Accounting for Law Firms: The Monthly Financial Playbook Every Firm Needs

Law firm accounting is the specialized financial management system that legal practices use to handle client funds, trust accounts, billing, and firm operations while maintaining compliance with state bar rules and IOLTA regulations. Unlike general business accounting, it requires strict separation of client and firm money, matter-level tracking of every transaction, and adherence to ethical standards that carry the risk of disbarment for violations.

The monthly financial operations of a law firm demand systems built specifically for accounting for law firms - systems that address legal trust compliance, matter-level tracking, and the revenue timing unique to legal work.

This playbook outlines the monthly financial workflow that high-performing law firms use to maintain compliance, preserve profitability, and scale confidently. These practices separate firms with defensible books from those facing audit surprises, trust accounting violations, or profitability blind spots that erode financial performance.

Beyond daily bookkeeping, law firm financial reports provide the visibility managing partners need to make informed decisions about hiring, compensation, practice area investment, and firm growth.

What Makes Law Firm Accounting Different

Law firm accounting differs from traditional business accounting in structure, compliance requirements, and risk profile. The handling of client funds through trust accounts, ethical obligations around money management, and matter-specific tracking create responsibilities that don't exist in conventional accounting.

Core complexities in legal accounting:

Trust accounts holding client funds that must remain segregated from firm operating money

IOLTA compliance with state-specific rules governing interest on lawyer trust accounts

Matter-level tracking for every financial transaction, cost, and time entry

Legal billing systems that track time, costs, and fee arrangements by client and matter

Retainer management and proper movement of funds from trust to operating accounts

Fee timing and determining when advances can be recognized as earned revenue

Client cost advances tracked separately from firm overhead to prevent commingling personal and business expenses

Three-way reconciliation requirements unique to trust accounts

Negative client balance monitoring to prevent ethics violations

Revenue recognition rules that differ from generally accepted accounting principles

Critical Definitions

Trust Account (IOLTA Account)

A segregated bank account holding client funds, advance retainers, settlements, and money belonging to clients rather than the firm. Trust accounts cannot be commingled with firm operating funds. Every dollar must be tracked at the client and matter level. IOLTA (Interest on Lawyers Trust Accounts) rules govern how interest earned on pooled client funds is handled.

Operating Account

The firm's business checking account used for payroll, overhead expenses, and earned revenue. Money moves from trust to operating only after fees are earned and properly invoiced to clients.

Three-Way Reconciliation (IOLTA 3-Way Reconciliation)

The monthly process of matching three separate records: (1) bank trust account balance, (2) sum of individual client ledger balances, and (3) general ledger trust liability account. All three must reconcile to the penny. This is the primary control preventing trust account violations.

Matter Ledger

A subsidiary ledger tracking all financial activity for a specific client matter—retainers received, costs advanced, time entries, invoices generated, payments applied. Matter ledgers provide the detail behind trust account balances and enable matter-level reporting.

Client Cost Advances

Money the firm pays on behalf of clients for filing fees, expert witnesses, court reporters, or case-related expenses. These costs must be tracked separately from firm overhead, allocated to specific matters, and either reimbursed from client funds or billed appropriately.

Legal Billing Systems

Specialized software designed for law firms that integrates time tracking, expense tracking, trust accounting, invoicing, and matter management. Examples include Clio, MyCase, PracticePanther, and Bill4Time. These systems connect to accounting software like QuickBooks Online to maintain synchronized financial records.

Matter-Level Reporting

Financial reports showing profitability, costs, time invested, and realization rates broken down by individual client matter rather than only firm-wide totals. This reporting reveals which practice areas, clients, and case types generate the best returns.

The Monthly Financial Workflow for Law Firms

Law firms require a structured monthly close process that addresses both standard accounting and legal-specific compliance. This workflow maintains legal trust compliance while providing leadership with decision-making data.

Step 1 — Reconcile All Bank and Credit Card Accounts

Timeline: Complete by day 5 of the following month

Monthly reconciliation matches every bank and credit card statement to the general ledger. For law firms, this includes operating accounts, trust accounts, and credit cards used for both firm expenses and client cost advances.

Bank reconciliation workflow:

Download bank statements for all accounts

Match cleared transactions to general ledger entries

Investigate and resolve discrepancies

Identify outstanding checks and deposits in transit

Verify bank balance matches adjusted book balance

Credit card reconciliation workflow:

Match credit card transactions to expense entries

Categorize charges as firm overhead or client costs

Allocate client costs to specific matters

Flag personal charges on firm cards for immediate reclassification

Verify statement balance matches general ledger

Trust account reconciliation adds a critical layer: Beyond matching the bank statement, trust reconciliation verifies that the sum of all individual client ledger balances equals the bank balance and the general ledger trust liability account.

