DIY Bookkeeping for Law Firms: 7 Costly Mistakes That Add Up Fast

Updated November 2025

According to the American Bar Association, 27% of attorney disciplinary actions stem from financial management issues. The leading cause? Trust account violations - most of which aren't intentional fraud. They're bookkeeping errors.

DIY bookkeeping seems responsible. You're saving money, maintaining control, and handling your own finances like the business owner you are.

But law firm bookkeeping isn't regular bookkeeping with legal clients. It's a specialized function with unique compliance requirements, significant liability exposure, and mistakes that can cost you your license.

Most attorneys doing their own books are making errors they don't even know about. This guide covers the seven most common - and most expensive - mistakes law firms make with DIY bookkeeping, and what to do about them.

Mistake #1: Skipping Monthly Trust Reconciliations

The Error: You reconcile your operating account monthly but your trust account quarterly. Or whenever you "get around to it." Or when your CPA asks for it during tax prep.

Why It's Expensive: Monthly three-way trust reconciliation isn't a best practice - it's an ethical requirement in every jurisdiction.

When you skip months, discrepancies compound. A $50 error in January becomes a $300 unexplained gap by March. By the time you reconcile, you can't remember which transactions caused the discrepancy or how to fix it.

Worse: even if your trust account balance is technically correct, failure to reconcile monthly is itself a compliance violation. If your state bar audits you, "the money was all there" doesn't matter. Late reconciliations = violation.

The Real Cost:

Bar complaints and ethics investigations

Potential suspension or disbarment for repeat violations

Hours spent reconstructing months of transactions

Lost trust with clients if discrepancies involve their funds

The Fix: Reconcile your trust account by the 10th of every month. No exceptions.

If you can't commit to this timeline, you need to consider outsourcing your bookkeeping.

Mistake #2: Not Maintaining Individual Client Ledgers

The Error: You track your total trust account balance in QuickBooks. You know how much money is in the account. But you don't maintain individual ledgers showing exactly how much belongs to each client.

Why It's Expensive: Without client-level ledgers, you have no way to verify that each client's balance is accurate. You're managing a pooled trust account by feel, not by data.

This creates exposure to two serious problems:

Negative client balances: You transfer fees to your operating account based on your overall trust balance, not the specific client's balance. Result: Client A's funds are used to pay for Client B's work. That's misappropriation - even if unintentional.

Audit failure: When your state bar asks for proof that your trust account is accurate, you can't provide client-level documentation. Your books fail the audit even if no money is missing.

The Real Cost:

Misappropriation charges if client funds are commingled

Bar disciplinary action for inadequate recordkeeping

Inability to answer client questions about their retainer balance

Failed audits and mandatory remediation

The Fix: Maintain a client ledger for every trust account deposit. Your practice management software (Clio, MyCase, etc.) should handle this automatically if configured correctly.

If you're using QuickBooks alone, you need to set up sub-accounts or use a separate tracking method for each client.

If this sounds complicated, that's because it is. This is exactly the type of technical requirement that legal-specific bookkeeping services handle as standard practice.

Mistake #3: Misclassifying Retainers as Income

The Error: Client pays a $5,000 retainer. You deposit it in your operating account and record it as income.

Why It's Expensive: Retainers aren't income when received - they're liabilities. The money belongs to the client until you've earned it through work performed.

Recording unearned retainers as income creates three problems:

Tax liability: You're paying income tax on money you haven't earned and may have to refund.

Ethics violation: Unearned fees must be held in trust, not operating. Depositing them in operating is commingling.

Cash flow distortion: Your P&L shows revenue you haven't actually earned, making your firm look more profitable than it is.

The Real Cost:

Overpayment of income taxes on unearned revenue

Commingling violation (trust funds in operating account)

Inaccurate financial statements that misrepresent firm performance

Potential refund obligations without cash available to cover them

The Fix: Unearned retainers go in trust. Period.

As you work on the client's matter, you transfer earned fees from trust to operating - and only then do you record income.

If you're using flat fees or evergreen retainers, this gets more complex. You need systems that track what's been earned versus what remains unearned. Most attorneys doing DIY bookkeeping aren't set up to handle this correctly.

DIY law firm bookkeeping costs: $19,500 lost billable time, $13,000 accounting errors, $22,000 compliance risks - data from ABA survey

Mistake #4: Commingling Personal and Business Expenses

The Error: You use your business credit card for personal purchases. Or you use your personal card for business expenses and forget to track them. Or you transfer money between personal and business accounts without documentation.

