Law Firm Profitability: The Complete Guide to Measuring and Improving Your Margins

Updated December 2025

A personal injury firm billing $1.2 million sat down with us last year to figure out why they couldn't make payroll in March despite having their "best year ever." The answer was in their numbers - they just couldn't see it.

Their overall profit margin looked healthy at 28%. But when we broke it down by practice area, their PI contingency work showed 42% margins while their "side business" of general civil litigation ran at 8%. They were subsidizing losing work with winning work and had no idea.

That's the difference between tracking revenue and understanding profitability. One tells you money came in. The other tells you whether you're building wealth or just staying busy.

What Is Law Firm Profitability?

Profitability measures what your firm keeps after expenses - not what it bills or collects.

Profit = Revenue - All Expenses

Profit Margin = (Profit ÷ Revenue) × 100

Simple formula. Complex execution. Because "all expenses" includes items most firms don't track correctly, and "revenue" requires clarity about when money is actually earned versus when it hits your bank account.

A firm collecting $800,000 annually with $520,000 in total expenses generates $280,000 in profit - a 35% margin. That 35% funds partner draws, reserves, and growth investment.

But firm-level calculations hide the details that drive strategic decisions. Your 35% margin might come entirely from two practice areas while a third loses money. One partner might generate 70% of profits while others consume resources without proportional return.

Real profitability analysis requires drilling past the top line into practice areas, matters, and individual performance.

Law Firm Profit Margin Benchmarks: What the Data Actually Shows

Most "benchmark" articles throw out ranges without sources. Here's what the actual data says.

The Clio Baseline (2024 Legal Trends Report):

The fundamental math of law firm profitability starts with how attorneys spend their time:

Source: Clio 2024 Legal Trends Report

Those three rates compound. The average attorney works an 8-hour day but only bills 2.9 hours. Of that, only 88% makes it to an invoice. Of invoiced work, only 91% gets collected.

The math: 2.9 billable hours × 88% realization × 91% collection = 2.3 hours of collected revenue per 8-hour day.

That's a 29% effective rate on attorney time before you subtract any expenses.

Utilization Rate by Firm Size (2024):

Source: Clio 2024 Legal Trends Report

Larger firms aren't more profitable because their attorneys work harder. They're more profitable because they've built systems that protect billable time from administrative drain.

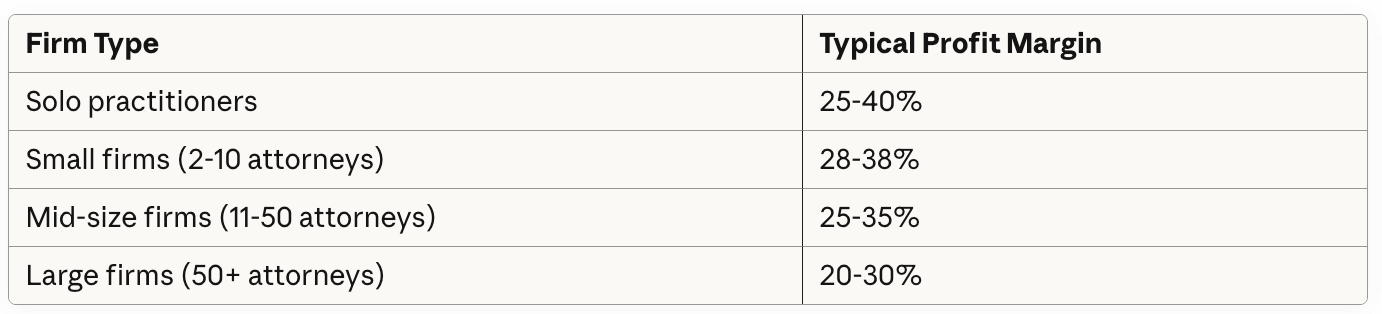

Profit Margins by Firm Size:

According to ABA data and industry surveys, median profit margins break down roughly as follows:

Source: ABA and industry surveys

Solo practitioners can achieve higher margins because they carry minimal overhead and take no profit-sharing dilution. But the data hides a critical nuance: solo attorneys spend only 55% of their day on billable work versus 69% for attorneys at firms with 11+ lawyers (ABA). That non-billable administrative burden caps their revenue ceiling even when margins look strong.