Step 2 — Perform Full IOLTA 3-Way Reconciliation

Timeline: Complete by day 7 of the following month

Compliance requirement: Monthly minimum (weekly recommended for high-volume firms)

Trust accounting for law firms demands monthly verification that client funds remain properly segregated and tracked. This is the highest-risk area in law firm accounting - errors here trigger ethics complaints and bar audits.

IOLTA 3-way reconciliation workflow:

Match bank to client ledgers

Export trust bank statement ending balance

Run client trust ledger report showing all individual client balances

Sum all client ledger balances

Verify sum equals bank balance exactly

Match client ledgers to general ledger

Run general ledger report for trust liability account

Verify GL trust liability balance equals sum of client ledgers

Investigate any variance immediately

Review individual client balances

Identify negative client balances (immediate red flag)

Flag stale retainers with no recent activity

Verify client balances reconcile to open matters

Review trust transfers for proper documentation

Trust accounting triggers requiring immediate action:

Any negative client balance

Trust bank balance doesn't match client ledger sum

Client ledger sum doesn't match GL trust liability

Unexplained trust transfers

Trust payments without corresponding invoices

Client refund checks uncashed for 60+ days

Retainers held for closed matters

State bar associations audit trust accounts aggressively. Monthly IOLTA 3-way reconciliation catches issues before they become reportable violations.

Step 3 — Review Work-in-Progress and Accounts Receivable

Timeline: Complete by day 10 of the following month

Legal work creates value before invoices are generated. Work-in-progress (WIP) represents unbilled time and costs that will eventually convert to revenue - or get written off if not managed properly.

WIP review workflow:

Run WIP aging report by matter

Identify matters with 60+ days of unbilled time

Flag matters exceeding budget expectations

Review for time entries requiring write-down decisions

Prioritize matters ready for billing

AR aging workflow:

Run accounts receivable aging report

Review invoices 30+ days outstanding

Identify clients with payment pattern issues

Flag matters requiring collection action

Calculate days sales outstanding (DSO)

