Law Firm Bookkeeping Cleanup: How to Fix Messy Books

Updated December 2025

Law firm bookkeeping cleanup reconstructs financial records that have fallen behind, been handled incorrectly, or never existed in proper form. Unlike ongoing bookkeeping services that maintain current records, cleanup projects fix historical problems - backlogged reconciliations, trust accounting gaps, miscategorized transactions, and documentation missing from prior periods.

Cleanup becomes necessary when firms change bookkeepers, prepare for audits or transactions, or discover their existing records don't meet compliance standards. The scope ranges from minor catch-up work to complete reconstruction depending on how long problems accumulated and how severe the gaps are.

When Law Firms Need Bookkeeping Cleanup

Several situations trigger cleanup projects:

Changing Bookkeeping Providers

New bookkeepers inherit whatever the previous provider left behind. If records are incomplete, reconciliations are backlogged, or trust accounting documentation is missing, cleanup must happen before ongoing service can begin on solid footing.

Bar Audit or Compliance Review

Bar auditors examine trust records going back years. If three-way reconciliation wasn't performed monthly, client ledgers don't exist, or documentation has gaps, cleanup becomes urgent. Reconstructing records before auditors arrive is far better than attempting explanations during the audit.

Firm Sale or Partner Changes

Buyers and new partners conduct financial due diligence. Messy books delay transactions, reduce valuations, and sometimes kill deals entirely. Cleanup demonstrates financial discipline and provides the documentation due diligence requires.

Tax Preparation Problems

CPAs preparing returns need accurate records. When books are incomplete or unreliable, tax preparation becomes expensive guesswork. Cleanup before tax season prevents extensions, amended returns, and potential audit triggers.

Discovery of Problems

Sometimes firms simply realize their books aren't right. Trust balances don't match expectations. Financial reports don't make sense. Questions arise that existing records can't answer. Recognition of problems is the first step toward fixing them.

What Cleanup Actually Involves

Cleanup scope varies based on what's broken and how long it's been broken. Most projects include some combination of these elements:

Trust Account Reconstruction

Trust accounting problems are the most serious and often the most labor-intensive to fix. Reconstruction may include:

Building client ledgers that never existed

Recreating three-way reconciliation documentation for prior months

Identifying and documenting historical discrepancies

Tracing trust transactions to proper client matters

Separating commingled funds if operating and trust were mixed

Trust cleanup isn't optional for firms holding client funds. IOLTA compliance requires documentation that can withstand bar scrutiny. If that documentation doesn't exist, creating it is the cleanup priority.

Reconciliation Catch-Up

Monthly reconciliation of bank accounts, credit cards, and trust accounts should happen every month. When it doesn't, backlogs accumulate. Cleanup means working through each missed month:

Obtaining historical bank statements

Matching transactions to accounting records

Identifying and researching discrepancies

Documenting reconciliation for each period

Correcting errors discovered during the process

The further behind reconciliation falls, the harder catch-up becomes. Twelve months of backlog takes more than twelve times the effort of one month because transaction memory fades and documentation becomes harder to locate.

Transaction Categorization

Cleanup often reveals transactions that were never categorized, categorized incorrectly, or assigned to wrong accounts. Fixing this requires:

Reviewing uncategorized transactions and assigning proper accounts

Identifying and correcting miscategorized expenses

Separating personal and business transactions if mixed

Ensuring trust transactions are properly distinguished from operating

Rebuilding chart of accounts if the existing structure doesn't fit law firm needs

Proper categorization enables accurate financial reporting. Without it, P&L statements and balance sheets don't reflect reality.

Historical Record Organization

Beyond transaction-level cleanup, firms often need broader record organization:

Locating and organizing source documents (invoices, receipts, statements)

Digitizing paper records for accessibility

Creating filing systems that support ongoing maintenance

Documenting procedures so problems don't recur

Organization work supports both the cleanup project itself and the ongoing bookkeeping that follows.

Cleanup Scope Assessment

Before cleanup begins, assessment determines what's actually needed. A thorough assessment examines:

Trust Accounts

Do three-way reconciliations exist for each month?

Are client ledgers maintained and accurate?

Can trust balances be traced to individual client matters?

Are there unexplained discrepancies or negative client balances?

Operating Accounts

Are bank reconciliations current?

How many months of backlog exist?

Are transactions properly categorized?

Does the chart of accounts fit law firm needs?

Documentation

Can source documents be located for significant transactions?

