not a strategy. That's a wish.

For most firms, the answer is more complicated than it looks. Revenue increases while profit stays flat. Headcount grows while efficiency drops. The firm gets busier but the owners don't see proportional returns.

That's not growth. That's expensive busy work.

Real law firm growth means profit and efficiency improve - not just billing. This guide covers the metrics that reveal whether your firm is genuinely growing, the mistakes that keep firms stuck, and what to focus on based on your stage and structure.

What Stage of Growth Is Your Firm In?

Before diving into metrics, identify where you are. Each stage has different priorities.

Stage 1: Survival (Year 1-2)

Focus: Getting clients, covering overhead, building reputation

Key question: Can I pay myself and keep the lights on?

Priority metrics: Cash runway, client acquisition, revenue consistency

At this stage, growth means reaching stability - not scaling. Don't hire. Don't expand. Focus on systems and sustainable client flow.

Stage 2: Stability (Year 2-4)

Focus: Consistent revenue, basic systems, improving margins

Key question: Am I profitable enough to reinvest in the business?

Priority metrics: Profit margin, realization rate, client profitability

At this stage, growth means improving efficiency. You have clients - now make sure they're profitable and your operations can handle more without breaking.

Stage 3: Scale (Year 4+)

Focus: Hiring, delegation, leverage, market position

Key question: Can I grow revenue without proportionally growing my time?

Priority metrics: Revenue per attorney, client acquisition cost vs. lifetime value, revenue concentration

At this stage, growth means building leverage. Your time shouldn't scale linearly with revenue. Systems, team, and client selection become critical.

For a complete overview of financial management for legal practices, see our guide to accounting for law firms.

The Math of Real vs. Fake Growth

Here's why revenue alone is meaningless:

Firm A:

Revenue: $800K → $1M (25% increase)

Expenses: $600K → $850K

Profit: $200K → $150K

Revenue grew 25%. Profit dropped 25%. That's not growth - that's a more expensive way to make less money.

Firm B:

Revenue: $600K → $700K (17% increase)

Expenses: $400K → $420K

Profit: $200K → $280K (40% increase)

Revenue grew 17%. Profit grew 40%. That's real growth - doing more with less friction.

The difference? Firm B focused on efficiency and margins, not just revenue. Firm A just got busier.

The 6 Metrics That Reveal Real Law Firm Growth

These metrics work alongside your law firm KPIs to give you a complete picture of firm health. Track these monthly. They'll tell you what your bank balance won't.

1. Profit Margin

What it measures: What percentage of revenue you actually keep after expenses.

Formula: (Revenue - Expenses) / Revenue

What healthy looks like:

Solo practitioners: 40-60%

Small firms (2-5 attorneys): 30-45%

Red flag: Margin shrinking while revenue grows. This means you're scaling inefficiently - adding cost faster than value.

What to do: Review your P&L monthly. If margin drops two months in a row, investigate before it becomes a trend. Common culprits: bloated overhead, poor client selection, underpriced services.

For the complete breakdown of margins and other key numbers, see law firm financial metrics.

2. Revenue Per Attorney

What it measures: How much revenue each attorney (including you) generates.

Formula: Total Revenue / Number of Attorneys

What healthy looks like:

Solo: $250K-500K+ depending on practice area

Small firm: $300K-600K per attorney

Red flag: Revenue per attorney declining as you add attorneys. This means new hires aren't pulling their weight - or your systems can't support them.

What to do: Calculate this quarterly. If it drops when you hire, diagnose why: training issues, bad hire, inadequate systems, or unrealistic expectations. Don't add attorneys until this stabilizes.