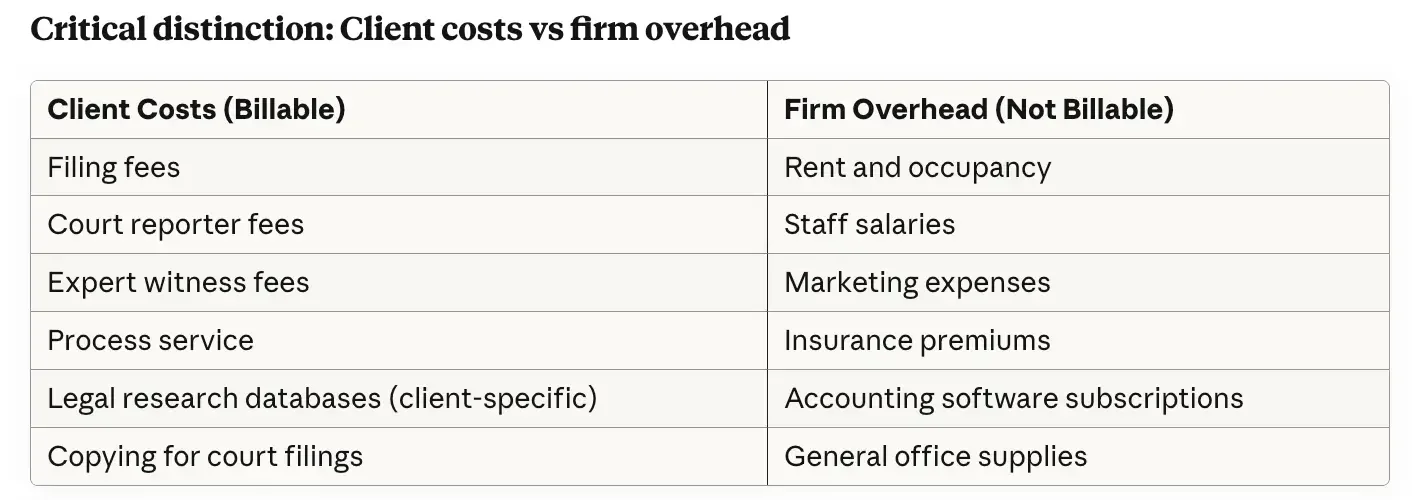

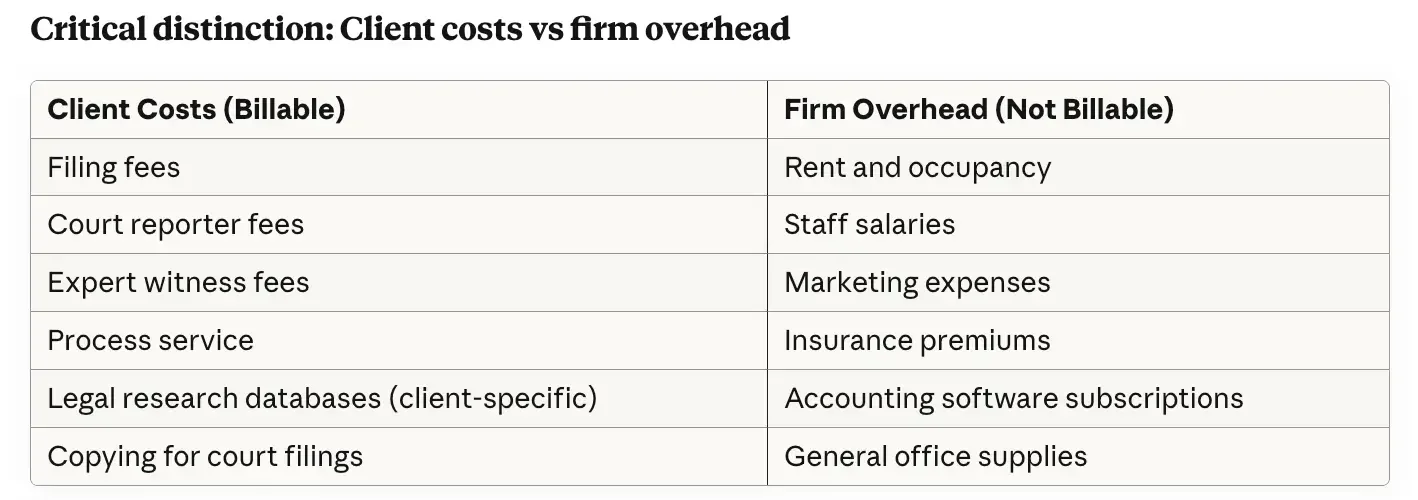

Step 4 — Categorize Expenses and Allocate Client Costs

Timeline: Complete by day 8 of the following month

Expense categorization affects financial reporting accuracy, tax planning, and ethical compliance. Client-billable costs require different treatment than firm overhead.

Expense categorization workflow:

Review all unclassified transactions

Separate client costs from firm overhead

Allocate client costs to specific matters

Verify vendor payments match accounts payable

Reconcile credit card charges to expense categories

Critical distinction: Client costs vs firm overhead

Misallocating expenses creates financial reporting errors and potential ethics issues if clients are billed for costs they shouldn't bear.

Step 5 — Generate and Review Monthly Financial Statements

Timeline: Deliver by day 12-15 of the following month

Financial statements translate accounting data into decision-making information. Law firms need four core reports monthly plus trust-specific reporting.

Required monthly financial statements:

1. Profit and Loss Statement (Income Statement)

Revenue by practice area and attorney

Expenses by category

Net income and profit margins

Comparison to prior month and year-to-date

2. Balance Sheet

Assets (cash, AR, WIP, fixed assets)

Liabilities (AP, trust liability, loans, credit cards)

Equity (retained earnings, partner capital)

Trust liability must match trust bank account exactly

3. Cash Flow Statement

Operating activities (revenue and expenses)

Investing activities (equipment purchases, investments)

Financing activities (loan payments, partner distributions)

Net change in cash position

4. Trust Liability Report

Individual client balances in trust account

Must reconcile to trust bank balance and GL trust liability

Sorted by matter with aging information

5. Matter Profitability Report

Revenue and costs by individual matter

Time invested vs revenue generated

Realization rates by matter type

Identifies profitable practice areas and clients

Each of these reports serves a distinct purpose in firm management. For detailed guidance on how to read and interpret your monthly law firm financial statements, including which metrics to track in each report, see our complete financial reporting guide.