Are records organized and accessible?

What documentation gaps exist?

Systems

Is accounting software configured correctly for law practice?

Are trust and operating properly separated?

Can the current system produce required reports?

Assessment typically takes 2-4 hours and results in a cleanup proposal with defined scope, timeline, and cost estimate.

What Cleanup Costs

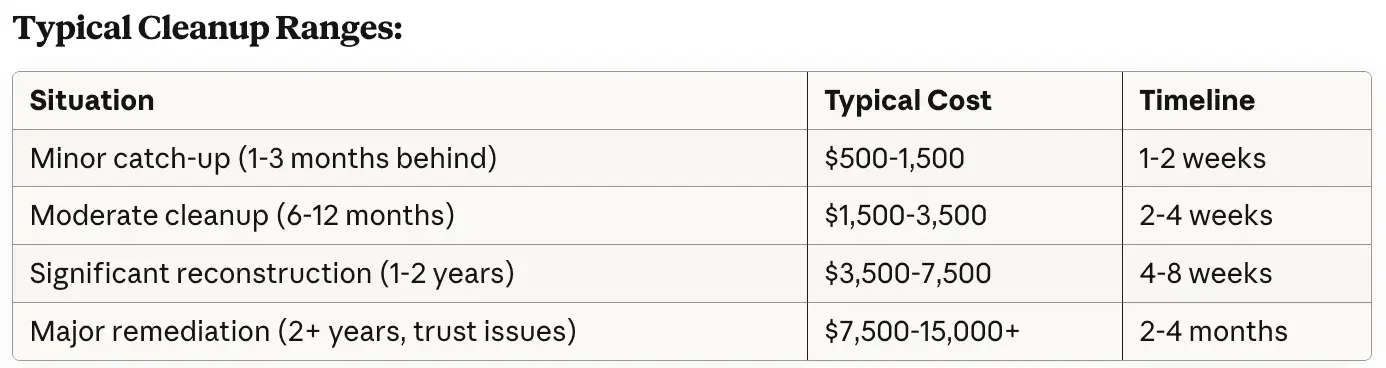

Cleanup pricing depends on three factors: how far behind records are, how messy the existing state is, and how much trust accounting reconstruction is required.

Trust accounting reconstruction adds significant cost because it requires transaction-by-transaction review, client ledger creation, and documentation that meets bar compliance standards.

What Affects Cost:

Transaction volume (more transactions = more work)

Number of bank accounts and credit cards

Trust account complexity and client count

Quality of existing records and documentation

Availability of source documents

Accounting software state and configuration

Most cleanup projects are billed as fixed-fee based on assessment findings. This provides cost certainty rather than open-ended hourly billing.

DIY Cleanup vs. Professional Help

Some cleanup work can be handled internally. Other situations require professional expertise.

DIY Cleanup Can Work For:

Simple catch-up on reconciliations with good source documents

Transaction categorization when categories are clear

Basic organization of accessible records

Situations without trust accounting complexity

Professional Cleanup Is Necessary For:

Trust account reconstruction requiring compliance expertise

Complex reconciliation problems with multiple accounts

Significant historical gaps requiring forensic reconstruction

Situations where bar audit or compliance review is pending

Records so disorganized that assessment itself requires expertise

The DIY vs. professional decision often comes down to trust accounting. If trust records need reconstruction, legal bookkeeping specialists are essential because general bookkeepers don't know what bar compliance requires.

The Cleanup Process

Professional cleanup typically follows this sequence:

Phase 1: Assessment (Week 1)

Review current state, identify gaps, determine scope, and provide cleanup proposal with fixed-fee quote.

Phase 2: Document Gathering (Week 1-2)

Obtain bank statements, source documents, and any existing records needed to complete cleanup. Client provides access to accounting software and banking portals.

Phase 3: Reconciliation and Reconstruction (Weeks 2-6)

Work through backlogged periods, reconcile accounts, reconstruct trust documentation, and correct transaction categorization. This is the bulk of cleanup work.

Phase 4: Review and Documentation (Week 6-8)

Quality review of completed work, creation of summary documentation, and preparation of clean starting point for ongoing service.

Phase 5: Transition to Ongoing Service

Cleanup ends with books current and compliant. Ongoing bookkeeping begins from a clean foundation rather than inherited mess.

Timeline varies based on cleanup scope. Minor catch-up finishes in days. Major reconstruction takes months.