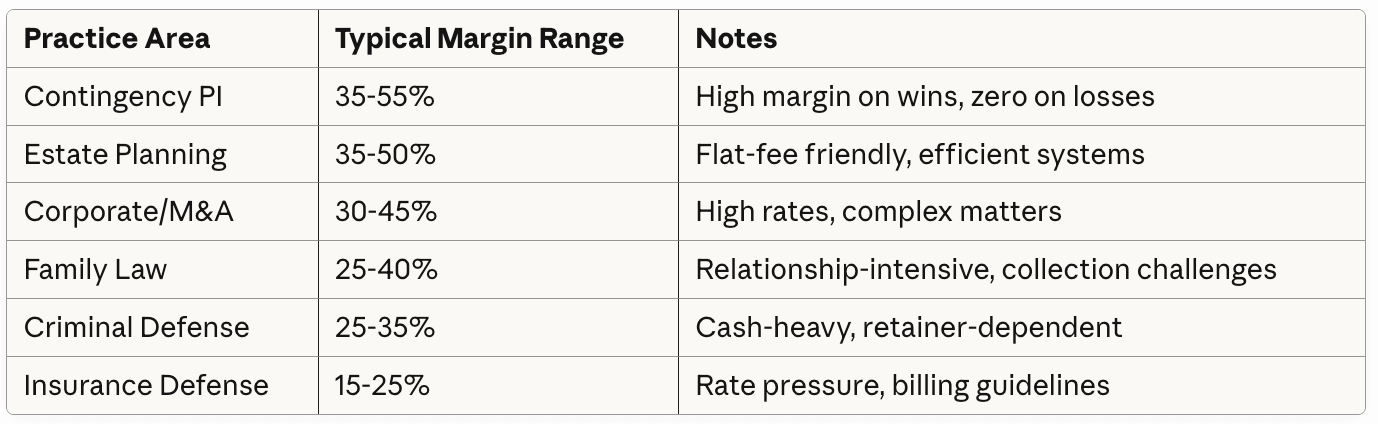

Profit Margins by Practice Area:

Practice area dramatically affects margin potential:

Industry benchmarks; contingency margins reflect settled cases only

The contingency number requires context. A 45% margin on settled cases means nothing if 30% of cases settle. Effective margin accounts for the fully-loaded cost of matters that return zero.

How to Calculate Law Firm Profitability (The Right Way)

Most firms calculate profitability incorrectly. Here's the methodology that produces actionable numbers.

Step 1: Establish True Revenue

Revenue should reflect earned income. For accrual-basis firms, recognize revenue when work is performed. For cash-basis firms, track both collected revenue and outstanding AR to understand economic reality.

Include:

Legal fees (hourly, flat-fee, contingency)

Earned portions of retainers

Recovered costs billed to clients

Exclude:

Unearned retainers still held in trust

Client cost advances (pass-throughs)

Trust account activity

Getting this wrong overstates or understates your true economic position by thousands.

Step 2: Capture All Expenses

Direct expenses:

Attorney compensation (salary, draws, benefits)

Paralegal and staff compensation

Bar dues, CLE, malpractice insurance

Overhead expenses:

Rent and utilities

Technology (practice management, research, accounting)

Marketing and business development

Administrative staff

Professional services (bookkeeping, accounting, IT)

Insurance (general liability, cyber)

Commonly missed expenses:

Partner health insurance paid personally

Home office costs for remote attorneys

Technology subscriptions on personal cards

Meals and travel buried in personal accounts

Continuing education paid outside firm

Expense leakage averages 5-12% of true overhead in firms without rigorous tracking. That leakage comes directly off your profit margin.

Step 3: Calculate Firm-Level Margin

Net Profit = Total Revenue - Total Expenses

Profit Margin = Net Profit ÷ Total Revenue

Run this monthly. Track trailing 12-month trends to smooth seasonal variation. A single month tells you nothing; directional movement over quarters tells you everything.

Step 4: Break Down by Practice Area

Firm-level margin hides practice area performance. For each practice area, calculate:

Revenue generated

Direct costs (attorney time at loaded cost, paralegal time, matter-specific expenses)

Allocated overhead (proportional share of rent, admin, technology)

Practice area profit margin

This analysis routinely reveals that the "biggest" practice area by revenue generates the smallest margin. Smaller areas often deliver superior returns per dollar invested.

Without this breakdown, you can't make informed decisions about where to grow, where to invest, and what to exit.

Step 5: Connect Trust Accounting to Profitability

Here's what most firms miss - and what separates struggling practices from profitable ones.

Trust accounting isn't just a compliance function. It's a profitability signal.

