Bookkeeping for Consultants: The Essential Guide 2026

Consulting is booming, with thousands of new firms launching each year. Yet, many struggle to stay on top of bookkeeping for consultants, risking compliance issues and missed profits.

This essential guide will help you streamline your finances, ensure full compliance, and maximize your profitability in 2026’s complex business landscape.

Inside, you will find everything you need: bookkeeping basics, system selection, solutions for consultant-specific challenges, automation strategies, and actionable best practices. Ready to gain financial clarity and stress-free compliance? Let’s dive in.

The Fundamentals of Bookkeeping for Consultants

Bookkeeping for consultants is the backbone of financial health in a service-based business. It goes beyond recording numbers, serving as the foundation for smarter decisions, reliable tax filings, and sustainable growth. As the consulting sector expands in 2026, understanding the essentials of bookkeeping for consultants is no longer optional—it is a requirement for legal compliance and profitability.

What Is Bookkeeping for Consultants?

Bookkeeping for consultants refers to the systematic recording, organizing, and managing of all financial transactions related to consulting activities. Unlike accounting, which interprets and analyzes financial data, bookkeeping for consultants is a daily practice that ensures every dollar earned or spent is accurately tracked.

This process includes logging client payments, invoices, expenses, and receipts. By maintaining up-to-date records, consultants gain real-time insight into their business’s financial position. Bookkeeping for consultants is crucial for meeting tax obligations, forecasting cash flow, and making strategic business decisions.

Why Accurate Bookkeeping Matters

Accurate bookkeeping for consultants is essential for several reasons. First, it keeps your business compliant with tax laws and regulations. Well-maintained books make it easy to prepare for tax season and reduce the risk of costly mistakes.

Second, it provides a clear picture of cash flow and business performance. Consultants rely on this visibility to budget effectively and plan for growth. Bookkeeping for consultants also supports better client management, as timely invoicing and expense tracking prevent revenue loss.

Key bookkeeping tasks include:

Tracking all income and expenses

Creating and sending invoices to clients

Managing and organizing receipts

Reconciling bank and credit card accounts

For a detailed breakdown of these essential responsibilities, see Bookkeeping tasks every business needs.

Consultant Income Streams: What to Track

Consultants often earn income in diverse ways, each with unique bookkeeping needs. The main income streams include:

Bookkeeping for consultants must account for these streams accurately to avoid confusion, especially when handling deposits, partial payments, or project advances. Each method affects how income is recognized and reported, impacting cash flow and tax treatment.

Risks of Poor Bookkeeping

Neglecting bookkeeping for consultants can have serious consequences. Common risks include IRS penalties, missed tax deductions, lost revenue, and an increased chance of audits. According to SCORE, 40% of small businesses incur tax penalties due to bookkeeping errors.

Consider the example of a consultant who, after organizing their books and implementing regular reconciliation, discovered several unbilled client hours. By correcting these mistakes, they increased annual profitability and reduced tax season stress.

Cash vs. Accrual Accounting: What Consultants Should Know

Consultants can choose between cash and accrual accounting methods. Cash accounting records transactions when money changes hands, making it simple and ideal for solo consultants. Accrual accounting records income and expenses when they are earned or incurred, providing a more accurate view for larger consultancies.

Selecting the right method for bookkeeping for consultants affects when income and expenses are recognized, which in turn impacts tax obligations and business planning.

Setting Up a Bookkeeping System for Your Consulting Business

A robust system is essential when it comes to bookkeeping for consultants. Setting up the right framework not only saves time but also ensures you stay compliant and have a clear financial picture at all times. Whether you are a solo consultant or leading a growing team, the right approach can make or break your business’s financial health.

Choosing Your Bookkeeping Approach

The first step in bookkeeping for consultants is selecting how you will manage your books. You can handle everything yourself, hire a part-time bookkeeper, or outsource to a specialized firm.

DIY is cost-effective but requires time and diligence.

Hiring a bookkeeper brings expertise, though it is an ongoing expense.

Outsourcing offers flexibility and access to professionals familiar with consultant challenges.

Consider your business size, budget, and comfort with financial tasks. For those interested in outsourcing, review this Guide to outsourcing bookkeeping to weigh your options.