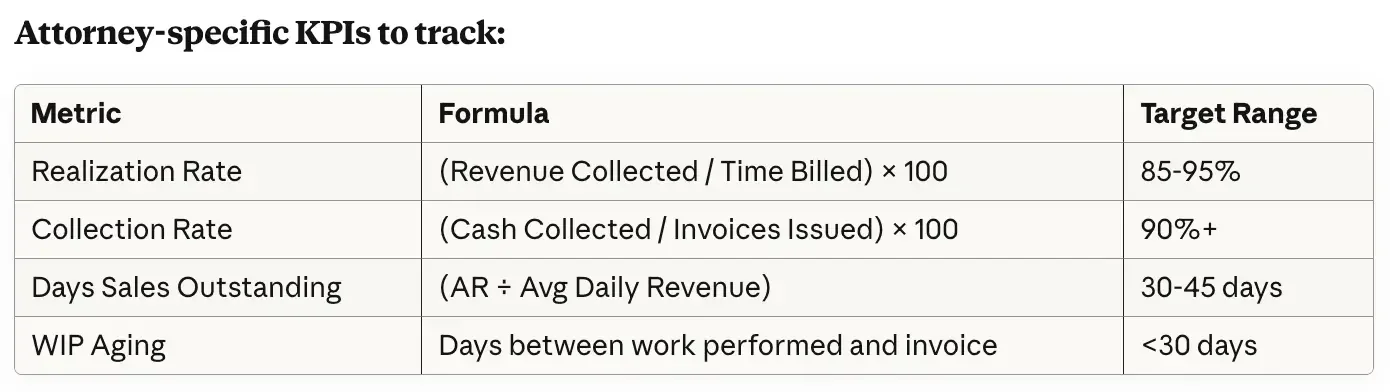

Step 6 — Calculate and Monitor Law Firm Financial Metrics

Timeline: Complete by day 15 of the following month

Financial statements show what happened. Metrics reveal whether results indicate health or risk. Law firms benefit from tracking operational metrics that measure financial performance beyond standard business indicators.

Critical law firm financial metrics:

Step 7 — Document Compliance Checkpoints

Timeline: Complete monthly as part of close process

Law firm accounting includes compliance documentation that protects against audits and ethics complaints.

Monthly compliance checklist:

[ ] Three-way trust reconciliation completed and documented

[ ] No negative client balances in trust account

[ ] All trust transfers supported by client invoices

[ ] Client cost advances properly allocated to matters

[ ] Personal and business expenses properly separated

[ ] Credit card reconciliations completed

[ ] Bank reconciliations signed off by partner

[ ] Financial statements reviewed by managing partner

[ ] Trust liability report matches bank and GL exactly

[ ] Matter ledgers updated with all transactions

Monthly vs Quarterly Financial Responsibilities

Law firms benefit from understanding which financial tasks require monthly attention versus quarterly review.

Monthly Responsibilities

Bookkeeping tasks (complete every month):

Bank and credit card reconciliations

IOLTA 3-way trust reconciliation

Expense categorization and client cost allocation

AR aging review and collection follow-up

WIP aging review and billing prioritization

Financial statement generation

Matter ledger maintenance

Compliance checkpoint documentation

Attorney review tasks (monthly minimum):

Financial statement review

Key metrics monitoring

Trust liability report verification

Collection priority decisions

Write-off approvals

Matter profitability analysis

Quarterly Responsibilities

Strategic financial review (every quarter):

Comprehensive KPI analysis and trending

Practice area profitability deep dive

Pricing and rate card adjustments

Partner compensation review

Cash flow projections for next quarter

Budget vs actual variance analysis

Tax planning check-in with CPA

Compliance review (quarterly minimum):