Trust activity reveals:

Cash flow timing: When retainers convert to earned revenue affects your operating cash position. Firms that don't integrate trust-to-operating transfers into cash flow planning face unnecessary crunches.

Client payment behavior: Retainer depletion rates and replenishment patterns predict collection problems before they hit AR aging.

Matter profitability signals: Matters burning through retainer faster than expected indicate scope creep or underpricing - both profit killers.

Compliance as canary: Trust accounting errors correlate with broader financial management problems. Firms struggling with three-way reconciliation typically have deeper operational issues affecting profitability.

Trust accounting violations remain among the top causes of attorney discipline nationally. In Florida's 2024 discipline statistics, trust accounting issues ranked in the top three complaint categories. The firms facing these problems rarely have isolated trust issues—they have systemic financial management breakdowns.

This is exactly why our Legal Ledger Protocol™ integrates trust accounting into overall financial management rather than treating it as a separate compliance checkbox. When trust data flows into your management reporting, you see problems before they become violations - and before they drain profit.

Cash Flow vs. Profitability: Different Problems, Different Solutions

Law firm cash flow and profitability are related but distinct. Confusing them leads to decisions that damage one while optimizing for the other.

Profitability = Economic performance over time. Revenue minus expenses.

Cash flow = Money movement. When cash arrives and leaves your accounts.

A firm can be profitable but cash-poor. A firm can have strong cash flow while bleeding profit.

The cash flow trap:

Firms that manage to P&L alone often miss cash crunches until they hit. Firms that manage to cash flow alone often miss profitability erosion until it's critical.

Manage both. Track profit margin monthly. Track AR aging weekly. Build cash reserves equal to 60-90 days of operating expenses. Make partner distributions based on actual cash available, not paper profit.

7 Hidden Profitability Drains (And How to Fix Them)

Profit margin problems trace to a handful of recurring issues. These drains operate invisibly until someone looks.

1. The Utilization Gap

The problem: Your attorneys bill 2.9 hours per 8-hour day (industry average). The other 5+ hours go to administration, marketing, firm management, and unbillable client service.

The cost: Every unbillable hour at a $300/hour rate represents $300 in theoretical lost revenue. At 5 hours per day, that's $1,500 daily, $7,500 weekly, $390,000 annually - per attorney.

The fix: Audit where non-billable time actually goes. Outsource administrative functions where the cost is lower than attorney hourly rates. Invest in systems that protect billable time. Target 45%+ utilization - moving from 37% to 45% utilization represents a 22% increase in billable capacity.

2. Realization Rate Erosion

The problem: Not all billable time makes it to invoices. Write-offs, write-downs, missed entries, and "courtesy" discounts erode revenue before you even try to collect.

The cost: The gap between 88% realization (average) and 95% realization (top performers) on $500K of billable work is $35,000 in lost revenue annually.

The fix: Track realization at the matter and attorney level. Investigate matters falling below 90%. Address chronic discounting - if you're always discounting, your rates are wrong or your scope management is broken.

3. Collection Failures

The problem: 91% average collection means 9% of invoiced work never converts to cash. On $500K invoiced, that's $45,000 left on the table.

The cost: AR over 90 days has significantly lower collection probability. Every dollar stuck in aging AR is a dollar not funding operations or profit.

The fix: Monitor AR aging weekly. Implement systematic follow-up at 30, 45, 60 days. Consider retainer requirements for clients with collection history. Bill promptly—delays in billing correlate with collection problems.

4. Invisible Practice Area Losses

The problem: Firms track total revenue without practice area profitability. Resources flow to revenue-generating areas without considering margin.

The cost: A practice area generating $400K revenue at 12% margin contributes $48K profit. One generating $200K at 40% margin contributes $80K. Without visibility, you'd invest in the wrong one.

The fix: Configure your chart of accounts for practice area tracking. Run practice-area P&Ls monthly. Let data guide resource allocation, not revenue assumptions.

5. Wrong Staffing Leverage

The problem: Partners doing work associates or paralegals could handle at lower cost. Or matters staffed too lean, creating quality issues requiring expensive rework.

The cost: A partner at $400/hour doing work a $150/hour associate could handle doesn't just reduce profit - it constrains firm capacity and often reduces margin when clients resist partner rates for routine tasks.

The fix: Audit matter staffing quarterly. Create role-appropriate task guidelines. Invest in training that allows appropriate delegation with quality oversight.

6. Overhead Creep

The problem: Expenses increase incrementally without corresponding revenue growth. Software subscriptions, office expansion, additional staff - each justified individually, collectively compressing margin.