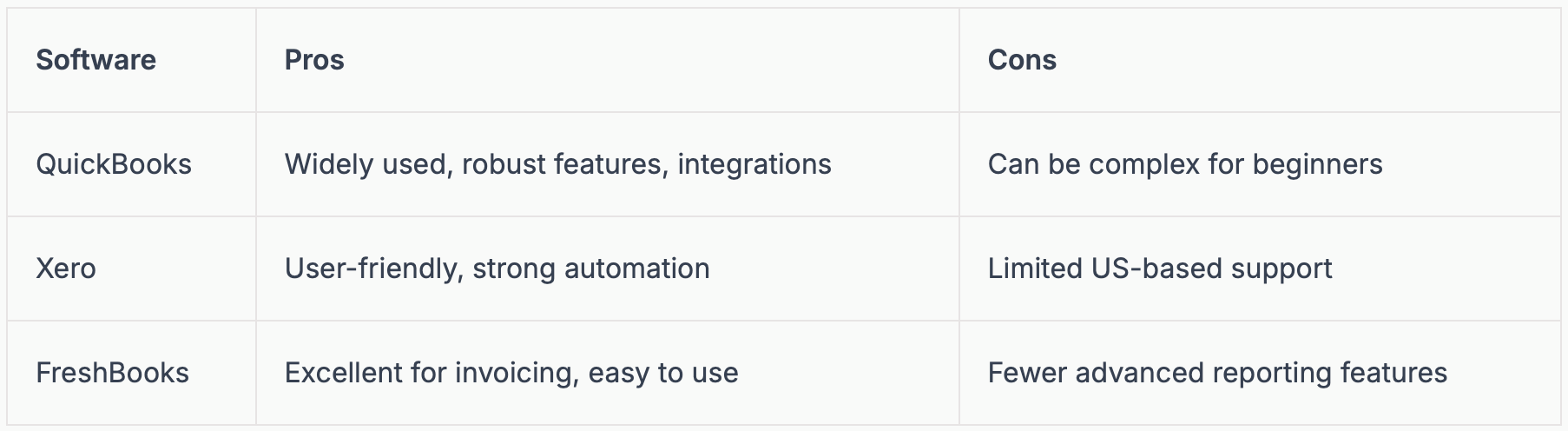

Evaluating Bookkeeping Software

Selecting the right software is a key decision in bookkeeping for consultants. The right platform streamlines invoicing, expense tracking, and reporting. Here is a comparison of popular options:

For a deeper dive, consult Choosing the right bookkeeping software. Select a solution that fits your workflow, business size, and budget.

Separating Business and Personal Finances

One of the most important steps in bookkeeping for consultants is keeping business and personal finances distinct. Open a dedicated business bank account and credit card. This practice simplifies tax time, improves record accuracy, and protects your liability.

Set up your chart of accounts to reflect the unique categories relevant to consulting:

Income: Client Payments

Expenses: Subcontractors, Travel, Software, Office Supplies

Assets: Accounts Receivable

Liabilities: Credit Card, Loans

Regularly monitor and update your accounts to ensure nothing is missed.

Document Management and Cloud Solutions

Efficient document management forms the backbone of successful bookkeeping for consultants. Use digital tools to capture and organize receipts, store documents in secure cloud folders, and maintain an audit trail for every transaction.

Adopt templates for invoices, expense tracking, and client payment logs to standardize your process. Here are common templates to consider:

Customizable invoice template for projects and retainers

Expense tracker with category breakdowns

Payment log for monitoring client receipts

Over 60% of consultants now use cloud-based accounting solutions for better efficiency and data security. Embrace these tools to streamline your workflow and focus more on serving clients.

Final Thoughts

Setting up a solid system for bookkeeping for consultants is a foundational investment in your business’s success. By choosing the right approach, leveraging modern software, and maintaining organized records, you will gain financial clarity and peace of mind.

Consultant-Specific Bookkeeping Challenges and Solutions

Consulting businesses encounter a unique set of financial hurdles that make bookkeeping for consultants particularly demanding. From unpredictable cash flow to multi-state tax obligations, every aspect of a consultant’s finances requires tailored attention. Recognizing and addressing these challenges is the first step to keeping your books accurate, compliant, and actionable.

Unique Challenges in Bookkeeping for Consultants

Consultants rarely enjoy a steady, predictable revenue stream. Instead, income often arrives sporadically, depending on project completions or client billing cycles. This irregularity complicates forecasting and requires diligent cash flow management.

Another challenge is the complexity of client billing. Projects may be invoiced hourly, by milestone, or under monthly retainers. Each model affects how income is recognized and recorded in bookkeeping for consultants. Tracking billable hours and ensuring all services are invoiced accurately can be time-consuming, especially when juggling multiple clients.

Multi-state tax obligations add another layer of complexity. Serving clients across state lines means navigating varying tax rates and compliance rules, which can increase the risk of errors if not managed carefully.