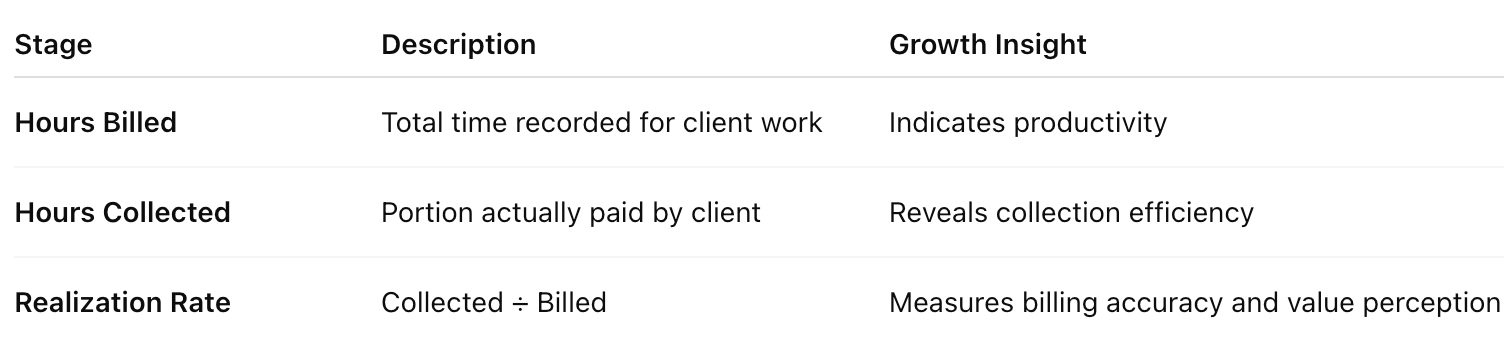

3. Realization Rate

What it measures: What percentage of billed time you actually collect.

Formula: Collected Revenue / Billed Revenue

What healthy looks like: 85-95%

Red flag: Below 80%, or declining over time. This means you're either billing for work clients won't pay for, or your collection process is broken.

What to do: Track this by client and matter type. Low realization often comes from scope creep, poor client communication, or bad-fit clients. Fix the intake process, not just the collection process.

See law firm financial metrics for more on calculating and improving realization rate.

4. Client Acquisition Cost vs. Lifetime Value

What it measures: Whether your marketing and business development spend makes sense.

Formulas:

Client Acquisition Cost (CAC) = Marketing Spend / New Clients Acquired

Lifetime Value (LTV) = Average Revenue Per Client × Average Retention Period

What healthy looks like: LTV should be at least 3x CAC. If you spend $500 to acquire a client, they should generate at least $1,500 over the relationship.

Red flag: CAC rising while LTV stays flat. This means you're spending more to acquire clients who aren't worth more.

What to do: Track by referral source. Some channels (referrals, SEO) have low CAC. Others (paid ads) have high CAC. Make sure high-CAC channels deliver high-LTV clients. If not, reallocate.

5. Revenue Concentration

What it measures: How dependent you are on a small number of clients.

Formula: Revenue from Top 3 Clients / Total Revenue

What healthy looks like: No single client over 15-20% of revenue. Top 3 clients under 40% combined.

Red flag: One client represents 30%+ of revenue. If they leave, your firm is in crisis.

What to do: Calculate quarterly. If concentration is too high, prioritize diversifying your client base before you "need" to. This is a vulnerability, not a success metric.

6. Cash Runway Trend

What it measures: How many months you can operate on current cash reserves—and whether that number is growing or shrinking.

Formula: Cash on Hand / Average Monthly Expenses

What healthy looks like: 3-6 months of runway, trending stable or upward.

Red flag: Runway shrinking while revenue grows. This signals cash flow problems: slow collections, poor timing of expenses, or overinvestment in growth before the revenue catches up.

What to do: Track monthly. If runway drops below 3 months or declines three months in a row, stop investing in growth and fix the cash flow gap first.

For a complete breakdown of the reports your firm needs, see law firm financial reports - the foundation of financial visibility.

Growth Metrics by Practice Type

Solo Practitioners

Focus on these three:

Profit margin (are you keeping what you earn?)

Realization rate (are you collecting what you bill?)

Cash runway (can you weather slow months?)

Common growth mistakes:

Hiring before you have systems (leads to chaos, not leverage)

Taking any client who calls (kills margins and time)

Ignoring realization rate (you're busier but not richer)

Growth priority: Improve efficiency and selectivity before adding capacity.

Small Firms (2-10 Attorneys)

Focus on these three:

Revenue per attorney (is each hire producing?)

Client acquisition cost vs. lifetime value (is marketing ROI positive?)

Revenue concentration (are you vulnerable to client loss?)

Common growth mistakes:

Hiring to handle overflow without fixing systems first

Measuring success by headcount instead of profit per head

Ignoring client profitability (some clients cost you money)

Growth priority: Build leverage - systems, delegation, and client selection that let you grow without proportionally growing your hours.

The 5 Law Firm Growth Mistakes That Keep Firms Stuck

1. Chasing Revenue Instead of Profit

More revenue with more expenses isn't growth. You can double revenue and make less money. Always ask: what's the margin on this growth?

2. Taking Every Client Who Calls

Not all clients are profitable. Some consume disproportionate time, pay slowly, and refer similar bad-fit clients. Selectivity is a growth strategy.

3. Hiring Before Systems Are Ready

Adding staff to a broken system makes it break faster. Build the systems first - intake, billing, delegation, communication - then add people.