Why It's Expensive: The IRS requires clear separation between personal and business expenses. When you commingle, you create audit risk and lose deductions.

Specific problems:

Lost deductions: Personal expenses paid from business accounts aren't deductible. Business expenses paid personally are easy to forget when preparing taxes.

Audit triggers: Commingled accounts raise red flags with the IRS, increasing audit likelihood.

Piercing the corporate veil: If you're an LLC or PC, commingling can compromise your liability protection.

The Real Cost:

Thousands in lost tax deductions annually

Higher audit risk and potential IRS penalties

Lost liability protection if business structure is challenged

Messy books that CPAs charge extra to clean up

The Fix: Maintain complete separation. Business expenses on business accounts. Personal expenses on personal accounts. Always.

If you need to move money between accounts (draws, distributions, capital contributions), document it properly. Every transfer should have a clear business purpose and appropriate categorization.

DIY bookkeepers routinely mess this up because it requires discipline and consistent documentation. A professional bookkeeper enforces the separation automatically.

Mistake #5: Waiting Until Tax Season to Organize Records

The Error: You save receipts in a folder (or your email) and deal with them once a year when your CPA asks.

Why It's Expensive: Tax prep should be simple if your books are maintained monthly. When you wait until year-end to organize everything, you create expensive chaos.

Your CPA charges more because they're cleaning up a year's worth of receipts instead of reviewing clean monthly financials. You miss deductions because you can't find documentation. You pay tax penalties if deadlines are missed while you scramble to get organized.

The Real Cost:

Higher CPA fees (often $1,000-2,000 more than necessary)

Missed deductions due to lost receipts or forgotten expenses

Late filing penalties if tax deadlines are missed

Estimated tax underpayment penalties from inaccurate quarterly projections

Stress and rushed decisions during tax season

The Fix: Monthly bookkeeping. Categorize transactions as they happen. Reconcile accounts monthly. Close your books properly at year-end.

When tax season arrives, your CPA should be able to pull your financial statements and prepare your return without additional cleanup. If they're asking for receipts and transaction details, your bookkeeping isn't working.

Mistake #6: Not Tracking Accounts Receivable

The Error: You bill clients but don't systematically track who owes what or how long invoices have been outstanding.

Why It's Expensive: Untracked AR becomes uncollected AR.

When you don't know exactly who owes you money, you don't follow up consistently. Invoices age. Collection difficulty increases. Cash flow suffers.

Many attorneys discover they have $20,000-50,000 in outstanding invoices - some over a year old - only when they finally run an AR aging report.

The Real Cost:

Delayed cash flow (money you've earned but aren't collecting)

Write-offs when aged invoices become uncollectible

Lost opportunity cost (money you could have collected months ago)

Client relationship damage when collection efforts become adversarial

The Fix: Run an AR aging report monthly. Know exactly who owes what and for how long.

Follow up on invoices over 30 days. Have a collection process that escalates at 60 and 90 days. Don't let invoices age past 120 days without serious collection action.

If you're not tracking AR systematically, you're leaving money on the table. Professional bookkeepers include AR management as standard practice because they understand how expensive inattention is.

Mistake #7: Using Generic Chart of Accounts

The Error: You use QuickBooks' default chart of accounts designed for general businesses, not law firms.

Why It's Expensive: Law firms need specific account categories that generic charts don't include:

Trust liability accounts for each client

Separate income categories for different practice areas

Matter-specific expense tracking

Partner draw and distribution accounts

Retainer and evergreen fee categories

Without a legal-specific chart of accounts, you can't track profitability by practice area, you can't properly categorize trust transactions, and your financial reports don't tell you what you need to know.

The Real Cost:

Inability to analyze profitability by practice area or attorney

Incorrect financial statements that don't reflect legal business structure

Missed insights about which work is actually profitable

Tax prep complications when your CPA has to translate your categories

The Fix: Implement a law firm-specific chart of accounts. Your practice management software may provide templates, or your CPA can help you set one up.

This requires expertise to do correctly. Most DIY bookkeepers either don't know this is necessary or don't know how to implement it properly.