Managing Irregular and Complex Income Streams

Effectively handling unpredictable income is essential for successful bookkeeping for consultants. Consultants typically operate with a mix of project-based, retainer, and hourly billing. Each income type has its own bookkeeping requirements.

For project-based work, deposits and milestone payments need to be tracked as deferred revenue until earned. Retainer arrangements require consistent monthly tracking and clear recognition of services performed. Hourly billing demands precise time logs to support invoices and justify payments, reducing disputes with clients.

To streamline income management, consultants should implement a systematic process for categorizing payments and reconciling them with contracts. This approach minimizes revenue leakage and ensures accurate financial reporting.

Tracking Expenses, Reimbursements, and Mixed-Use Assets

Consultants regularly incur expenses on behalf of clients, such as travel, supplies, or software subscriptions. Properly recording these reimbursable expenses is crucial in bookkeeping for consultants. Failure to separate billable expenses from business overhead can lead to missed reimbursements or tax deductions.

Mixed-use assets, like a home office or shared software, require careful allocation between personal and business use. This allocation must be clearly documented to satisfy IRS requirements and maximize allowable deductions.

Maintaining digital records of receipts, using expense tracking apps, and categorizing transactions promptly help consultants avoid costly mistakes and remain audit-ready.

Handling Subcontractors and 1099 Compliance

As consulting practices grow, many professionals hire subcontractors for specialized tasks. This introduces new responsibilities in bookkeeping for consultants, especially regarding 1099 compliance. Consultants must accurately track payments to each subcontractor, ensuring that all amounts exceeding the IRS threshold are reported properly.

Failure to issue correct 1099 forms can trigger penalties and audits. Implementing a standardized onboarding process for subcontractors, collecting W-9 forms upfront, and using bookkeeping software that tracks contractor payments simplifies compliance.

Regular review of contractor expenses also aids in monitoring project profitability and prevents overpayment or duplicate entries.

Solutions, Tools, and Best Practices

Modern solutions streamline bookkeeping for consultants and address these unique challenges. Automation tools, such as integrated time-tracking and invoicing platforms, reduce manual data entry and help prevent missed billable hours. Standardized processes, including regular account reconciliation and scheduled financial reviews, keep records accurate and up to date.

A consultant using automated invoicing and expense tracking can reclaim up to 20% of previously missed billables. Additionally, cloud-based bookkeeping systems enable real-time financial oversight and secure document storage.

For an in-depth look at overcoming these common hurdles, the 2026 Guide to Bookkeeping for Small Businesses outlines practical strategies and solutions tailored to the evolving needs of consulting businesses.

In summary, adopting the right technology, maintaining consistent workflows, and staying informed about compliance requirements are essential for mastering bookkeeping for consultants. With these strategies, consultants can minimize risk, maximize profitability, and focus on delivering value to their clients.

Leveraging Automation and Technology in Bookkeeping

Staying competitive in 2026 demands that every consultant harness the power of technology. Automation has become a game changer in bookkeeping for consultants, enabling streamlined processes and real-time financial insights. As consulting businesses grow more complex, digital solutions are no longer optional but foundational to efficiency and compliance.

The landscape of bookkeeping for consultants now includes a range of automation tools that address every stage of the financial workflow. Leading apps like QuickBooks Online, Xero, and FreshBooks offer features such as automatic bank feeds, receipt capture through mobile devices, and seamless invoicing. Integrations with payment processors ensure that transactions are tracked instantly, reducing manual entry and minimizing the risk of errors.