Trust account procedures audit

Internal controls assessment

Legal billing system optimization review

Chart of accounts cleanup

Vendor and contractor relationship review

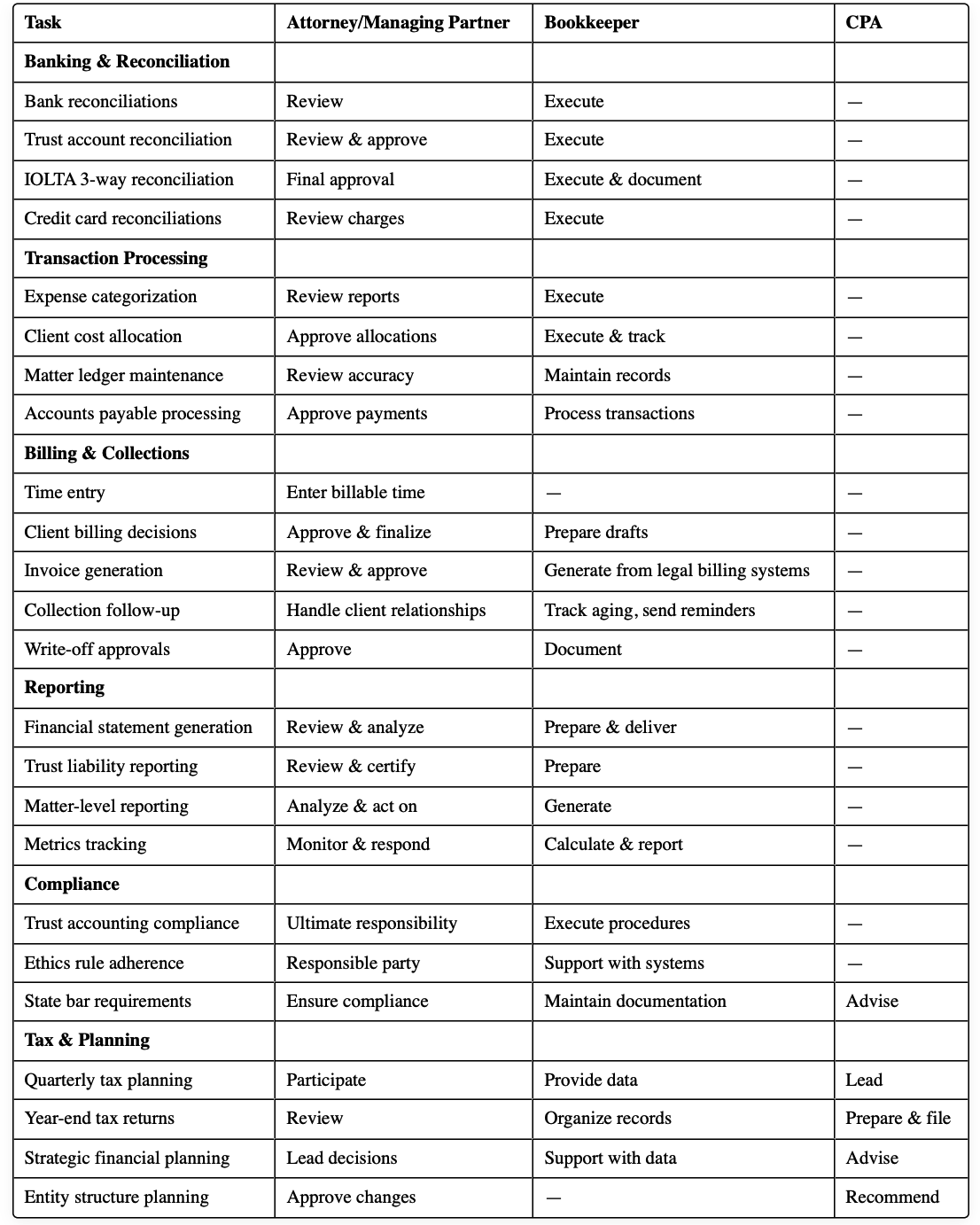

Attorney vs Bookkeeper vs CPA Responsibilities

Clarity about financial responsibilities prevents gaps and duplication. This table outlines typical monthly ownership in law firm accounting:

The Gaps Attorneys Always Miss

Even experienced managing partners overlook critical aspects of law firm accounting. These gaps create risk exposure that compounds over time.

Gap 1: Trust Accounting Frequency

Common mistake: Monthly trust reconciliation performed casually or skipped during busy periods.

Risk: Negative client balances, commingling violations, ethics complaints, bar audits, and potential disbarment.

Solution: Treat IOLTA 3-way reconciliation as non-negotiable monthly minimum. High-volume firms should reconcile weekly. Document every reconciliation with supporting schedules.

Gap 2: Matter-Level Financial Visibility

Common mistake: Reviewing only firm-wide financial statements without matter-level reporting.

Risk: Profitable matters subsidize unprofitable ones indefinitely. Firms can't identify which practice areas, clients, or case types generate returns.

Solution: Run monthly matter profitability reports. Track time, costs, revenue, and realization by matter. Make strategic decisions based on actual matter economics.

Gap 3: Client Cost Tracking and Allocation

Common mistake: Client costs paid from operating account and tracked in spreadsheets rather than accounting software.

Risk: Costs don't get billed to clients, creating cash flow problems. Personal and business expenses get commingled. Financial statements misrepresent true firm overhead.

Solution: Integrate client cost tracking with legal billing systems and accounting software. Allocate every client cost to a specific matter immediately when incurred.

Gap 4: Realization Rate Monitoring

Common mistake: Tracking hours billed but not monitoring how much actually gets collected.

Risk: Attorneys generate impressive hours but firm revenue lags. Write-offs and collection failures erode profitability invisibly.

Solution: Calculate monthly realization rates by attorney and practice area. Address low realization through pricing adjustments, billing frequency changes, or client mix decisions.

Gap 5: Trust Account Stale Balances

Common mistake: Leaving closed-matter retainers in trust account indefinitely without client communication.

Risk: Unclaimed property reporting requirements triggered. Ethics violations for abandoning client property. Unnecessarily large trust balances complicate reconciliation.

Solution: Monthly trust liability report review should flag balances older than 90 days with no activity. Contact clients about closed matters and process refunds promptly.

Gap 6: Cash Flow vs Profitability Confusion

Common mistake: Assuming profitable months mean healthy cash position, or vice versa.

