Legal Bookkeeping Mistakes: 7 Errors That Put Law Firms at Risk

Updated December 2025

Legal bookkeeping mistakes create compliance exposure, drain profitability, and threaten licenses. Unlike general business accounting errors that trigger minor corrections, law firm bookkeeping failures can result in bar complaints, trust account freezes, and disciplinary action. The stakes are higher because the rules are stricter - ABA Model Rule 1.15 governs client fund handling with zero tolerance for violations.

These seven mistakes appear consistently in firms that later face compliance problems. Avoiding them requires understanding why they happen and implementing systems that prevent them.

Mistake 1: Incomplete Trust Account Reconciliation

The most dangerous legal bookkeeping mistake is performing two-way reconciliation when three-way is required.

Two-way reconciliation compares trust bank balance to general ledger. This catches bank errors and posting mistakes but misses the critical question: Do individual client balances match the total?

Three-way reconciliation adds the third comparison - individual client ledger balances summed against total trust liability. This catches allocation errors, missing transactions, and potential commingling that two-way reconciliation misses entirely.

Why It Happens:

General bookkeepers perform two-way reconciliation because that's standard practice in most industries. They don't know three-way reconciliation is required for law firms, so they deliver what they've always delivered - and firms assume compliance is handled.

The Consequence:

Trust accounts can appear balanced while individual client allocations are wrong. When bar auditors examine client ledgers - which they always do - discrepancies trigger investigations regardless of whether the bank balance is correct.

The Fix:

Monthly three-way reconciliation is non-negotiable. Your bookkeeping provider must produce reports showing bank balance, trust liability, and client ledger totals matching exactly. If they can't produce this report on demand, your trust accounting isn't compliant.

Mistake 2: Using Generic Accounting Software Without Legal Configuration

QuickBooks and similar platforms can handle law firm accounting - but only when configured correctly. Out-of-the-box setups designed for retail or service businesses lack the structure legal practices require.

What's Missing in Default Configurations:

Trust account segregation from operating accounts

Matter-level expense tracking

Earned vs. unearned income classification

Client ledger maintenance

Legal-specific chart of accounts

Why It Happens:

Firms adopt accounting software without customizing it for legal practice. The software works for basic bookkeeping, so problems aren't immediately obvious. Gaps only surface during audits, tax preparation, or attempts to generate legal-specific reports.

The Consequence:

Financial reports don't reflect law firm realities. Trust and operating funds blur together in reporting. Matter profitability can't be tracked. Financial statements lack the structure bar auditors and CPAs expect from legal practices.

The Fix:

Configure accounting software specifically for law practice. This means custom chart of accounts separating trust and operating transactions, matter-level tracking capabilities, and integration with practice management platforms like Clio or MyCase. Done correctly, standard software handles legal requirements well.

Mistake 3: Misclassifying Earned vs. Unearned Income

Retainer deposits aren't revenue until earned. This distinction matters for trust compliance, tax reporting, and financial accuracy - yet many firms get it wrong.

How Misclassification Happens:

Recording retainer deposits as revenue when received

Failing to track when trust funds become earned income

Transferring funds from trust to operating without documentation

Treating all retainers identically regardless of type

Why It Matters:

Unearned funds belong to clients and must remain in trust. Recording them as firm revenue before work is performed violates IOLTA compliance rules. Even if funds are physically in the trust account, improper classification on books creates audit problems.

The Consequence:

Revenue is overstated, trust liability is understated, and the books don't reflect reality. Tax returns based on incorrect income recognition create additional exposure. Bar auditors examining trust records find documentation gaps that trigger deeper investigation.

The Fix:

Implement clear protocols for income recognition. Retainers enter as trust liability, transfer to operating when earned, and revenue is recognized at transfer. Every transition should be documented with matter reference and work description justifying the transfer.

Mistake 4: Expense Misclassification and Poor Matter Coding

Proper expense classification serves two purposes: accurate client billing and meaningful financial reporting. Failures in either area create problems.

Common Classification Errors:

Coding billable expenses as overhead (underbilling clients)

Coding overhead as client expenses (overbilling clients)

Failing to allocate shared costs appropriately

Not tracking expenses at matter level

Inconsistent categorization across similar expenses

Why It Happens:

Expense classification requires judgment and consistency. Without clear protocols and training, staff make inconsistent decisions. General bookkeepers unfamiliar with legal billing norms apply retail logic to law firm expenses - which doesn't translate.

The Consequence:

Client billing accuracy suffers. Firms either leave money on the table by not billing legitimate costs, or create ethical issues by billing inappropriate items. Financial reports can't show practice area profitability because expenses aren't properly allocated.

The Fix:

Establish a legal-specific chart of accounts with clear definitions for each category. Document which expenses are billable, which are overhead, and how shared costs should be allocated. Train everyone who touches expense coding, and review classification accuracy monthly.