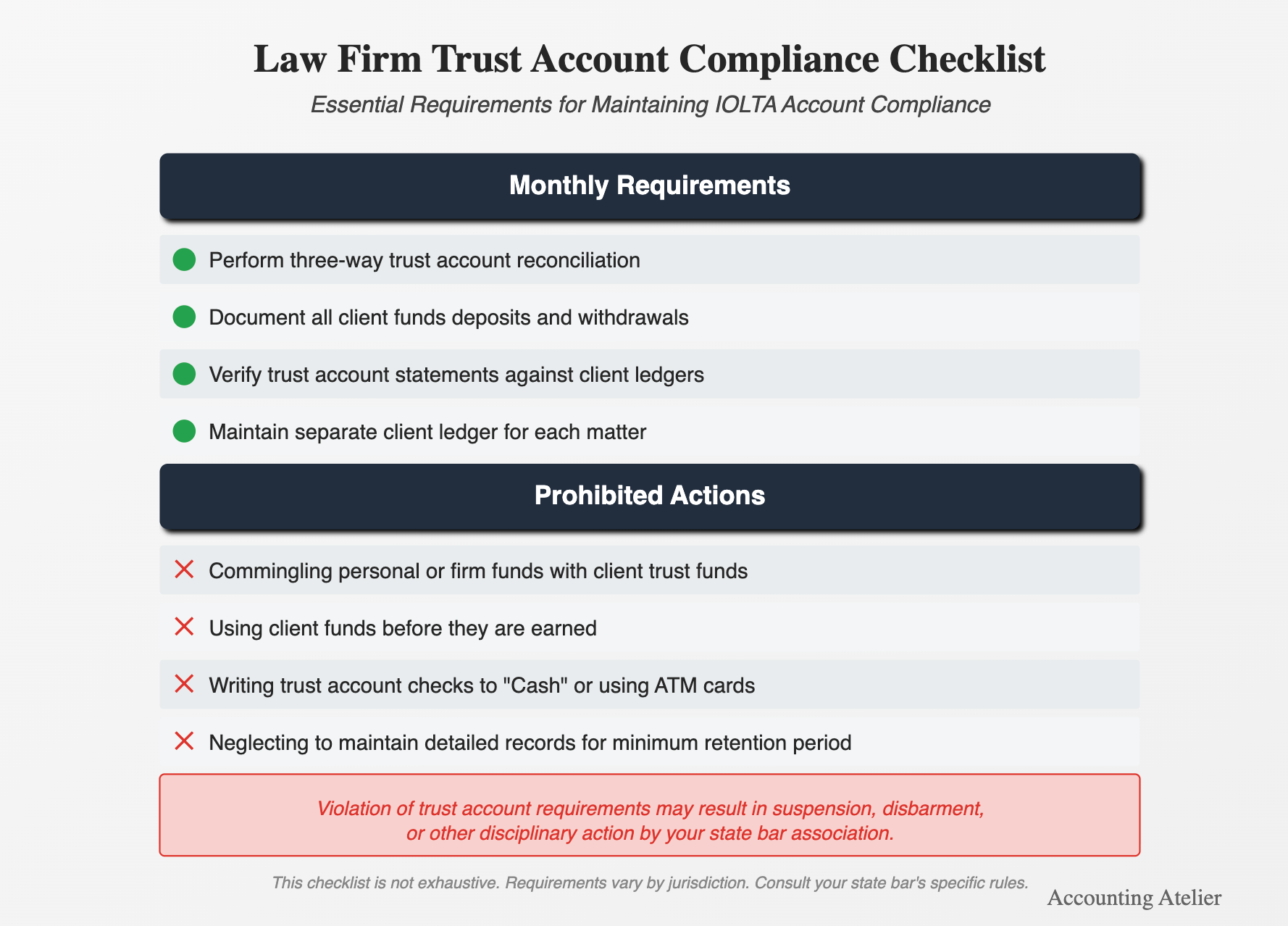

IOLTA compliance checklist for attorneys: monthly trust reconciliation requirements and prohibited actions that risk disbarment - required by state bar associations

The Hidden Cost: Your Time

Beyond these specific mistakes, there's a broader cost that most attorneys overlook: opportunity cost.

If you're spending 3-5 hours per week on bookkeeping, that's 12-20 hours per month. At $250/hour (conservative for most attorneys), that's $3,000-5,000 per month in lost billable time.

Professional bookkeeping costs $750-1,500 per month.