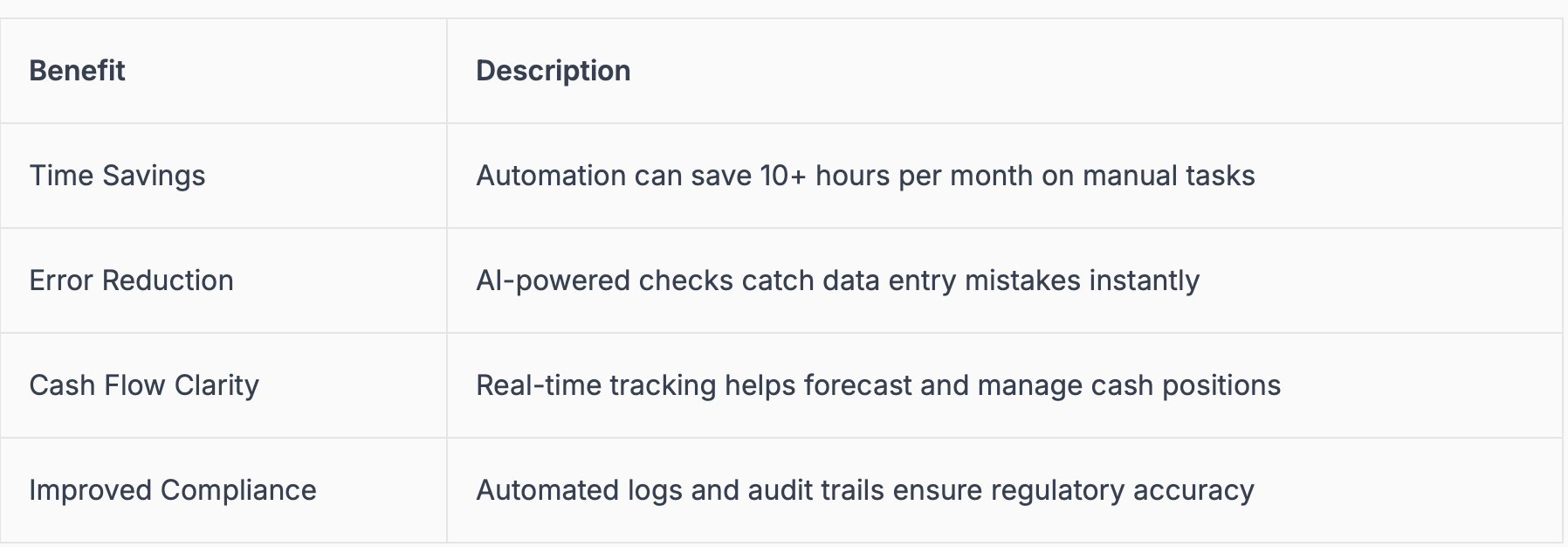

Below is a summary table highlighting the core benefits automation brings to bookkeeping for consultants:

Setting up automation in bookkeeping for consultants starts with connecting your accounting software to your bank and payment platforms. Most tools allow you to create rules for expense categorization and set automated reminders for outstanding invoices. This proactive approach ensures you never miss a payment or overlook a deductible expense. Many platforms now offer AI-driven suggestions for categorizing expenses, further simplifying your workflow.

Security is central to bookkeeping for consultants, particularly when handling sensitive client information. Select software providers that offer robust encryption, two-factor authentication, and secure cloud backups. Always review privacy policies and consider regular password updates to safeguard your financial data.

Consider this real-world scenario: A consultant implemented integrated time tracking and automated invoicing, resulting in over 10 hours saved each month. This not only freed up valuable time for client work but also improved billing accuracy and cash flow predictability. Industry surveys show that 70% of consultants report better financial accuracy and efficiency after embracing automation.

For those seeking advanced strategies, resources like Bookkeeping Best Practices for Small Businesses in 2025 provide tips on leveraging automation for compliance and business growth. Looking ahead, tools that incorporate AI and predictive analytics, as described in Mastering the Art of Bookkeeping: Best Practices for Small Business Success in 2025, are set to further transform bookkeeping for consultants.

Embracing automation is no longer just an efficiency upgrade. It is a strategic move that enables consultants to focus more on client relationships and less on paperwork. By integrating these technologies, you ensure your bookkeeping for consultants is accurate, compliant, and future-ready.

Best Practices and Tips for Bookkeeping Success in 2026

Achieving excellence in bookkeeping for consultants requires more than just recording transactions. It demands a disciplined approach, ongoing learning, and the right tools to maintain clarity and compliance in 2026’s fast-paced business environment.