Mistake 5: Inadequate Cash Flow Tracking

Law firms face unique cash flow challenges. Retainers arrive before work. Contingency fees arrive months or years after work. Collection timing varies dramatically by client and matter type. Generic cash flow tracking doesn't capture these patterns.

Cash Flow Blind Spots:

No visibility into when pending matters will generate cash

Inability to project partner distribution capacity

No early warning of collection slowdowns

Confusing revenue recognition with cash receipt

Why It Happens:

Standard accounting focuses on accrual-basis P&L - what was earned - not cash position. Firms know their profitability but can't answer basic questions: Can we make payroll next month? Can we fund this case investment? When can partners take distributions?

The Consequence:

Cash crunches force bad decisions. Firms delay hiring despite capacity needs. Partners take distributions the firm can't afford. Growth opportunities pass because cash position is unclear. Worst case: profitable firms face liquidity crises because revenue doesn't equal cash.

The Fix:

Implement cash flow reporting alongside accrual statements. Track accounts receivable aging religiously - AR aging is the leading indicator of future cash. Build 13-week rolling cash projections that incorporate known inflows, fixed outflows, and variable expenses.

Mistake 6: DIY Bookkeeping by Attorneys

Attorneys handling their own bookkeeping create two problems: poor compliance and expensive labor allocation.

The Compliance Problem:

Attorneys aren't trained in legal bookkeeping requirements. They know substantive law but not accounting rules. DIY bookkeeping frequently produces incomplete reconciliations, improper trust handling, and reports that wouldn't survive audit scrutiny. Good intentions don't equal good systems.

The Economics Problem:

Attorney time spent on bookkeeping has opportunity cost. At $250-400/hour billing rates, five hours monthly on bookkeeping costs $1,250-2,000 in foregone revenue. Professional bookkeeping services at $750-1,500/month cost less while delivering better compliance.

Why It Happens:

Solo and small firm attorneys assume bookkeeping is simple and doesn't justify outside expense. They see the cash outflow for professional services without calculating the hidden costs of DIY: time, errors, compliance risk, and missed tax deductions.

The Fix:

Calculate the true cost of DIY bookkeeping including attorney time value. Compare against outsourced bookkeeping costs. For most firms holding client funds, outsourcing costs less and delivers more - better compliance, cleaner reports, and freed attorney capacity.

Mistake 7: Using Bookkeepers Without Legal Experience

General bookkeepers lack training in trust accounting, three-way reconciliation, and bar compliance requirements. Their skills transfer from other industries, but their knowledge doesn't include the specialized rules governing law firm finances.

What General Bookkeepers Miss:

IOLTA compliance requirements and documentation

Three-way reconciliation protocols

Earned vs. unearned income handling

Matter-level accounting requirements

Bar audit preparation and documentation

Why It Happens:

Firms hire based on bookkeeping credentials without evaluating legal-specific knowledge. The bookkeeper's general competence creates false confidence. Problems remain hidden until audits or compliance reviews expose gaps.

The Consequence:

Technically correct general bookkeeping that violates legal-specific rules. Trust accounting that looks fine but fails bar scrutiny. Bookkeeping cleanup projects costing thousands to remediate years of improper handling. In severe cases, bar discipline for violations the firm didn't know were occurring.

The Fix:

Evaluate bookkeepers specifically on legal experience. Ask about three-way reconciliation, Rule 1.15, and IOLTA requirements. A legal bookkeeping specialist may cost more than a generalist, but the premium prevents compliance failures that cost far more to fix.

Compounding Effects

These mistakes rarely occur in isolation. Firms using generic bookkeepers often also have poorly configured software, incomplete trust reconciliation, and inadequate cash flow visibility. The problems compound:

Generic software makes proper trust tracking difficult

Untrained bookkeepers don't know what they're missing

DIY oversight lacks expertise to catch problems

Issues accumulate until audit or crisis exposes them

By the time problems surface, cleanup requires reconstructing months or years of transactions. The firms that avoid these situations invest in proper systems upfront rather than paying for remediation later.