Risk: Cash flow crises despite paper profitability. Poor financial decisions based on incomplete information.

Solution: Review cash flow statement monthly alongside P&L. Track cash runway metric. Understand timing differences between revenue recognition and cash collection.

Risk Areas: Audits, Ethics Complaints, and Cash Shortages

Law firm accounting carries risk exposure that doesn't exist in conventional businesses. Three primary risk areas demand proactive management.

Trust Account Audit Risk

Trigger events for bar audits:

Negative client balance discovered during random audit

Client complaint about mishandled trust funds

Dishonored trust account checks

Missing or late trust reconciliation documentation

Large unexplained trust account discrepancies

Failure to maintain adequate trust accounting records

Commingling of client funds with firm operating money

Protection strategies:

Monthly IOLTA 3-way reconciliation without exception

Documentation of every trust account decision and transaction

Partner review and sign-off on monthly trust reports

Immediate investigation of any trust accounting discrepancy

Regular training on trust accounting rules and procedures

Annual trust accounting review by specialized legal accountant

Ethics Complaint Risk

Common complaint triggers:

Using one client's trust funds for another client

Taking fees from trust before properly earning them

Misallocating client costs to wrong matters

Failing to communicate about trust account balances

Not refunding unused retainer portions promptly

Poor documentation of fee arrangements and trust activity

Protection strategies:

Written fee agreements for every engagement

Client communication about trust account activity

Clear policies on when fees move from trust to operating

Matter-level tracking of every dollar

Prompt response to client questions about billing

Regular partner review of trust accounting practices

Cash Flow Shortage Risk

Warning signs of cash flow problems:

Partner draws taken from trust account

Payroll funded from credit cards or lines of credit

Accounts payable aging beyond 60 days

Client costs not reimbursed within 30 days

Cash runway below 2 months of operating expenses

Revenue and cash collections diverging significantly

Protection strategies:

Monthly cash flow statement review

Cash runway calculation and trending

AR aging analysis with aggressive collection

WIP billing frequency optimization

Operating expense monitoring against budget

Line of credit established before cash problems emerge

Partner distribution policies aligned with cash availability

Cash Basis vs. Accrual Accounting for Law Firms

Cash basis accounting records revenue when payment hits your bank account and expenses when they leave it. Accrual accounting records revenue when it’s earned and expenses when they’re incurred - regardless of when money moves.

Most solo and small law firms start on cash basis because it’s simpler and aligns with how attorneys think about money: “Did the client pay me yet?” But firms billing over roughly $250K annually, carrying significant accounts receivable, or planning for growth should consider accrual.

Here’s how the two methods compare for a typical law firm:

Important: Regardless of which method you choose, trust accounting rules don’t change. IOLTA and client trust funds follow their own strict compliance requirements under your state bar’s rules. Your operating accounting method has no effect on how you handle trust money.

Not sure which method fits your firm? Most of the law firms we work with at Accounting Atelier start on cash basis and transition to accrual once revenue consistently exceeds $250K or they add partners.

We handle the conversion as part of our law firm bookkeeping services.

Setting Up a Law Firm Chart of Accounts

Your chart of accounts is the backbone of your firm’s financial reporting. It’s the master list of every category where money gets recorded - revenue, expenses, assets, liabilities, and equity.

The problem most law firms run into: their chart of accounts was either auto-generated by QuickBooks with irrelevant categories (you don’t sell “products”) or set up by a general bookkeeper who doesn’t understand legal-specific line items like IOLTA trust liabilities, client cost advances, or retainer deposits.

Here’s a simplified chart of accounts structure designed specifically for law firms:

Assets

Operating checking account

IOLTA trust account(s)

Client cost advance receivable

Accounts receivable — legal fees

Office equipment / furniture

Liabilities

Client trust liability (mirrors IOLTA balance - must always match)

Accounts payable

Credit card payable

Payroll liabilities

Line of credit

Revenue

Legal fees earned

Flat fee revenue

Consultation fees

Recovered client costs

Expenses

Payroll and benefits

Office rent / lease

Practice management software (Clio, MyCase, etc.)

Accounting and bookkeeping fees

Bar dues and CLE

Malpractice insurance

Client cost advances (reimbursable)

Marketing and advertising

Court filing fees (non-reimbursable)

Equity

Owner’s equity / partner capital

Owner’s draws / distributions

Retained earnings

Two rules that matter most: First, your IOLTA trust account balance on the books must always equal the actual bank balance AND the sum of individual client trust ledgers. This is the three-way reconciliation that your state bar requires. Second, never mix client trust categories with operating categories - they should be clearly separated in your chart of accounts.