Establish a Bookkeeping Routine

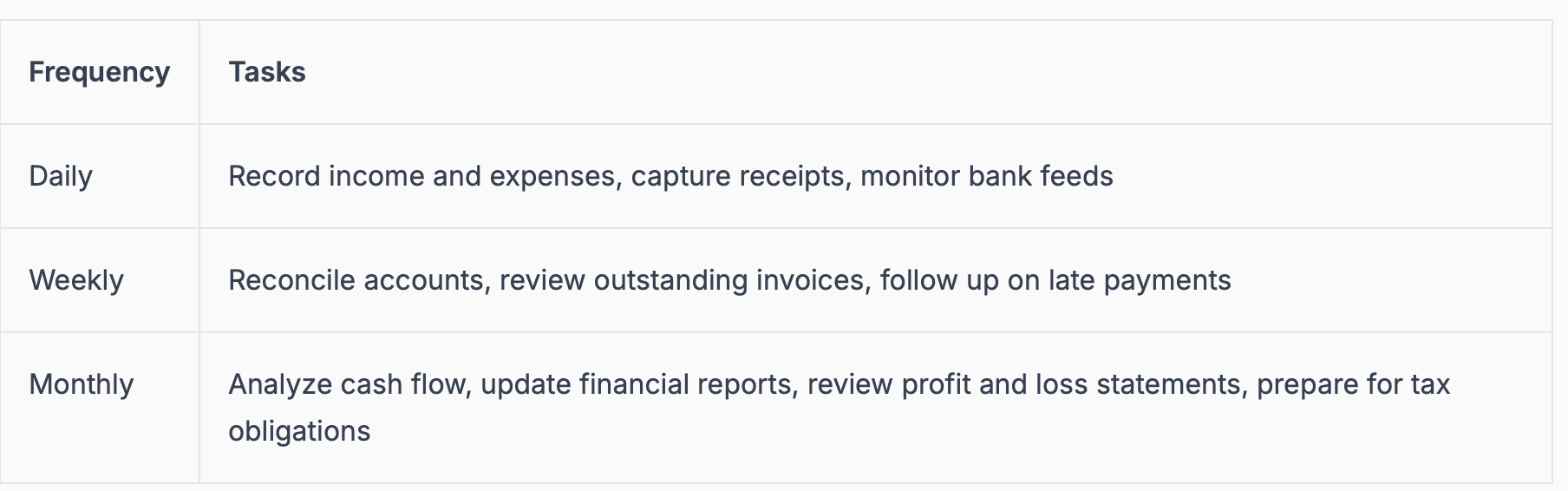

Consistency is the foundation of effective bookkeeping for consultants. Establishing a structured routine allows you to stay on top of your finances, avoid costly errors, and catch discrepancies early.

Here’s a sample checklist to guide your daily, weekly, and monthly activities:

Integrating these routines into your workflow ensures that bookkeeping for consultants remains manageable and accurate. Use reminders and calendar blocks to build these habits.

Maintain Real-Time Financial Visibility

For consultants, financial clarity is crucial for making informed decisions. Leverage cloud-based accounting tools to access your books anytime and anywhere. Real-time dashboards allow you to monitor key metrics such as revenue, expenses, and profit margins.

Regular account reconciliation is a must. By comparing your records with bank statements, you can quickly identify any mismatches and resolve them before they escalate. This practice not only supports compliance but also strengthens trust with clients and stakeholders.

Manage Cash Flow Effectively

Unpredictable cash flow is a common challenge in bookkeeping for consultants. Proactive management means forecasting income, tracking receivables, and handling late payments with clear processes.

Consider these strategies:

Set up automated reminders for clients to encourage prompt payments.

Offer multiple payment options to reduce friction.

Maintain a buffer in your business account to cover lean periods.

Review your cash flow statement monthly to spot trends and take corrective action early.

Prioritize Compliance and Audit Preparedness

Staying compliant is non-negotiable in bookkeeping for consultants. Ensure you retain all relevant documents, including receipts, invoices, and contracts, for the recommended period. Use secure digital storage with backup solutions for added protection.

Prepare for audits by maintaining organized records and clear audit trails. Keep up with regulatory changes for 2026 to avoid surprises. Consultants who prioritize compliance face fewer disruptions and can respond confidently to requests from tax authorities.

Maximize Deductions and Minimize Tax Liability

A key benefit of diligent bookkeeping for consultants is the ability to identify and claim all eligible deductions. Track expenses related to your home office, business travel, software subscriptions, and professional development.

Schedule regular financial reviews to uncover cost-saving opportunities. For example, one consultant improved net income by 15% after implementing a monthly expense analysis to eliminate redundant subscriptions.

Working with a professional bookkeeper can further optimize your tax strategy and reduce risk. According to industry analysis, consultants who review their financials monthly are twice as likely to achieve year-over-year profit growth.

Continue Learning and Leverage Resources

Bookkeeping for consultants is an evolving discipline. Stay informed by accessing trusted resources and industry updates. For ongoing reference, consult the Bookkeeping glossary for consultants to deepen your understanding of essential terms and concepts.

Commit to professional development, attend webinars, and connect with peers to remain agile in a changing landscape. By making education a priority, you future-proof your business and elevate your financial management skills.

Book a 15-Minute Consultation

Let’s talk about where your books are now - and what’s possible when they’re finally right.

No pressure. Just clarity.

Financial management is crucial for consultants to maintain profitability and growth.