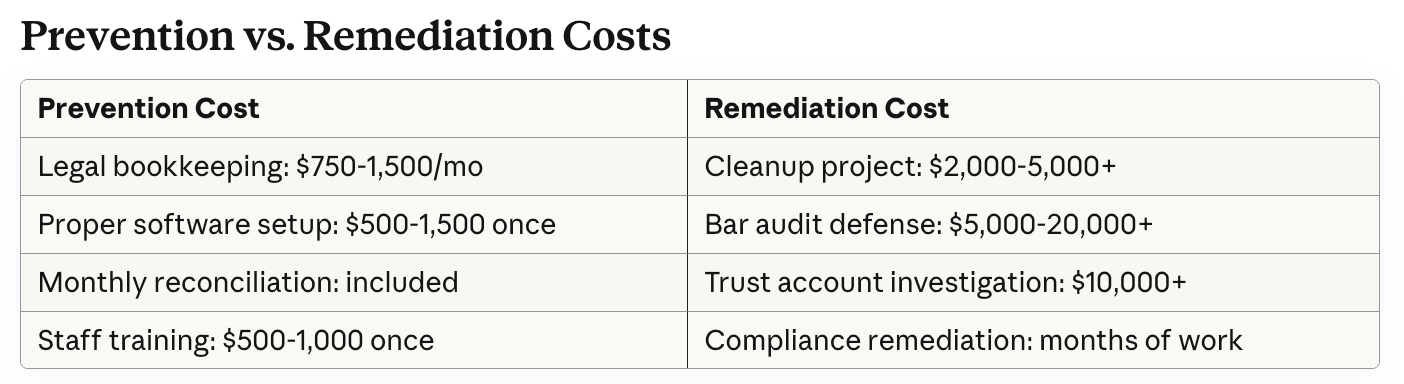

The math consistently favors prevention. Firms that view legal bookkeeping services as overhead rather than risk mitigation misunderstand the calculation. The question isn't whether you can afford proper bookkeeping - it's whether you can afford the consequences of improper bookkeeping.

Building Systems That Prevent Mistakes

Avoiding legal bookkeeping mistakes requires three elements working together:

Qualified People

Whether in-house or outsourced, bookkeeping personnel must understand legal-specific requirements. General bookkeeping skills are necessary but not sufficient. Legal expertise is non-negotiable for firms holding client funds.

Proper Technology

Accounting software must be configured for law practice. This means trust account structure, matter-level tracking, and legal chart of accounts. The software itself matters less than the configuration - QuickBooks configured correctly outperforms expensive platforms configured poorly.

Documented Processes

Written procedures for trust handling, expense classification, reconciliation timing, and report delivery create consistency. Processes should specify who does what, when, and how work is verified. Documentation also provides audit defense when questions arise.

When all three elements are in place, legal bookkeeping mistakes become rare rather than routine. The investment pays returns in compliance confidence, accurate reporting, and freedom from the anxiety of wondering what problems are hiding in your books.

Moving Forward: Creating Financial Clarity and Compliance

These seven blind spots represent the most common - and costly - bookkeeping deficiencies facing law firms today. While the challenges are significant, they’re also entirely solvable with the right combination of technology, expertise, and processes.

Turning Bookkeeping Blind Spots Into Strategic Advantage

Your practice deserves law firm bookkeeping systems that reflect the caliber of your legal work. By addressing these blind spots now, you’ll safeguard your firm from compliance breakdowns and unlock the insights needed to drive profitability, efficiency, and strategic growth in a competitive legal market.

If your firm is still relying on general bookkeeping support or patchwork financial systems, now’s the time to upgrade. At Accounting Atelier, we specialize in outsourced legal bookkeeping that protects your trust accounts, strengthens compliance, and gives you the financial visibility you need to make confident business decisions. Whether you're preparing for growth, an audit, or an acquisition, we’ll help you build a system that works the way your firm does.

[Book a discovery call →] and let’s talk about what your financial operations should look like and how legal bookkeeping support can help.

Frequently Asked Questions

-

The most common mistakes include incomplete trust reconciliation (two-way instead of three-way), using generic software without legal configuration, misclassifying earned vs. unearned income, poor expense coding, inadequate cash flow tracking, DIY bookkeeping by attorneys, and using bookkeepers without legal experience.

-

Three-way reconciliation compares bank balance, trust liability, and individual client ledgers. This catches allocation errors and potential commingling that two-way reconciliation misses. Most bar associations require monthly three-way reconciliation with documented records to ensure every client's funds are properly tracked.

-

General bookkeepers lack training in trust accounting, IOLTA compliance, and bar requirements. While their basic bookkeeping skills transfer, they don't know the specialized rules governing legal finances. Firms using general bookkeepers frequently discover compliance gaps during audits or bar reviews.

-

Cleanup projects typically run $2,000-5,000 depending on severity and duration. Bar audit defense can cost $5,000-20,000+. Trust account investigations create even larger exposure. Prevention through proper bookkeeping at $750-1,500/month costs far less than remediation.

-

Generally no. Attorney time spent on bookkeeping has high opportunity cost - $250-400/hour in foregone billable work. DIY bookkeeping also creates compliance risk because attorneys aren't trained in legal accounting requirements. Outsourcing typically costs less while delivering better results.

-

QuickBooks Online works well when properly configured for law practice. The key is legal-specific setup: trust account structure, matter-level tracking, appropriate chart of accounts, and integration with practice management software. Configuration matters more than platform choice.

-

Ask specific questions: Can you explain three-way reconciliation? What's Rule 1.15? How do you handle earned vs. unearned income? What IOLTA documentation do you maintain? Hesitation or confusion signals knowledge gaps that create compliance risk.

-

Legal bookkeeping includes trust accounting compliance, three-way reconciliation, IOLTA documentation, matter-level tracking, and bar audit preparation. General bookkeeping handles basic transaction recording but lacks the specialized knowledge and procedures legal practices require.