Even if you're not making specific errors, DIY bookkeeping is expensive simply because of what you're not doing while you're reconciling accounts and categorizing transactions.

When DIY Becomes Too Risky

DIY bookkeeping might work for a solo practitioner with minimal trust activity and very simple billing. But it breaks down quickly when:

Your trust account activity increases

You hire staff

You manage multiple practice areas

You have significant AR to track

Your transaction volume exceeds 50-75 per month

If any of these describe your firm, the mistakes outlined above aren't hypothetical - they're inevitable without professional systems in place.

For guidance on whether it's time to outsource, see our decision framework for law firms evaluating bookkeeping options.

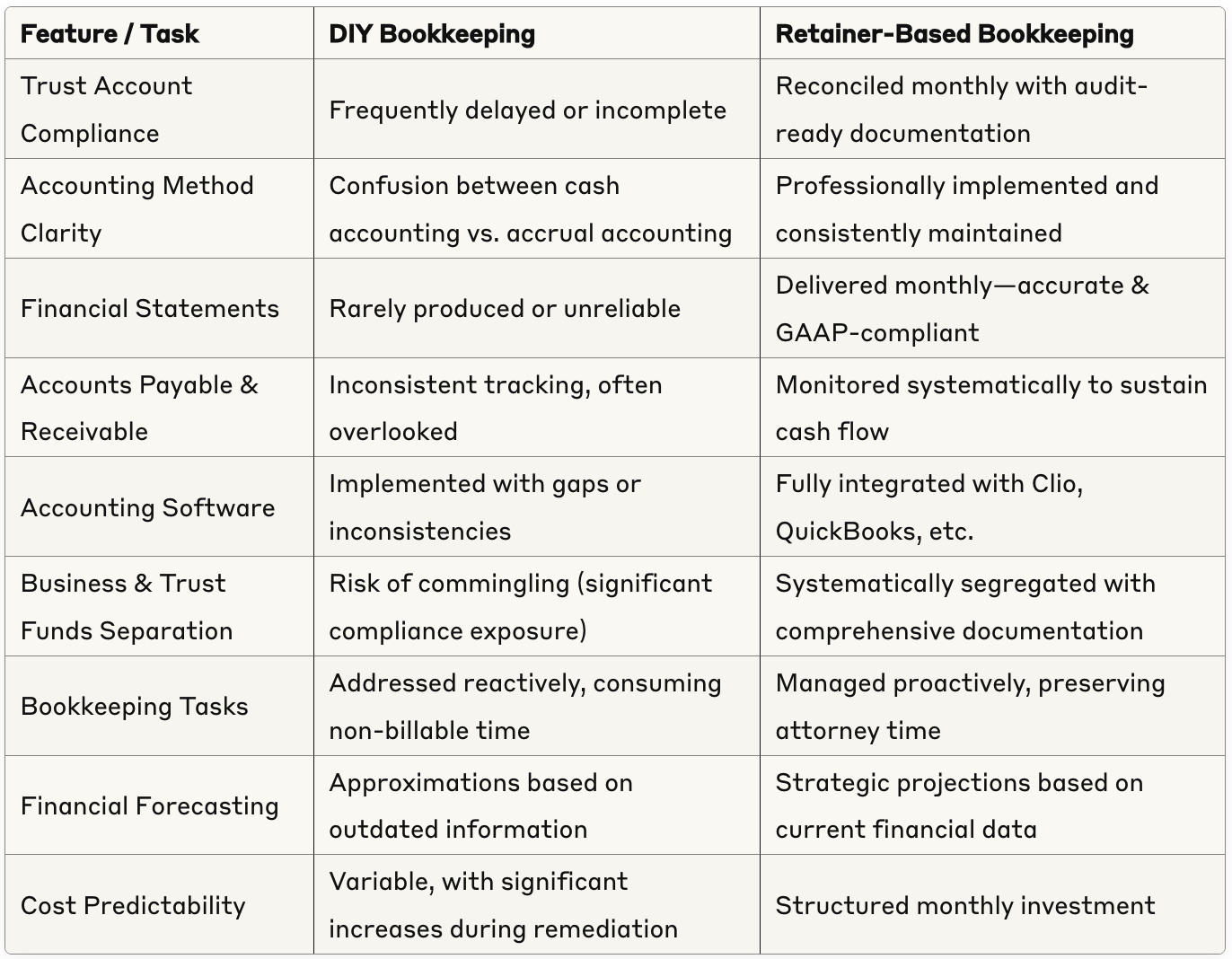

DIY vs. Retainer-Based Bookkeeping for Law Firms

What Professional Bookkeeping Prevents

A legal-specific bookkeeping service eliminates these mistakes by design:

Monthly trust reconciliations happen automatically, with full documentation

Client ledgers are maintained in real-time, with no risk of negative balances

Retainer tracking properly distinguishes earned vs. unearned fees

Expense separation is enforced - no commingling

Monthly close processes mean you're always tax-ready

AR management includes systematic follow-up and aging reports

Legal-specific chart of accounts provides actionable financial insights

You're not just avoiding errors. You're building financial infrastructure that supports growth.

The Bottom Line

DIY bookkeeping isn't inherently wrong. But it's risky, time-consuming, and expensive when mistakes happen.

If you're currently managing your own books, run through this checklist:

Trust account reconciled monthly with client ledgers

Retainers properly tracked (earned vs. unearned)

Complete separation of personal and business expenses

Monthly transaction categorization and account reconciliation

AR tracked systematically with aging reports

Legal-specific chart of accounts implemented

Books closed properly each month and year

If you checked all seven boxes, you're in the minority. Most DIY bookkeepers are missing at least three—and often more.

The question isn't whether you're smart enough to do bookkeeping. It's whether the risk, time cost, and opportunity cost are worth it.

For most firms, they're not.

Want to see what's possible with professional bookkeeping? Learn what outsourced services include or book a consultation to discuss your firm's specific needs.

Frequently Asked Questions

-

The most common DIY bookkeeping mistakes for law firms include: skipping monthly trust account reconciliations, failing to maintain client-specific ledgers, misclassifying retainers as earned income, commingling personal and business expenses, waiting until tax season to organize records, not tracking accounts receivable by matter, and using generic charts of accounts instead of legal-specific ones. According to the American Bar Association, trust account reconciliation failures account for over 40% of attorney disciplinary actions related to financial mismanagement.

-

Skipping trust reconciliations creates compliance violations that can result in bar disciplinary action, license suspension, or disbarment—even when no client funds are missing. State bar associations require monthly three-way reconciliation comparing bank statements, client ledgers, and general ledger balances. Missing even one month of reconciliation can trigger automatic audit requirements in many jurisdictions and creates compounding errors that become exponentially harder to correct over time.

-

Misclassifying advance retainers as earned income creates multiple problems: premature tax liability on unearned funds, trust account violations when funds are spent before being earned, inaccurate financial statements showing inflated revenue, and potential ethics violations for commingling earned and unearned fees. The IRS requires retainers to remain in trust accounts until work is performed and properly invoiced. Correcting this error often requires amended tax returns and trust account reconstruction.

-

Law firms without systematic accounts receivable tracking typically experience 15-25% higher write-offs and 45-60 day longer collection cycles compared to firms with proper AR management. This translates to $50,000-$150,000 in lost revenue annually for a 5-attorney firm. Without matter-level AR tracking, firms cannot identify slow-paying clients, aging invoices, or collection priorities, leading to cash flow problems and increased bad debt expense.

-

Generic charts of accounts don't accommodate legal-specific requirements including: separate trust liability accounts, client cost advances distinct from operating expenses, IOLTA interest tracking, retainer management, matter-level expense allocation, and three-way reconciliation reporting. Using generic structures makes compliance reporting nearly impossible and obscures the true financial position of the firm by incorrectly categorizing legal-specific transactions.

-

Commingling personal and business expenses creates tax compliance problems (lost deductions, inability to substantiate business expenses during audits), legal liability issues (piercing the corporate veil in malpractice cases), inaccurate financial statements for decision-making, and ethics violations if personal expenses are paid from trust accounts. The average cost to reconstruct and correct 12 months of commingled expenses ranges from $3,000-$8,000 in accounting fees, plus potential tax penalties and lost deductions.

-

Law firms should transition from DIY bookkeeping when: spending more than 10 hours weekly on financial tasks, consistently missing monthly close deadlines, experiencing recurring trust account discrepancies, facing compliance violations or audit notices, revenue exceeds $50,000 monthly, managing trust accounts for multiple clients, or when bookkeeping prevents focus on billable work. Most firms benefit from professional bookkeeping once they reach 2-3 attorneys or manage complex trust accounting requirements.