4. Ignoring Realization Rate

High billings with low collection is a vanity metric. If you're not collecting 85%+, fix that before trying to bill more.

5. No Financial Visibility

You can't improve what you don't measure. Firms without monthly financial reports are guessing. Guessing doesn't scale.

What Real Law Firm Growth Looks Like

Real growth is:

Profit margin stable or increasing as revenue grows

Revenue per attorney stable or increasing as you add people

Cash runway growing, not shrinking

Client base diversified, not concentrated

You working on the practice, not just in it

Real growth feels like control, not chaos. It feels like options, not obligations.

If your firm is getting busier but not better, the problem isn't effort. It's focus. You're measuring the wrong things and optimizing for activity instead of outcomes.

Want to sharpen your firm’s financial control and compliance strategy? Read our Law Firm Bookkeeping in 2025: The 3 Financial Reports Every Managing Partner Needs.

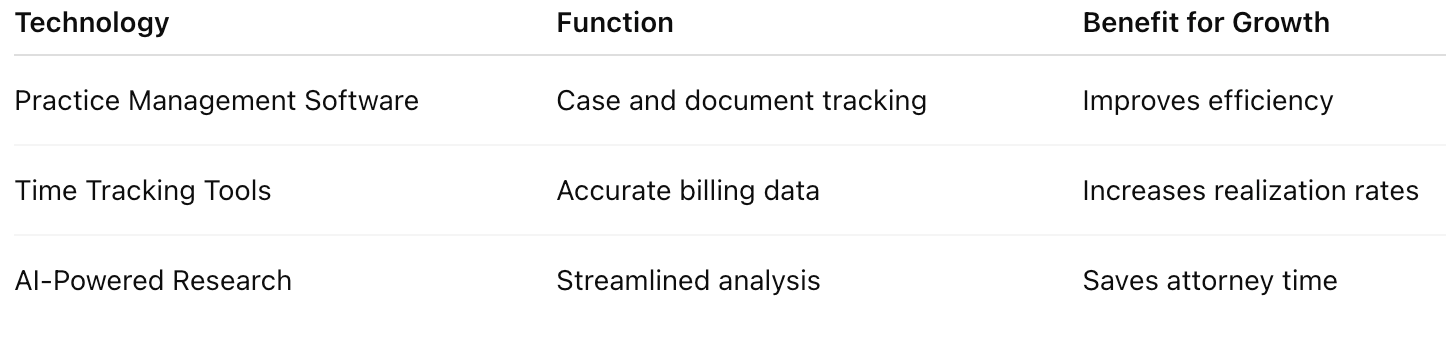

Building Systems That Support Growth

Growth without systems creates chaos. Before scaling, make sure you have:

Financial systems (see our complete guide to bookkeeping for law firms):

Monthly P&L and balance sheet (delivered by the 10th)

IOLTA account reconciliation (monthly three-way)

AR aging review (weekly)

Cash flow projection (90 days out)

Operational systems:

Documented intake process

Clear billing and collection workflows

Delegation protocols for support staff

Client communication standards

Strategic systems:

Quarterly review of key metrics

Annual planning with specific targets

Regular assessment of client profitability

For more on what your financial reports should show, see law firm financial reports.

Take Control of Your Law Firm's Growth

Growth isn't about working harder. It's about working on the right things - and measuring whether they're working.

If you don't have visibility into these metrics, you're guessing. And guessing doesn't scale.

We help law firms build the financial systems that support real growth: monthly reporting, IOLTA compliance, and the metrics that show you what's actually happening in your practice.

Frequently Asked Questions

-

Profit margin. Revenue means nothing if you're not keeping enough of it. A firm with $500K revenue and 50% margin is healthier than a firm with $1M revenue and 15% margin. Start with margin, then optimize the other metrics.

-

Sustainable growth is usually 15-25% annually for small firms. Faster than that often creates operational strain - hiring too fast, cash flow gaps, quality issues. Grow at the pace your systems can support.

-

When you have consistent overflow work (not just a busy month), documented systems they can follow, enough margin to absorb training time, and at least 3 months of cash runway. Hiring into chaos doesn't solve the chaos.

-

Probably because expenses grew as fast or faster than revenue. Check your profit margin trend in your law firm financial reports. If margin is flat or declining while revenue grows, you're scaling inefficiently. You need to either cut costs or increase prices - or both.

-

Track time spent (not just billed), collection rate, communication overhead, and referral quality. Some clients pay their bills but consume so much time and energy that they're not worth it. If a client consistently stresses your team or pays slowly, they might be costing you money even if the invoice gets paid.