Preventing Future Cleanup Needs

Cleanup projects are expensive and stressful. Preventing recurrence requires:

Monthly Bookkeeping Discipline

Reconciliation, categorization, and reporting should happen every month without exception. Professional bookkeeping at $750-1,500/month costs far less than periodic cleanup projects.

Trust Accounting Protocols

Three-way reconciliation monthly. Client ledgers maintained continuously. Documentation created as transactions occur rather than reconstructed later. Trust accounting red flags addressed immediately rather than ignored.

Qualified Support

Whether in-house or outsourced, bookkeeping support must understand legal requirements. General bookkeepers create problems they don't recognize. Legal specialists maintain compliance from the start.

Regular Review

Partners should review financial reports monthly rather than delegating and forgetting. Catching problems early prevents accumulation that requires cleanup later.

Red Flags That Suggest Cleanup Is Needed

If any of these describe your firm, cleanup should be on your agenda:

Bank reconciliations are more than 2 months behind

You can't produce a three-way trust reconciliation for last month

Your bookkeeper doesn't understand trust accounting requirements

Financial reports don't match your sense of how the business is performing

Your CPA asks for records you can't easily provide

You're preparing for bar audit, firm sale, or partner changes

You've changed bookkeepers and the transition revealed problems

Trust account balance doesn't match what client ledgers should show

Ignoring these signals allows problems to compound. Legal bookkeeping mistakes don't fix themselves—they accumulate until cleanup becomes unavoidable.

Questions to Ask Before Starting Cleanup

When engaging a cleanup provider, get clear answers:

What's included in the fixed fee? Understand scope boundaries and what might trigger additional charges.

What do you need from me? Know your responsibilities for providing access, documents, and information.

What's the timeline? Get specific milestones, not vague estimates.

How will you handle trust accounts? Ensure they understand IOLTA requirements and three-way reconciliation.

What will I have when cleanup is complete? Understand deliverables: reconciled accounts, trust documentation, organized records.

Do you offer ongoing service after cleanup? Cleanup without ongoing maintenance recreates the same problems. Integrated service prevents recurrence.

The Bottom Line

Law firm bookkeeping cleanup fixes problems that accumulated through neglect, inexperience, or inadequate systems. The work isn't glamorous, but it's essential when records don't meet compliance standards or support firm operations.

Cleanup costs less than the consequences of leaving problems unaddressed: failed bar audits, deal complications, tax problems, and the ongoing stress of operating without financial clarity. Firms that invest in cleanup and follow with proper ongoing bookkeeping services eliminate the cycle of accumulating problems and periodic crisis remediation.

If your books need cleanup, the best time to start was when problems began. The second best time is now - before problems compound further.

Frequently Asked Questions

-

Cleanup reconstructs financial records that have fallen behind or been handled incorrectly. This includes catching up backlogged reconciliations, rebuilding trust account documentation, correcting transaction categorization, and organizing historical records to meet compliance standards and support accurate reporting.

-

Cleanup typically costs $1,500-7,500 depending on how far behind records are and whether trust accounting reconstruction is needed. Minor catch-up runs $500-1,500. Major reconstruction involving years of backlog and trust account issues can exceed $10,000.

-

Timeline depends on scope. Minor catch-up finishes in 1-2 weeks. Moderate cleanup takes 2-4 weeks. Significant reconstruction requiring trust account work may take 2-4 months. Assessment before cleanup begins provides specific timeline estimates.

-

Simple catch-up on reconciliations with good documentation can be handled internally. However, trust account reconstruction requires legal bookkeeping expertise because general bookkeeping knowledge doesn't include bar compliance requirements. Professional help is essential for trust-related cleanup.

-

Common triggers include changing bookkeeping providers, preparing for bar audit or compliance review, firm sale or partner changes, tax preparation difficulties, or simply discovering that existing records are incomplete or unreliable.

-

Typical cleanup includes bank and trust account reconciliation catch-up, transaction categorization correction, trust documentation reconstruction, chart of accounts fixes, and record organization. Scope varies based on assessment findings.

-

Maintain monthly bookkeeping discipline with reconciliation, categorization, and reporting every month. Use qualified bookkeepers who understand legal requirements. Perform three-way trust reconciliation monthly. Review financial reports regularly rather than delegating and forgetting.

-

Usually yes. Providers who perform cleanup understand your firm's history and systems. Transitioning to ongoing service with the same provider ensures continuity and prevents the knowledge loss that occurs when switching providers.