If your current chart of accounts is a mess of generic QuickBooks categories, it’s worth rebuilding it properly. A clean chart of accounts makes monthly financial reporting dramatically easier and gives you the visibility you need to make smart business decisions.

When Law Firms Should Stop DIY Accounting

Many law firms start with attorneys or office managers handling bookkeeping. This approach fails as complexity grows. Red flags indicate when to bring in specialized law firms accounting expertise:

Time and efficiency red flags:

Managing partner spending 10+ hours monthly on bookkeeping tasks

Financial reports consistently delivered after the 20th of following month

Month-end close process taking longer than 5 business days

Partners doing bank reconciliations instead of billable work

Compliance and risk red flags:

Trust account surprises during reconciliations with unclear explanations

Negative client balances discovered during reviews

Missing or incomplete IOLTA 3-way reconciliation documentation

Trust accounting performed less than monthly

No documented trust accounting procedures

Uncertainty about trust account compliance with state rules

Visibility and decision-making red flags:

No matter-level reporting available

Financial statements showing only firm-wide totals

Can't answer "which practice areas are most profitable?"

Client cost tracking in spreadsheets rather than accounting software

No attorney-level performance metrics calculated

Budget vs actual comparisons not performed regularly

System and process red flags:

Legal billing systems not integrated with accounting software

Manual data entry between systems creating errors

No chart of accounts designed for law firms

Cash basis accounting used when accrual would provide better visibility

Accounts payable managed in email rather than accounting system

No systematic process for categorizing expenses monthly

These issues cost more than time. They create compliance exposure, miss profitability opportunities, and prevent firms from scaling confidently.

The cost of specialized law firm bookkeeping services typically ranges from $800-2,500 monthly - often less than the hidden costs of DIY errors, compliance risks, and partner time spent on reconciliations.

What High-Level Bookkeeping for Law Firms Provides Monthly

Outsourced bookkeeping for law firms delivers more than transaction processing. Specialized providers act as financial operations partners, handling compliance workflows and surfacing insights that inform strategy.

Monthly deliverables from specialized legal bookkeeping:

Transaction and reconciliation services:

Complete bank and credit card reconciliations with discrepancies investigated

IOLTA 3-way reconciliation executed and documented

Trust liability report generated and verified

Matter ledger maintenance with all transactions properly allocated

Expense categorization using law firm chart of accounts

Client cost allocation to specific matters

Accounts payable processing with proper coding

Compliance and documentation:

Trust accounting compliance procedures followed monthly

Documentation package supporting trust reconciliation

Negative client balance monitoring and alerting

Stale retainer identification and reporting

Compliance checkpoint verification

Audit-ready trust accounting records maintained

Reporting and analysis:

Monthly financial statement package (P&L, balance sheet, cash flow)

Trust liability report with client balance detail

Matter-level profitability reporting

Accounts receivable aging analysis

Work-in-progress aging report

Key law firm financial metrics calculated

Delivered by 10th-15th of following month consistently

Strategic support:

Proactive communication about unusual transactions

Identification of compliance risks before they become violations

Recommendations for process improvements

Financial performance insights based on metrics trending

Matter profitability analysis and observations

Cash flow forecasting and runway monitoring

The goal extends beyond clean books to creating financial operations infrastructure that supports growth without creating risk.

Understanding pricing structures and what's included at different service levels helps firms budget appropriately. Learn more about law firm bookkeeping costs and typical monthly packages.

How to Bring Law Firm Accounting Up to Standard in 60 Days

Firms inheriting messy books or transitioning from inadequate systems can reach compliance and reporting standards within 60 days using a structured approach.

Phase 1: Assessment and File Review (Days 1-15)

Complete financial operations assessment identifying gaps, errors, and compliance risks.

Assessment deliverables:

Trust account reconciliation review for trailing 12 months

IOLTA compliance evaluation against state rules

Matter ledger accuracy verification

Chart of accounts review and recommendations

Legal billing systems integration assessment

Internal controls evaluation

Written findings report with prioritized remediation steps

60-day remediation roadmap

Critical assessment questions:

Do trust reconciliations exist for every month?

Does the trust liability report match the bank balance?

Are client ledgers maintained at the matter level?

Is the chart of accounts designed for law firms?

Are legal billing systems integrated with accounting software?

Are client costs properly separated from firm overhead?

Do financial statements include matter-level reporting?

Phase 2: Cleanup and Trust Corrections (Days 16-45)

Systematic correction of identified issues, prioritizing highest-risk areas.