The cost: Overhead growing at 8% while revenue grows at 4% destroys margin within years.

The fix: Review all recurring expenses annually. Benchmark each category as percentage of revenue. Question anything growing faster than revenue. Kill underutilized subscriptions and services.

7. Siloed Financial Data

The problem: Trust accounting operates separately from firm finances. Billing doesn't integrate with accounting. Practice management lives in its own system. Partners make decisions without complete picture.

The cost: Missed cash flow insights, disconnected reporting, compliance data not leveraged for management, and inefficient reconciliation processes consuming hours monthly.

The fix: Integrate practice management, billing, trust accounting, and firm accounting. Use connected systems or proper integration. Run financial reports that synthesize all sources. The Legal Ledger Protocol™ exists specifically to create this integration for law firms—trust compliance and financial management as unified function, not separate silos.

Building Systematic Profitability

Profitability improvement requires systematic effort, not occasional attention.

Months 1-3: Establish Visibility

Configure accounting for practice area tracking

Calculate current margins (firm-level and by practice area)

Establish baseline metrics (utilization, realization, collection)

Implement monthly financial review discipline

Months 4-6: Address Obvious Drains

Fix realization and collection rate problems

Review and cut unnecessary overhead

Identify unprofitable clients and matters

Adjust pricing where margins don't support the work

Months 7-12: Optimize Structure

Refine leverage model for appropriate staffing

Invest in high-margin practice areas

Consider exiting persistent low-margin work

Build cash reserves (60-90 days operating expenses)

Ongoing: Maintain Discipline

Monthly financial review with action items

Quarterly profitability analysis by practice area

Annual overhead audit and benchmarking

Weekly cash flow and AR aging monitoring

The Infrastructure Investment

You can't improve what you don't measure. Most law firm profitability problems persist because firms lack systems to see them.

The difference between firms building wealth and firms staying busy often comes down to financial infrastructure: proper bookkeeping that captures the right data, accounting configured for law firm analysis, trust accounting integrated with management reporting, and partners who actually review the numbers.

Building this infrastructure has costs. Professional bookkeeping runs $500-2,000+ monthly depending on complexity. Practice management software runs $50-150 per user monthly. Integration and setup requires upfront investment.

But operating without visibility costs more. Strategic decisions made on incomplete data. Problems compounding for months before detection. Profit leaking through gaps no one monitors.

Profitable firms treat financial management as strategic infrastructure - not administrative overhead.

Frequently Asked Questions

-

Good profit margins range from 25-40% depending on firm size and practice area. According to ABA data, the median profit margin for firms with 1-10 attorneys is approximately 30%. Solo practitioners can achieve higher margins (35-40%+) due to lower overhead, while larger firms often see 25-30% due to infrastructure costs.

-

Calculate profitability by subtracting all expenses from revenue. Profit margin equals profit divided by revenue, expressed as a percentage. For actionable insights, calculate both firm-level margin and practice-area margins to understand where profit originates and where it leaks.

-

Profitability measures economic performance - revenue minus expenses over time. Cash flow measures money movement - when cash arrives and leaves. A firm can be profitable but cash-poor (if clients pay slowly) or cash-rich but unprofitable (if collecting old AR while current work loses money). Managing both metrics is essential.

-

The three critical metrics are utilization rate (billable hours as percentage of working hours), realization rate (billed hours as percentage of worked hours), and collection rate (collected as percentage of billed). These compound: industry average of 37% utilization × 88% realization × 91% collection = 29% effective rate before expenses.

-

Larger firms carry infrastructure costs - associates, support staff, office space, technology - that compress margins even as revenue scales. They also face higher attorney compensation requirements to attract talent. However, they typically achieve higher utilization rates (45% vs 26% for solos) due to better systems protecting billable time.

-

Trust accounting provides early signals of profitability problems. Retainer depletion rates indicate pricing or scope issues. Trust-to-operating transfer timing affects cash flow. Compliance problems correlate with broader financial management breakdowns. Integrating trust accounting into financial management surfaces these issues before they impact profit.

-

Monthly analysis should cover firm-level profit margin, cash position, and AR aging. Quarterly analysis should add practice-area profitability and realization rates. Annual analysis should include full financial benchmarking against industry data, overhead audit, and strategic planning based on profitability trends.

-

The most common causes are poor utilization rates (attorneys spending too much time on non-billable work), realization problems (work not making it to invoices), collection failures (invoices not converting to cash), overhead creep, wrong practice mix, and lack of visibility into practice-area performance.