Trust accounting cleanup (first priority):

Complete historical IOLTA 3-way reconciliations for gaps

Rebuild client ledgers if necessary using bank statements and billing records

Research and correct negative client balances

Document stale retainers and initiate client communication

Reconcile trust liability GL account to client ledger totals

Create trust accounting procedures documentation

Establish ongoing three-way reconciliation template

Operating accounting cleanup:

Correct expense categorization errors

Reallocate client costs to proper matters

Reconcile accounts payable to vendor statements

Clean up balance sheet accounts with old balances

Restructure chart of accounts for law firm operations

Integrate legal billing systems with accounting software

Set up matter-level reporting structure

Process documentation:

Monthly close procedures written and approved

IOLTA 3-way reconciliation workflow documented

Client cost allocation procedures established

Matter ledger maintenance guidelines created

Responsibility matrix clarifying attorney/bookkeeper/CPA roles

Phase 3: Ongoing Monthly Cadence (Days 46-60)

Transition to standard monthly close process outlined in this playbook.

Implementation of monthly workflow:

Execute Steps 1-7 of monthly financial workflow

Deliver first complete monthly financial statement package

Calculate baseline metrics for all attorney-specific KPIs

Establish reporting calendar and delivery schedule

Implement compliance checkpoint documentation

Begin monthly partner financial review meetings

Validation and refinement:

Partner review and approval of monthly reporting package

Adjustments to chart of accounts or reporting formats

Refinement of metrics based on firm priorities

Integration troubleshooting between legal billing systems and accounting software

Optimization of monthly close timeline

This 60-day transformation creates infrastructure for compliant, scalable financial operations.

Ready to Build Financial Operations That Match Your Legal Standards?

Law firm accounting demands the same rigor attorneys apply to client matters. The monthly financial workflow outlined here creates infrastructure for compliance, profitability, and confident growth.

Professional financial operations separate law firms that scale successfully from those constrained by back-office chaos. Clean books, compliant trust accounting, and matter-level visibility provide the foundation for strategic decisions.

If you want your law firm's accounting handled with the same care you give your cases, let's talk numbers.

Frequently Asked Questions

-

Yes. State bar ethics rules don't exempt solo practitioners from IOLTA compliance requirements. Monthly IOLTA 3-way reconciliation protects against inadvertent violations and maintains documentation needed if the bar requests an audit. Trust accounting complexity doesn't scale with firm size - solo attorneys managing client funds face identical rules as 100-attorney firms.

-

Bookkeeping handles transaction recording, reconciliation, and report generation—the daily financial operations keeping records current. Law firm accounting includes interpretation, analysis, tax planning, and strategic advisory work. Most law firms need specialized bookkeeping monthly and accounting support quarterly or annually. Generally accepted accounting principles apply differently in legal practices due to trust account requirements and client fund handling restrictions.

-

Monthly minimum as required by most state bars. High-volume firms with significant daily trust activity should reconcile weekly. Best practice completes reconciliation within 10 days of month-end. The three-way reconciliation (bank balance, client ledger sum, general ledger trust liability) is the primary control preventing trust accounting violations.

-

Not reliably. Trust accounting rules, IOLTA compliance requirements, matter-level tracking, legal billing systems integration, and legal industry revenue recognition require specialized knowledge. Bookkeepers experienced with retail or service businesses will miss critical requirements creating ethics exposure for attorneys. Law firm bookkeeping services should demonstrate specific legal industry experience and knowledge of state trust accounting rules. For a detailed breakdown of what's included at different price points, read our complete guide to law firm bookkeeping costs.

-

Common triggers include: negative client balances discovered, client complaints about trust fund handling, dishonored trust account checks, missing reconciliation documentation, random audit selection, firm name changes or ownership transitions, and attorney discipline in other areas. Protection requires consistent monthly IOLTA 3-way reconciliation with complete documentation.

-

Stop immediately and investigate the root cause. Negative balances indicate one client's money was used for another client - a serious ethics violation. Never make adjusting entries until identifying why the negative balance exists. Document the investigation thoroughly. Correct by depositing firm funds into trust to cover the shortage, then investigate whether client notification or bar reporting is required based on state rules.

-

Required monthly: profit and loss statement, balance sheet, cash flow statement, and trust liability report. The trust liability report must reconcile exactly to trust bank balance and general ledger trust liability account. Add matter-level profitability reporting for strategic visibility into which practice areas and clients generate the best returns. For a detailed breakdown of what each report reveals and which metrics to monitor, read our guide to essential law firm financial reports attorneys should review monthly.

-

Most law firms benefit from accrual accounting providing better visibility into work-in-progress, accounts receivable aging, and accounts payable obligations. Cash basis accounting shows only money movement, obscuring economic reality of firm performance. Legal billing systems typically operate on accrual basis, making integration cleaner when accounting system matches.